Many newbie traders are drawn to the market because they have heard or attended a webinar about daytrading or short-term scalping. There are some educators that tout scalping strategies as the be all and end all when it comes to trading the market, particularly the currency markets. It’s important that you understand what Forex scalping entails, and some of the challenges that it poses. By the end of this lesson, you should have a pretty good idea as to whether or not this style of trading suits your personality.

What Are Forex Scalping Techniques?

There are a few primary trading techniques that can be applied to the financial markets. These include position trading, swing trading, daytrading, and scalp trading. These different names refer more or less to the average holding times of a position. Position traders tend to be longer-term traders, who focus on holding positions for months and even years. Swing traders, tend to be intermediate-term traders with an average holding time that ranges from about a week to a month or so.

Day traders will usually get in and out of positions within the same trading session. They typically like to hold positions from about an hour to a few hours. Scalpers tend to be very short-term market traders. They seek to profit from very minor price moves that can last anywhere from a few minutes to about a half an hour or so. One of the most successful class of traders that specialize in the very short-term scalping arena are the high-frequency trading firms. These outfits are generally trade micro trends and structural market patterns that can be measured in 1/100th of a second increments.

A large percentage of traders that specialize in scalping methodologies tend to be automated traders. They utilize computerized algorithms to execute their orders in the market. This helps them to gain maximum efficiency and speed, which is extremely important in the world of short-term trading.

These Algos will often give system traders an additional edge over their discretionary counterparts, whose decision-making processes are going to lag those of computer models. Nevertheless, scalping is not the exclusive reign of systems traders, but, it’s important to keep in mind that they will usually have a big advantage when it comes to sniffing out the best short-term edges.

Having said that, there are certain techniques that a discretionary scalper can employ that will not directly compete with the high-frequency firms. We’ll be looking at some of these techniques as we advance forward. A typical example of a Forex scalping risk to reward profile might look like the following; risking 10 pips to make 10 pips, risking five pips to make 10 pips, risking 10 pips to make five pips. These are just some very basic examples, however, it should give you some idea as to the types of trades that a typical Forex scalper may look for in the market.

How To Scalp Forex

Now that you have a basic understanding of how scalping works, let’s take a deeper dive into learning more about the mechanics of scalping the markets. Scalp traders tend to gravitate towards timeframe such as the one minute, three minute, and five minutes time frames.

These time frames will tend to offer sufficient volatility to take advantage of short-term price swings. Sometimes traders use a combination of these time frames within their overall trading strategy. For example an FX scalper may look to the five minute timeframe to gauge the overall market trend, and then switch to the higher resolution one minute timeframe for the purpose of executing their actual trade setups.

As with any other type of trading style, a trader that scalps the market must have a well-defined trading plan. One of the more popular methodologies for scalping include the use of technical indicators. Trading indicators such as the ADX, Stochastics, Momentum, and RSI can provide a scalper the necessary timing model needed for executing their trade setups. Additionally, some traders prefer a pure price action based trading strategy. This form of analysis would include relying on support and resistance levels, supply and demand zones, candlestick patterns, chart patterns, and other related price action analysis methods for executing scalp trades.

Because of the very short-term nature of scalping techniques, which can lead to a lot of turnover and trading volume, it’s imperative that scalpers do their very best to get a handle on their transaction costs, primarily in the form of bid ask spreads. The very best broker model for Forex scalpers is an ECN model.

Brokers that operate on an ECN based model offer the lowest bid ask spreads available. These brokers will pass on the true market pricing to you without any additional markups. You will however, have to pay a small commission associated with each trade. Even so, the costs will be significantly lower than traditional dealing desk brokers.

There are some trading platforms that are better suited for scalpers. You want to do your due diligence and compare the different trading platforms available to you and choose one that is compatible with short-term scalping.

Some of the more reputable execution platforms available to currency traders include Metatrader, Ninjatrader, Tradestation, and Multicharts. Of these, Metatrader tends to be the most popular amongst spot Forex traders, and Ninjatrader is one of the more popular choices amongst currency futures traders.

