Determining the future change in the direction of an exchange rate takes prudent research. And many traders focus on the forex markets to find opportunities that will generate profits when the market moves.

Determining the future change in the direction of an exchange rate takes prudent research. And many traders focus on the forex markets to find opportunities that will generate profits when the market moves.

But many foreign exchange transactions are initiated for other reasons beyond pure speculation. Using the forex markets to hedge against adverse changes in the capital markets is a strategy used by many professionals.

Many portfolio managers as well as corporate treasurers, have currency exposure which can generate significant losses if the market makes an unexpected move. In this article, we will discuss the mechanics of hedging in the forex markets and how you can reduce your currency exposure by using specific forex hedging strategies.

Currency Hedging Basics

Currency hedging strategies can be implemented in different ways and can vary based on the investor’s potential goal. You can have a systematic approach in place that mitigates risk when your exposure reaches a specific level, or you can use a discretionary approach when you perceive that the risks of holding directional currency risk outweighs the potential gains. Many traders will also use a currency option hedge to mitigate their forex exposure.

There are many reasons why an investor or investment manager would hedge their holdings. For example, if you have a fixed income or stock portfolio that produces gains that are in another currency, you might want to hedge your currency risks to avoid losses that are not part of your portfolio mandate. So, if you are domiciled in the United States, but are running a European stock portfolio, your gains would likely be in Euros. As such, a portfolio manager may decide to hedge their positions. They reduce their exposure by calculating their currency positions and laying off their risk in the currency markets.

This would also be the case for a corporate treasurer who has departments that are located overseas. For example, the gains that the department sees, will usually be generated in a currency that is not the corporation’s base currency. The best way to hedge this exposure is to offset the currency risk by offsetting currency positions in the spot foreign exchange market.

Many corporations have fx hedging strategies that trigger at a currency limit. If the limit is breached they initiate a currency transaction that will reduce their liability. This is a systematic approach. For example, say a corporate treasurer has a currency limit for his European branch. When the cash on the balance sheet exceeds 10 million Euros, for example, the treasurer performs a fx hedge and sells Euros and buys U.S. dollars. This is an simple example of a forex hedging system.

There are many reasons you might perform an FX hedge. Most of the time, if you are a retail trader, you will purchase or sell a currency pair because you are looking for a change or acceleration in your intended trade direction for that currency pair. But what if you had a long-term view and wanted to hold your position, and needed to figure out a way to mitigate your risk exposure. One of best ways for you to achieve that would be by employing a forex hedging strategy.

If you are a forex trader or manager that is trading a portfolio of currencies, you might consider having a hedging strategy. The simplest type of forex hedging system would be to sell a portion of your position, when it exceeds a limit that you create. This process would entail reducing some of the risk you might have if the market moved against you. But what if you decided this was not how you wanted to play the market. What if instead you wanted to just pay up front for protection against an adverse move in the forex market. In this case, you could use options to hedge your currency exposure.

Forex Hedging using Currency Options

A currency option gives you the right to buy or sell a currency pair at a specific price, some date in the future. Currency options are quoted by market participants, who use several variables to determine the value of an option. If you are looking to hedge but do not want to sell a portion of your position, you can purchase or sell an FX option which will help you reduce some of your directional currency risk exposure.

Most major currency pairs have actively quoted options that have robust liquidity. You might be asking yourself whether the value of the option makes sense. A way you can determine if the market valuation of an option is realistic is by checking the value using an option pricing model, such as the Black Scholes option pricing model. This is a mathematical model that requires several variables, which include, the current exchange rate, the strike price, the expiration date, the current interest rate, and the implied volatility. The option model provides you with a premium that is based on the likelihood that the exchange rate will be “in the money” at expiration.

Currency Options Explained

As a recap of the basics, a call option is the right but not the obligation to purchase a currency pair at a specified price, on or before a certain date. The price at which the call option buyer has the right to purchase the currency pair is called the strike price, and the date when the option matures is referred to as the expiration date. If the underlying currency pair is above the strike price of a call, the option is referred to as “in the money”. When the price of the underlying currency pair is below the strike price of a call, the option is referred to as “out of the money”. Lastly, when the underlying exchange rate of a currency pair is exactly at the strike price, the option is called “at the money”.

For a put, the option is considered “in the money” when the underlying exchange rate is below the strike price and a put option is referred to as “out of the money” when the underlying exchange rate is above the strike price of the option.

Intrinsic and Time Value of Currency Options

There are two primary components that make up the value of an option. The first is called intrinsic value. This describes whether the strike price is in the money or out of the money.

For a call option, if the price of the currency pair is above the strike price, then the intrinsic value equals the “in the money” value of the option. A simple calculation for the intrinsic value for a call option, is the exchange rate of the underlying currency pair rate minus the strike price. For a put option, you can calculate intrinsic value by subtracting the strike price from the underlying exchange rate.

The second component that makes up the value of an option is the time value. The time value of the option is the value of the option minus the intrinsic value of the option. For example, if the value of the option was $0.10, but there was no intrinsic value, the time value would equal $0.10.

As we see in this example, if there is no intrinsic value of an option, then the entire value of the option is time value. This occurs when the strike price of a call option is above the underlying price of a currency pair, or the strike price of a put option is below the underlying price of a currency pair.

The value of an option is partially determined by the proximity of the strike price to the underlying exchange rate of the currency pair. If all variables remain unchanged, except the strike price, the more the strike price is in the money, the higher the value of the option. Additionally, when the strike price is “out of the money”, the closer it is to the underlying price, the higher the value of the option.

