The vast majority of methods touted on market forums and trading blogs are centered around trend based strategies. There is not as much literature on trading methods that are focused on countertrend approaches. In this lesson, we will define and discuss the basic elements of countertrend trading, and present some best practices and strategies for implementing such strategies in the market.

Countertrend Trading Defined

Countertrend trading is a contrarian trading approach, wherein a trader seeks to profit from price moves that run counter to the prevailing trend. Countertrend traders typically fade the trend in an attempt to catch a short-term price retracement or possibly a trend reversal.

Generally, countertrend trading strategies tend to be intermediate-term in length. More specifically, countertrend swing traders seek to hold positions between a few days to a few weeks. Now, there are also a class of short-term traders that trade countertrend strategies and for whom this timeframe does not necessarily apply. These day traders and scalpers may be in and out with their countertrend techniques within a few hours or by the end of the trading session.

Regardless, the underlying premise of countertrend trading can be understood as being the opposite to a trend following methodology. Whereas a trend trading style focuses on momentum breakouts and riding a trend for as long as possible, a contrarian or countertrend style often calls for locating potential reversal points within the larger price movement.

The mindset of a trend trader is very much different than that of contrarian trader. Both styles of trading can prove to be profitable in the right market environment, and when it aligns with a trader’s personal psychology and makeup.

Based on a more technical definition, trend traders seek to locate and participate in impulsive price moves, while countertrend and mean reversion traders seek to find critical turning points to take advantage of corrective price movements.

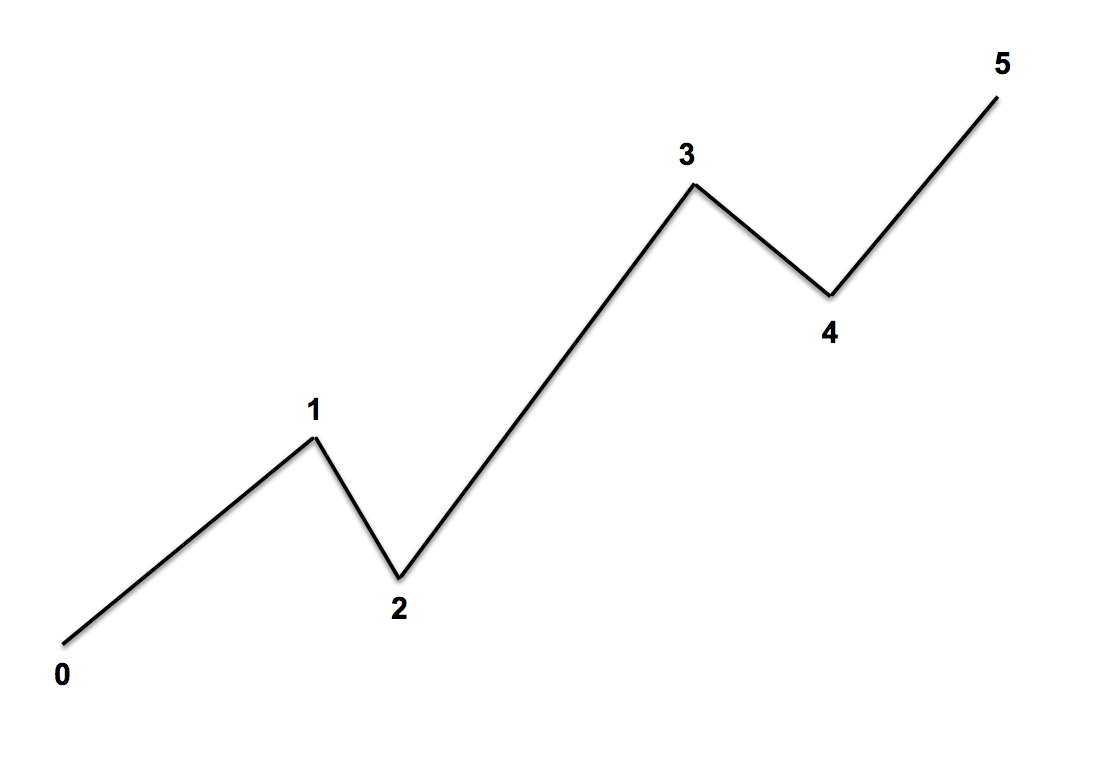

Impulsive price moves as described within the Elliott wave theory, is a scenario wherein the price action is moving along in the direction of the larger trend. And conversely, corrective price moves as described within the Elliott wave theory, describes a scenario wherein the price action is moving along in a direction that is counter to the larger trend.

