Currency futures were first introduced by New York-based International Commercial Exchange in 1970, but it virtually had no practical use due to the fixed currency rate environment governed by the Bretton Woods system. However, as soon as the Bretton Woods system was abandoned in 1972, the Chicago Mercantile Exchange (CME) started offering institutional investors the option to trade currency futures.

Over the last few decades, the popularity of currency futures has gone up tremendously. Currently, the Chicago Mercantile Exchange (CME) currency futures market has an average daily trading turnover of over $100 billion, which makes it the second largest foreign exchange market after the interbank spot Forex market.

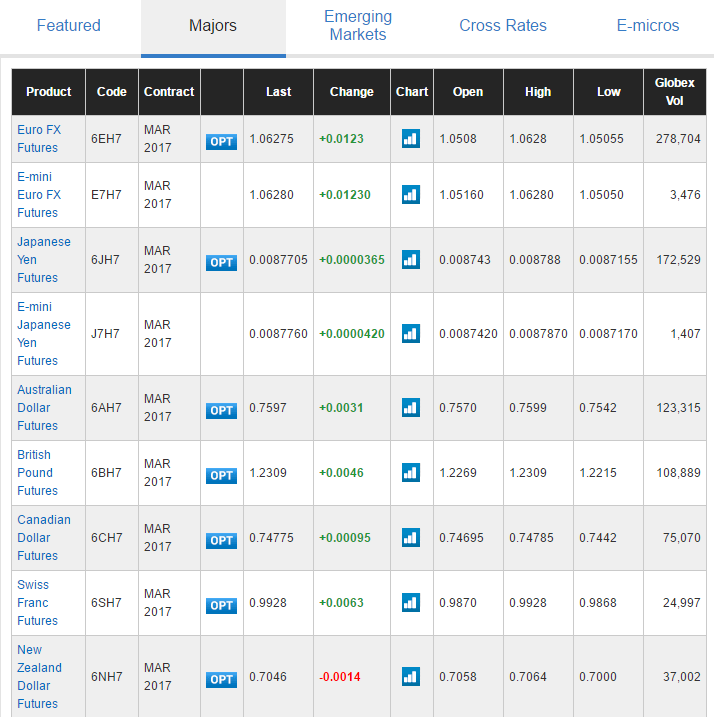

Figure 1: Major Currency Futures Contracts Offered by the Chicago Mercantile Exchange

While there are many different types of commodities futures, the currency futures contracts usually quote only against US Dollars. For example, the Chicago Mercantile Exchange (CME) offers approximately 49 currency futures contracts along with numerous other E-mini currency futures contracts, which are smaller in size compared to the full-sized contract.

One thing beginner futures traders often get confused about is forward and futures contracts. Therefore, it is worth mentioning that a currency forward contract is an over-the-counter private transaction between counterparties. By contrast, a futures contract is traded via a public exchange.

If you are familiar with how other futures contracts work in the commodities market, then understanding foreign currency futures contracts should be relatively straightforward. Similar to commodities futures, currency futures and options also enable the buyer of the contract to complete the transaction at a future date, based on the current agreed on price.

If you are new to trading, then you might want to further expand your basic understanding regarding futures contracts before diving into forex futures trading. We will discuss some details you should be acquainted with regarding the currency futures market so that you can consider adding currency futures to your investment portfolio.

What Are Currency Futures Contracts?

What Are Currency Futures Contracts?

An FX futures or currency futures contract is a type of foreign exchange derivative, where a buyer agrees to buy one currency in exchange for another currency, at a future date and at a current agreed upon price by both buyer and seller at the moment of creating the contract.

When you are trading spot Forex, you are also exchanging one currency for another currency at an agreed price. However, an important distinction between trading Forex and trading currency futures is that with the futures contract, you agree to trade one currency in exchange for another currency, at a future date and time based on the already agreed rate.

Commodities futures contracts can end up delivering the goods physically. Many producers and merchants use the futures market to lock in the price of a product before producing the product. The currency futures market is often used by buyers and sellers to mitigate risks of price fluctuation by hedging or trying to make a profit by speculating.

As a result, currency futures contracts almost never end up in a physical delivery of the currency. Instead, Foreign exchange speculators often use currency futures contracts to speculate about the potential movement in the currency price of a pair and profit from the exchange rate fluctuations. Obviously, as with trading spot forex, if your prediction around the price movement is wrong, and the market moves against your speculated price level, you can incur losses from futures currency trading.

E-Mini & E-Micro Currency Contracts

Please note that if you are a newer currency trader, it is better that you start your currency futures career by trading E-mini and E-Micro contracts, as the smaller size and low margin requirements would help you trade various instruments with lower risk factors.

Generally, the liquidity of currency futures is much lower compared to the spot Forex market. Also the volume on the standard currency futures are much higher than those of the micro contracts. But if you are a new currency futures trader, you will find it much less capital intensive, to test the waters using the E-mini and E-micro contracts compared to the full sized contracts.

