One of the most crucial aspects of a trader’s journey is deciding how they will trade. That might seem obvious, but it is a far larger question than many anticipate. Before a trader even gets into picking a system to follow or developing their own, they need to first of all think about what sort of trader they want to be. This will allow them to answer one of the very first questions which is, what timeframe will I trade?

There is a significant difference between long term trading on the higher time frames and intra-day trading on the lower timeframes. Traders must decide at the very beginning of their journey how they will approach the market. Now, there are pros and cons to both styles of trading, and both have specific strategies that suit them better. In this article we are going to focus on intraday trading strategies.

So, first thing’s first, why would a trader want to focus on intraday trading strategies?

Benefits to Intraday Trading Strategies

Quicker Results

There are a variety of reasons that attract traders to an intraday strategy. One of the most common is that trading on the lower timeframes has more immediate results. If a trader places a trade on the daily charts, it can take days or even weeks for a trade to play out. On the lower timeframes, however, if a trader is on the 5-minute chart for example, a trade can play out in less than 30 minutes. For many, traders this is a big draw. Not only is it a more exciting, engaging way of trading, but it increases the amount of opportunity a trader has in any given day, or week.

Lower Costs

Another key benefit to using intraday trading strategies is that traders will avoid the costs associated with holding a position overnight. When a trade is held overnight, the trader can incur negative carry if there is a negative interest rate differential with the pair they are holding (in Forex) or alternatively can incur extra commission (in Futures). These negative costs are avoided when a trade is simply closed within the day it was opened.

So, now that we have discussed some the benefits and attractions to using an intraday trading strategy, let’s take a look at some actual strategies that traders can employ in the markets. We’ll start off with a simple intraday trading strategy and then progress through to some advanced intraday trading strategies.

Breakout Trading

One of the most common, simple and profitable intraday trading strategies is the breakout trade. Breakout trading is a very safe intraday trading strategy and can be applied in all markets and instruments. The core of breakout trading is simply to identify momentum in the market and look to capitalize on this momentum as the market expands.

