A forex trading system that works needs to have a series of parameters that are well defined and implemented with discipline. An FX trading system needs a set of rules to decide when to enter a buy or sell trade, and where to place a stop loss and profit limit. In addition, there needs to be a clear set of rules for money management.

The rules for trade entry may come from technical or fundamental analysis. Both are valid for manual or automated trading in creating rules for signals that will tell you when to engage the market. Most system traders will implement technical analysis only, while many discretionary traders will use a mix of technical and fundamental analysis.

Setting up a manual forex trading system is part of a trader’s learning curve. These systems allow for a lot of discretion when it comes to deciding if a trade should be entered or not. Whereas, an automated forex trading system will eliminate the discretional component from manual trading altogether.

Some argue that automated trading systems should have complete control of the factors that lead to a buy or sell trade, as well as the limits for stop and profit. This helps in eliminating the emotional and psychological aspects of trading. Others will say that there are many missed opportunities with automated trading and that the discretional part of manual trading is what gives them the edge over automated trading.

In any case, you do not have to necessarily choose one over the other. Many traders have both systems running at the same time. This might mean having two accounts, one for manual and another for automated trading. They can be completely compatible.

Designing a forex trading system can be a complex process, but we will try to simplify the process as much as possible for you here. We will be looking at how to build both a manual and an automated forex trading system.

