We are going to look at the best forex trading platform providers and analyze the services they provide forex traders. There are various things to consider when choosing which forex trading platform to use. Ease of use or user-friendly interface is a must, although this may be very subjective. You will need to consider the availability and number of technical indicators and variety of order types. You may be looking for an open-source forex trading platform. Additionally, you might not be using automated trading bots now, but you may be planning to do so in the future.

Ultimately, deciding on which is the best forex platform for you is going to be based on a combination of subjective and objective matters. If technical analysis is one of your top factors then the total number of indicators and variety of drawing objects will determine a higher score for those platforms to trade forex. If you are just starting then you should be choosing one that has a forex demo platform available. Most of them do, although some will charge fees for data or news from the start.

Three things are essential to making it as a top forex platform – charting package, cross-platform availability, and notifications. Most traders are highly dependent on charts and technical analysis for timing. In fact, all of the platforms viewed have charts and technical indicators. Being able to check your positions on the go is a very important aspect for many traders, given how fast lifestyles are nowadays. Having said that, not all mobile platforms support the same features as their desktop peers. We also need to be notified when we have entered or exited a trade, and if our stop or profit has been hit.

Secondly, there are other features which should also be available. Although depending on your needs you may allocate them to the group above. Open API, also known as an open source feature allows you to create your own technical indicators or trading robots. You will be using programming code provided by the platform, usually similar to Python or C++. Together with an open-source structure, you should have a vibrant online community for Expert Advisors, indicators, or automated trading bots. Unless of course, you want to take on the task of learning to write the script for your EAs by yourself.

Of course, it goes without mention that all trading platforms should offer various types of trade orders, and trade and order management. With live update feeds for your open positions and current margin. Along with easy access to stop loss levels or profit limits allowing you to change them if necessary and to view what those prices are. Also, they should offer on-chart trading, especially if you are a day trader or scalper, since your fastest access to entering a trade is usually by clicking directly on the chart.

List of Forex Trading Platforms

Here is the list of the most popular platforms that we will be taking a closer look at.

NinjaTrader

Ctrader

MarketsX

ProTrader

ProRealTime

MT4

MT5

People often ask which are the best forex trading platforms for beginners. The truth of the matter is, there are no forex platforms that are designed for beginners. As a forex trader, you won’t be a beginner for long, if you are you simply won’t be a trader for long either. Forex platforms are designed to take care of every facet of forex trading. They are also geared up so that the most sophisticated and experienced traders can get the most out of them.

As a beginner, you need to arm yourself with patience. It is a very steep learning curve, but as in most matters, a bit of dedication and persistence all driven by a passion for the markets will certainly help in making that climb a bit easier.

A common question is which is the most popular forex trading platform? According to Financial Magnates, it has been the MT4 forex platform for quite some time. MT4 and its close counterpart MT5 make up for around 55% of trading volume. Although Meta Trader was not one of the first platforms to launch, its ease of use and open source have made it the most popular retail trading platform.

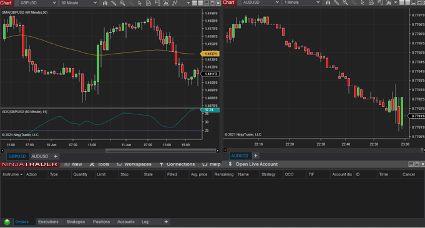

NinjaTrader

Ninjatrader is a US-based platform. US residents are not allowed to trade CFDs, so you will not find this instrument available if you are using a US-based broker. This platform has a large variety of technical indicators and objects allowing for sophisticated analysis. You can also import your own indicators and it also has a strategy tester.

The software is free, so you can create a demo account and discover its functionality for as long as you like. This platform allows you to create separate windows for your charts from the main body of the platform. Meaning you don’t have to occupy a whole screen or keep a downsized window of the platform open.

The trading community for this platform is relatively moderate in size, with only around 60,000 traders using the platform. This means there is also a smaller community of coders allowing for less access to tailor-made indicators or strategies. There are 37 time frames available, starting with tick data out to yearly time frames. Hundreds of technical indicators and some pre-configured strategy programs come already loaded, with one click on-chart trading.

Ctrader

This software provided by Spotaware has cross-platform connectivity and even has a browser based version with no need to download any software. This platform was launched in 2011 and has become possibly the biggest contender for taking the top spot from Meta Quotes MT4.

It has a large array of technical indicators and the possibility of back-testing strategies. Automated trading is supported on their cAlgo platform, the platform uses the C# programming language. This popular language means it may be easier to find programmers or coders. However, the community of dedicated coders to the world of forex is still relatively small in this language.

Back-testing is also available. The platform offers 54 different time frames from ticks to monthly and possibly the largest array of technical indicators and drawing tools. Depth of market is also available on this platform allowing you to see orders that are queued and each price level.