The Relationship between Interest Rates and Futures Contract Rates

Before you embark on trading currency futures, you need to understand the relationship between spot Forex rates and futures rates. One important thing you need to know is that the difference between interest rates associated with the currency pair in question often plays a significant role in the pricing for that futures currency contract.

In the currency futures industry, this relationship between the difference in interest rates is known as the “cost of carry.”

As you may already know, the central banks that issue the currency offer overnight rates. Your spot Forex broker usually passes this on to you in terms of swap rates.

For example, let’s assume the Bank of England offers a 4% per year interest on Pound, and the US Federal Reserve offers a 1.25% interest per year. If you are a US-based Forex trader, then you can borrow 100,000 US Dollar at 1.25%, then convert it into Pound and invest it for a quarter (three months) at 4% per year rate. At the same time, you can enter into a currency futures contract to get delivery of the same quantity of US Dollar in three months.

By opening both the spot Forex transaction and currency futures contract at the same time, you can make a (4 – 1.25) 2.75% per year return, which would turn out to be a 0.688% risk-free return in three months. This assumes that the price of the currency remains the same at the end of the 3 month period.

Hence, the currency futures rate is always likely to be higher or lower compared to the spot Forex rate, depending on the positive or negative interest rate differential of the currency pair in question. Usually, the currency futures rate would be trading at a discount compared to the spot Forex rate for the currency pair with a positive interest rate differential and vice-versa.

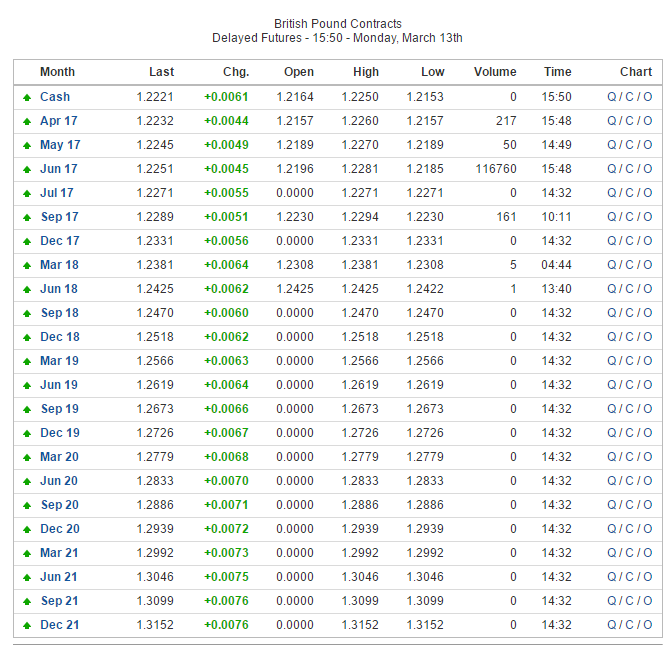

Figure 2: GBPUSD spot Forex (Cash) is Trading at a Discount to GBPUSD Currency Futures Rate

For example, on March 13, 2017, the US Federal Reserve had a benchmark interest rate of 0.75%, and the Bank of England had a benchmark interest rate of 0.25%. Hence, the GBP/USD pair had a negative interest rate differential.

Therefore, GBP/USD spot Forex rate would have traded at a discount to GBP/USD currency futures rate as the Pound had a lower associated interest rate (0.25%) compared to the US Dollar (0.75%) at the time.

As you can see in figure 2, as of March 13, 2017, the GBPUSD spot Forex rate, which is the cash rate, was trading at 1.2221, but the March 2018 GBPUSD currency futures rate was trading at 1.2381. As a result, you would not have been able to make any real profit if you tried to open two simultaneous currency futures and spot Forex trades, as the cost of carry would diminish any possibility of risk-free profit.

Using Currency Futures to Hedge

As we discussed earlier, you can use currency futures to do two things: first, you can either hedge your risks against future Forex spot price through buying currency futures or selling currency futures. Secondly, you can speculate that future Forex spot price will be different compared to the quoted currency futures prices and try to profit from the difference in prices.

While large corporations involved in international business buy currency futures contracts to take physical delivery of the currency, they also hedge against any currency rate fluctuation in the future.

For example, let’s assume Japanese car manufacturer Toyota got an order to deliver 100 units of vehicles to an importer in Kuwait for $3,000,000. Here, the delivery date is set three months from the date of the contract and the payment will be received upon the physical shipment of the cars to Kuwait. If the USD/JPY rate on the date of signing the contract is 120 Yen per US Dollar, then Toyota is set to earn a revenue of 360,000,000 Yen in three months.

Now, Toyota executives can start manufacturing the cars in Japan the next day and hope that the USD/JPY spot rate remains at 120 after three months. However, if USD/JPY spot rate comes down to 110, their revenue in Yen would turn out to be only 330,000,000, which translates into a loss of 30,000,000 Yen, or $250,000 based on USD/JPY spot rate of 120, right?

