There are a wide array of currency pairs that Forex traders can choose from. Based on your specific methodology and preferences you will need to choose the best currency pairs to trade. Having said that, there are certain Forex pairs that are ideal from the perspective of volume, volatility, and other related characteristics. One such currency pair that Forex traders should keep on their radar is the USDJPY pair. In this lesson, you will learn how to trade the USDJPY pair and why you should.

USDJPY Major Currency Pair

The USDJPY currency pair represents the exchange rate for the US Dollar to Japanese Yen. The Japanese Yen is considered the quoted currency, while the US dollar is considered the base currency. The exchange rate tells us how many Japanese Yen are required to purchase one US dollar. As an example, if the USDJPY exchange rate is currently trading at 110, then that means that ¥110 are required to purchase $1.

The USDJPY is classified as a major currency, and is one of the most widely traded pairs within the foreign exchange market. Along with the EURUSD currency pair, the USDJPY pair is also one of the most liquid Forex instruments to trade. In fact, after the EURUSD, the USDJPY pair has the most average volume traded. Specifically, as of recent figures the average daily turnover in this pair exceeds one trillion dollars. This figure represents just short of 20% of the total daily turnover within the entire foreign exchange market. As such, it appeals to all different class of traders including scalpers, day traders, swing traders, and position traders.

Along with the favorable volume attributes that are seen in the USDJPY currency pair, there are other reasons for adding this pair to your watchlist. As a result of the widespread interest in trading this pair, there is a large amount of order flow on both the buy and sell sides. Therefore, the bid ask spreads for the USDJPY are relatively low compared to most other Forex pairs. In fact, many ECN Forex brokers will show bid ask spreads on USDJPY that is just a fraction of a PIP.

In order to make money on price movements of any financial instrument, there must be a reasonable amount of volatility. Volatility essentially refers to the extent of price changes within a given period.

Many traders utilize the ADR indicator, which is the average daily range study to measure the volatility within a specific market. The USDJPY currency pair offers a healthy amount of volatility for traders to efficiently execute their strategies in this market.

Another benefit of trading USDJPY is the abundance of technical and fundamental analysis available on the pair. This is especially beneficial for new traders who are just getting started and need some expert guidance in market analysis techniques. There are dozens of currency news websites that are dedicated to providing free research and analysis on various currency markets. Most of these resources will have USDJPY analysis within their research reports.

Last but not least, there is a distinct forecasting advantage in trading major currency pairs such as the USDJPY. More specifically, due to the high liquidity and market participation seen within the majors, the price action tends to be cleaner compared to other less liquid Forex pairs such as those classified as cross currency pairs, and exotic pairs. Trend followers will also be glad to hear that price trends tend to persist longer within the majors and these trends can often extend several months to several years.

Best Time To Trade USDJPY

Best Time To Trade USDJPY

Some novice traders mistakenly believe that since the Forex markets are open 24 hours a day, five days a week, that all periods during the session are viable times to trade the market. But the fact of the matter is, there are certain periods during the day that are better than others when trading specific currency pairs. And this guideline holds true for the USDJPY pair as well.

There are certain pockets during the day when the volume and volatility tend to be the highest. These are the times where we want to pay the most attention to potential trade setups. It is during these periods where the bid ask spreads will be the tightest, the volatility will be the highest, and the volume will be at its daily peak. These are all characteristics that help put the odds in our favor.

Now, the markets open for business during the Australian and Asian session, and then the European markets open afterwards. Finally, the US market opens for business after Europe opens.

And so, during the Australian and Asian sessions, those pairs that include the Australian Dollar, New Zealand Dollar, and Japanese yen tend to become more active. During the European session, those pairs that include the British Pound, and Euro become more active. And during the US session, those pairs that include the US Dollar, and Canadian Dollar become more active.

So what are the best times of the day to actually trade the USDJPY currency pair? Well, unlike many other currency pairs the USDJPY tends to be relatively stable over the course of the session. Having said that, there is a specific time window where the volume and volatility drops off quite sharply in this pair.

The period I’m referring to is the time between the New York close and the Tokyo open. This is a two hour period where only the Australian markets are open for business, and where there is very little activity in the market.

This period of low volume can be a dangerous period to trade. Since the volume is relatively low, there is a tendency for false breakouts and other types of fake outs to occur during this time. As such, it’s best to avoid taking any new positions during this time window and consider closing out any positions that are close to their target point.