Swing or Day Trading System Design

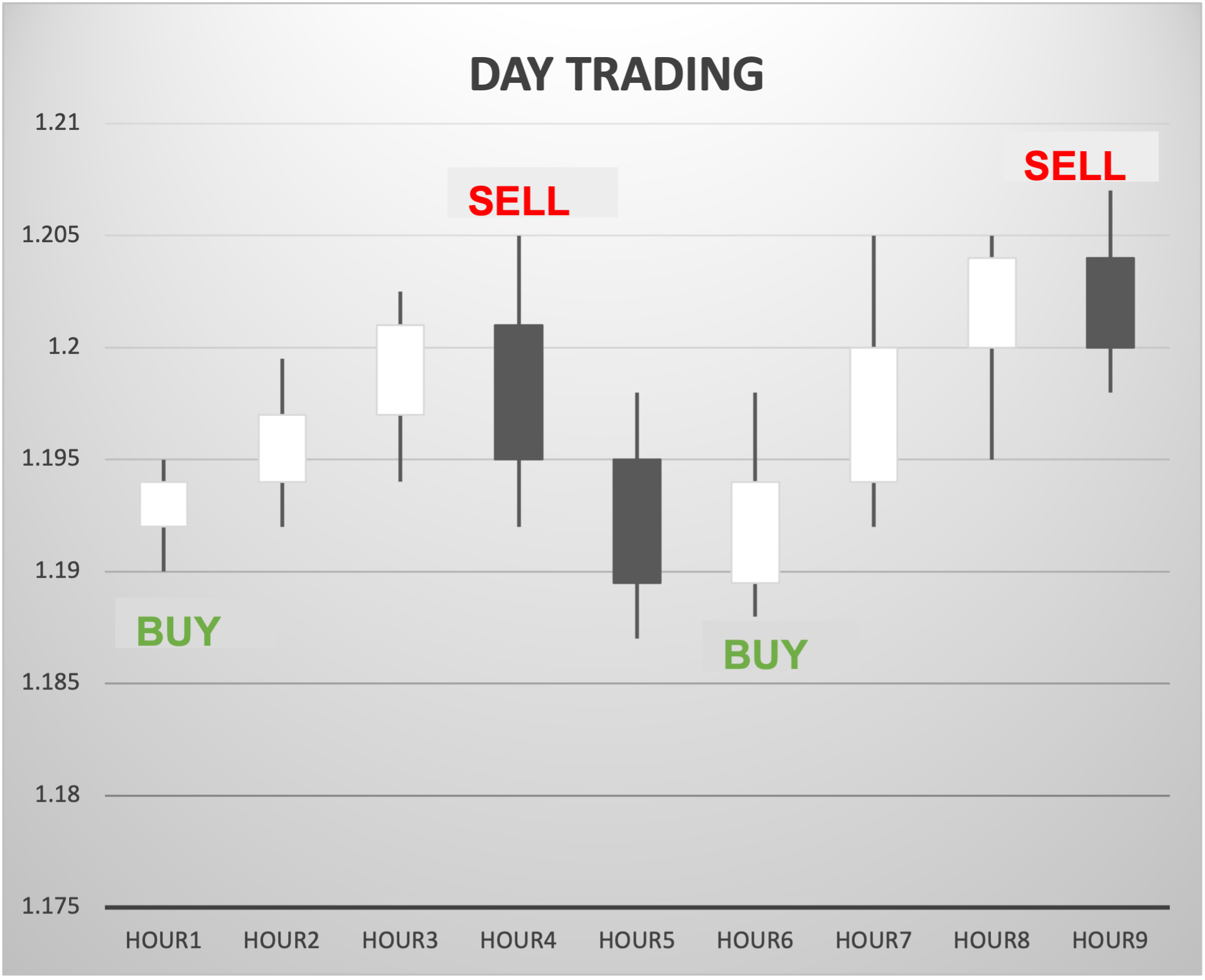

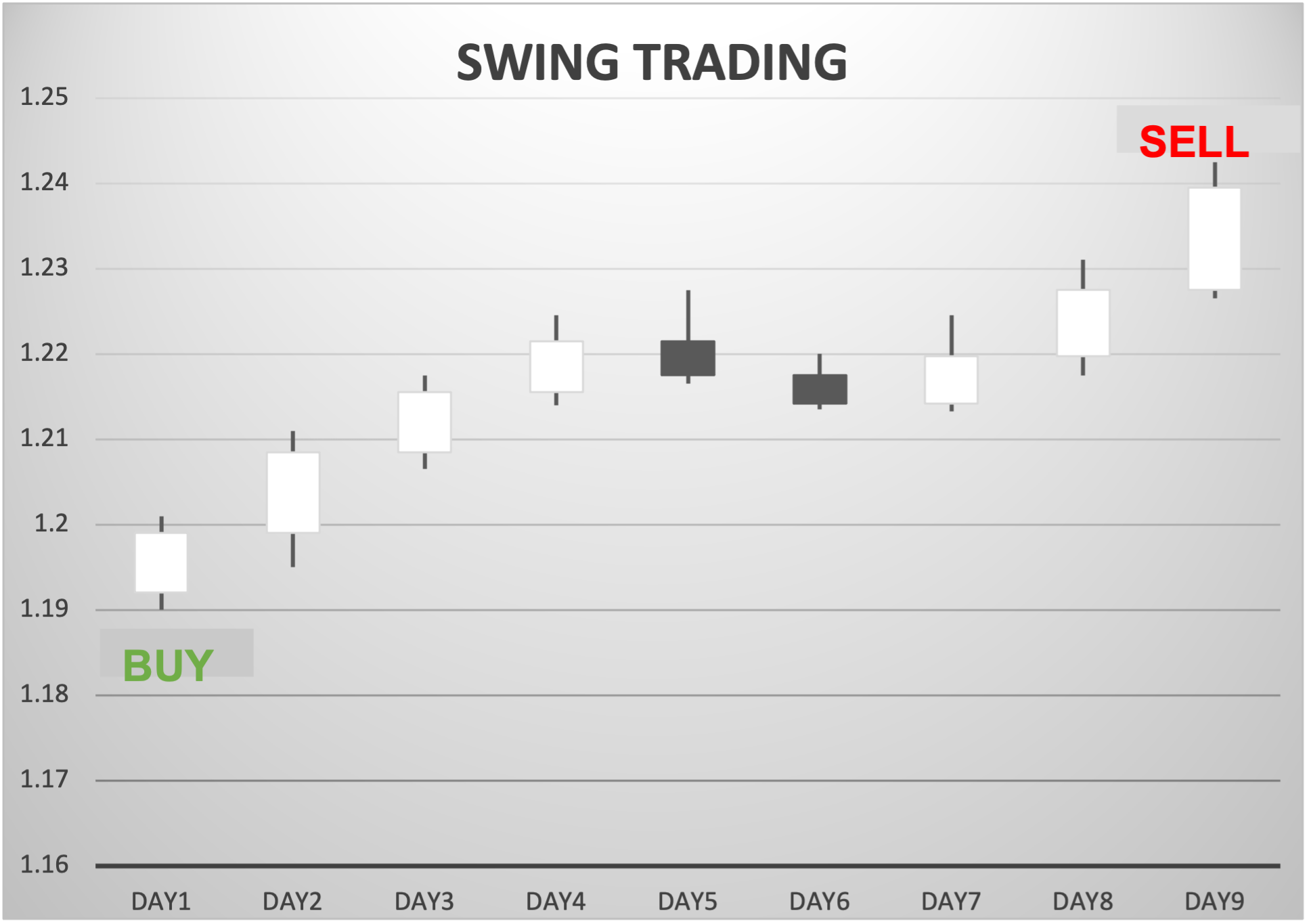

First, you need to decide if you are going to implement a forex swing trading system or a forex day trading system. Day traders, as the name suggests, are going to open and close positions within the same day. Swing traders will keep their trades open for multiple days, up to a few weeks.

