Many people new to forex trading seem to gravitate initially toward operating largely on an intraday basis, which is commonly known among traders as day trading. There are a number of popular trading strategies that are used by day traders, but due to the inherent nature of day trading, many of these strategies do not provide a positive edge in the long run.

Many people new to forex trading seem to gravitate initially toward operating largely on an intraday basis, which is commonly known among traders as day trading. There are a number of popular trading strategies that are used by day traders, but due to the inherent nature of day trading, many of these strategies do not provide a positive edge in the long run.

Though there are several advantages to using this sort of short term trading timeframe, the overwhelming shortcomings make day trading an uphill battle for most who engage in this type of trading related business.

For example, a number of traders find they are not emotionally suited to the various stresses of day trading, or they may be unwilling or unable to devote sufficient time to make their day trading program successful. Many newer day traders also find out the hard way that their dreams of getting rich quick trading currencies are unrealistic.

Becoming a day trader may seem attractive at first glance, but it really makes sense for a novice trader to take a good look at what they will be doing as a day trader and assess both their probability of success and whether or not day trading will suit their desired lifestyle.

The next sections of this article will discuss various key aspects involved in day trading currencies and will describe how you can stand a better chance of winning against the adverse odds that many newer forex day traders will face as they enter into the market.

Pros and Cons of Day Trading Forex

Choosing a day trading strategy definitely has its advantages and its disadvantages for the average forex trader. Before attempting to develop a day trading strategy, it would make sense to review these pros and cons and get a sense for whether you can tolerate the negatives in order to obtain the positives for your currency trading business.

You may also want to research what day trading strategies have been used in the past by some successful day traders who have been willing to make their methods public.

First of all, here are some of the more favorable reasons why day trading might make sense for someone interested in trading currencies:

- Reduced market exposure – Taking a position for brief periods throughout the trading day when you are able to focus on market developments means you do not have to bear the extra risk of holding positions overnight. Overnight risk exposure can be very costly since they may not just result in the triggering of stop loss orders, but also in significant order slippage.

- Shorter drawdown periods – Most traders using a system discover that they will suffer a string of losing trades from time to time. Since the number of trades involved in an unsuccessful run like this tends to be similar, a day trader will generally come out of their trading slump much faster than a long term trader. Having a shorter recovery period from drawdowns can be especially important for those who are trading to make a living.

- Rapid gratification – Day traders quickly know whether their trading decisions were right or wrong. This can suit more impatient people who often like to know, relatively quickly, whether their trade was a winner or loser.

- Higher activity levels – Traders who get a thrill from trading and like to keep active often find that regular day trading provides them with a higher level of trading involvement that they enjoy most.

- Simple decision making – Many day traders use simple decision making methods as a matter of necessity since they need to make quick decisions on whether to enter or exit the market.

On the other hand, choosing a day trading strategy can also have its downside, which include the following disadvantages:

- Higher trading costs – Day traders tend to enter into more transactions than longer term traders do since they enter and exit the market throughout the trading day. Since each transaction involves paying away the dealing spread and perhaps even broker commissions, these costs can really add up and reduce the overall profitability of your trading business.

- Greater impact of order slippage – Since a day trader will usually be more active, they will also tend to have more stop loss orders executed. This means that they generally stand a greater risk of experiencing slippage on those order levels when the market gaps through their levels so the stop losses cannot be executed as planned.

- More trading activity involved – Day trading systems usually execute more transactions, so some people find that having to spend the time making more trades means having less time available for other things they might enjoy doing in life.

- Greater focus required – Since day traders typically look for opportunities to enter and exit the market throughout the day, this means they will often need to watch it more carefully and spend more focused time on market activity.

- Need for fast decision making – In order to take advantage of smaller intraday market movements, day traders usually need to make simpler and faster decisions than longer term traders. This requires fast thinking and responses that might create more stress for a trader.

- Higher cost of market monitoring software and newswire services – Day traders generally need to keep their fingers on the pulse of the market. This often means investing in costly systems that allow them to monitor the market and relevant financial news in real time.