As you might imagine, counter trend traders need to be much more adept and nimble to make consistent profits from the market. That is not to suggest that countertrend trading is not a profitable endeavor, but rather, it should shed a light on the level of difficulty that exists in finding and applying a consistent edge when it calls for fading the market.

Best Practices For Counter Trend Trade Setups

Countertrend traders should take the proper steps to ensure that they are not trying to catch a falling knife, or fade a euphoric price run. Regardless of how confident we may be in our trade assessment we must realize that “the markets can remain irrational, for longer than we can remain solvent”. This is an old adage that every trader should keep in mind, particularly those who are in the business of fading trends.

So let’s discuss a few best practices as it relates to trading countertrend set ups in the market. These guidelines will apply equally regardless of whether you trade the foreign exchange market, futures market, or the equities market for that matter.

Avoid counter trend setups during parabolic style price moves – Anytime the price action is behaving in an abnormal manner, particularly during strong uptrends or strong downtrends that resemble one-way price action or parabolic price moves, it’s best not to engage in any type of countertrend trades.

The best course of action during these events is to consider staying on the sidelines and waiting for the market volatility to subside. It’s very easy to get run over during a fast-moving market and losses can add up quickly if we do not control our contrarian impulses.

Always have a hard stop in the market – Some traders prefer to have what are referred to as mental stops in the market rather than hard stops. A mental stop is essentially a stoploss level that a trader has deemed important and one wherein they will likely exit if the trade begins to move against them.

A hard stop on the other hand, refers to an actual stop loss that is placed in the market and will be triggered automatically when that specific level is reached. Countertrend traders should consider always having a hard stop in the market to avoid the complications of having to react to sharp adverse price moves.

Do not add to a losing position – Some contrarian oriented traders have a tendency to add to their positions as the prices move against them. Although, this may work for a small minority of experienced traders who are extremely disciplined, the vast majority will find it to be a losing strategy, and one that can run the risk of leading to excessive losses on a position.

It’s difficult enough to pinpoint a possible inflection point within the price action. But doubling down on those probabilities by adding size as the price moves against you can and often will put you in an uncomfortable position.

Wait for confirmation before entering a counter trend set up – Adding the requirement for some type of confirmation mechanism within a countertrend strategy is advisable. Although waiting for confirmation can sometimes reduce the reward to risk profile on a trade, it will boost the overall win rate when used properly. This is particularly true for mean reverting techniques, where even a minor miscalculation can lead to a losing result.

Set a reasonable take profit level – The majority of countertrend trading opportunities tend to offer limited profit potential from the risk reward perspective. Unlike trend following systems wherein you might expect reward to risk profiles of 3 to 1, 4 to 1, or even higher, mean reverting strategies tend to offer less attractive potential profit to potential risk profiles. As a result, contrarian swing traders often find it best to set a conservative take profit target level, typically in the range of 1 to 1 or 2 to 1 reward to risk units.

Do not risk more than 2% on a trade – The success of any trading strategy will rely heavily on a proper and well-planned risk management component. One area of risk management that traders need to pay particular attention to is position sizing.

Betting too little will often result in subpar percentage returns, while betting too much can result in potentially catastrophic damage to your trading account. As a general guideline, countertrend traders should consider a 2% risk per trade model. It provides an acceptable level of risk for a desirable level of potential return.

Pros Of Counter Trend Trading Method

Traders that decide to take a contrarian trading investing approach, will often be looking for opportunities to sell into an uptrend, and similarly, they will be seeking to buy at lower levels within the context of a downtrend. As we’ve alluded to earlier, this contrarian style of trading can be challenging at times, however, there are some distinct advantages to trading against the crowd from time to time.

Let’s now take a look at some of the advantages of trading a countertrend methodology.