Day traders are looking for relatively small price movements that happen within a day and may place various trades on the same day. While swing traders are attempting to achieve larger pip gains by keeping the positions open for longer. Both are going to use technical and fundamental analysis, although swing traders will be concerned more with the ongoing fundamental trend.

Swing trading will mean trading less frequently and holding your positions open longer for larger per trade gains. You will be ignoring small retracements in the major trend as price movements play out through the day.

If you have chosen day trading, another choice to make is whether you prefer trend trading or mean reversion trading. These are two directly opposing systems. Trading the trend means you are looking to enter a major day trend and only trade in favor of that trend.

Retracements will be used to re-enter the market in the direction of the major trend. Mean reversion or Oscillator based trading is used in sideways markets, where you expect the price to move in one direction temporarily, to then retrace to its initial levels. This is repeated throughout the day, and may even last several days.

An oscillating system will attempt to determine where the support and resistance levels are to enter a trade. A trend system is looking for a movement in one direction that triggers a trade signal in the same direction. Again, you may want to design both types of systems, an oscillator system is useful in a sideways market, whereas a trend system is useful when the market moves in one direction with consistency.

Both types will be useful at some point. Markets have plenty of times wherein price is consolidating as well times when the price is moving in a directional manner. Having both systems allows you to switch from one to the other according to what type of market you are experiencing.

Both systems can be designed for manual or automated trading, meaning you may end up with four systems in total. Although you should only be using two of them at any one time. Clearly, if the market is moving sideways you should be using the swing trading system both for manual and automated trading, whereas in a market with a clear trend you would be using the trend system.

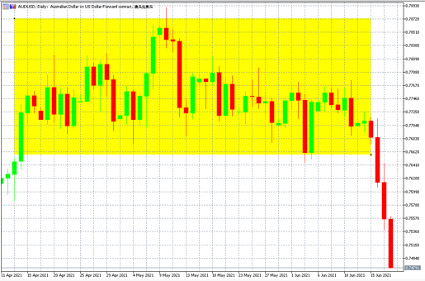

Oscillating trading systems can also be applied to swing trading timeframes since sideways markets can occur for several days. In which case, if you are using trend analysis to enter your trades you may miss out as the market continues to move back and forth every few days.

The chart below shows how price action moved sideways for several weeks before breaking into a down trend. If you are swing trading and not taking into account the market is oscillating there will be serious headaches for you during that period.

Deciding Trade Entry and Exit Points

This is the construction of rules that will indicate a buy or sell signal for entry and exit. You can use a technical indicator or a combination of indicators during this process. The system will signal a buy or sell trade entry when all the initial conditions are met. It will also determine your exit conditions.

One way to establish exit criteria is to have your current position closed and a new position entered when conditions are met for a trade in the opposite direction. You will only exit your current open trade when the conditions are met to open a trade in the opposite direction.

Another way is for a set of rules or rule to be met for the current position to be closed. The system would then consider if the conditions are fulfilled before a new position is opened. A third way is to determine a set profit limit from the entry of a trade, independent of other conditions. It is also possible to use a combination of the three, a set number of pips closes your current positions or a set of rules, whichever comes first.

If you are considering an automated trading system, then you will have designed the same set of conditions mentioned above. The difference is that here they will be scripted in a program and will execute automatically via your execution platform.

Automated trading systems can be as simple or as complicated as you want. Some hedge funds still use a simple moving average cross-over to determine their buy and sell positions. Of course, they may have some added rules on top of that. For example, a strong move in one direction is usually followed by a retracement move in the opposite direction. Therefore, a take profit exit may be issued before a new trade is signaled in the opposite direction.

Most likely you are looking at a combination of technical indicators to establish when to enter a trade. If you are trading manually you still need to write them down, this will help you, firstly to remember all the criteria, but most importantly to be disciplined. If you are automating your rules, then the trades will execute seamlessly. However, with manual trading, there is always a level of discretion that may be applied.

Writing down your rules, if you are trading manually, will help avoid using too much discretion. Being excessively lax in following your rules will most likely lead to failure. Presumably, you have designed a set of rules that has been backtested and has shown a considerable amount of accuracy.

Of course, discretion will allow you to drop the rules on occasion. For example, a news event or an unexpected number of an economic data release may cause you to take contrary action.

You will need to choose which indicators you will use to create the rules governing trade entry and exit. You may also want to add price action rules. That is when a certain pattern on the chart is formed and then broken creating a buy or sell signal. It would be possible to create a price action trading system, without relying on any technical indicators.

Setting the Rules for Market Engagement

It’s time to decide what factors your system is going to use. Presumably, you will also use fundamentals, however, as that is quite a complex subject, we will only look at price action and technical indicators for our discussion here. Let’s just list some of the most common technical indicators used in trend markets or oscillating markets.

