The forex market was one of the original financial markets to provide quotations to traders around the clock during business days. This situation largely arose due to the global importance of currency trading to companies and banks located in different countries around the world.

The forex market was one of the original financial markets to provide quotations to traders around the clock during business days. This situation largely arose due to the global importance of currency trading to companies and banks located in different countries around the world.

In the Interbank forex market, professional forex traders working at one branch office of a large international bank, would typically pass their local clients’ foreign exchange orders on to an affiliated branch so that efficient round the clock trade execution is possible.

Unless interrupted by a bank holiday, this process would generally proceed in an orderly fashion as time marched on around the clock during regular currency market hours. The banks situated in each major or minor city involved in this cycle have normal business hours that form what eventually came to be known as a forex or currency trading session.

Each of these forex sessions is typically given the same name as the money center city that has the business hours they correspond to. If you are looking to discover the best time to trade forex pairs, then understanding when the various forex sessions operate and what currencies are most liquid during that time frame becomes quite important.

Global Forex Market Hours

Forex trading currently occurs actively from the official forex market open that occurs each week on Sunday afternoon at 04:00 New York time in the New Zealand cities of Auckland and Wellington until the market eventually closes on Friday afternoon at 17:00 New York time in New York City.

Although the forex market as a whole remains unregulated and without any official organization, these hours represent the effective and customary forex open times during which traders can execute foreign exchange transactions in currency pairs.

After the New York close, a modest amount of afterhours forex trading might subsequently occur in the Midwestern U.S. city of Chicago, as well as in the West Coast U.S. cities of San Francisco and Los Angeles. This sort of trading is largely for banking clients.

Still, when the traders working at banks situated in those cities stop quoting and go home on Friday, the forex market effectively closes for the weekend.

Normal FX Trading Hours of the Major and Minor Forex Trading Centers

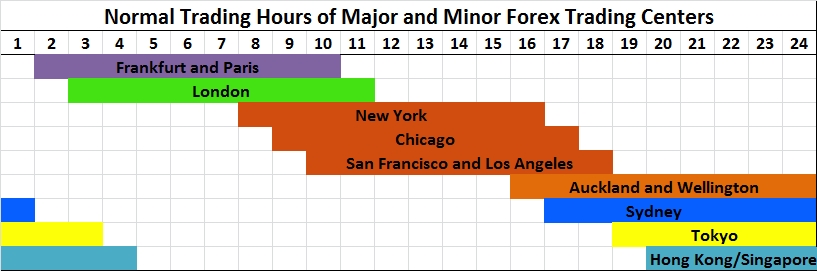

Each of the major trading centers has normal business hours that most banks and their professional traders keep each day, excluding weekends and bank holidays. In all cases, these hours overlap with the normal business hours of another major trading center. This overlap allows for the smooth and continuous progression of forex trading around the world.

The chart in Figure 1 shows the FX market hours of each major forex dealing center color coded by economic bloc or country. This chart includes hours for cities with well-developed financial districts such as: Frankfurt, Paris, London, New York, Auckland, Wellington, Sydney, Tokyo, Hong Kong and Singapore.

Figure 1: This chart shows the normal forex trading times of all of the major and minor forex trading centers using the time in New York City in the United States as the base time. These trading centers include those in continental European cities like Frankfurt and Paris. In addition it includes London, New York, Wellington, Auckland, Sydney, Tokyo, Hong Kong and Singapore.

A very important element to note about the above chart is that the business hours in one major financial center — such as London, New York and Tokyo — overlap with the business hours in another. These overlaps correspond to times of considerably greater liquidity and trading volume due to the higher number of market participants currently active.

The Three Major Currency Trading Sessions

In the over the counter and online electronic forex market, the three major trading sessions for currencies generally correspond to the normal banking business hours worked in the major cities of London, New York and Tokyo. Each of these cities is the major money center in their respective countries of Great Britain, the United States and Japan.

