The United States and Canada are two of the largest economies in the world. As such, the USDCAD currency pair is widely watched and traded around the globe. There are some very unique characteristics of the USDCAD currency pair that traders should be aware of. We’ll dive into those important characteristics and discuss some other notable features of the USDCAD Forex pair.

USDCAD Major Currency Pair

USDCAD is a major currency pair that represents the exchange rate of the US dollar to Canadian dollar. The USDCAD pair has been nicknamed “Loonie”, which is a reference to the symbol of the loon bird that is ingrained within the Canadian one dollar coin. The USD CAD exchange rate tells us how many Canadian dollars are required to purchase one US dollar. For example, if the USDCAD exchange rate is currently trading at 1.30, then this exchange rate tells us that it takes $1.3 Canadian dollars to buy one US dollar.

The Forex “Loonie” currency pair is one of the most liquid trading instruments within the foreign exchange market. This is no wonder since it represents the currencies of two of the largest and most stable economies in the world. The economic environment in Canada is akin to the United States. The two countries have a long history of being trade partners and both countries have a high per capita income.

Canada has a gross domestic product coming in at approximately 1.7 trillion dollars. Canada is well known for being rich in commodity resources. And as such, the Canadian dollar tends to be highly correlated with certain natural resources, particularly oil. Canada plays an important role in the global economy, as it is a large exporter of energy resources around the world.

The US Federal Reserve is tasked with managing the US dollar, while the Bank of Canada is in charge of monetary policies relating to the Canadian dollar. Both the US dollar and the Canadian dollar are considered free-floating fiat currencies. Historically, the USD CAD exchange rate has hovered over parity.

That is to say that the USD CAD currency pair has generally traded over the 1.00 mark. There have been times, however, when the USD CAD pair has traded below parity. When this has occurred, it has come during times of financial crisis within the United States, or during rising energy prices, particularly oil.

Why Trade USDCAD?

So why should you consider trading the USDCAD currency pair? Well for one, it is one of the most liquid Forex pairs to trade. Liquidity is a very important consideration for all types of traders, particularly those that rely on day trading or swing trading strategies. The more liquid an instrument is, the better the bid ask spreads would generally be.

Additionally, traders that focus on liquid currency pairs will experience little slippage costs in normal market conditions. These costs are often underestimated, but they can make the difference between a winning strategy and one that is just breakeven or even losing.

The primary way that Forex traders make money from their trading activities is by taking a directional bet. As such, traders need a good level of volatility in order to profit from price movements. As such, volatility is also an important consideration when trading the currency markets. Some currency pairs have very little volatility as measured using the average true range, or average daily range indicator.

The USDCAD currency pair is a very stable currency pair to trade. At the same time, it displays good volatility characteristics allowing traders the opportunity to make ample profits from its exchange rate price movement.

The USDCAD analysis is well-suited for both technical based traders as well as fundamental based traders. Due to the large volume of trading that occurs within the USDCAD pair, technical traders will find recurring price patterns that provide for trading opportunities.

This includes classical chart patterns such as triangles, and flags, as well as harmonic patterns such as Gartleys and Bats. Additionally, there are many other types of price action patterns available to technical traders. Because the USDCAD currency pair is highly correlated with certain commodity resources, it can be an excellent instrument for fundamental traders that rely primarily on economic data for basing their trading decisions in the market.

Best Time To Trade USDCAD

Best Time To Trade USDCAD

The currency markets are open 24 hours a day five days a week. As such, the USDCAD pair can be traded at any time while the market is open. There are three primary sessions for the foreign exchange market. This includes the New York session, the London session, and the Tokyo session. The USDCAD pair is most active during the US and London sessions, and particularly during the overlap between the US and London sessions.

This overlapping period occurs between 8 AM and noon. Due to this increased activity, the USDCAD pair typically sees the highest amount of volatility during this time period. It’s also important to note that many of the major news announcements and economic reports within the US and Canada are released between 8:30 AM and 9:30 AM. This adds further volatility to the USDCAD currency pair in the morning session.

As we enter into the Australian, and Tokyo sessions, the activity within the USDCAD pair begins to subside. This is often seen by the bid ask spreads increasing slightly during this overnight session. Although managing existing trades can still be done efficiently during this less active time of the day, it’s not the ideal time for initiating new positions.

Having said that, if you are a longer-term position trader, there will generally be very little impact on your position by entering during this less than ideal time of the day. This guideline serves as more of a precaution for scalpers and day traders that are seeking very short-term price swings. For optimal results, these traders should stick to the 8 AM to noon time window for trading the USDCAD pair.