Trend Indicators

Ichimoku Kinko Hyo

Moving Average (MA)

Average Directional Movement Index (ADX)

Moving Average Convergence Divergence (MACD)

Oscillator Indicators

Relative Strength Index (RSI)

Stochastic RSI

Commodity Channel Index (CCI)

The lists above indicate some of the most commonly used technical indicators, but there are many more. You may want to investigate other indicators also and see how they work for you. This is just meant to be an example of how you go through the process.

Once you have determined which indicators work best for you, it is time to put a set of rules together. Bearing in mind your time horizon for trading, you could for example set a buy or sell signal when all three indicators, in this case, MA, ADX, and MACD, produce the same signal simultaneously.

The Ichimoku cloud could set the rule for when to accept a long or short signal. That is, when price is above the cloud your system only accepts buys signals, and when price is below the cloud your system only accepts short signals. Bear in mind that some indicators work well only on 1-day charts, or longer. This is the case with the Ichimoku cloud.

You could also add price action into the system. For example classical early session breakout. Price action of this kind could override any other technical indicator. This is because pure price action is going to alert us to a price movement faster than technical indicators. The longer the time frame the more accurate indicators and price patterns tend to be. This is especially true with price patterns, so if you are thinking of setting up a price action system only, you probably want to go for 4-hour or 1-day charts.

If you are setting up a system for sideways markets you could use the same principle above with the oscillator indicators. You could use a combination of indicators, such as the ones listed above, to time overbought or oversold price levels. These indicators work well once you can determine price action is in a horizontal range. The CCI I would say is a hybrid, as it also works as a trend indicator. While the index is between +100 and -100 the indication is that price action is range-bound. However, moves above +100 or -100 indicate momentum is picking up and the trend could continue.

Where to Place Your Stop Loss

This is a tricky parameter to define. Too close a stop loss and you will be stopped out often even though your trade may have made money if it had stayed open a bit longer. A lot depends on whether you will be day trading or swing trading, and whether you are trading trends, or oscillating markets. The volatility of the currency pair will also be a decisive factor.

The first thing to establish is the average volatility for the currency pair. There are some websites like Fxstreet or Dailyfx that do that for you. You can also see it from your chart, although that might take a bit more effort. You will have to be looking at the volatility of the charting period you will be trading on. That is to say, if you are using the 1-hour chart for trading, then you should be looking at the 1-hour volatility of that currency pair.

If your system keeps your current position open until a new reverse signal is received, then you will probably need to widen your stop loss to avoid being stopped out before the new signal arrives.

Money and Risk Management

This needs to be done before you start trading to set limits and define risk. Limits need to be set as to how much money you can lose per trade, per day, and what your maximum drawdown can be before you stop altogether. The maximum drawdown is often overlooked, with many traders trading until they have lost everything.

If you are consistently losing money on your trades, you should consider re-evaluating. It is a totally personal choice, but if you are down 30 percent or more, you may want to consider stopping for a while to reassess the system.

Setting limits on how much money you can lose per trade will also determine your trade size. If you have a stop loss per trade of $1000, you clearly should not be trading $1,000,000 notional value of EURUSD, as 10 pips will already stop you out.

Setting limits on how much you can lose per day will also help avoid continuously placing losing trades. Sometimes we just have a bad day at the office, and it is better to break the trend and start over the next day. If you are a swing trader these rules still apply although in a different way. Since you are likely to keep your trade open days up to weeks, you may find yourself with your P&L showing up negative for quite some time, so you need to consider how negative that figure can be. Your risk appetite must fit in with your trading system. It may be a matter of adjusting trade size to fit your limits, so you do not have to compromise your system.

Conclusion

The process of setting up a forex trading system is complex but rewarding. There is very little chance of being successful without a structure. Traders need to have everything well defined, from stop loss to profit, entry and exit rules as well as money management. Your endeavors to create the most accurate trading system are what will make you more likely to succeed.

Some traders are tempted at looking for a Forex trading system online, however, a proven forex trading system is something a trader would want to keep to themselves. If everyone has the same system you would lose your advantage, and eventually, the system would stop fulfilling itself. Some forex trading system reviews show promises of success but if too many people are using the system, it is likely to stop working.

It seems highly improbable that these systems, some cost as little as $100, would deliver on what they promise. This is why many funds use the black box principle, meaning their actual trading system is fully known only to certain people within the organization, not even investors in the fund are allowed to know exactly how it works.

To test your forex system, you can use the MT4 system, which has various back-testing capabilities and a large variety of indicators. This platform allows you to experiment with various time frames.