Trade execution is an important aspect of a trader’s activity. A straightforward entry into the market is a simple buy or sell at market order. However, there are various types of orders that allow you to have more control over trade execution. There is a full array of order execution types that allow you to manage your execution price more effectively.

Most retail trading market execution is done through an online broker, which allows for extremely quick and agile execution. If the broker is connected to an Electronic Communications Network he will be able to offer tighter bid-offer spreads than those that pull their prices from one market-maker. ECN execution matches buy and sell orders with a network of market makers. In either case, thanks to today’s technology, electronic execution allows for near-immediate execution of trading orders, and the capability to cater to various entry rules set by the trader.

We will be taking a look at how to use market orders to improve market execution in forex. Some market orders can be triggered by a set of rules given by a computer script, often known as an Expert Advisor. As timing is often essential to traders, and even more so when the trading time horizon is a short one, it is of vital importance to understand all the trade execution tools we have at our disposal.

Using Trade Orders to Time the Market

You may not always want to enter the market in the direction you have decided at that same moment you have made your decision. You may see that the market has broken a resistance level and is likely to continue its rally. That said, you may also see that the market is running into overbought territory and is likely to retrace before continuing north.

Or, you may feel that if the price hits a certain level, above or below the current market price, you will want to enter a buy or a sell trade respectively. These examples are some of the processes involved when setting up a trade.

However, many traders are not in front of their screen 24 hours a day. Most likely they will be following more than one market, making the matter of supervising the market prices constantly very challenging. You may also want to add more control to your market order execution by using one of the many types of market orders.

Market Orders & Use

Markets orders are a very useful tool when setting up your trade. Rather than running straight into battle with a head-on charge, they allow you to use some strategy and allow for a timely strike. This is what happens with the simplest market order, which is the At Market Order. This type of order gets you into a trade at the push of a button.

The At market order is given to enter a buy or sell trade at the going market price when the order reaches your broker. This means the trade will be opened at the next available price once you hit the buy or sell button. This often creates some slippage, which is the difference between the price you saw on the screen when you hit the buy or sell button, and the price at which the trade was actually executed.

This is going to happen when, for example, you enter a buy trade in a bull market and you see the price rising sharply. The market is moving at a much higher speed than usual, and therefore the time elapsed between hitting the button and the broker processing the trade order. This may result in a difference of several pips to the price seen when you hit the trade button.

There are various market orders which can prove very useful in a variety of situations. Let’s have a look at the most commonly used ones in the order execution process.

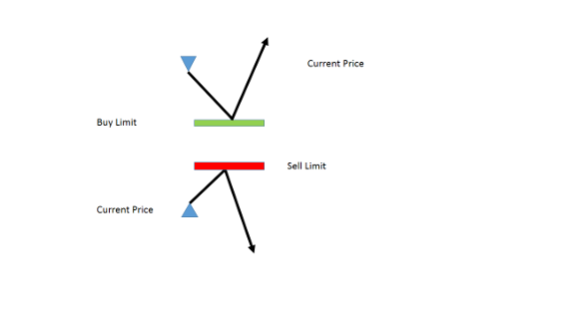

Buy & Sell Limit

One of the most common market orders is the Buy & Sell Limit. These allow you to set a buy price below the market or a sell price above the market. This type of order is useful when you see the trend has already traveled some distance. Your concern may be that the next move will be a retracement, which could cost you a number of pips on the entry price.

Let’s say you are looking to buy the EUR/USD, and the current price is 1.2000. However, you want to wait for the market to correct back down to 1.1970. You can place a Buy Limit order at 1.1970, which will tell the broker to buy EUR/USD at this price or better automatically.

With a Sell Limit order, the same is true but applied to a sell trade. Let’s say you want to sell GBP/USD at 1.3000. You determined your entry level to be at 1.3050, then you would enter a sell limit order with your broker at that price. If the market reaches that level your broker will automatically execute the order at that price or better.

