The Shark pattern is a relatively newer discovery within the harmonic trading arena. It has a very distinct appearance, and specific Fibonacci relationships that compose the overall structure. In this article, we will be discussing all aspects of the Shark trading pattern.

Harmonic Shark Pattern

The Shark pattern is a chart formation that is classified within the harmonic family of patterns. It was introduced to the trading community by Scott Carney, who has done extensive research into Fibonacci-based harmonic patterns including the Bat, Gartley, and Crab patterns.

As with other harmonic patterns, the Shark pattern exhibits a very specific set of Fibonacci relationships within its structure. As for the labeling convention for the Shark pattern, it differs a bit from the traditional labeling convention seen within most harmonic patterns. More specifically, the five points within the Shark pattern are labeled as 0, X, A, B, and C. This is in contrast to many other traditional harmonic patterns that are generally labeled as X, A, B, C, and D.

The main take away from this is that the terminal point within the Shark pattern should be recognized at the end of the BC leg, rather than the end of the CD leg as is common with most other harmonic structures. Many traders often confuse the Shark pattern with the Cypher pattern. While both of these patterns are harmonic formations, and have certain similarities between them, there are some distinct differences between the two that we will be reviewing a bit later on.

Upon drawing the harmonic Shark pattern, you will notice a few important features. As far as the general appearance, many traditional technical analysts may recognize the pattern as a double top formation upon the pattern completing the B point within its structure, in the context of an up trending market phase.

Similarly the Shark pattern appears as a double bottom formation upon the pattern completing the B point within its structure, in the context of a down trending market phase. This is a fairly general description of the harmonic Shark pattern. We will be looking at the very specific Fibonacci proportions within the structure next. Although it is not required, a Shark pattern indicator will help in outlining the structure.