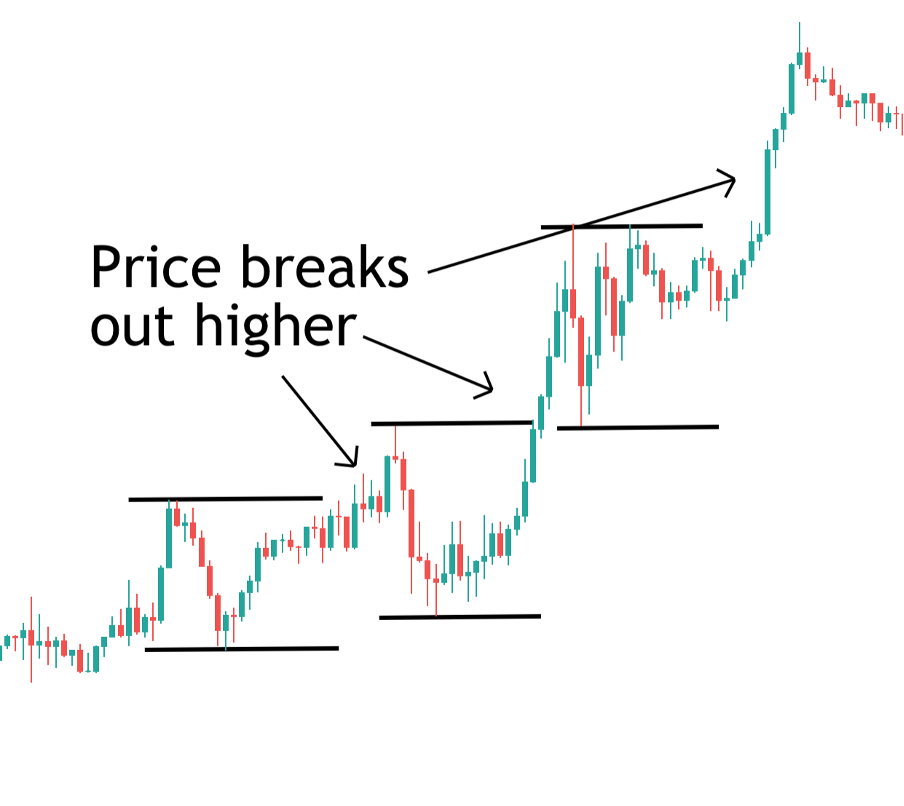

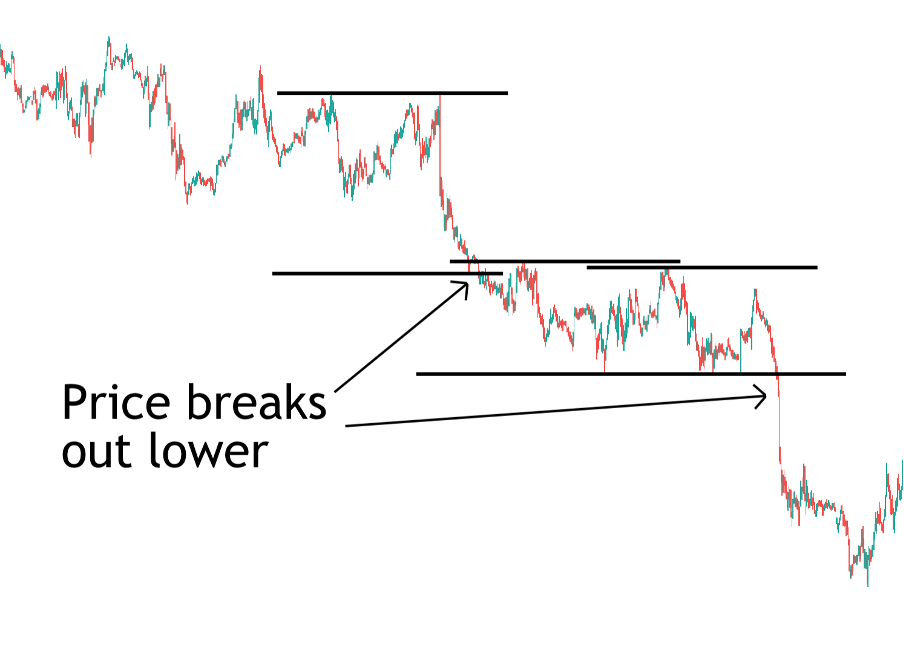

So, for a bullish breakout trade, the trade will look to identify bullish momentum in the market (presence of a bullish trend) and then place a trade as price breaks out above the last high. With a bearish breakout trade (which is often called a breakdown trade) the trader will do the opposite. In this scenario, the trade will look to identify the presence of bearish momentum (presence of a bearish trend) and then place a trade as price breaks out below the last low.

Bullish Breakout Trade Example

In the chart above we have a great example of a bullish breakout intraday trading strategy. First off, we see price trading higher, establishing our bullish momentum. The market then makes a high and corrects slightly. However, buyers step in and take price higher. As the market breaks out above the first high, we can go ahead and place our buy trade. The market then expands higher as bullish momentum continues. Price then makes a new high point before correcting lower slightly. However, once again, buyers step in and take price higher. We can place a second buy trade as price breaks out above the last high.

As you can see this is a very simple intraday trading strategy to follow and it can also be one of the most profitable intraday trading strategies to use.