Best Currency Pairs For Scalping

The decision of which currency pairs to trade is an important consideration for all successful forex scalpers. There are a few key characteristics that you will want to analyze for each potential Forex pair. The first is the average daily range within a currency pair. This is also referred to as ADR, and this metric tells us what the average high to low range is for a specific financial instrument. The larger the ADR, the higher the range, meaning that the currency pair has a relatively good level of volatility, which is important for short-term trading profits.

Another key consideration is average trading volume. This can be a difficult data point to gather, because there is no centralized trading exchange within the spot foreign exchange market. As such there is very limited data around average daily trading volumes. However, there is enough historical data that tells us what the most heavily traded and liquid currency pairs are.

And these are traditionally the major currency pairs wherein the US dollar is traded against a currency pair of another major country or region. For example, EURUSD, GBPUSD, USDCAD, USDJPY, USDCHF, and AUDUSD are considered major currency pairs and have solid amount of trading volumes behind them.

Of these currency pairs, EURUSD is by far the most heavily traded currency pair in the world, followed by USDJPY, and GBPUSD. As of this writing, EURUSD accounts for approximately one quarter of all currency trading transactions. USDJPY accounts for approximately 13% of all currency trading transactions, and GBPUSD accounts for approximately 10% of all currency trading order flow.

Although, all three of these tend to be excellent choices for scalping the Forex market, EURUSD, and GBPUSD, are the two best currency pairs for scalpers in the Forex market. They both offer a relatively large average daily range, coupled with very tight bid ask spreads, and excellent liquidity and volume characteristics. The best scalping systems usually incorporate one these major currency pairs.

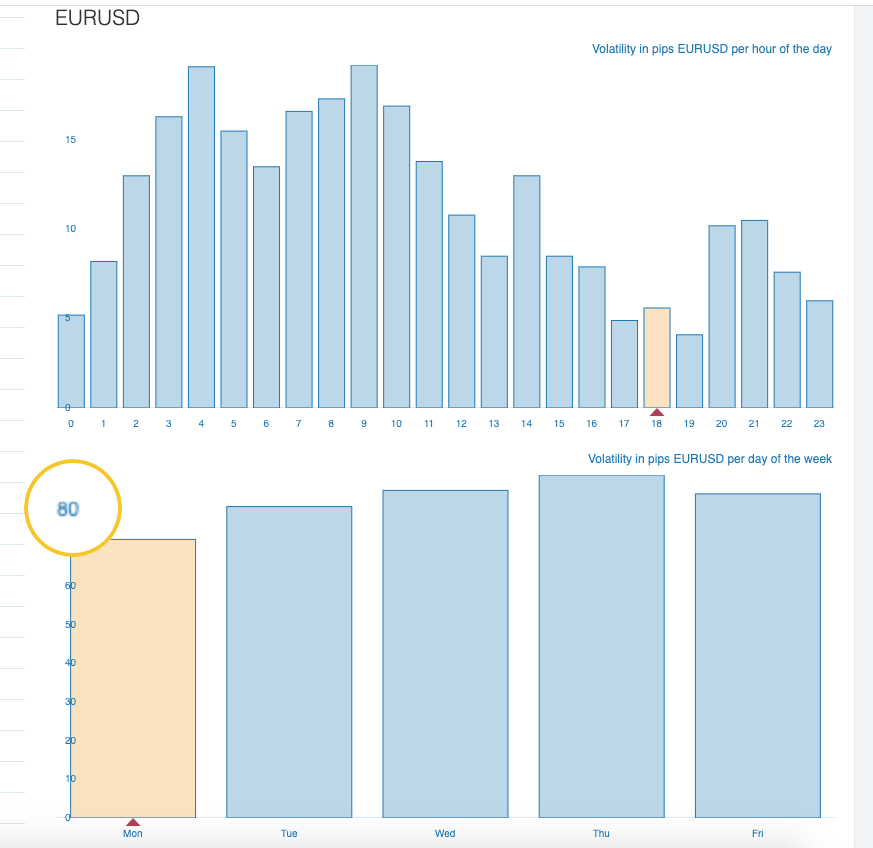

Below you will find the latest hourly, and daily volatility data for the EURUSD pair as provided by Mataf.net. We can see in the below graph that as of this writing, the average daily volatility for EURUSD is approx. 80 pips.