The above pros and cons represent some of the key considerations you will need to take into account when determining whether or not using a currency day trading strategy is going to be suitable for your personality and preferred lifestyle choice.

The Most Liquid Day Trading Currencies

The foreign exchange market is the largest and most liquid financial market in the world, so it has a lot to offer the average day trader. The major currencies that tend to see the most active forex market trading volumes are: the U.S. Dollar, the Eurozone’s Euro, the Japanese Yen, the British Pound, the Australian Dollar, the Swiss Franc and the Canadian Dollar. The New Zealand Dollar is also quite popular with currency speculators.

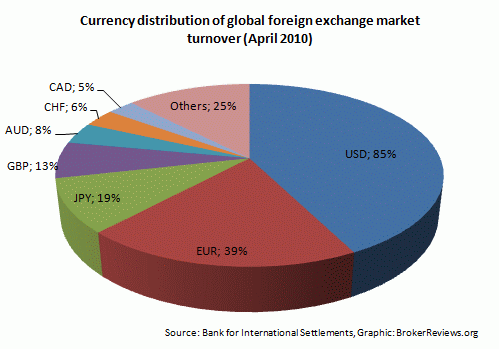

The pie chart diagram shown below displays the relative distribution of each major currency in terms of its turnover as a percentage of the total turnover based on information provided by the Bank for International Settlements in April 2010. One notable thing that really stands out from this image is how important the U.S. Dollar and the Euro are, thereby making the EUR/USD currency pair that involves both of them one of the most liquid currency pairs for day trading.

Figure 1: Pie chart showing major currency turnover in percentages as of April 2010 based on data provided by the Bank for International Settlements. Note that the total of the percentages shown add up to 200 percent since each forex transaction involves two currencies.

Not only will day traders want to focus on the more actively traded currencies, but they will also want to choose the most active currency pairs, since all trading in the forex market occurs in pairs. Basically, since day traders tend to trade more actively, minimizing their transaction costs typically becomes very important to the success of their strategy.

As a result, day traders will usually want to operate solely in the most liquid forex currency pairs since the dealing spreads are generally tighter and the presence of more market makers means potentially costly pricing gaps and order slippage will typically occur less frequently.

The following table first lists the most active and liquid currency pairs involving the U.S. Dollar that are commonly known as the “majors”. Most day traders will want to confine their dealing activities to these seven currency pairs. Below the majors, the table also lists the major currency crosses that day traders can sometimes also find enough liquidity in to operate comfortably.

Table 1: Displays the most liquid currency pairs traded in the forex market that would be most suitable for a forex day trader.

Choosing Among Daytrading Brokers

Choosing Among Daytrading Brokers

Once the exclusive realm of large financial institutions and professional traders, day trading has become available to speculators of any size through online forex trading. A major consideration in selecting a day trading broker is their reputation and trustworthiness.

A broker that is overseen by a reputable regulating agency such as the Financial Conduct Authority in the UK and CySEC in the European Union is a criteria that should be at the top of the list. The National Futures Association oversees brokers that do business in the United States.

The next important consideration is security. Ideally, the broker one chooses should have secure SSL encryption to receive and transmit your personal financial information. A broker that does not encrypt your information is putting your information at risk of data theft.

Next on our list are commissions and the cost of doing business as a day trader. Typically, online forex brokers receive their commissions from the bid/offer spread, therefore, the tighter the dealer spreads on currency pairs, the more cost effective your day trading will be. In the case of a commission per transaction, these costs can add up quickly depending on how actively the account is traded.

In addition to the above considerations, the broker’s trading platform should be easy to navigate and use, since day trading involves the need to make quick decisions. Also, a broker’s account types and customer service should be considered when selecting a broker for day trading.

How to Make Money Day Trading

The answer to question about how to make money day trading really depends on the individual and the way that the trader implements their trading plan. Many day traders are extremely active when they trade, often initiating and exiting positions within seconds in some cases. Other day traders position themselves at a certain level of a currency pair using limit orders, and then take their time in closing out the position sometime later on the same trading day.