Potential for higher win rates – As we touched upon earlier, trend following systems tend to offer better risk to reward profiles, at the cost of lower win rates. Mean reverting strategies on the other hand tend to offer less desirable risk to reward profiles, but come with the advantage of higher win rates.

As a result of being able to apply a strategy that offers a more attractive win percentage, a countertrend trader can often realize lower max drawdowns. Additionally, when drawdowns do come, countertrend swing traders can often trade out of these losing periods faster than those employing longer-term trend trading strategies.

Lower holding periods on trades – The traditional countertrend trader is considered to be a swing trader who seeks to hold positions for as little as a few days to as long as several weeks. An average of about one week would be an ideal trade duration for most traders who consider themselves contrarian swing traders. Holding positions for a relatively short period of time can provide psychological benefits for those who are impatient or have a tendency to lose focus, or simply lose interest in the trade management process over time.

More opportunities to apply your edge – Due to the lower holding periods that we just mentioned, countertrend traders will often enjoy the benefit of applying their strategy in the market more frequently than other longer-term position traders. Having an edge in the market is critical to producing profitable results.

But just as importantly, the ability to apply that edge over a longer series of trades, will help amplify those trading returns. It’s not at all uncommon for counter trend trading systems to generate upwards of 75 or more trades per year on a particular instrument. This would be very uncharacteristic of most trend based strategies.

The ability to trade in and out of positions – Contrarian swing traders have the advantage of being able to get in and out of positions quickly. They do not have to project price trends over very long periods of time. Instead they can focus on shorter to intermediate term price swings, allowing them to be flexible and trade either side of the market. The ability to be nimble and open to whatever the market presents is a characteristic that many successful swing traders share.

Cons Of Counter Trend Trading Style

Now that you have a sense of some of the benefits that a countertrend style offers, we should also mention some of the drawbacks of such an approach. For most traders, especially those that are new to the markets or fairly inexperienced, it is much better to start with learning a trend based method. Once you have refined a strategy that trades in alignment with the larger market trend, then you can then add a countertrend method as a supplement to your overall trading arsenal.

Below we have outlined some of the disadvantages of trading against the trend as a primary trade strategy.

You’re going against the natural flow of the market – In markets as in life, it’s always easier to follow the path of least resistance. And more specifically as it applies to the markets, when a trend is set in motion there is a tendency for it to persist. And as a result, attempts to fade the trend can and do often result in a series of losing trades.

Market trends persist longer than turning points – Those that favor countertrend approaches have to be extremely skilled and enter only at the most favorable time. The reason for this is because turning points in the market can occur rather quickly, providing little time for a trader to react to it. Trends on the other hand are much easier to recognize and will often persist for extended durations making it fairly straightforward to enter into, even at less than ideal entry points.

It can be psychologically difficult to be a contrarian – There is no greater feeling in trading than taking a position against the crowd and the market proving you correct. While that can certainly be a boost to your ego, it can also be a dangerous exercise, and damage both your trading account, and your own psyche when you are incorrect in your assessment. A contrarian is often regarded as the lone wolf. That in itself can sometimes take a toll on a trader’s mental well-being.

You will rarely realize any major outsized gains – Countertrend tactics are overwhelmingly bread-and-butter types of trades. That is to say that one should not expect regular intervals of hugely profitable trades. Countertrend traders are akin to baseball players who are seeking to hit singles and doubles, rather than home runs and grand slams. While there is nothing wrong with consistently eking out average gains, if you are the type of trader that craves the big price moves, then your personality may not mesh with a contrarian trading methodology.

Counter Trend Trading Strategy

Now that you’re equipped with a solid understanding of what a contrarian trading style looks like, let’s build on that knowledge base and see how we might go about building such a strategy to capture profits within our chosen market.

The countertrend trading strategy that will be revealed here incorporates several different types of technical studies. Once they align to meet our conditions, it will provide for a high probability fade trade set.

Within the financial markets, you will often see three distinct price legs or pushes in the direction of the trend, which are interrupted by two smaller corrections. For those who are familiar with the Dow theory or Elliott wave theory, you will recognize this as the impulse structure.