Fundamentals That Impact USDCAD

Let’s now look at some of the most important fundamental factors that impact the exchange rate of the USDCAD currency pair.

First and foremost, any central rate decisions made by the Federal Reserve or the Bank of Canada can have a significant impact on the price of the USDCAD pair. The level of interest rates set by the central bank will have a large influence on the growth or contraction within an economy.

Generally speaking, when the central bank is seeking to control a rising inflation rate environment, it will often hike interest rates in order to stabilize the overall economy. Conversely, when the central bank needs to stimulate the economy due to a recession, they will often lower interest rates, which will serve to spur growth within the economy. Additionally, the Federal Reserve or Bank of Canada’s monetary policy as it relates to the money supply will often result in price adjustments within the USDCAD currency pair.

As we noted earlier, Canada is one of the largest producers and exporters of oil in the world. Currently Canada exports more than 3 million barrels of oil to the United States per day. As a result, the United States is highly reliant on Canada for its oil consumption.

The supply and demand dynamics of oil can have a large impact on the price of the USDCAD currency pair. Generally, when the US demand for Canadian oil rises, this increased demand can lead to higher oil prices, and falling USDCAD exchange rate. Conversely, when the US demand for Canadian oil falls, this reduced demand can lead to lower oil prices, and a rising USDCAD exchange rate.

One of the most widely watched data points by currency traders and investors is the employment rates within a country or region. When the economy is running at or near full employment, it is a sign of a healthy economy. Conversely when the economy has a high unemployment rate, it is indicative of a weak economy.

The US nonfarm payrolls report issued by the Bureau of Labor and Statistics in the United States, can lead to extreme price movements in the USDCAD currency pair, particularly when the reported figures deviate from economists’ expectations.

USDCAD Correlations

As we’ve noted, the USDCAD currency pair is highly correlated to oil prices. As such it is one of three important commodity pairs within the foreign exchange market. The other two include AUDUSD, and NZDUSD. Let’s look at an important correlation as it relates to the USDCAD pair and the price of oil . Historically, there has been an inverse relationship between the USDCAD currency pair and the price of oil. That is to say that when the price of oil increases, the USDCAD currency pair tends to fall. And similarly when the price of oil decreases, the USDCAD currency pair tends to increase.

What about correlations with other currency pairs? Well, the USDCAD currency pair tends to move in the direction of USDCHF, and USDJPY. As such, the USDCAD generally has a positive correlation with these two currency pairs. On the other hand, the USDCAD forex pair tends to move in the opposite direction of EURUSD, AUDUSD, and GBPUSD. As such, the USDCAD pair generally has a negative correlation with these three major currency pairs. Keep in mind however, that correlations can and do change over time.

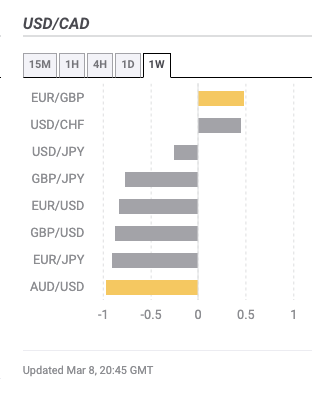

Let’s look at an example of a simple correlation study. Below you can see the weekly correlations of the USDCAD pair with some other major and minor pairs taken as of this writing. You can note the positive correlations noted to the right of the vertical 0 line, and the negative correlations noted to the left of the vertical 0 line.

Trading The Loonie – USDCAD Trading Strategy

We will now describe a simple day trading strategy that will show you how to trade the USDCAD currency pair. This outlined strategy is a type of opening range breakout strategy. Within the strategy, we will seek to find the highest high and lowest low within the USDCAD currency pair from 8:30 AM Eastern to 9:30 AM Eastern. This will be the one hour window that we will use for the opening range. We prefer to use the starting time of 8:30 AM because many US and Canadian announcements and economic reports tend to occur during this time window.

So here are the rules for trading the strategy. The strategy is best represented using 15 minute bars.

- An important economic report related to the US or Canadian economy must be scheduled between 8:30 AM and 9 AM Eastern.

- Note the high of the price between 8:30 AM and 9:30 AM Eastern.

- Note the low of the price between 8:30 AM and 9:30 AM Eastern.

- Enter in the direction of the breakout from the one hour range as noted above.

- The stop loss will be placed 2 Pips beyond the opposite extreme.

- The exit will be based on a fixed target, which will be measured using the length of the one hour price range. In the case of a long entry, the equivalent length of the one hour range will be projected upwards for the fixed target. In the case of a short entry, the equivalent length of the one hour range will be projected downward for the fixed target.