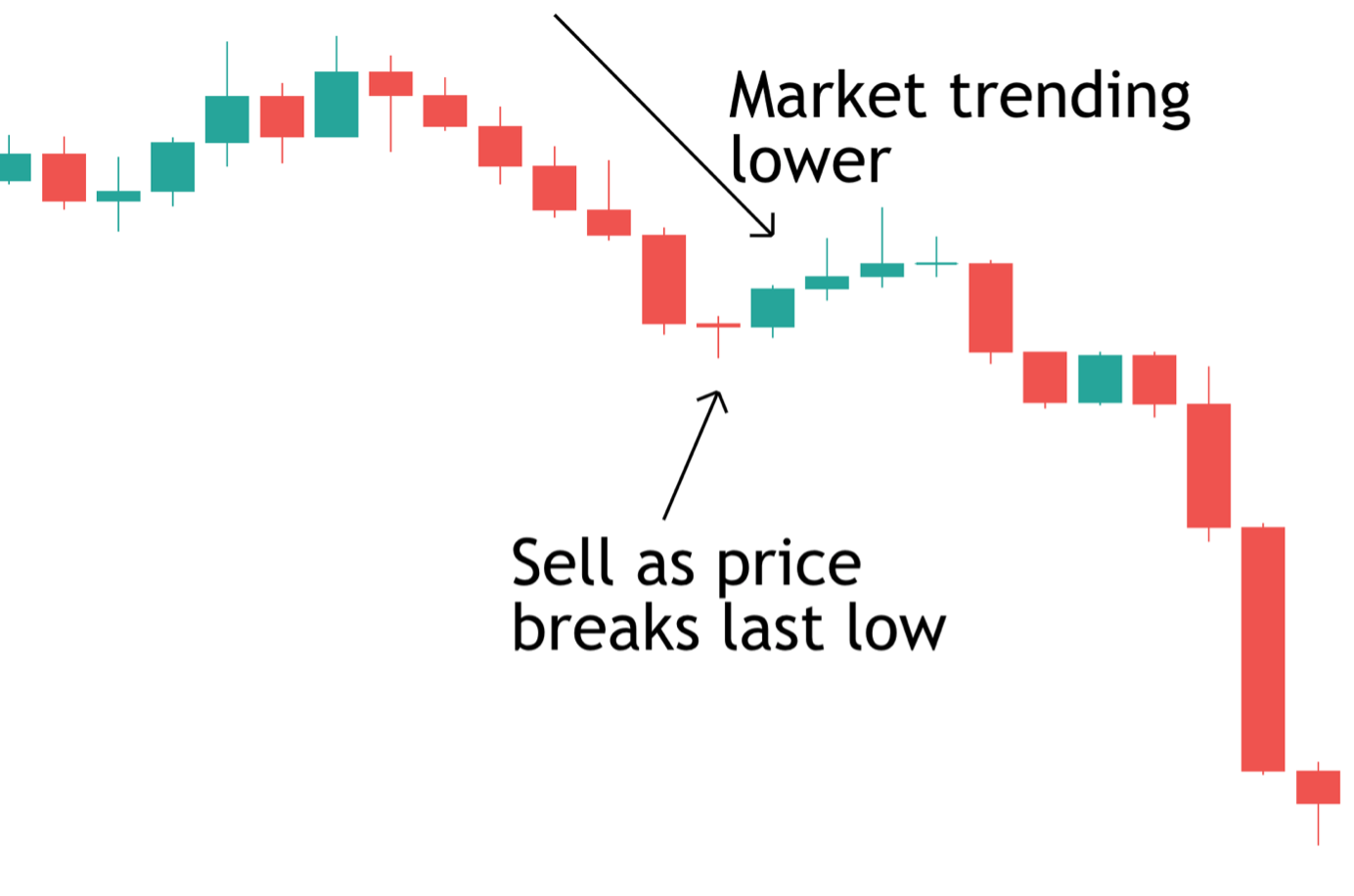

Bearish Breakout Trade Example

In the image above we have a great example of a bearish breakout trade or breakdown trade. We can see that price is trending lower to begin with, making a new low. However, buyers then step in and price corrects a little higher. However, the market then rolls over again as sellers step back in and we can place a sell trade as price breaks down below the last low, targeting a continuation lower.