The advantage is quite clear, you don’t have to wait with your eyes stuck to the screen, to see if the price comes back to the entry level you have determined. You can enter the buy or sell limit order and not worry about it. Of course, the downside is that you may or may not enter the market, so its use is for those trades that you feel are only worth putting on if they reach your level.

Stop Loss

The Stop loss order is possibly the most commonly used market execution order, and certainly the most valuable one. A stop loss order allows you to exit a trade when it is losing money at a predetermined level. This type of market order allows you to limit your losses at a predetermined price. As the order is executed automatically you are also covered if you are holding a position overnight. These orders also allow you to be disciplined in setting limits for your losses, as the stop will be executed automatically once it is hit. They allow you to be away from your screen and still get executed.

Using the example above, let’s say you entered a buy trade in EUR/USD at 1.1970. You have decided that if the market continues to decline another 40 pips you will exit the trade. You, therefore, set a stop loss at 1.1930. The broker will execute the order automatically once the price reaches that level.

Similarly, if you entered a sell trade at say 1.2030 and you determined that if the market moved to 1.2070 you would exit the trade, you would set your stop loss order at that level. The broker would then automatically execute the buy order if the market reaches that price.

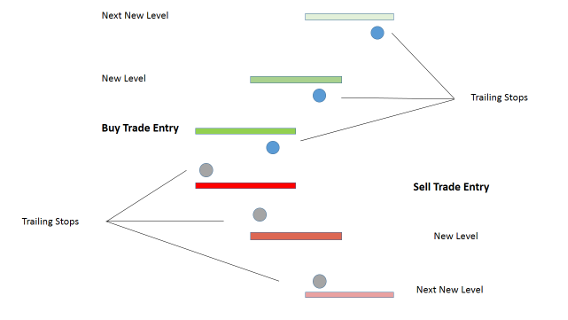

Trailing Stop Loss

This type of order acts in the same way as the stop loss above, with an added feature. The stop loss you set when you enter your trade will move accordingly if the market goes in your favor. The stop loss price is readjusted only when the market moves in your favor. If the price starts going against the direction of your trade the stop loss price is not reset.

For example, let’s say you enter a buy trade in USD/JPY at 110.20 with a 30 pip trailing stop loss. Your stop loss is now set at 109.90; if the market were only to go down from entry then your stop loss order would be executed if the price reaches 109.90

If the price moves up another 30 pips to 110.50, then your stop loss would be reset to 110.20. This is still the same amount of pips as the initial stop loss level, but the order moves the stop loss price up. If at this point the market turns south your position would be closed at the new stop loss level of 110.20.

If the market were to rise again to 110.80, the trailing stop loss would reset your stop loss order to 110.50. If the market were to fall back down from there your stop loss order does not change, and your broker would execute the stop at 110.50.

As can be seen, this type of order helps in guaranteeing that you lock in some of the profit if it is reached, instead of seeing your trade losing money on your initial stop loss after having reached profitable levels.

You may not always want to use this type of order to enter a trade. This is due to the fact that your initial stop loss might be wider at trade entry. Whereas, when you see the trade is running into positive territory then you might want to add a closer trailing stop loss. Let’s say the buy trade in USD/JPY you entered at 110.20 has now reached 111.00. You feel it may continue to reach new highs, however, you don’t want to miss out on reaping the benefits of a profitable trade. You could then enter a trailing stop loss at 110.90, if the market comes down from there you will still lock in most of the profit. However, if the price continues to rise, you will be able to lock in higher profits as the stop loss continues to be adjusted higher.

Stop Entry Order

This type of order will only be executed once the market has reached a preset level. A buy or sell stop order will be stopped from execution until the market price has reached the stop price.

It consists of placing an order to buy above the current market price if it is reached, or to enter a sell trade below the current price if the market falls to that level.