The effects of this will be more applicable to short-term scalpers and day traders who are trading smaller time frames such as the 5, 10, or 15 minute. Generally speaking, if you are holding a swing trading or longer-term position, this should not be of great concern to you.

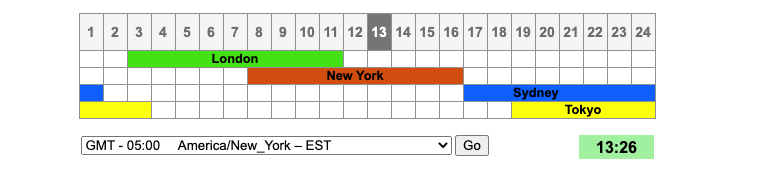

Below you can see the different trading sessions throughout the 24 hour period based on the GMT -5 time zone, also known as New York Eastern Standard Time. Notice the two hour window noted earlier between 1700 and 1900 hrs.

Factors That Influence The Price of USDJPY

There are a myriad of factors that influence the price movement of the USDJPY currency pair. Let’s take a look at some of the more important ones now.

Interest Rate Differential – One of the major factors contributing to price movements in the USDJPY currency pair is the interest rate differential. This represents the difference between the interest rate set by the Federal Reserve, and the interest rate set by the Bank of Japan. This interest rate differential or disparity can often drive institutional flow of funds. The interest rate differential is the backbone for one of the most popular trading strategies utilized by large hedge funds and CTAs, specifically the Carry trade.

Traditionally, the interest rate on the Japanese Yen has been relatively low compared to other currencies. As such, when these conditions are present large traders and investors would apply the carry trade strategy to the USDJPY currency pair as a way to generate yield. In the more recent years this disparity has shrunk, and as such this trade has become less popular. Nevertheless, anytime this scenario re-emerges there will be a tendency for large price moves in this currency pair.

Central Bank Policy – Aside from the importance of current interest rate levels between the US Dollar and Japanese Yen, there are other monetary policies that can act to drive the exchange-rate of the USDJPY as well. For example, policies related to money flow, quantitative easing, inflation measures are widely watched by traders and investors to gauge its effects on the price of the USDJPY pair.

General Economic Conditions – The USDJPY exchange-rate will be heavily influenced by the overall economic conditions in the United States versus Japan. Economic data releases can keep a trader stay abreast potential shifts in economic conditions that can lead to long-term price trends. Some of the more important scheduled news releases to watch for include the US Nonfarm payroll report, trade data between the two countries, quarterly GDP, manufacturing and industrial production reports, and retail data. Additionally, geopolitical events can contribute to price changes within the exchange-rate, both in the short term, and potentially over the long-term, depending on the significance of the event.

Commodity Correlations – The USDJPY can be influenced by the price of commodities, particularly Oil prices. This is because Japan imports almost all of its oil requirements, while the US imports only about half of its oil requirements. As such, when the price of oil increases, that can often cause the Yen currency to devalue against the US dollar. As such, the Dollar Yen pair is particularly sensitive to worldwide energy prices particularly crude oil.

USDJPY Currency Correlations

Traders should pay close attention to currency correlations when trading in the Forex market. Understanding correlations between different currency pairs can help traders to minimize risk and reduce overexposure within their trading account or currency investment portfolio. There are a few well respected Forex analysis websites that provide currency correlation tables. One such website is Mataf.net, where you can view correlations among the different Forex pairs, including of course the USDJPY pair.

There are two types of correlations – positive correlation, and negative correlation. Positive correlation refers to price movement relationships that occur in the same direction, while negative correlation refers to price movement relationships that occur in the opposite direction.

As a general guideline, a positive correlation is one where you will find a reading of +.80 or higher. A negative correlation is one where you will find a reading of -.80 or higher.

So which pairs tend to be the most correlated with USDJPY pair? Well, currency correlations are dynamic and different across various time frames. Having said that, there are a few important currency pairs that generally have a positive correlation to the USDJPY pair. This includes the EURJPY, CHFJPY, and CADJPY. As a result, if you have a long or short position open in the USDJPY pair, you will generally not want to have another position on in the same direction within these positively correlated pairs. Doing so could expose you to excess risk due to the tendency for price movements to occur in the same direction.

These are a few important Forex pairs that generally have a negative correlation to the USDJPY currency pair. This includes EURUSD, GBPUSD, and AUDUSD. Again this means that there is generally an inverse relationship between the USDJPY and these other pairs. As a result if you have a long or short position open in the USDJPY, then you would want to caution against having another position on in these negatively correlated pairs that is in the opposite direction.