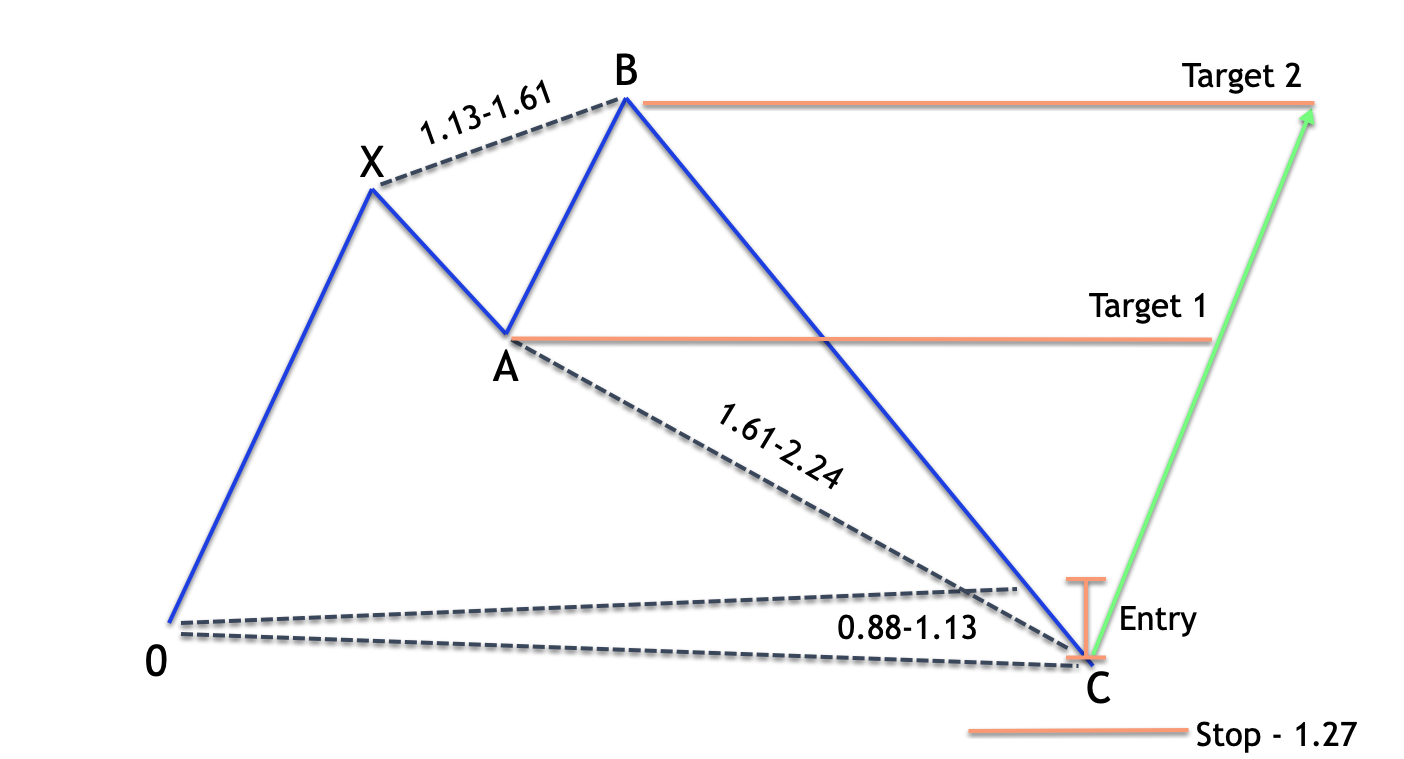

Below you can see an illustration of the bullish variety of the harmonic Shark pattern.

As we can see, the Shark pattern is a five point formation with four primary legs. The formation starts at point 0 and ends at point C. Below is a detailed description of each swing within the bullish Shark pattern.

OX price leg – This is the first leg within the structure. Price travels higher from point 0 to point X, and this price move appears to be impulsive in nature, meaning that it has characteristics of a trending price move.

XA price leg – This is the second leg within the structure. After point X reaches its peak, the XA leg retraces a portion of the initial upside price move. While there is no specific retracement level for the XA price leg it must be less than a 100% retracement of the initial price move.

AB price leg – The AB price leg is the third leg within the structure. After point A has completed price begins to move higher within the AB leg. Eventually this price move extends beyond the swing high seen at point X. Ultimately, the AB leg will be a 113% to 161% extension of its prior XA swing.

The BC price leg – This is the final leg within the structure. Starting from point B, the price action begins to move lower in an impulsive type of move. The price should travel approximately 161% to 224% the length of the XA leg.

Additionally the terminal point within this pattern occurs at point C, which will fall between the 88.6 and 113% retracement of the initial 0X price swing. At this point, the structure is considered to be completed, and a bullish price move should ensue from this terminal C point.

The Shark pattern can be seen as a type of exhaustion pattern. Within the context of a bullish Shark pattern, price makes a move to the to the upside which later leads to a sharp price decline that ultimately gives back most if not all the gains seen within the structure. And just when traders are convinced that a new downtrend is in place, a reversal is set to take place at point C which will again lead to a bullish impulse leg.

In our example here we have discussed the bullish variety of the Shark pattern, but it’s important to note that the Shark pattern can occur as a bearish variety as well. In this case, the pattern would be inverted.

Bullish Shark Pattern

Let’s quickly recap the primary fib ratios for the Shark pattern, and consider some trade management rules for the bullish variety of the pattern.

OX price leg – This is the initial bullish impulsive price move.

XA price leg – This leg retraces a portion of the initial OX leg

AB price leg – This leg extends beyond the swing high at point X. Point B should terminate within the range of 113 to 161% of the XA leg.

BC price leg – As price moves lower, point C should terminate at a level that corresponds to 161% to 224% projection of the XA leg. Additionally, point C should retrace to 88% to 113% of the OX leg.

Now, there are several different ways that harmonic traders will trade the bullish shark pattern. As such, there is no universal method for trading this pattern. Below are some of the more traditional trade management rules for the bullish Shark pattern.

Enter a limit order to buy between the 88% and 113% retracement level of the OX leg.

Place a stop loss at the 127% extension of the OX leg.

Utilize a dual target scale out exit approach, with the initial target set just below point A of the pattern. The second target will be set just below point B of the pattern.

If you refer to the illustration of the bullish Shark pattern above once again, you can see where these levels would trigger within the pattern structure.