If you are not entirely familiar with the concepts within the Elliott wave principle, you will still be able to benefit and use this particular countertrend method. So, once the market completes these three pushes in the direction of the trend, prices will often reverse and begin to correct a portion of the prior impulsive move.

Knowing this, we will seek to locate price trends that have completed this third push, either to the upside in the context of an uptrend, or to the downside in the context of a downtrend.

In addition to this price action pattern, we will incorporate the Relative Strength Index, or RSI indicator into the mix. Once we have been able to isolate the third push within the impulse structure, we will need to see a regular divergence pattern form between the second and third push and the RSI indicator. This divergence pattern between price and the RSI indicator will further validate a potential reversal in the market.

Only once these conditions have been met will we prepare to take a countertrend position in the market.

So here are the rules for entering a long position:

- The price action displays an impulsive structure, which is seen as three distinct price legs or pushes down within a bearish price trend.

- A bullish divergence pattern must be present as seen by drawing a line between the swing lows of the second and third push, and a line connecting the same troughs of the RSI indicator.

- A bearish trend line should be drawn that best connects the corrective peaks within the bearish impulse price move.

- An entry order to buy will occur upon a breakout and close above this trendline, following the third push.

- A stop loss order should be placed below the low of the candle preceding the breakout candle.

- The take profit target will be set at the 50% Fibonacci retracement of the prior impulsive move.

And here are the rules for entering a short position:

- The price action displays an impulsive structure, which is seen as three distinct price legs or pushes up within a bullish price trend.

- A bearish divergence pattern must be present as seen by drawing a line between the swing highs of the second and third push, and a line connecting the same peaks of the RSI indicator.

- A bullish trend line should be drawn that best connects the corrective troughs within the bullish impulse price move.

- An entry order to sell will occur upon a breakout and close below this trendline, following the third push.

- A stop loss order should be placed above the high of the candle preceding the breakout candle.

- The take profit target will be set at the 50% Fibonacci retracement of the prior impulsive move.

Forex Counter Trend Strategy In USDCAD

Now that we have outlined a countertrend strategy for trading the markets, let’s look at a practical example to help illustrate it better. The forex counter trend trading example will be shown on the USDCAD pair. The chart below is for the US dollar to Canadian dollar currency pair based on the eight hour timeframe.

Starting at the lower left of this chart, we can see that the price started to trade higher, ultimately creating an easily recognizable uptrend. During this upward price progression we can see three distinct legs or price pushes within the impulse structure.

Notice how the first push creates a swing high followed by a minor correction, and then the second push creates another swing high which is again followed by a minor retracement. Finally, we can see the third push which breaks above the high the second push.

Once we have recognized this price action pattern, we would prepare for a potential short countertrend trading opportunity. But before we do, we need to confirm that a bearish divergence pattern exists. To check this, we would draw the line connecting the swing high of the second push to the swing high of the third push, and then connect a line along the same peaks on the RSI indicator.

Notice that third push makes a higher high on the price chart, while the third push makes a lower higher on the RSI indicator. This is a classic bearish divergence pattern, and one that further validates our short trade bias.

Next, we have drawn a line connecting the swing lows within the uptrend, as can be seen by the upward sloping orange line. The sell entry signal would come upon a break and close below this line following the third push. You can see that sell signal noted on the price chart with the blue arrow. Once the sell entry order was initiated, we would turn our attention to the trade management process.

Firstly, the stoploss order should be placed above the high of the candle preceding the breakout candle, as can be seen by the black dashed line above the entry. Finally, the target is set at the 50% Fibonacci retracement level of the prior impulse price move.

That level is shown by the green horizontal line below the sell signal. We can see that immediately following the sell entry signal, the price began to consolidate and move sideways for a period of time before ultimately breaking lower and reaching our target.

Final Thoughts

By now you should have a solid understanding of the contrarian trading approach and how it differs from a trend trading methodology. Although going against the main trend can be profitable in the right market context, it should be noted that it is a more difficult type of set up for consistently beating the market.

Nevertheless, more experienced traders should take some time to research various mean reverting tendencies in the market, and consider adding these types of strategies into their overall trading program. Many successful traders out there have built and trade both a trend or momentum based model, along with a contrarian or countertrend model. Doing so, helps to add a level of strategy diversification within a portfolio.