The spot forex market is the largest single financial market in the world. The term spot indicates for immediate delivery. This differentiates from forward contracts such as futures which involve delivery at a preset date in the future, or swaps which involve a spot transaction and forward transaction set at a date in the future.

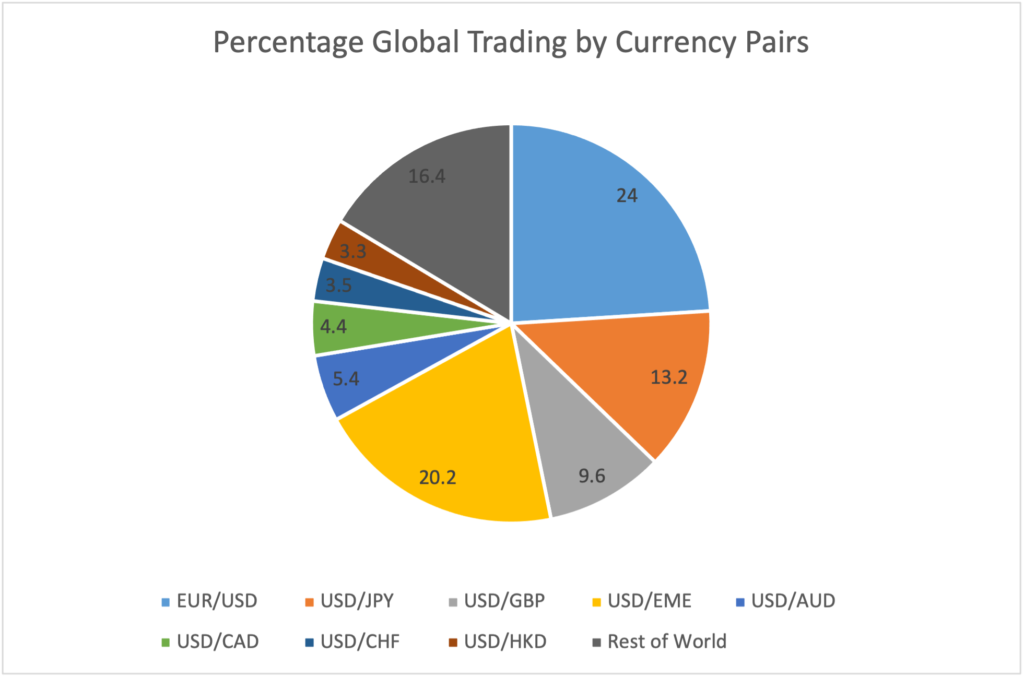

The latest data from the Bank of International Settlements shows daily spot FX turnover at $6.6 trillion. The most dominant pair is EUR/USD which accounts for 24% of all trading. The second most traded pair in the FX spot market is USD/JPY, however, lagging way behind at 13.2%. The third most traded pair is GBP/USD at 9.6%. Other common pairs such as AUD/USD or USD/CAD are even further behind in terms of turnover. Emerging Market currencies also make up a relatively large slice of trading activity. Currencies like the Mexican Peso and Turkish lira, help contribute to this sector counting for 20.2% of all trades.

Most spot forex trading is done out of the five main financial centers in the world. 79% of all trading is executed between the USA, the UK, Hong Kong, Singapore and Japan. This is not surprising as they are also the largest centers in the world for just about every financial product. The FX market differs in many aspects from the traditional stock and bond markets, but there is one characteristic that stands out more than others. Unlike most other markets, the FX spot market is open for business 24 hours a day, 5 days a week.

EME: Emerging Market Economies

The foreign exchange market has been around ever since international trade began. Merchants traveling from one part of the world would exchange the local currency they received for their goods into the currency of their home country.

This continues today, as global trade has reached levels never seen in history. This has brought an increased need for spot foreign exchange contracts. For example, companies in Europe selling their products or services in the US will need to exchange the US dollars they receive for Euros at some point, and vice versa.

This need for currency exchange created the foreign exchange market. Institutions and traders have since increased its depth by trading these markets for profit or hedging.