Bearish Shark Pattern

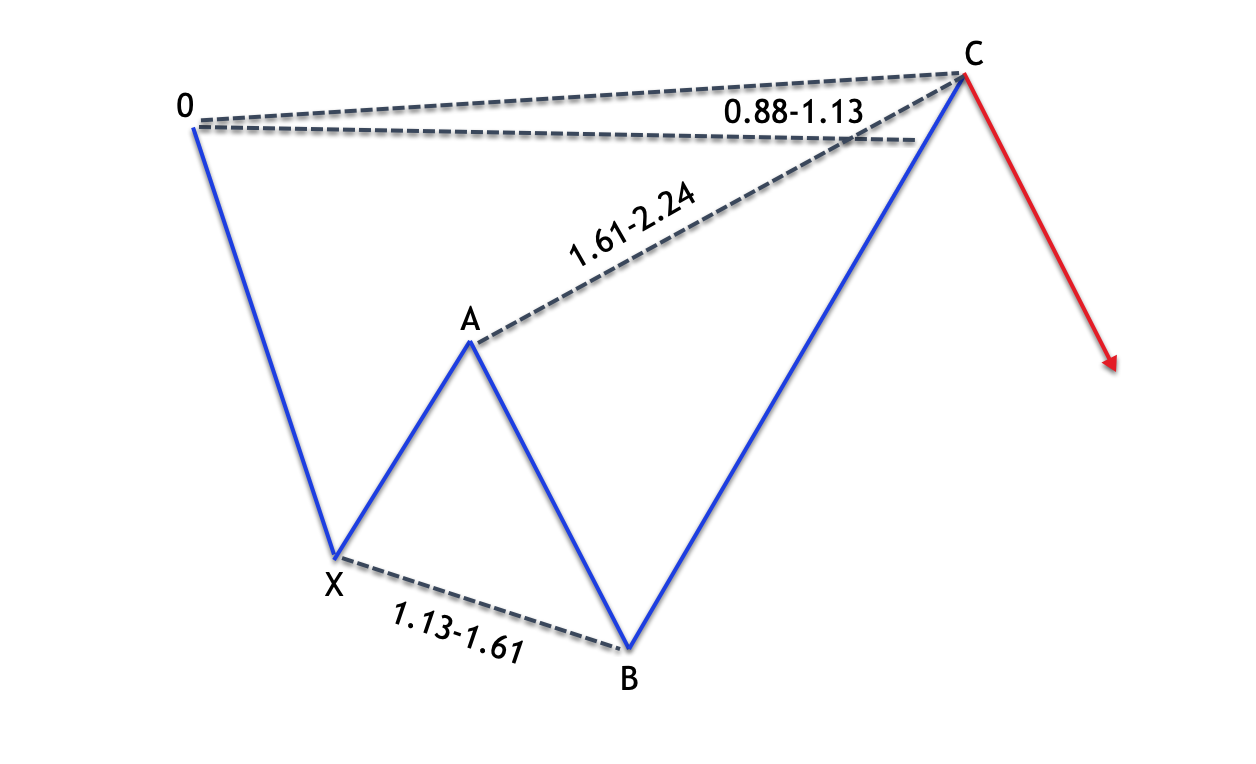

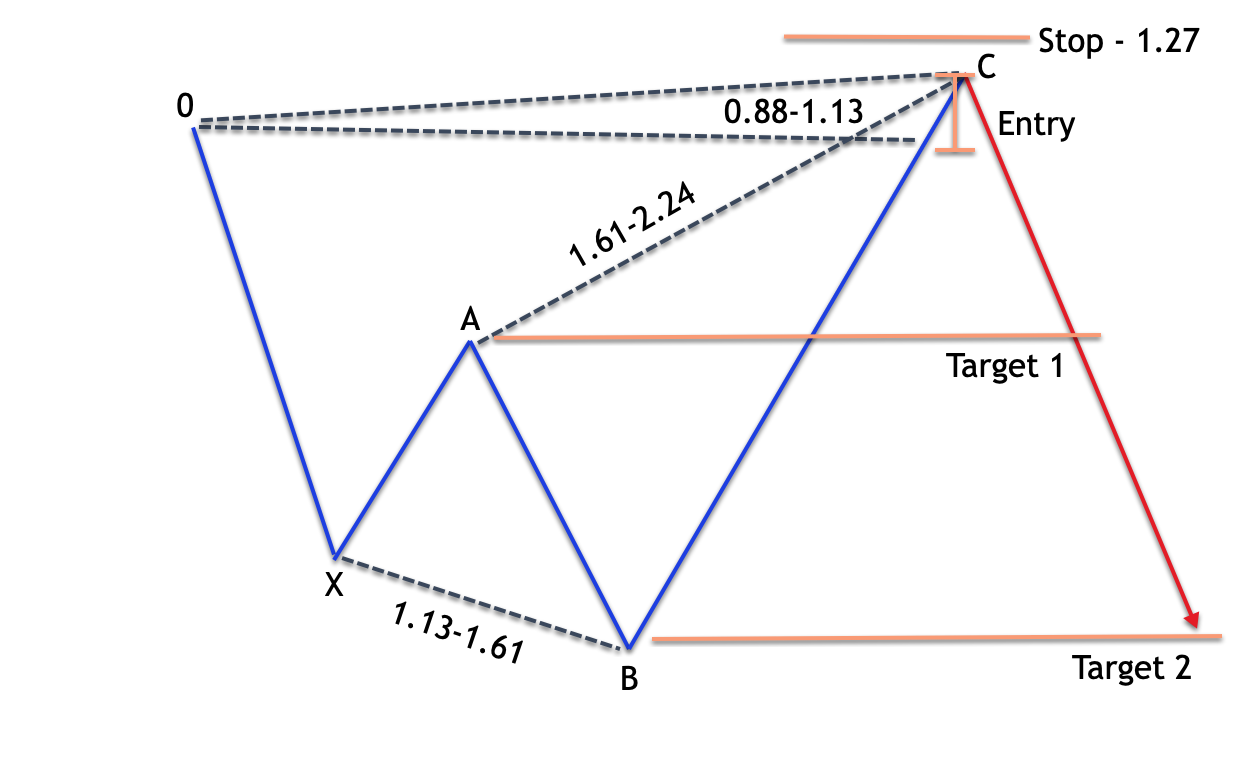

Let’s now see what the bearish Shark pattern appears like.

Below you can see an illustration of the bearish variety of the Shark pattern along with the key Fibonacci relationships within the structure.

OX price leg – This is the initial bearish impulsive price move.

XA price leg – This leg retraces a portion of the initial OX leg.

AB price leg – This leg extends beyond the swing low at point X. Point B should terminate within the range of 113 to 161% of the XA leg.

BC price leg – As price moves higher, Point C should terminate at a level that corresponds to 161% to 224% projection of the XA leg. Moreover, point C should retrace to 88% to 113% of the OX leg.

Now let’s discuss the main Fibonacci relationships and trade management rules as it pertains to the bearish variety of the Shark pattern.

Below you will find some traditional trade management rules for the bearish Shark pattern.

Enter a limit order to sell between 88% and 113% retracement level of the OX leg.

Place a stop loss at the 127% extension of the OX leg.

Utilize a dual target scale out exit approach, with the initial target set just above point A of the pattern. The second target will be set just above point B of the pattern.

If you refer to the illustration of the bearish Shark pattern again, you can get a sense for where these levels would occur within the Shark pattern formation

Shark pattern vs Cypher

The Shark pattern and Cypher pattern appear very similar in structure, however, there are some distinct differences between the two. It’s important to know what these differences are so that you are executing at the highest probability levels within each respective formation.

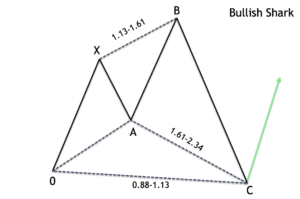