Forex Price Action Scalping Strategy

Let’s now build a simple scalping strategy for the currency market. The strategy that we are going to describe can be utilized in both the spot Forex market, and the currency futures market. You can trade this particular strategy on any major US currency pair; however, it works best when employed on EURUSD, GBPUSD or USDJPY. As mentioned earlier, these three currency pairs have many characteristics that align with a viable scalping methodology.

Our scalping model will be a fairly straightforward price action based method. We want to look for a breakout of a horizontal resistance level in the case of a long trade. Similarly we will watch for a breakout of a horizontal support level in the case of a short trade.

Adding to this, will add a condition that states that in case of a bullish breakout, the breakout bar should be a bullish marubozu candlestick. And in the case of a bearish breakout, the breakout candle should be a bearish marubozu candlestick. If you’re not familiar with a marubozu candlestick pattern, it’s a one bar candlestick pattern that opens at one end of the range, and closes at or near the opposite end of the range.

The significance of a marubozu candlestick is that is indicative of strength. And so, when the upside breakout occurs on strength, i.e. bullish marubozu candle, it provides further confirmation for a bullish trade. And similarly, when the downside breakout occurs on strength i.e. a bearish marubozu candle, it provides additional confirmation for a bearish trade.

Once these two conditions have been met, we will wait for price to pull back to retest the broken horizontal price level. When prices draw near this level after a break to the upside, the old resistance level will act as new support. Along the same lines, when prices draw near this level after a break to the downside, the old support level will act as new resistance. This is an important trading concept, and one that we will incorporate into this trading strategy.

The entry signal in the case of a long set up will occur upon the price moving one PIP above the price candle that touched the new support level upon the pullback lower. The stoploss will be placed just below the same candle. As for the take profit target, we will use a simple 2 to 1 reward to risk criteria.

The short entry signal will be triggered upon the price moving one PIP below the price candle that touched the new resistance level upon the pullback higher. The stoploss will be placed just above the same candle as well. The signal to exit the trade with a profit will be set using the 2X to 1X reward to risk requirement.