The beauty of breakout trading is that it is very simple and effective to use. The last high and last low give us defined entry points to use and also defined points to place our stop. For example, with the bullish breakout trade, as price breaks out above the last high, we would place our stop just below the corrective low which formed before the breakout.

Similarly, for a bearish breakout trade, when price breaks down below the last low, we would place our stop just above the corrective high which formed before the sell off. Once we have our entry and stop we can then simply target a minimum of twice our risk, this ensures that we have positive risk-reward, increasing our chances of being successful over time.

Another big benefit of this system is that because breakouts, by nature, are an expansion of momentum, they tend to occur very quickly. And since we are trading on the lower timeframes anyway, these can be very quick trades meaning that the trader is able to take multiple of such trades in many different assets and markets over the day.

ORB Strategy for Intraday Trading

Another very popular intraday strategy to use which is more of a specific version of what we have just looked at, is the ORB strategy for intraday trading. The Opening Range Breakout trading strategy has always been very popular with intraday traders. This is because, as with the most breakout strategy, it is very simple and effective to use.

The ORB strategy is similar to the breakout strategy discussed above, however, it differs in that the support and resistance levels used are pre-determined. In this strategy, the trader will open their chosen chart on their chosen timeframe, typically, any time frame between the 5 minute and 30-minute charts.

They will then mark in the high and low of some specified opening range, typically the first half hour or hour of trading. The objective then is to trade a breakout higher as price breaks above the high of this opening range and, alternatively, to trade a breakout lower as price breaks below the low of this opening range.

Daily High Low Range Breakout

The daily high low range breakout strategy is similar to the ORB strategy, however, instead of using some pre-defined opening range, the S/R levels used are the high of the previous day and low of the previous day.

In the image below we have a fantastic example of a set of bullish Daily high low trades. So, at the start of the trading session, the trader will mark in the high and low of previous day. This can either be done just after the turn of the day, or before the session starts in the morning. The trader will then look to see which way price breaks.

In the image below we have a fantastic example of a set of bullish Daily high low trades. So, at the start of the trading session, the trader will mark in the high and low of previous day. This can either be done just after the turn of the day, or before the session starts in the morning. The trader will then look to see which way price breaks.

As you can see with our first trade here, price broke higher initially, trading up to make a new high before reversing back into the prior day’s range. We then go ahead and mark up that day’s range. The next day you can see that price breaks out strongly higher before reversing to give us that day’s range to mark up. On the third and final day of the example shown here you can see that price once again trades firmly higher.

So, in each scenario shown here we would look to place a bullish trade as price breaks out above the prior day’s high. Again, because we are trading intraday here, we are not looking to hold our position for a long time or overnight. We want to trade the initial breakout and then exit our position.

Again, the best strategy here is to enter as price breaks higher, use a pre-determined stop, for example, a quarter of the day’s range, and then look to target twice that amount. So, if you took a trade and the range was 40 pips, your stop would be ten pips and your target would be 20 pips.

Bearish Trade Example

Bearish Trade Example

In the image above you can see we have a great example of the bearish version of the daily high low intraday trading strategy. So, this time around we mark up our previous day’s high and low and we can see that price breaks lower on the first day, giving us a short trade opportunity. Price then consolidates for a day in the middle, where the market neither breaks out above or below the prior day’s high/low. Then, on the third day we can see that price once again breaks lower, giving us another short opportunity as the market breaks below the prior day’s lows.

Now, the great thing about this example is that it shows us something really important about this strategy. As you can see, in the middle day, price fails to break above or below the prior day’s range, meaning there is no trade to take.

Now, in these circumstances, the typical way to manage it is that we keep the range of the prior day as the day that formed within the range of the prior day (and failed to breakout) is known as an inside day. So, the range we would use to trade our Daily High Low Breakout would be the prior day’s range and as you can see, eventually price broke through those lows and gave us another bearish trade opportunity.