Below you can see the bullish Shark pattern shown at the top, while the bullish Cypher pattern is shown below it.

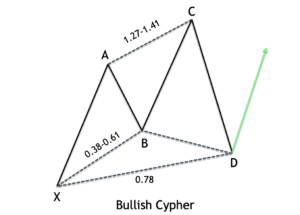

Firstly, the labeling convention for the Shark pattern is OXABC, while the labeling convention for the Cypher pattern is XABCD.

In addition, notice that within the Cypher pattern, the second leg within the structure has a Fibonacci retracement requirement of 38 to 61% of its prior leg. Within the Shark pattern there is no specific Fibonacci retracement requirement for the second leg.

Another important distinction between the two relates to the extension that occurs in the third leg. Within the Shark structure, the extension should fall within the 113 to 161% range. Within the Cypher pattern that third leg extension should fall within the 127% to 141% range.

And finally, the terminal point of the Shark pattern will occur between the 88 and 113% of the initial OX leg, while in a Cypher pattern the terminal point should occur at the 78% retracement of the move from point X to point C.

Shark Pattern Trading Strategy

Let’s now build a complete trading strategy based on the Shark pattern.

Below you will find the rules for entering into and managing a long position upon identifying the bullish Shark pattern on your price chart.

- Enter a limit order to buy as price approaches the swing low at point O.

- Place a stop loss at the 127% extension of the OX leg.

- We will use a two-tier target with the initial target set just below point A of the pattern. The second target will be set just below point B of the pattern.

And these are the rules for entering into and managing a short position upon identifying the bearish Shark pattern on your price chart.

- Enter a limit order to sell as price approaches the swing high at point 0.

- Place a stop loss at the 127% extension of the OX leg.

