Since 2010 cryptocurrency trading has been growing in popularity. News about the spectacular gains of various virtual coins has been in the financial press on a daily basis. Bitcoin, for example, has become a household name. It gained 445% in the six months from September 2020 to March 2021 alone. Although it often goes through a helter-skelter ride, it continues to gain traction with the trading community.

Foreign exchange markets remain the largest financial markets in the world. On a daily basis, $6.6 trillion is exchanged every day. Computer technology and high-speed internet connections have made trading these markets accessible to retail traders across the globe.

We will look at the main differences between forex trading vs crypto trading. Hopefully, you will be able to determine by the end of the article which market suits you better. Or perhaps, that they are both of interest to you in your trading pursuit.

Market Size

In a comparison of forex vs crypto volume, the forex markets far outweigh virtual coin markets. As mentioned above the FX market is a $6.6 trillion daily market. According to data from the BIS (Bank of International Settlements) the currency pair EUR/USD trades 28% of that volume, equal to $1.85 trillion on a daily basis.

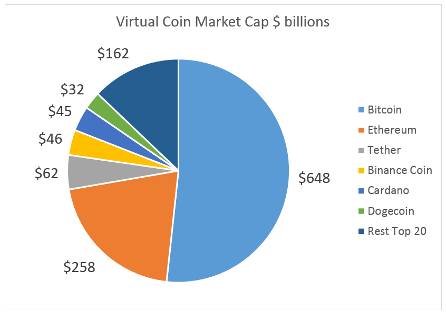

Exact figures for cryptocurrency traded volume are hard to find. This is due to the decentralized nature of all cryptocurrencies. However, if we look at market capitalization, the biggest cryptocurrency, Bitcoin, has a market cap of $647 billion at current prices. Forex trading volume almost certainly dwarfs the cryptocurrency market when comparing cryptocurrency vs forex for traded volume.

Looking at the second and third largest cryptocurrencies, Ethereum & Tether, the market cap of these virtual coins are $258 billion & $62 billion respectively. When we compare these assets to the second & third most traded FX pairs, GBP/USD & USD/JPY, we again see an impressive difference. According to the BIS, GBP/USD & USD/JPY each represents 13% of daily volume, equal to $858 billion traded daily on each of these pairs.

Market volume is a very important aspect of trading for any asset or market. A financial market without sufficient liquidity will be a hard market to trade. Initiating a trade will take longer and be more costly. More importantly, exiting a trade may prove extremely painful if market liquidity does not provide the necessary prices for ease of transaction.

Market volume is a very important aspect of trading for any asset or market. A financial market without sufficient liquidity will be a hard market to trade. Initiating a trade will take longer and be more costly. More importantly, exiting a trade may prove extremely painful if market liquidity does not provide the necessary prices for ease of transaction.

In comparing bitcoin vs forex trading for trading volume forex trading comes heads up in a big way. Liquidity is very high especially during European trading hours. According to the BIS 42.5% of daily trading in FX is executed in London. However, other centers such as New York and Hong Kong account for 16% and 7.5% respectively.

Variety of Assets

There are currently 200 different virtual coins in circulation. However, only the ones at the top of the list represent a viable market for retail traders. What makes the others less viable is their market size. A coin like Nexo, ranked 80, has a market cap of $838 million. But even Binance USD, ranked 11, only has a market cap of $10.6 billion. Their market size does not mean they cannot be traded, they certainly can. However, you may find you are crossing very wide bid offer spreads to open or close a position, as well as high fees if you are not trading CFDs. Perhaps more importantly, market prices may be pushed in one direction if a large order comes through, or a few large enough players could manipulate market price.

The forex market represents a high level of liquidity in the 7 major pairs, all against the dollar which are EUR, GBP, JPY, AUD, CHF, CAD, and NZD. Although you will be free to choose from many other pairs quoted against the USD as well as crosses. Currency crosses are currency pairs that do not involve the USD, for example, GBP/JPY or EUR/GBP.

Crosses and exotics, for example, USD/MXN can also be much more expensive than trading one of the majors. You will find that bid offer spreads are much wider, and that market liquidity shrinks at certain hours of the day. This is due to the location of the main market makers who may be in one center only rather than spread across the globe.

In terms of asset variety, trading crypto vs forex allows for a wide choice in both markets. However, for certain less liquid assets, you may want to trade with a medium-term horizon. This is often known as swing trading, as opposed to day trading. Choosing a longer trading horizon will help offset the extra costs of opening and closing a trade.