Market Players

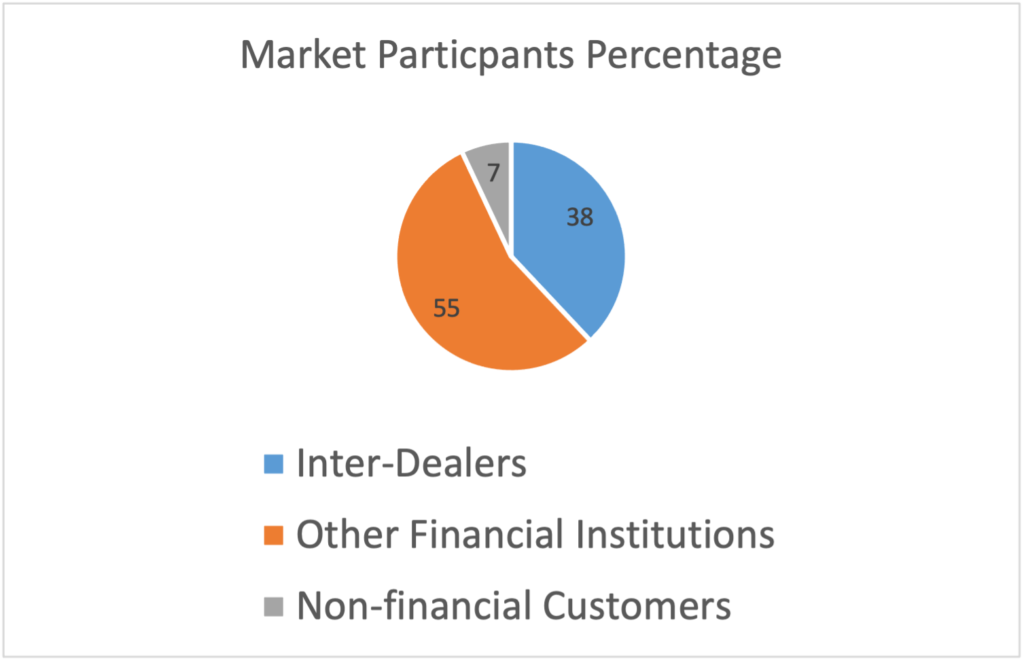

Things have changed a lot over the past two decades, and especially so since the advent of personal computer technology and the internet. In the 90s, 64% of foreign exchange spot trades were executed by institutional dealers. That ratio has changed and inter-dealer institutions now only make up approximately 40% of all transactions.

The retail market for spot currency trading has taken a strong foothold thanks to the ease of access to the information necessary to trade this market. The fact that inter-dealer institutions are no longer overwhelmingly the biggest players means the market is also more efficient. There can be no dominant position by a group of banks as the playing field is much more divided.

The other main group of market players are made up by non-dealer banks and institutions, institutional investors, hedge funds and prime brokers. All together this group makes up for the largest part of trading activity. Retail traders are not considered as a category, and the percentage of trading they account for will generally be understated as they tend to put their money in various institutions, such as non-dealer banks or prime brokers.

Prices for spot FX rates are mainly generated by the inter-dealer banks, also known as market makers. These institutions supply most of the prices available in the market. Other market participants will receive quotes for forex spot rates from their banks or brokers. Only a small portion of market making will come from non-dealer participants.

Role of Brokers

As a retail trader you will need the services of an FX broker. Thanks to the internet and computer technology anyone can access these services from any part of the world.

Brokers are connected to various dealers and collect the best prices from the various institutions that are market making through the broker. The broker then passes these prices on to their clients or traders and charge a small commission. The other possibility is that the bid ask spread is widened and the broker does not charge a commission. In other words, the broker can decrease the best bid he has and increase the best offer. This allows them to get compensated from that small difference.

Brokers can also offer other services such as different order types, leverage and account record keeping. There are various market orders such as Stop Loss, Target Profit and Limit Orders. The stop loss order limits the amount of money which can be lost on an FX spot trade. For example, if the EUR USD spot price is currently 1.2000 and you enter a buy trade at that price, but you want to limit your loss to say 50 pips, then in this case you would give the broker a stop loss order at 1.1950.

This means your long position will be closed if the market trades down at 1.1950. This is done automatically and helps avoid losing more than you were counting on when entering the trade. Note that stop losses are not always a guarantee of maximum loss. The market price may gap and the next price available may cause you to lose more than the original amount set with the stop loss.

The limit profit order acts in the same way as a stop loss order, but in this case it will lock in a profit automatically when a certain level is reached. Considering the above example, let’s say you think the market can reach a high just over 1.2100 before turning back down. To make sure you cash in on a profitable trade, you would place a target profit order at 1.2100.

Limit buy or limit sell orders are also common among brokers and popular with traders. These orders allow you to set the price at which you wish to buy or sell a certain currency pair. You can set the buy limit below the current market value. This allows you to enter the market when it retraces down to a lower level. In the same way, you can set a limit sell order above the current market price, where you enter a sell trade when the market corrects higher.

Leverage is probably the most important factor in increasing profits, or losses, for FX trading. Leverage allows you to trade in sizes that can be many multiples of the money you have in your account. A leverage of 10 to 1 will allow you trade a value of $10,000 with $1,000 on your account.

However, leverage clearly has its advantages and disadvantages. Using too high a leverage ratio may allow you to make some fast money, but you may blow it all away just as quickly.

Choose Your Markets

Choose Your Markets

The most popular way to trade FX spot markets is through an online FX broker. Usually the broker will receive FX prices from market makers in the foreign exchange market. Another option that is becoming increasingly popular is spot CFD. CFD, Contracts For Difference, is a derivative of the underlying spot FX market.

When you enter a trade in the FX market using a CFD, you are placing an order with your broker that tracks the underlying market. So, if you buy EUR/USD at the current market rate you will profit if the actual price of the currency pair increases. If the price decreases you will lose money. The effect of using this product is the essentially same as actually entering a trade in the FX market.

CFDs usually offer higher leverage ratios and smaller minimum lot sizes. Standard FX trading may allow for prices with a tighter bid offer spread. The choice of which to use may simply come down to whether CFDs are available in your country or if your broker of choice offers one or the other.