For example, EUR/USD is currently at 1.2000, and you want to enter a buy trade if the market reaches 1.2050. Placing a buy stop at 1.2050 will tell the broker to automatically execute a buy trade if the market price reaches that level.

In the same way, if you want to enter a sell trade in EUR/USD if the market falls to 1.1950, then you would give the broker a sell stop order at that price. If the market falls to that level the broker will automatically execute a sell trade at the price.

Some caution is necessary with this type of order. You may find that your buy or sell stop order is filled when the market moves sharply in one direction, perhaps on the back of unexpected news. The market may become extremely thin at this moment, meaning the next available price after your buy or sell stop is hit is considerably higher or lower than the level you indicated.

Marketable Limit Order

This type of order is an at market buy or sell order with a limit as to how far away from the current bid or offer you are willing to trade. The order sets a price below the bid or above the offer that limits how far away from the current level you are willing to trade.

For example, GBP/USD is currently bid at 1.3050, you want to enter a sell trade, and set the marketable limit order at 1.3045. This means that the broker can execute the sell trade at the market bid, but not lower than 1.3045.

This kind of protection is extremely useful when you are trading after high-impact news events, like Federal Reserve meetings or Non-farm Payrolls data. Markets can become extremely volatile after such events. Along with the increased volatility, you may also find the market gaps in price as bid and offer rates begin to thin.

Executing an at market order in these environments may see you going long or short at a level much higher or lower than the level showing on the screen at the time you hit the buy or sell button.

Algorithmic Execution

Algorithmic trading may sound extremely complicated and have an aura of mystery surrounding it. This may be true for certain strategies applied by high frequency trading hedge funds or quant traders. However, for our purposes, it’s a whole lot simpler.

The algorithm may be a very simple one. Such as, X number of pips move in one direction in a certain time frame to execute a trade in the opposite direction. Or 2 consecutively lower or higher closes on a 5 minute, 10 minute, or X minutes chart to enter a sell or buy trade respectively.

The trade is executed automatically after the criteria established in the algorithm are met. The algorithm is simply a set of rules established by the trader. These rules are written in script in what is known as an Expert Advisor. EAs are easy to use on the MT4 platform, although writing the script can cause a lot of headaches unless you are familiar with other programming codes such as C+. However, these EAs can be acquired thru the MQL4 community, usually for a modest fee.

To execute the trade you will need to install the EA file in your MT4 platform and decide which time frame it will be applied to. MT4 also allows you to backtest the EA to see its past performance.

Market Order Duration

Usually, market orders are considered to be good until canceled, or GTC. This is typically the case with stop loss orders, as they are always in place for the life of the trade, to protect you from unexpected losses when you are not in front of the screen. If you are a day trader you will need to check if you can make the market order good for the day, or good till date, known as GTD. If that is not the case you will need to cancel any market orders at the end of your trading day. If the broker does offer this feature, GTD orders automatically expire at the end of the day they were placed.

Wrapping up

Trade execution is an important aspect for any trader. Market orders are a valuable set of tools that will help you implement your strategies more effectively. Not all trades are entered at the spur of the moment, and you may not always be in front of your screen when the market price hits the level you are looking for.

In a financial market that is open 24 hours a day, 5 days a week, having orders in place that will automatically execute your trading ideas is a great asset. They also allow for a trader to be more disciplined. When the stop loss is set at trade entry you are making sure you will limit your losses instead of hanging on to a losing position, with adverse consequences.

You are always looking to implement FX execution in the best way possible, and brokers, often known as execution brokers, have an obligation to provide the best execution possible. This entails providing the best service possible to the client, although the broker cannot be obligated to provide the best possible price in the market. However, they are expected to take all steps at their disposal in providing the best result possible.

Most brokers will have an order execution policy on their website, or if they are under license by a financial authority then they will be operating under the terms set by these institutions. The main financial authorities, such as the FCA in the UK, CFTC in the USA, or any of the EU authorities under MiFID II, all have a best execution policy.