EURUSD Scalping Strategy

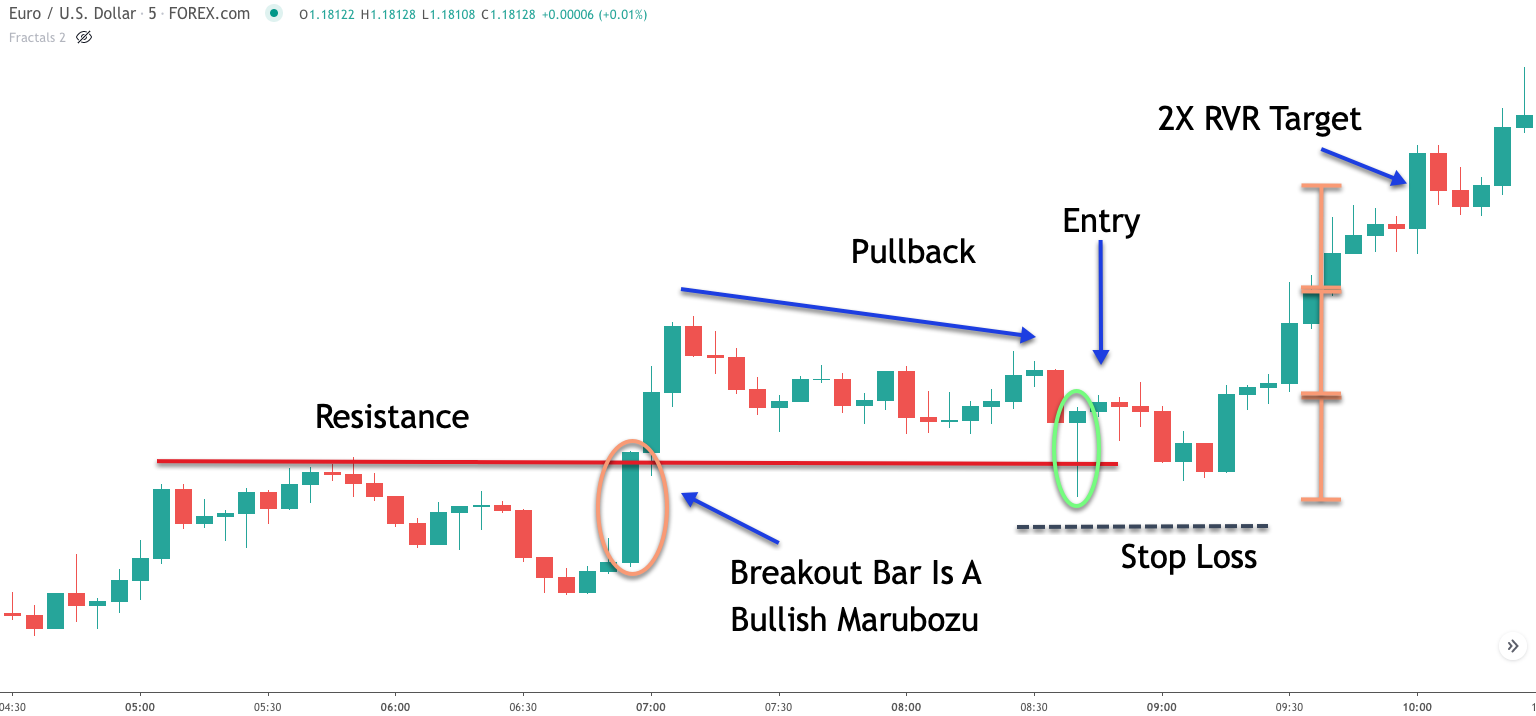

Let’s now illustrate a trading example using the fx scalping strategy outlined earlier. We’ll start off by taking a look at the bullish variation of the set up. Below you will find the five minute candlestick chart for the Euro to US dollar pair.

The very first thing that we will need to look for is a potential resistance level within the price action. If we scroll over to the far left of the price chart, we can see that the price action was beginning to consolidate. We can see the resistance level that formed within this minor consolidation phase. At this point, we will watch the price action closely and see if we can spot a strong breakout from this level to the upside. More specifically, we want a bullish Marubozu candle to be the breakout candle to the upside. Remember, a bullish Marubozu candle is simply a price bar that opens at the lower end of the range, and closes at the upper end of the range.

Soon after prices began to move higher towards the resistance level, we can spot a strong, wide range bar that closes above the resistance level. In fact, this breakout bar is a bullish Marubozu candlestick, which validates our long set up in this case. But keep in mind, that this event only serves to confirm that a potential long opportunity exists. Price will need to pull back to this level for an actual long trade to be initiated.

Following the bullish breakout, we can say that prices continued higher for several more bars, before subsiding and beginning a consolidation phase again. As the prices were consolidating in a downward motion, it eventually reached the original breakout point. You can see where that occurred by referring to the candle within the green circle. If you’re a student of candlestick analysis, you will also recognize this candlestick pattern. It is considered a bullish hammer formation, also called a bullish pinbar formation.

Now that the price has touched the old resistance as new support, we will use that candle as our potential long signal bar. Keep in mind, that we will need to wait for the price to move at least one PIP above this specific candle to trigger our long entry signal. The bar following the hammer candle did meet this requirement which would have triggered our long entry.

The stop loss would be placed just below the low of the hammer candle here, which again is the candle that was the first to touch the old resistance level as new support. Our take profit level will be based on a two to one risk to reward ratio. If you refer to the far right of the price chart, you can see the vertical brackets that serve as our measuring technique for the target.