All of these major money centers have a large number of banks situated in them that actively make markets in a wide range of forex currency pairs. In addition to dealing with their clients, these banks also trade among each other in the over the counter Interbank market via telephone, brokers and using electronic dealing systems.

Banks situated in a particular forex trading center will typically see higher trading volumes in currency pairs that involve the local currency. For example, a Japanese bank situated in Tokyo may see a larger volume of USD/JPY transactions than in any other currency pair. Similarly, a British bank situated in London may see a large volume of GBP/USD trades.

- The London Session: This very active trading session takes over from Tokyo and starts at 03:00 New York time and runs until 12:00 or noon New York time when its traders generally pass books on to their New York based counterparts. This session typically sees a high trading volume in European currencies — like the Euro and Pound Sterling — and also in their major crosses.

- The New York Session: This active forex trading session starts at 08:00 New York time and closes at 17:00 New York Time. New York traders take over fully from their London-based counterparts at 12:00 pm or noon New York time, and so this session overlaps with London from 08:00 until noon NY time during which time the forex market is highly active and liquid. New York does not overlap directly with Tokyo, so institutional bank traders in New York will typically pass books on to either West Coast counterparts or to those situated in New Zealand cities like Auckland or Wellington or to Sydney, Australia. Currencies traded versus the U.S. Dollar and the Canadian Dollar seem most active and liquid during this time frame.

- The Tokyo Session: This session starts at 19:00 New York time and closes at 04:00 New York Time whereupon books are passed to counterparts situated in London or continental European cities like Frankfurt or Paris. During the Tokyo and London overlap time, the forex market is again quite active and liquid. Major currency pairs and those involving the Japanese Yen, Australian Dollar and New Zealand Dollar seem most active and liquid during this trading session.

Forex Market Times of the Minor Trading Sessions and Futures Contracts

In addition to the three major trading sessions corresponding to business hours in London, New York and Tokyo, several relatively minor forex trading sessions are worth noting.

In addition to the three major trading sessions corresponding to business hours in London, New York and Tokyo, several relatively minor forex trading sessions are worth noting.

Some of these sessions offer transitional liquidity to the forex market as the opening of a major center is awaited, while others provide additional liquidity in less actively traded currencies.

In addition to the major New York session, two minor U.S. trading sessions exist to offer liquidity to forex traders and banking clients during U.S. business hours. These sessions correspond to business hours in Chicago, which run one hour later than New York’s, and also to the hours observed in West Coast U.S. cities like San Francisco and Los Angeles, which run three hours later than New York’s and end at Tokyo’s open.

Several minor trading sessions are located outside the United States. The first corresponds to the normal business hours of Wellington and Auckland in New Zealand that overlaps with both the New York Session and the Tokyo session.

The trading session of Sydney in Australia also overlaps with the New York and Tokyo sessions. In Asia, the trading session of Singapore and Hong Kong does not overlap with New York, but it does overlap with both Tokyo and London.

When it comes to currency futures, some of the most active contracts trade using the Chicago-based CME Group’s electronic network. Its hours start with a pre-open for order taking and market indications at 17:00 New York time on Sunday, with trading formally beginning an hour later at 18:00.

During regular weekdays, this currency futures market starts its pre-open activates at 17:45 New York time with trading commencing at 18:00. Trading in these currency futures contracts officially ceases at 17:00 New York time each Friday evening.

Overlapping Forex Session Times

The overlaps among forex trading sessions are important to traders because those times typically correspond to periods of greater exchange rate and order activity, volatility and trading volume.

Perhaps the most important and active of these overlaps occurs between the London and New York sessions. This overlap runs from 08:00 New York time until 12:00 or Noon New York time. During this time period, considerable overall liquidity is usually observed, with greater activity focused on the Canadian Dollar and European currencies quoted versus the U.S. Dollar.

Another important overlap occurs between the relatively minor sessions of New Zealand, Sydney, Hong Kong and Singapore and the major Tokyo session. This one takes place from 20:00 New York time until 24:00 New York time and tends to offer traders greater liquidity in the Oceanic and Asian currencies.