How to Hedge Currency Positions

Below are some currency hedge trading tips. There are several ways you can undertake hedging in forex using options to reduce your currency exposure. The easiest way is to purchase either a call or put option. For example, let’s assume you have a large position in the EUR/USD and you wanted to protect yourself after the exchange rate moves in your favor. If you are long the currency pair, you could purchase a put option on the EUR/USD.

For example, if you had a position where you were long the EUR/USD at 1.10, you could purchase a 1.10 put option, and this would provide you with the right to sell the currency pair if the exchange rate declined below this level. For this right, you would have to pay a premium, to the option seller.

Alternatively, you might be willing to take more of a loss by purchasing an out of the money put option such as a 1.05 put, which would begin to protect your position once the exchange rate falls below the 1.05 level. By doing this, you would reduce the premium you need to pay to the option seller.

If you are short a currency pair you can use a call option, which will give you the right to purchase a currency pair at a specified price. Remember, options have expiration dates, which means that they do not last forever, and if your option expires out of the money, it will expire worthless.

There is another type of option hedge that is less protective, but it can assist in reducing your overall exposure. Instead of purchasing a call or a put to reduce your loss, you could sell and option instead. If you sell an option against a currency position you already own, this is referred to as covered call (or put) selling.

When you sell a covered call, or put, you are adding premium to your returns, which will help counter the effects of an adverse move in your position. For example, say you decide that instead of paying away a premium on your EUR/USD position to protect against a decline down to 1.05, when the exchange rate is 1.10, you can sell a 1.12 call option. This scenario is covered because you already own the EUR/USD currency pair.

For this example, let’s assume that the call option purchaser is willing to pay half of a big figure for this option (0.005). If the price of the EUR/USD increased above 1.12, the option buyer would call your currency position away from you at the strike price of 1.12. You would retain your premium, but would not be able to participate in future increases in the exchange rate on your initial position. On the other hand, if the exchange rate moved lower, the premium you received would protect you from additional adverse changes. In this example, you would be protected as the exchange rate declined to 1.0950 (1.10 – 0.005), and then begin to lose money if the exchange rate declined further.

Using a Collar Options Strategy

While selling a call or put option seems like a good idea, it does not capture all the losses you might experience if you were really attempting to hedge your total exposure. While buying a put sounds like a great idea, there will be many times that the premiums are very costly and will make purchasing a hedge discouraging.

A technique that can solve this problem is a collar. This is technique where you are selling one option, and using the proceeds to purchase another option.

For example, say you have a long position in the EUR/USD, when the exchange rate is at 1.10, and want to hedge your exposure if the price falls below 1.05, but don’t want to pay away premium. You could consider purchasing a 1.05 EUR/USD put and simultaneously selling a 1.15 EUR/USD call.

You would use the premium from the call to purchase the put, which might completely offset the entire cost of the put premium. In this structure, you would be subject to the call buyer taking your position if the price moves above 1.15.

You can adjust your collar by moving the strike price of both the call option and the put option to find exchange rates were the premium will be either zero cost, or a partial cost or even provide you with a premium for selling a call that has a higher premium than the put you purchased.

Pricing Currency Options

Pricing Currency Options

Options on currencies are actively traded in the over the counter markets as well as on exchanges, making these derivative products very popular.

The question that many investors have is how are these products valued? If you are planning to trade options, as a hedging strategy, you need to have some idea of how these products are traded.

The inputs that are used to price an option include the current exchange rate of the currency pair, the strike price of the option, the expiration date, the current interest rates as well as implied volatility.

Implied volatility is a variable that tells you the markets estimate of how much an underlying currency pair could move in the future. This is how traders determine the probability of the option settling in the money.

Since nobody knows how far the market can move, this estimate is based on the market’s sentiment, which is generally driven by both fear and greed.

Implied Volatility

Implied volatility is determined by using an option pricing model to determine how much traders believe the market will move over the course of a year. Most over the counter currency options are posted in percentage terms.

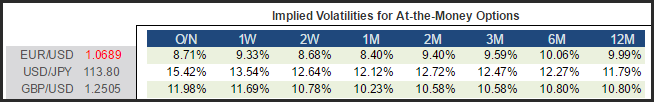

For example, this table shows currency options for each currency pair along with the implied volatility that is used to price an option for each tenor such as 1 week or 1 month or even 1 year. The most commonly quoted implied volatilities are for at the money options. Options that are out of the money and in the money, will have different implied volatility values.

This number is annualized and will tell you how far option traders believe the market will move over the course of a year. During periods of uncertainty, such as the U.S. Presidential election in 2016, implied volatility became elevated, but in the weeks, that followed, implied volatility dropped to 12-month lows.

Summary

Hedging is an important tool for traders that want to reduce their risks either ahead of events or because they believe there will be an adverse market change. Hedging currency exposure is actively performed by professional traders and portfolio managers that produce currency risks from both stock, bond or commodity portfolios that have exposure to products that are not based in their domestic currency. Currency hedging is also used by corporations that need to be convert cash back to the company’s base currency.

There are many ways to hedge currency exposure. You can find a systematic approach and perform a spot or forward transaction when the risk breaches a specific level or use a discretionary approach. You can also use options such as calls and puts as well as a combination of both to reduce your currency risk. If you plan on using options to hedge your portfolio you should become familiar with how options are traded before you transact in these derivatives.