Let’s move on and take a look at another high probability intraday trading strategy. This however, a slightly more advanced intraday trading strategy so please consider this.

Intraday Scalping Strategy

Whereas with breakout trading we are looking to trade in the same direction that the market is moving, to capitalize on the underlying momentum. Scalping is a different type if intraday trading strategy, however, where we are looking to trade a reversal. The most common and effective for of scalping strategy is where a trader will look to sell price as it tests resistance, anticipating a reversal lower and look to buy price as it tests support, anticipating a reversal higher.

Typically, a trader will identify the main support and resistance levels to monitor over the session, often times looking at higher timeframes to find key levels, then look to trade the reaction on the lower timeframes.

Bearish Intraday Scalping Example

In the image above we can see a great example of a bearish scalping set up. So, we can see we have a big swing high on the left. Price was trading firmly higher initially before sellers stepped in at the peak with large power and caused a major reversal. Once we have marked that level as our big resistance, we then simply monitor the market and wait for price to trade back up and test it.

The basis of support and resistance trading is that these big levels often continue to be reversal points for the market. In this case, as price trades up and tests the resistance level we want to set a short, scalp trade, targeting a move lower. In this example you can see that we actually got two such opportunities. Each time you can see price tests the level and then reverses lower as sellers step in once again.

Because we are scalping on the lower timeframes, we are simply looking for a short-term reaction. Depending on the timeframe you are trading this could be anywhere from 5 pips (extreme scalping) to 20 – 30 pips (typical scalping). The beauty here is that we are not trying to call a major turning point in the market, we are simply looking to profit from a quick, and usually short-lived, reaction.

In terms of managing these trades, the typical approach is to trade as price tests the level with a stop just above. For example, on a 5-minute chart trader might sell at the level with a ten pip stop, targeting a 20-pip gain. Again, the point here is we are targeting a short-term reaction, not a full reversal.

Bullish Intraday Scalping Example

In the image above you can see we have a great example of a bullish scalping opportunity. Now, this is a great example because not only does it show us how the trade setup works, but it also really emphasizes the nature and focus of scalping.

So, we can see that we have established our big swing low which was the site of a major reversal higher. [price had been trading sharply lower (judging by the candle, most likely a news spike lower) before buyers stepped in to drive price higher, giving us our swing low to mark up as support. So, once we have our level marked up, it is then a case of once again monitoring the market as price comes down to test the level.

You can see that we did indeed get a test, giving us a nice little reaction higher before the market rolled over. So, this example highlights the beauty of scalping as an intraday trading strategy. Because we are only looking for a short-term reaction it doesn’t matter that we only saw a brief bounce before the selloff continued. This reaction is enough to profit from. Keep in mind, these are very short-term scalping strategies

We have now looked at a few different intraday trading strategies from the very simple breakout strategy, through to the more specific ORB strategy, Daily High Low breakout, and finally, the more advanced intraday trading strategy for scalping. Hopefully by now you can see just how you can go about building an effective intraday trading strategy for yourself.

As you prepare to head to the charts, let’s just close by rounding up a few key considerations to keep in mind when using intraday trading strategies.

Key Considerations for Intraday Trading Strategies

The first thing to point out is that it is the task of each trader to pursue a high probability intraday trading strategy. This means, taking the methods discussed above and learning to adapt them to your own trading. The important thing here is establishing which markets you prefer to trade and which time frame suits you best. There is no one size fits all here or such a thing as a perfect intraday trading strategy. However, the strategies discussed above can be highly effective.

The best action is, as always, to spend some time practicing these strategies and learning how best to trade them. We have discussed some ideas for stop loss placement and targets but as always, the actual parameters of the trade you take will be up to you so spend some time exploring different settings to work out which one suits you best.

One big question that is always asked is whether it is best to trade these strategies in forex or in futures? The answer is, there really isn’t too much difference between the two and the methods discussed above work just as well as forex intraday trading strategies as they do futures intraday trading strategies.