A $250,000 or an 8.33% reduction in revenue can significantly reduce the net profit from the deal. Hence, to mitigate the risk of USD/JPY spot rate fluctuation in three months, Toyota executives can turn to the forex and futures market and hedge the $3,000,000 (360,000,000 Yen) worth of Yen currency futures contract against the US Dollar, maturing in three months.

In this currency futures example, we tried to demonstrate the practical side of how multi-national firms can use currency futures contracts. However, the vast majority of Forex traders would not use currency futures in the same way.

Instead of expecting an actual payment on a future date, futures traders may want to hedge their current exposure to the spot Forex market. For example, let’s say you have bought a full lot of EUR/USD with your Forex broker on the spot Forex market at the rate of 1.1000. If you have an expectation that in a few months, the EUR/USD rate would go up to 1.2, and it does so, then at that time you would be able to liquidate your position to make a handsome profit of 0.1 or 1,000 pips.

However, after few weeks into the trade, the unemployment rate of United States unexpectedly came down, as a result, the EUR/USD price went down against your previous speculation to now where you are sitting with a small loss. You want to keep the trade open but want protection as well, so what can you do?

Nonetheless, at this point, you can either liquidate (sell) your EUR/USD position for a small loss or the sell same quantity of euro currency futures as your EUR/USD position, with a maturity date in a few months’ time. By doing so, if the EUR/USD spot Forex rate continues to go down, you would still have the option to get out of the position with a small loss in the future instead of now.

On the other hand, if the EUR/USD price continues to go up, as you initially expected, you can just buy an additional euro currency futures contract to cover the first futures contract.

With these three transactions, one spot Forex and two futures contracts, you can hedge your risk when the market is moving against your position, but continue to speculate the EUR/USD price in the future without incurring a loss from the first spot Forex position.

Using Currency Futures for Pure Speculation

Most forex traders know that the actual nature of the business that they are involved in is financial speculation. As a spot Forex trader, you try to predict which way the price of a currency pair will move and buy or sell according to your inclination, right?

When you place a trade, you are risking your capital. If your speculation turns out to be right, you will be rewarded with a profit, and if your prediction turns out to be wrong, you lose some of your capital. In short, you take on risk to make a potential profit.

In the same manner, you also buy or sell currency futures contracts to speculate which way the futures rate would move, and stand a chance to gain profit if you are right, or lose money if you are wrong.

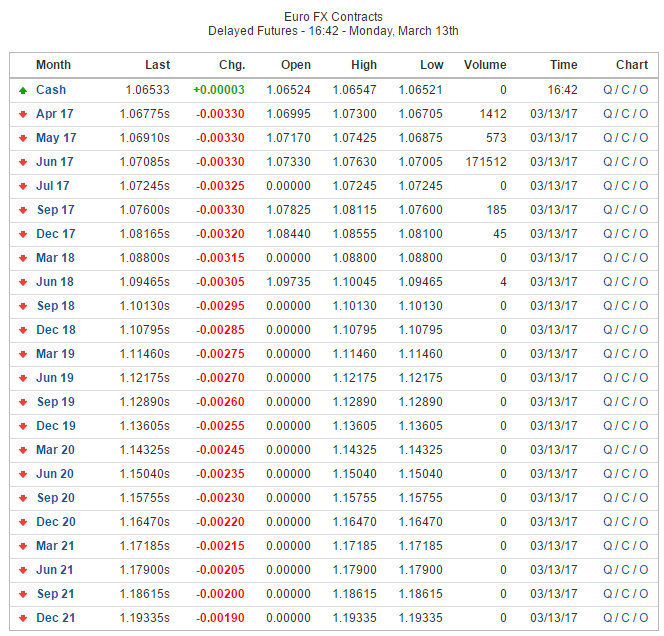

Figure 3: EURUSD Currency Futures Rates

For example, let’s say you buy ten CME May 2017 contracts of CME Euro FX contracts at 1.0691, and by the end of the trading day, you find that the rate closed at 1.0720. As each Euro FX contract is worth 125,000 Euro, each change of $0.0001/€ in price would result in $12.50 profit or loss.

As a result, your net profit based on the net change of 0.0029/€ in price would be (10 contracts x 125,000) 1,250,000 x 0.0029 = $3625. At the end of the trading day, you would have been paid this sum into your trading account.

Conclusion

Most professional and institutional Forex traders keep a close eye on the futures contract rates of the respective currency pairs they are trading in order to understand the general trend in the market. After all, all things being equal, the spot Forex rate would likely move towards the futures rate in the coming months.

Because the market often behaves irrational, as a Forex trader, you can try to find a divergence between the overall futures price trend and short-term counter moves, and develop a comprehensive arbitrage trading system to speculate and profit from such irrational market behavior.

Regardless how you decide to utilize the currency futures, it is essential that you have some basic understand of how it works and how the major players utilize it. As Forex traders, we should develop a clear understanding of how interest rates, and other important market fundamentals contribute to the relationship between the spot Forex rate and the currency futures rate.