GBPUSD Scalping Strategy

Let’s now illustrate the bearish variety of this scalping set up. On the price chart below, you will find the GBPUSD currency pair shown with the five-minute candlestick chart.

The initial part of our analysis will require us to locate and plot a horizontal support level. Notice the two swing lows at the left side of the price chart which we have used as the reference point for plotting the horizontal support line.

The prices were trading within a well-defined range leading up to the downside break out below the support level. We can confirm that this breakout bar is a bearish Marubozu candlestick pattern. Although, we can see a small minor wick at the lower end of the candlestick, it is, nevertheless considered a viable bearish Marubozu candlestick for practical purposes.

Now all we have to do is to wait for a pullback to this prior support level which should act as new resistance. A few bars following the bearish breakout, prices began to pull back to the old breakout level. The price touched the now new resistance, and penetrated above the area slightly. You will find the candlestick that serves as our signal bar circled in green. As soon as price moves one pip below the low of this candlestick, we will want to initiate a short position in the market.

The third bar following the signal bar would have triggered our short entry. You can see that candlestick marked as Entry on the price chart. The stoploss would be placed above the high of the signal bar as can be seen by the black dashed line above the Entry. The target for this trade would be reached upon the price achieving a 2 to 1 reward to risk measurement. The 2X RVR target is shown with the green dashed line near the bottom of the price chart.

Scalping Forex For A Living

Is it possible to make a living by scalping the Forex market? This is a question that many new traders who enter FX trading often asked themselves. The answer to this question is not always cut and dry. That is to say that there are traders that are making consistent profits by scalping the FX market, however, there are many more that have attempted it, and eventually burn out or burn through their account.

There are several reasons why scalping for a living has its challenges. Firstly, due to the relatively high transaction cost associated with very short-term trading, there is a bigger hurdle to overcome before you can see net positive results.

To illustrate this with a simple example, compare the swing trader will often have a target of 100 pips, versus a scalper who might only be targeting 10 pips of profit. If the bid has spread on the currency pair traded is two pips for example, then this transaction cost would only account for less than 2% of that swing trader’s profit potential, compared to 20% of a scalpers’ profit potential. And so, when you calculate this relatively higher cost over a long series of trades, transaction costs can and often do eat up over half a trader’s gross profit.

A second disadvantage that a scalper faces is the viability of trade setups at the very small time frequencies. Meaning that, trade setups that occur on higher time frames tend to be much more reliable than those that occur on smaller timescales such as the one minute, three minute or five minute bars.

For example, a breakout that occurs from a multi week resistance level, is a much higher probability trading set up, then a breakout that occurs from a multi-hour resistance level. Much of the back-and-forth price movements within the smaller time frames have very little value in terms of price predictability, due to the noisy nature of price movements at small time frequencies.

Now having said that, there are traders who have a profitable forex scalping strategy that works for them. The point is that there are certainly easier ways to make money in the markets, given all the challenges that a scalper faces. In any case, a trader that believes that they have an edge in the market which can be consistently applied to a scalping methodology, should demo trade their strategy and become intimately familiar with its related performance metrics before risking their hard-earned capital in the market.

Summary

As we have hopefully learned in this lesson, traders interested in scalping the Forex market should pay close attention to certain characteristics within their desired currency pairs. For example, you want to ensure that the Forex pair is relatively liquid and offers a good amount of average daily volatility. Additionally, it’s best to pursue scalping techniques with regulated ECN brokers, who offer the best bid ask spreads. Although, these characteristics hold true even for swing traders, they are especially important for shorter-term day traders and scalpers.

Once you have a plan for executing your forex scalping system in the market, you will need to continually test and refine your technique to have the best chance at long-term success. Scalpers are always looking for new angles from which to exploit price movements for profit. This is because many of the edges that are available at the smaller time scales will sometimes become less effective over time or dissipate altogether. Last but not least, you should be aware of the challenges that short-term scalping poses, and be ready to address these various shortcomings within your trading plan.