- We will use a two-tier target with the initial target set just above point A of the pattern. The second target will be set just above point B of the pattern.

Bullish Shark Pattern Setup

Let’s now look at a real example of how to trade the Shark pattern as shown on a price chart. For this example, we will be referring to the one hour chart of Apple stock.

As you can see from the outlined area labeled O,X, A, B and C, that the price action formed a bullish Shark pattern. Notice how the XA leg retraces a portion of the initial OX leg. And then, the AB leg moves higher and takes out the high at point X and eventually settles at the 1.14 extension of the XA leg. Keep in mind that the ideal Fibonacci extension for the AB swing is between 113 and 161%. In this case that extension terminated at the 114%, which is within the expected range for a Shark pattern.

After the price puts in a peak at point B, we can see an impulsive price move to the downside which eventually retraces the entire portion of the price move made from point O the point B. Based on all of these characteristics we can be confident in labeling this entire structure as a bullish Shark pattern.

Now that we have identified this structure as a bullish Shark pattern, we can refer back to our rules for trading the pattern. We know that our entry calls for placing a buy limit order as price approaches the point O swing low. You can see this Shark pattern entry signal marked on the price chart as represented by the downward pointing blue arrow.

Upon execution of the buy limit order, we would immediately place a stop loss on the trade. The stop loss should be placed at the 127% extension level of the OX price leg. You can see that level marked on the price chart by the green horizontal line below the buy entry.

We will also enter our two targets in case the trade moves in our intended direction. The initial target is set at a level that corresponds to the swing A low seen within the Shark pattern. Additionally, our second target will be set just below the point B high within the Shark pattern. Both of these levels are marked on the price chart for your reference.

As we can see, immediately following the buy entry, the price moved a bit lower, however, it quickly reversed course and started to trade higher before it could trigger our stop loss order. Ultimately the price reached both of our pre-set targets resulting in a profitable trade on this position.

Bearish Shark Pattern Setup

Let’s now look at an actual chart example of the bearish Shark pattern in Forex. Below you will find the price chart for the Canadian Dollar to Japanese Yen currency pair based on the eight hour timeframe.

Starting from the swing high at point O, we can see that the price moved lower in a fairly impulsive manner and ended at the swing low marked X. Then the prices retraced a portion of this move within the XA leg. More specifically, that retracement represented about 67% of the prior OX price move. Keep in mind there is no specific Fibonacci requirement for this particular leg, except that it does not retrace beyond 100% of the initial leg.

Moving on from here the prices traded lower in the AB leg. Ultimately, it was able to breach the swing low at point X, and then settled at the swing low which represented a 1.18 extension of the XA leg. This falls within our preferred range of 1.13 to 1.61 extension of the XA leg.

From the swing low at point B prices started to move higher within the final leg of the Shark pattern, the BC leg. Notice how the BC leg settles just a hair above the 113% extension level. This is a bit deeper than the ideal extension range of 88% to 113%. In any case, this would be a judgment call that the harmonic trader will need to make for themselves, based on all the other conditions within the entire structure. It’s important to understand that sometimes in the real world trading environment, we will need to address these types of gray areas that appear close to ideal but not necessarily ideal.

With all of these Fibonacci relationships evident within this structure, we would be safe to label it as a bearish Shark pattern. The entry signal would occur as prices move higher to test the swing high at point O. You can see where that sell entry order would have been placed within this particular trade set up.

After our sell entry order was executed we would turn our focus to the stop loss and target placements. The stoploss order would be placed at the 127% extension as shown above the sell entry. The first target would be set near the swing high at point A as shown on the chart. The second target would be set just above the swing low at point B.

Immediately following the sell entry signal, prices move higher however it turned out to be a temporary continuation to the upside. Eventually the upside momentum started to wane, and the price began to move lower before it could trigger our stoploss order.

Soon after, the price was able to hit our initial target, Target 1, as shown on the chart. From there the price began to retrace to the upside. Our expectation from here is that prices move lower towards the swing B low, which also serves as our second target point.

Summary

The harmonic Shark formation is a lesser-known pattern compared to some of the more widely traded structures within this category such as the Bat pattern, the Gartley pattern, Butterfly pattern and the AB=CD pattern. Nevertheless, it is one that is worth trading under the right conditions.

Those traders that are interested in trading the Shark pattern or other related harmonic patterns should consider the handful of harmonic indicators and software programs in the market that makes the identification of these patterns easier and more reliable. Although some of these products do come at a cost, they will help save a lot of time in the scanning process.