Volatility

For a trader, volatility can be a good friend or their worst foe. Extreme volatility will mean that prices may have moved greatly before you have been able to enter or exit the market. Being on the right side of a large move in a bout of high volatility can be very rewarding. But these wild swings can also create lost opportunities as you keep seeing the market move away from your entry level. It can also create excessive losses when you try to exit a trade as the market keeps moving in the wrong direction.

In the comparison of crypto vs forex for price volatility, cryptocurrencies show a much higher volatility than FX markets. EUR/USD has an average daily volatility, during most periods, of around 0.58%. When we look at Bitcoin, daily volatility averages 6.65%, with peaks up to 8.88%

This difference in volatility applies across the whole spectrum of cryptocurrencies. If we look at Ethereum, daily volatility is at 9.17% with increases during certain periods to 12.29%. In FX, GBP/USD has a daily volatility of 0.69%. It is safe to presume, as we run down the list of cryptocurrencies with the market cap decreasing, that volatility for the smaller volume coins gets only higher.

Of course, one of the main consequences of such high volatility is low leverage. Usually, the highest leverage most crypto exchanges will provide is 5:1. If we consider that Bitcoin has an average volatility that is 13 times a multiple of EUR/USD, then 5:1 leverage in crypto coins equates to 65:1 in FX. The very high volatility also confirms that cryptocurrency markets are smaller in volume. Assets with less liquidity will always move faster than assets with higher liquidity.

Trading Hours & Execution

When considering cryptocurrency vs forex trading open hours are definitely a big factor. FX markets, unlike traditional bond and stock markets, are open 24 hours a day 5 days a week. These long open hours create a continuous marketplace throughout the week. Yet cryptocurrency markets go one better and are open over the weekend also.

The decentralized and unregulated nature of cryptocurrencies allows for exchanges to organize according to demands from the market. These demands have been met and most exchanges are open for business 24/7, 365 days of the year. The endless continuity of the market is a point for cryptocurrency trading vs forex trading.

Executing a forex trade may seem easy or complex depending on each individual. For sure, all you need is to open an account with an FX broker. This process may take some time to allow for identification. Once that’s done you can fund your account, which usually takes a few days. Now you are all set, and you can open and close trades at the click of a button and receive instantaneous price and trade confirmation.

Trading in bitcoins will involve opening an account with an exchange or platform (decentralized exchange) and opening a wallet. The wallet is where your bitcoins are kept, if you are trading on an exchange the wallet is kept by the exchange, who owns the keys. While if you are using a platform the wallet and its keys are in your full control.

Fees will be much higher when you are trading cryptocurrencies, as high as 0.50% of the amount traded, plus the bid offer spread in the market at the time. FX fees are around 1 pip on average in the bid offer spread for EUR/USD. Forex commissions can be even lower when using an ECN broker.

That’s a big point for forex trading vs cryptocurrency trading when it comes to trading costs. A way to reduce those costs when trading cryptocurrencies is by using CFDs. In this case, you will only have to pay the bid offer spread offered by the broker. CFDs also allow for easier execution, and you won’t need to open a new account with an exchange or keep a wallet.

Transparency and Regulation

FX markets are well regulated by national authority bodies in each geographical location. Brokers and banks have to register and apply with their local regulator which guarantees oversight against any malpractice or possibility of fraud.

The funds held by your bank or broker are well looked after and have some protection. This may not be the case with cryptocurrencies. So far, none of the main jurisdictions have set up controls or regulatory requirements for cryptocurrencies. Although the FCA in the UK has established certain requirements for crypto trading. Exchanges in the UK must register with the FCA in compliance with AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) reporting and obligations.

Trading forex vs crypto still remains safer when considering the lack of regulatory requirements for crypto exchanges and the absence of identification in decentralized exchanges. The wallets where virtual coins are kept can be hacked. This can create particular security concerns if you are maintaining your own wallet.

True, if you are using a centralized exchange, they will have high levels of encryption and your wallet should be safer. However, in the past exchanges have been compromised and the coins in the wallets of their clients stolen. Losses have amounted up to billions and due to the deregulated nature of the virtual coins recuperating them has proven very difficult if not impossible.

Market Players

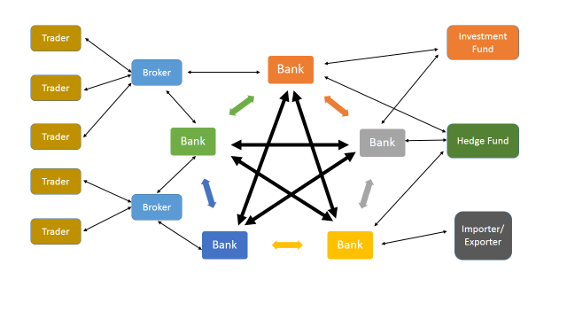

The players in forex are made up of market makers, mostly banks and some other high-end financial institutions, market users such as hedge funds and trading houses, investments funds, central banks, and retail traders. Another market player which is often forgotten is the importer or exporter.