- The target or the stop must be triggered within the first ten 15 minute bars following the breakout bar. If neither the target nor stop is reached within this time span, then you would exit at the start of the eleventh 15 minute bar.

This strategy only has a one-to-one risk to reward profile, however, it has a win rate that is generally in the 55% range historically. As such over a long series of trades, the strategy will generally provide a reasonable edge.

The important thing to remember is that this opening range breakout strategy should only be implemented when an important economic report is scheduled to be released. This is because, the breakout from the range, following the catalyst event, would generally bring in increased momentum that will move prices in the direction of the breakout for at least a few hours following the breakout.

USDCAD Trade Setup Example

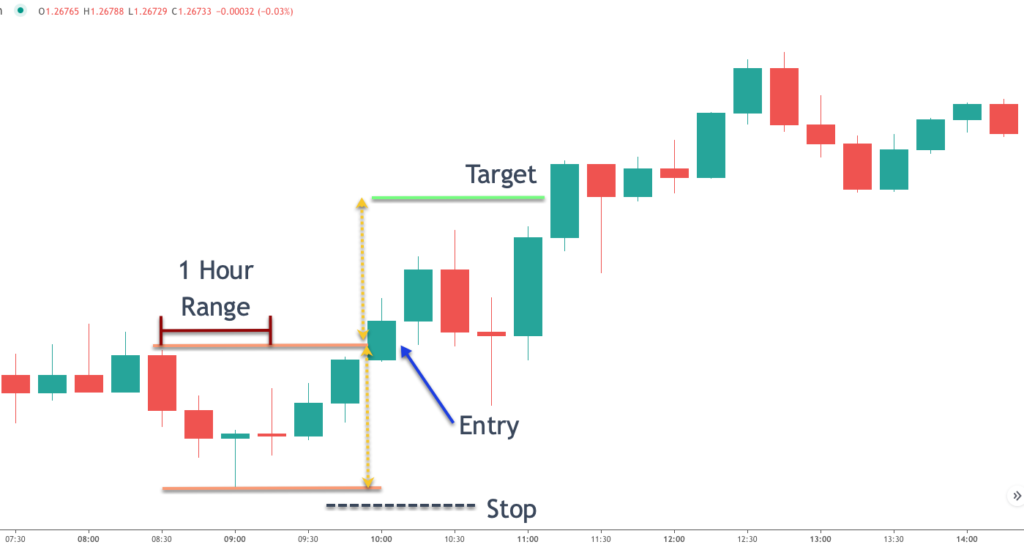

Let’s look at an example of the USDCAD trading strategy outlined using a real price chart. Below you will find the chart of the USDCAD exchange rate shown on the 15 minute time frame.

You will note the one hour range starting from 8:30 AM to 9:30 AM shown on this USDCAD chart. This consists of the four candles shown by the maroon horizontal bracket. In order to prepare for this trade set up, we must first confirm that an important economic report which could have an impact on this currency pair is scheduled during this time window. In this particular case, we were expecting the US Consumer Price Index CPI report to be released at 8:30 AM.

Notice that we have drawn two horizontal lines starting at 8:30 AM. The upper line represents the highest high during this one hour opening range, and the lower line represents the lowest low during this one hour opening range. Notice how the first bar is a strong down bar that occurs immediately following the release of the CPI report.

But, about 30 minutes later the declining price movement begins to subside, as a hammer candle forms as the third bar within this range. The low of the hammer candle represents the lowest low within the one hour range. Following, the hammer candle, prices begin to move higher. Ultimately, the upper resistance line of the one hour range is breached. This would have triggered our buy entry on the USDCAD pair.

The stoploss would be placed two pips below the lowest low within the one hour range. This is illustrated by the black dashed line below the lower support line. The exit strategy calls for a fixed target level which is measured upward from the breakout point and is equivalent to the length of the one hour range.

The lower yellow arrow line represents the length of the range, while the upper yellow arrow line represents the upward projection and the target point. Notice how prices were able to reach our target within the maximum allotted time of 2 ½ hours, represented by ten 15 minute candles following the breakout bar.

Summary

The USDCAD forex pair is among the most widely traded and liquid pairs within the currency markets. It represents the currencies of two of the most developed countries in the world, the United States, and Canada. The USDCAD exchange rate is relatively stable, and has predominantly traded above parity.

However, when there is financial turmoil that occurs within the United States, or there is a sudden shift in the supply and demand dynamics of oil, the USDCAD pair can become much more volatile, and even fall below parity. So now we have provided you with some USDCAD trading tips that should help you get started with this pair.