Any broker you chose should be overseen by a financial regulator. This insures the sanctity of the broker’s operations and allows you to invest your money with confidence. There are many national regulators, each with jurisdiction for the brokers operating in its country. Some regions have more than one forex regulator. The three main regulators around the globe are FCA (UK), CFTC (USA), and FFA Japan. In Europe each country has its own regulatory body which allows for the broker to operate in any of the EU member countries.

There are many currency pairs that are considered liquid. Liquid means that the prices are always available and that the spread between the bid and offer is comparatively small. Major currency pairs such as those described earlier will be the most liquid. Exotic currency pairs such as USD/ZAR for example are less liquid and can be subject to larger bid offer spreads compared to the main currency pairs such as EUR/USD or USD/JPY.

Choose your currency pairs carefully. Additionally, you need to have full access to the macro-economic news factors driving each market. EUR/USD and USD/JPY are markets for which information is extremely easy to access for most traders. It may be difficult to gain access to information in other pairs, including emerging market currencies such as the Brazilian Real or the Turkish Lira.

Set-up a Game Plan

You trading game plan needs to be based principally on two elements: type of analysis and time horizon. Traders usually use one or a mixture of both of fundamental and technical analysis. Fundamental analysis is used more in determining the long term trend by looking at data like GDP, employment and inflation. These factors have a long time horizon in playing out and are useful for understating the general trend of a given currency pair.

Technical analysis is concerned with understanding the repetition of patterns in price action. The repetition of patterns allows traders to try and successfully time the entry of a trade. This type of analysis is generally more adaptive to shorter term horizons but may also be used to generate views for medium to long term horizons.

For most retail traders, technical analysis is of upmost importance. This is because most traders will have a shorter time horizon, ranging from a few hours to hours or a few days. Since FX markets can be very volatile at the shorter time scales, market timing is essential.

The time horizon is an important aspect of your game plan. There are big differences between trading with a horizon of a few hours to trading with a horizon of a few days or weeks. The first thing to ask yourself is whether you are willing to have positions open overnight. This means you may have positions on when you are no longer watching the market, since you cannot be in front of a computer for 24 hours a day.

Many retail traders opt for day-trading. This style of trading requires that all positions are closed before the end of the trading session or trading day. Day traders typically hold trades lasting a few minutes to a maximum of a few hours, or at the very most for the entire day.

Another consideration that traders need to account for is whether to trade FX data releases and events. These are high impact news events which are scheduled in advance and on a regular basis. Some traders avoid engaging during these time as they can be extremely volatile.

Risk Limits

Stop loss and risk limits have to be well defined in advance. You should not be entering a trade without clear limits as to how much money you are willing or expecting to lose in a worse case scenario. Limits should be set as to how much money you could lose per trade. Limits also should be set on how many negative trades you are allowed to place in one day. Sometimes, we hit a bad streak, and you must have a plan in place to deal with such occurrences.

How much money you are willing to lose per trade will define your trading size for any given currency pair. You should determine the average daily volatility to help you place your stop losses. For example, If the average daily volatility is 100 pips, a stop loss of 10 or 20 pips may probably be too close to your entry price. The market may easily retrace the 10 or 20 pips before heading back in the direction of your trade.

If the number you have in mind for each stop loss is $100, opening trades of $100,000 would mean your stop loss would have to be at the most 10 pips from your entry price. This may be too close, causing you to be stopped out from a winning trade early. You will need to size your trades accordingly to allow for a stop loss wide enough to withstand the typical whipsaw price action of most currency pairs.

Auto Trading vs Manual Trading

You should also consider the pros and cons of discretionary trading vs automated trading. Discretionary trading relies heavily on discretion in the decision making process from the individual trader. Auto trading is executed solely by rules set out in a written program called a script or Expert Advisor. The human element is only present when deciding which rules to program into the system. After which a computer executes these rules with total adherence.

The immediate advantage of systems trading is that the software or script, is vigilant 24 hours a day, so while you are no longer at your computer it is still executing your trading rules. On the other hand it is not capable of assessing nuances that may occur during a trading session such as a statement from the head of central bank.

You can choose which FX markets you want to apply the automated trading strategies to, and which hours to keep the scripts active throughout the day or week. Some systems traders prefer to keep their trading algo running constantly while others pick and choose certain time frames to avoid high impact news releases.

The MT4 platform, one of the most widely used amongst retail traders, allows traders to implement automated trading through expert advisors. If you are not well versed in writing scripts in MQL4, there are also many skilled programmers within the MT4 community that can write your scripts for a fee.

Conclusion

FX trading can be an extremely lucrative and satisfying activity, but it can also damage your finances if you are not careful. You need to have a clear idea of what macro factors drive the FX spot market, as well as a good understanding of technical analysis.

Most technical indicators and studies are now available within all major charting platforms. It is advisable to learn as much as you can about different technical analysis tools to help you better time the market. Then it is a matter of determining which ones work best for you and your style of trading.

Last but not least, it is important to be able to access your trading platform and charts on an appropriate device. Something large enough to show you the price action on the screen clearly, and capable of allowing you to send orders to the market in a timely fashion with ease.