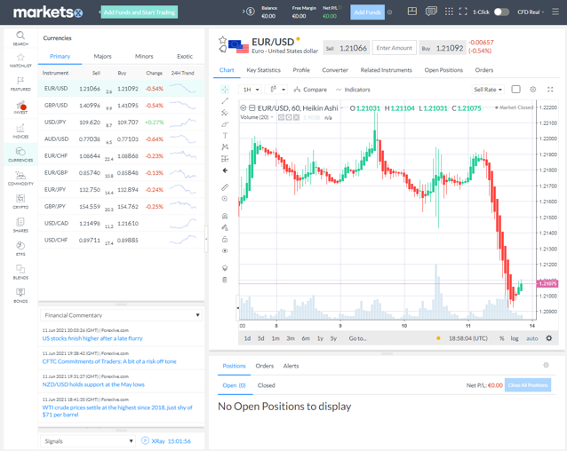

MarketsX

This platform was directly developed by the broker behind Markets.com. Being the development of a sole player it is probably the least common platform on the list. However, it is worth a mention due to its sophistication and high standards.

Probably the biggest downside to this platform is that it is only offered to Markets.com traders. However, the software has 88 different technical indicators and drawing tools, 67 different currency pairs, as well as a customizable interface. It only offers 10 time frames, and there is no availability of automating your trades. It does have a very strong financial news and analysis function, supplying real-time events and information.

The platform is web based, therefore accessed from your browser and available on mobile devices also. It is totally free to sign-up for a demo account.

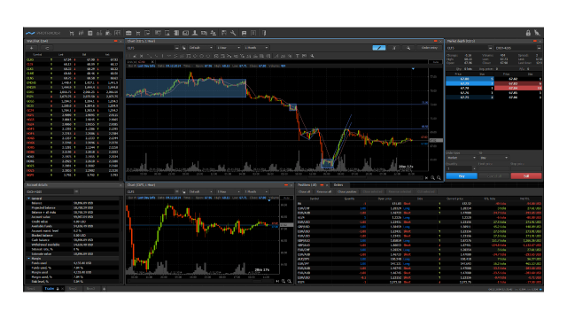

ProTrader

This platform was released in 2004 by PFSOFT, for the forex markets with later years seeing the addition of other instruments. This platform also has a web browser based application, allowing you to trade without downloading software, and still maintain the majority of the functionalities. It also has cross-platform availability with apps for Android and iOS.

This platform offers a full array of technical indicators, drawing tools, and time frames. For total sophistication, this platform supplies depth of market, options, one-click trading, and matrix. The latter allows for one-click order entry, modification, or cancellation.

Automated trading is available through its AlgoStudio module. This allows you to write, and backtest your own automated strategies using C# language. The coding community is rather small for this platform also, but as the coding language is C# which should make it fairly easy to find coders to write your programs.

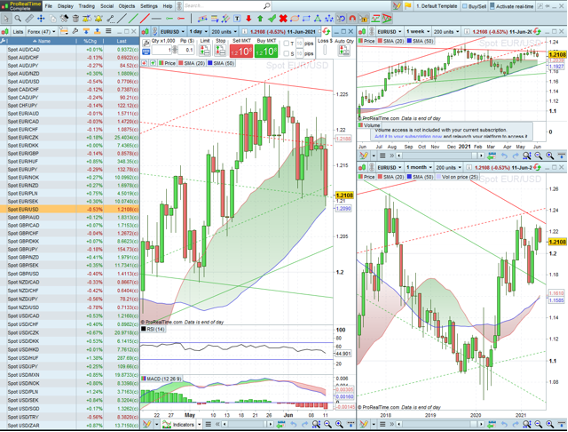

ProRealTime

This platform was first launched in 2001 and offers possibly the most varied selection of assets with 120 different pairs, including precious metals and cryptos. If you are just starting out there is a small catch; live data is not free unless you are actively trading and the minimum deposit required is 3k for forex and 1k for CFDs.

If you want to try out the platform you will only have access to end-of-day data. After that, it’s at least $36.55 per month with live data. Depending on what services you choose that fee can be even higher.

It also has cross-platform applications which also depend on what subscription you have signed up for or how active you are. Time frames range from tics to yearly and are completed with over 100 technical indicators and tools.

This interface is also built-in modules meaning you can have just one window of a chart open, while the main body is not. One-click trading is also possible directly from the chart.

A big difference to other platforms like MT4 or MT5 in automated trading is the fact that ProRealTime runs your trading bots on their servers. This is a web based service, so your automated system is sent to the platform’s servers and operated from there. This means you can turn off your PC and your trading bot will keep on sending orders to the market.