While large sums can be made trading in the forex market, one should never lose sight of the fact that these large sums can turn into losses in seconds in a volatile market. The conditions in the forex market can rapidly turn from a peaceful range trading environment to an extremely volatile one. Knowing when to exit a trade can be challenging for any trader.

Basically, making money day trading depends entirely on the quality of a trader’s trading plan, how well it is implemented in practice, and the trader’s discipline in adhering to their own rules. Day trading becomes even more challenging when a trader comes into the market each morning unprepared.

Some Popular Forex Day Trading Strategies

While many day traders initiate positions in a forex currency pair and exit them as soon as they are profitable, another popular trading strategy consists of hedging.

In a hedge strategy, a trader either takes a position which offsets the original position in the same currency pair, takes a position that reduces risk in another well correlated currency pair, or takes an offsetting position using currency options.

The first type of hedged trade example is for the trader to take an opposite position in the same currency pair. This strategy can only be implemented from a brokerage account that is not based in the United States. U.S. securities law prohibits holding two offsetting positions in the same account.

The second type of hedged example is for the trader to take an opposite position in a well correlated currency pair. The second currency pair trade will ideally move inversely to the original position.

A third strategy involves using currency options to hedge the position. This strategy provides a number of different ways to hedge the original forex currency pair position.

Once established, the hedge can be traded out of by liquidating its individual components or “legging out” of the position. Ideally, the position’s profit side will be higher than its losing side. Nevertheless, even if the original hedge is a losing trade, the position can be liquidated for a profit if the trader “legs out” of it in the right way.

Another very short term day trading strategy is known as scalping, where a trader will often quickly move in and out of the market in seconds aiming for a few pips profit.

Developing Successful Day Trading Systems

Developing a day trading system depends in large part on the trader’s analysis background. Technical analysts will generally use chart points and levels of supply and demand to determine exit and entry points.

Technical day traders rely on a number of indicators and signals that will alert them as to when to enter or exit a trade. These signals consist of oscillators, momentum indicators and in some cases, volume figures, as well as levels of support and resistance in the currency pairs traded.

Developing a technical day trading system involves selecting the most relevant signals and taking action once these indicators come into line with the trader’s criteria for initiating or liquidating a position.

Fundamental day traders generally rely on economic releases that are listed in a nation’s economic calendar. Important releases, such as a nation’s GDP, employment numbers or action taken by a country’s central bank can increase the volatility in a currency pair, which is generally the best trading environment for day traders.

Using Day Trading Signals

Knowing when to initiate or liquidate positions is the most important consideration for a day trader or for any trader really. A forex day trader hopes to gain an edge in the market by following signals provided by their trading strategy which is derived from market conditions during the trading day.

An overbought/oversold oscillator is a simple example of a technical day trading signal that can be used. When a currency pair reaches an extremely oversold condition, the commonly observed market reaction is generally that of a corrective rally. By using this signal, a trader would initiate a long position in the currency pair at the oversold level while expecting to profit from a correction to the oversold condition. The inverse is true for an overbought condition in the currency pair.

Nevertheless, one should be aware that just because a currency pair has become oversold, it does not necessarily mean that a rally will inevitably ensue. Depending on underlying economic and geopolitical conditions, the oversold condition could remain for quite some time as the currency pair continues to decline over a prolonged period.

Other day trading signals include the currency pairs opening and closing ranges for the different trading sessions, such as the Asian, European or American sessions. Fundamental economic releases can also be day trading signals, with positive or disappointing results generally moving the market on a currency pair.

Overall, the best day trading strategies to use will really depend on the trader, their trading plan, their account size, and how they implement and take action once they have established a trading position.

In any case, regardless of the strategy employed, aspiring day traders need to be aware of the pitfalls involved in day trading which makes it extremely difficult to gain and keep a positive edge in the long run.