Riskier Forex Trading Times

Every experienced forex trader can probably list a time or series of times when they think forex trading tends to be riskier than at other times. Most of these high risk times that can put a trader’s account at risk will involve important changes in key market risk factors for currency traders that usually include:

Every experienced forex trader can probably list a time or series of times when they think forex trading tends to be riskier than at other times. Most of these high risk times that can put a trader’s account at risk will involve important changes in key market risk factors for currency traders that usually include:

- Volatility – this term is related to the degree of market movement observed, and certain types of volatility, including implied, historical and actual volatility, have become important risk measures for many traders, and especially for those involved in option trading.

- Liquidity – this is related to the forex market’s depth and ability to handle large transactions effectively and assessments of it typically reflect the number of market participants willing to make quotations.

- Execution ability – this risk factor determines whether transactions can be effectively entered into without numerous re-quotes due to rapid market movements.

- Slippage – this refers to the difference between the level entered on a stop loss order and the level the order is actually executed at if the order is triggered by market movements.

- Dealing Spread – this is the difference between the bid and offer exchange rates quoted by a market maker.

Trading conditions typically deteriorate by most standards during risker forex trading times, and they might be characterized by such things as: increased volatility, reduced liquidity, more re-quotes, greater slippage on orders, and wider dealing spreads.

Many currency traders will find these risker trading times potentially problematic for their strategies, especially for those based on technical analysis.

Technical trading methods tend to operate better in highly liquid and orderly markets because technical analysis assumes the market price has already discounted all available data, and this assumption tends to break down in fast markets rapidly assimilating new information.

Accordingly, more conservative forex traders typically prefer to square rather than take positions during high risk time periods. The forex trading times which seem to be avoided by many forex professionals whose strategies perform better in liquid and orderly markets include the following:

- Friday and Sunday Afternoons – although the forex market is technically open, liquidity is often thin and dealing spreads wider at these times due to a reduced number of market participants.

- Bank Holidays – These can be especially problematic for liquidity when the holidays occur in one or more of the major trading centers that include London, New York and Tokyo.

- Major News Releases – These can include election results, national conflicts and disasters, as well as announcements from influential central banks.

- Major Economic Data Releases – Traders can check a forex economic calendar for the times and dates of such releases that are typically provided in advance of the actual release occurring. A particularly notable example is the U.S. Non-Farm Payrolls number that typically gets released on the first Friday of each month at 8:30am NY time, which usually corresponds to 1:30pm London Time.

Nevertheless, some forex traders actually like to take advantage of the dramatic movements seen in the market during high volatility periods.

These participants include news traders whose strategies are designed to take advantage of the large price swings typically seen around the release of major news announcements or economic data. They often look forward to trading the more volatile periods centered on these economic news releases, which many other technical oriented traders avoid by squaring positions until the riskier period is over.

The Best Forex Trading Sessions

An important trading time consideration for many forex traders involves deciding which trading sessions will typically offer the best opportunity to make trades given their particular trading strategy.

Although most traders prefer to simply operate during their normal waking or business hours, some traders may prefer to adjust their operating hours based on the currency pairs they want to trade the most.

For example, a person interested primarily in trading in the Japanese Yen may not be able to enjoy the same degree of liquidity and information flow during the New York trading session as they might see during the Asian trading session when large Japanese banks compete for forex business and Japan releases its key economic data.

Even if physically based in Europe or the United States, a Japanese Yen trader might choose to adjust their waking and trading hours to better conform to the standards of the local Japanese forex market.

Basically, determining the best forex trading session for your particular strategy, lifestyle preferences and other time-related constraints, such as another job, can be complex and unique for every trader.

Nevertheless, it can make good business sense in many cases for a trader to take some time to analyze the time-dependent liquidity and volatility profiles of each currency pair they might be trading and optimize them for their particular trading strategy and situation.