You also benefit from extremely fast computing capacity allowing for very fast calculations of complex systems. The fact that these servers are very close to the servers handling your orders allows for high execution speeds. The provider also allows for traders to create their automated systems without the need to learn how to code, you can also backtest your strategies with this platform.

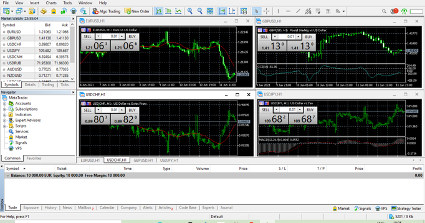

MT4

This platform was launched in 2005 by Meta Quotes and is probably the best known trading platform for forex. It is rather simple compared to some of the other platforms we have been looking at and it is easy to use and completely open source.

Automated trading is a big feature within this platform and there is a large trading community. This gives traders, who are not interested in learning how to write code, the chance to hire coders to write the programs for their automated systems. You can implement all kinds of trading bots, indicators, and objects all of your own design.

The platform uses its own language, MQL4, which is similar to C#. There is also plenty of literature available if you were to decide to learn the language yourself. It has 30 technical indicators and 33 tools, but only 9 timeframes from 1 minute to 1 month. It does allow for hedging but not for netting.

Unlike other platforms, MT4 is not modular, meaning you cannot float a chart on your desktop; you have to size down the whole application until it shows you just what you are looking for. MT4, like most platforms, also offers news feeds and event information. However, the design does not seem so appealing, and it is clear it was not an important feature for the developers.

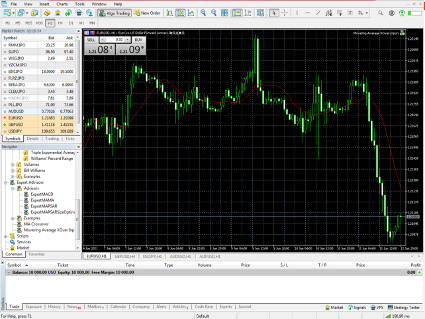

MT5

The improved version of MT4, MT5 was released in 2010 yet has not managed to catch up in popularity to MT4. This is despite the fact that MT5 offers various improvements over MT4. This may be due to the fact that it is hard to get seasoned traders to change their habits.

This platform also accommodates automated trading, however, it uses its own improved language called MQL5. This may have also been another factor that discouraged a lot of traders, the need to re-write all their trading bots in the new language.

MT5 has 21 timeframes, going from tick to 1 month, with 38 technical indicators and 68 tools. It also allows for netting as well as hedging. As with the MT4, this platform also allows for one-click trading and directly on the chart.

Although much less popular than the MT4 it still has a large community of traders and the possibility of hiring coders for your automated bots if necessary. Switching accounts has also been made easier if you are using different accounts for different strategies. It also has a news feed like MT4, and again the layout is not that attractive and clearly not at the top of the list for the developers.

Social & Copy Trading

Let’s have a quick look at what a forex social trading platform can do. These platforms are designed for traders to follow more experienced traders’ ideas. They can also be referred to as a forex copy trading platform.

Two of the most popular to date are ZuluTrade and eToro. Both work under the principle of copying other traders’ positions.

These platforms allow you to copy other traders as they go long and short of the currency pairs they have indicated they will trade in. You will have to open an account with one of the brokers that are linked to their platforms. Your account then automatically copies the trades, of the traders you follow, to your broker account.

Both platforms have ranking systems, although it is not completely clear how they rank their best traders. Factors that are given by ZuluTrade mention performance, stability, behavior, and outlook. However, they both have a high success rate for their investors. If you don´t have the time to pick and choose and filter through the hundreds of top traders they also offer their services to pick traders that suit your risk appetite. ZuluTrade is licensed in the EU, the UK, the US, and Japan. eToro is licensed in the EU, the UK, and Australia.

Conclusion

It is very hard to say which is the best or most reliable forex trading platform, as this will depend on many personal factors. User friendliness is an important factor and totally subjective. So, also deciding which is the easiest forex trading platform will inevitably be a very personal issue.

You may be looking for as many technical indicators as possible or you may be more concerned with the accessibility of automated trading bots and their application. A platform with a larger community for the exchange of ideas and easy hire of coders for your EAs may be more appealing. However, it may simply come down to which platforms are offered by the broker of your choice. NinjaTrader is offered by a handful of brokers, while MT4 and MT5 are offered by I would say a vast majority.

We have not made a direct forex trading platforms comparison, as all platforms offer the same essential functions, with different levels perhaps, such as in currency pairs, technical indicators, or time frames. What does change is the user interface and availability on mobile devices and at the brokers you may be considering to open your account. So, it is a matter of having a look around amongst the brokers you consider as candidates for your trading. Or, if you try a different platform from the one you are currently using you may have to open a new account with a broker offering that platform.