These companies may be exporters or importers of raw materials or finished goods. However, they will always need to use foreign exchange to convert their revenue into domestic currency or to pay for imports. This scenario shows a much diversified universe of actors with varying capabilities, needs, and firepower.

Crypto coins do not have such figures as a market maker, nor a diverse array of market players. Although more recently some institutions are beginning to invest in virtual coins, the spectrum is still far away from the diversity in FX markets. This is probably due to the use of fiat money compared to virtual currencies. The wide acceptance of fiat money means that the use of foreign exchange is primordial for many institutions.

Trading Venues

In the comparison of forex vs bitcoin trading for trading venues, we see that forex trading takes place in various brokers who are in turn linked to market makers such as banks. These banks also trade amongst each other in what is known as the interbank market. Other institutions will trade directly with banks or other online trading platforms for FX.

The trading venue for FX occurs in various locations simultaneously. A bank can be trading with other banks and with brokers or other financial institutions at the same time. A hedge fund may be trading with several banks simultaneously and so on. The variety of players helps balance the market. This is due to the differing needs of each player, from pure speculation like hedge funds to hedging requirements and risk management like investment funds.

In virtual coins, trading goes thru one of two venues: centralized exchanges or decentralized exchanges which use peer-to-peer technologies to connect buyers and sellers. The centralized exchanges are preferred by some as they take care of their wallets and their safety. Others prefer decentralized platforms for anonymity at the expense of taking on the maintenance of their wallets.

The lack of a varied number of market players might make you presume an even playing field. Yet for some virtual coins, their market cap is so small it is quite feasible that price manipulation could happen as it wouldn’t take huge amounts to move the market. Forex markets are so large especially in the major currency pairs it is harder for price manipulation to take place.

Evolution of Markets

The forex market has been around for a very long time, although it is hard to pinpoint how far back it could go. In its present form, of a globalized marketplace without borders or restrictions in the main currencies, it goes back to the 1990s. Then the world started opening up to global markets and although most transactions were still conducted over the phone volume started expanding.

The trading volume took an even bigger step when internet access and computer power made trading forex much cheaper. The entry of more market players forced market makers to offer lower bid offer spreads and created cheaper costs of transaction. The trend has been continuing as reported by the BIS.

The first report from the BIS for 1995 showed a daily trading volume of $1.19 billion. The last survey showed daily trading volume at $6.6 billion, a staggering increase under all considerations. The trend seems set to continue to rise, although at a slower rate perhaps.

Central banks have been busy with quantitative easing over the past years, and this has increased the total money mass. More players continue to enter the market so, the most likely presumption is an even bigger market.

Cryptocurrencies are fairly new compared to foreign exchange markets. However, since the launch of Bitcoin in 2009, we have seen hundreds of other virtual coins join the show. Some have been more successful than others and success will determine price performance and vice-versa.

It still remains to be seen how many other crypto coins can achieve the top cat status of Bitcoin. Bitcoin was first valued in the tens of US dollars and is now trading for tens of thousands. The limited supply of coins, set at 21 million, and the fact that it was the first may be factors that hold it in pole position for some time to come.

Wrapping Up

In the forex vs crypto trading comparison, we have been through various factors that define these two markets. The crypto market is comparatively smaller, with even the largest Bitcoin trailing way behind the main currency pair in forex.

FX markets can offer much higher leverage, and this is due to much lower volatility experienced with a much more liquid market. However, crypto investing may prove more rewarding in a buy and hold scenario. That is of course, if you are betting on the right horse, as some cryptos have had spectacular performances over short periods of time.

The playing field in forex is made up of various actors with different needs and capabilities, which can add more balance to the marketplace. Cryptocurrencies still lack the full involvement at the institutional level enjoyed by FX markets. Trading in forex takes place at various venues as market players are connected thru more than one venue. Crypto trading happens on a number of exchanges and is limited to the players on each exchange. In terms of regulation and security, FX markets are safer as they are regulated in each geographical location.

Cryptocurrency trading can offer total anonymity when trading thru decentralized platforms or exchanges. Cryptocurrency markets are open on weekends for trading, making it a truly round-the-clock market all year round. Forex markets get fairly close, opening 24 hours a day, but closing for the weekend.