USDJPY Trading Strategy

By now you should have a pretty good understanding of the USDJPY trading instrument. With all of the basic information covered, let’s now shift gears and work on building a trading method for the Dollar Yen currency pair. The strategy that will be describing is a very specific type of consolidation range breakout system that is tailored to the USDJPY currency pair. We will not be using any trading indicators within this strategy and rely on just the price action on the naked chart for our analysis. In that regard, it’s a technical based price action trading strategy.

So here are the rules for a long trade set up in the USDJPY. This strategy should be employed using the 15 minute timeframe.

- The price action from the prior day’s New York close to approximately 6 AM Eastern time should appear as a prolonged consolidation phase, with a clearly defined upper and lower boundary.

- Wait for breakout and close above the upper resistance line of the range. A prior breakout to the downside should not have occurred before this upside breakout.

- Enter a buy order immediately after the breakout confirmation signal.

- The stoploss will be placed at the center point of the consolidation range.

- The target will be set at twice the consolidation range, measured upward from the breakout point. This is essentially one pip above the upper resistance line.

And below are the rules for a short trade set up in the USDJPY. This strategy should be employed with the 15 minute timeframe.

- The price action from the prior day’s New York close to approximately 6 AM Eastern time should appear as a prolonged consolidation phase, with a clearly defined upper and lower boundary.

- Wait for breakout and close below the lower support line of the range. A prior breakout to the upside should not have occurred before this downside breakout.

- Enter a sell order immediately after the breakout confirmation signal.

- The stoploss will be placed at the center point of the consolidation range.

- The target will be set at twice the consolidation range, measured downward from the breakout point. This is essentially one pip below the lower support line.

Essentially, what we’re looking to do with this trading strategy is to take advantage of volatility expansion that is often seen in this pair during the early New York session, after a period of market indecision marked by range bound price movement starting from the prior day’s close.

USDJPY Trade Setup Example

Now that we have our Forex USDJPY strategy outlined, let’s now look at a practical example on the price chart. Below you will find the chart of the USDJPY pair as shown on the 15 minute timeframe.

The USDJPY chart above shows the price action for the US Dollar to Japanese Yen currency pair starting from the prior day’s New York close. You can see that the price action created what appears to be a rectangle formation. That is the long sideways price movement that is marked by the clear upper boundary, and the clear lower boundary. As such, the first requirement for this USDJPY trading strategy, which is the presence of a prolonged consolidation phase following the New York close to 6 AM Eastern time has been met.

At this point we will wait for a breakout and close to occur. As the price chart clearly shows, there was an upside breakout around 7 AM Eastern. This upside breakout is noted within the yellow circle area, and is marked as the breakout buy entry.

Now, we must remember to check that there was no breakout to the downside from this consolidation range prior to this upside breakout.

This is an important condition that needs to be met in order to qualify this trade set up as valid. The reason that we do this is because if there was a downside breakout from this rectangle formation prior, then there is a higher likelihood that the current upside breakout may be another fake out price move.

In any event, we can confirm in this case that there was no prior support line breakout within the structure. As a result, we can move ahead with entering the market buy order on this trade. We’ll want to protect ourselves in case the trade does not materialize as we hoped, and moves against us. As such, the stoploss order on this Dollar Yen trade should be entered just as soon as the buy entry is filled. That stoploss order should be placed at the center point of the consolidation range, as shown by the dashed black line.

Now as for the target, we will measure that by taking the high low distance of the range and use a 2X multiple of that to set the actual take profit level. The lowermost green vertical bracket represents the length of horizontal price range. The middle green vertical bracket represents a 1X multiple of that measured range, which is the equivalent length of the range. The upper green vertical bracket represents a 2X multiple of the measured range, and that level serves as the take profit target based on our strategy rules. If you refer to the chart you can see where the exit point would have occurred based on this take profit measurement.

Closing Thoughts

As you are familiar by now, the USDJPY Forex pair has many characteristics worthy of inclusion within your own trading watchlist. Along with the EURUSD, and GBPUSD pairs it is one of the most liquid products within the foreign-exchange trading universe. Both technical and fundamental analysts will find plenty of opportunities to trade this pair based on their particular strategies.

We’ve provided some USDJPY trading tips here and illustrated one simple price action based technical strategy for trading it. That should serve as a good starting point for you to do your own research and build your own Dollar Yen trading systems.