One of the hottest trends in the trading and investing space has been the emergence of social trading networks. This industry has grown dramatically with many players competing to attract users to their platform.

In this article, we’re going to highlight the best social trading platforms and the major features and benefits within each. This will help you in your evaluation process, and make you better informed, about the different options available to you in the social trading arena.

eToro Social Trading Network

eToro is the most well recognized and advanced copy trading platform in the market today. There are many different options for users who decide to join the eToro social trading community. If you join, you will be among 175,000 other traders who also use the platform.

You can trade your account as you would with any other broker, interact with other traders, follow and copy other traders in the network, and even provide signals to earn commissions based on your followers’ activity.

Their copy trading technology allows you to trade with other more experienced traders while offering you trade management features that can be tailored to your own risk parameters. eToro’s social trading features include an advanced search tool, trader analytics and statistics, and advanced filtering criteria.

One aspect of their copy trading platform that is very useful, is the ability to allocate a certain portion of equity to each trader that you are interested in copying. They do have certain limits on how much you can allocate to any one trader. Currently that limit is 40% and it serves as a good measure for novices who might otherwise not consider the benefits of diversifying among at least several traders.

As an eToro user, you have the ability to view a full performance record of traders that you are considering copying. Typically this data will go back about a year or so. The performance reports will list such items for each trade including the dates the trade was opened and closed, the order fill prices, total profit or loss on the trade, and other relevant data points.

Another added benefit to copying traders on the eToro platform is that only users that have a real, live trading account are eligible to have their signals copied. This provides some additional assurance and confidence if you are looking to copy trading signals from other traders. Knowing that a particular trader is actually trading with their own money rather than sending signals from a demo account is an important distinction that sets eToro apart from many other competitor platforms.

So you may be asking what the benefit is for those that are providing their valuable copy trading services to the community. Firstly, eToro uses the term Popular Investor to describe their preferred traders that participate in the copy trading program.

There are certain requirements that must be met in order for a trader to become a Popular investor, but those that are classified as such have the ability to earn money from others who copy their trades. Depending on the level that the Popular Investor falls into, they can earn a fixed monthly fee, a percentage of the revenue earned from the trader by eToro, or a 2% fee based on the Assets Under Management (AUM).

For those that would like to try the eToro platform without committing to opening a live trading account, you have the option to open a demo account and test the full functionality of their social trading platform. There is no time limitation on the demo account, and you can use it for as long as you like.

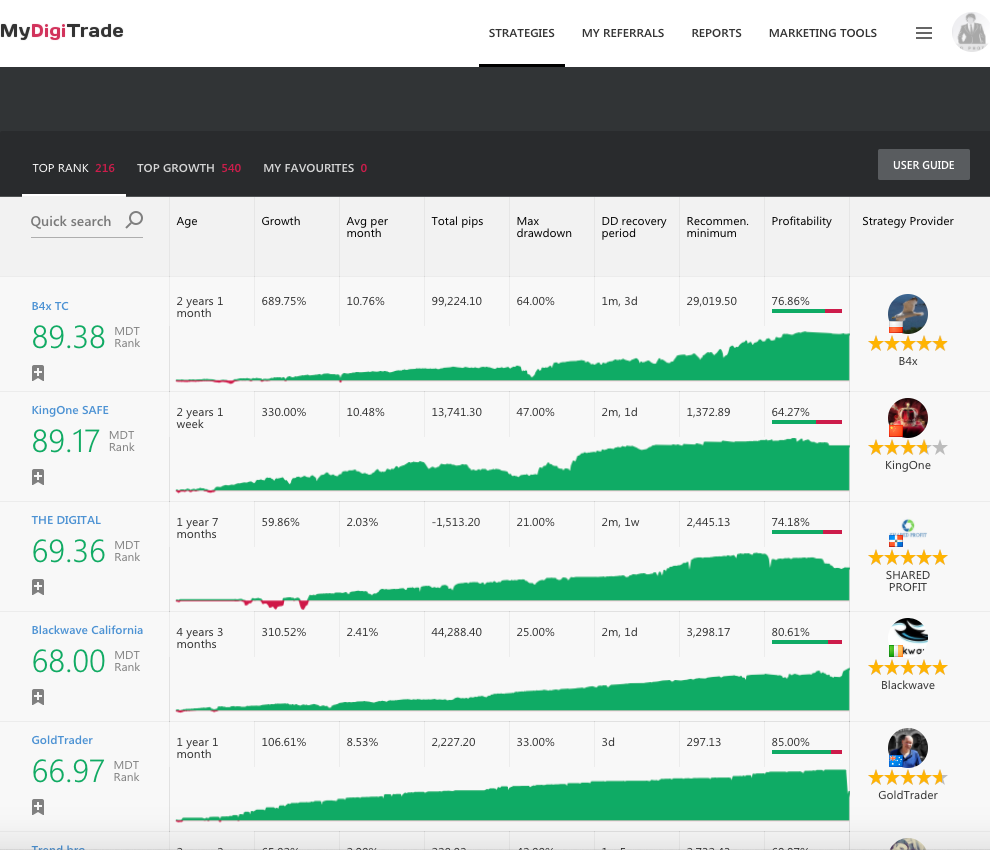

MyDigiTrade Social Trading Network

MyDigiTrade is a popular social trading network that was established in 2010. In order to access MyDigiTrade’s copy trading features, you would need an account with one of their partner brokers, and connect your brokerage account to the MyDigiTrade copy trading platform. There are currently 14 brokers that are supported by MyDigiTrade. Traders do have the option to demo the MyDigiTrade platform prior to setting up a live funded account. The demo is fully functional but is limited to a 30 day trial.

Since you would use your own choice of broker within their supported network, the spreads will differ from one user to the next. As with eToro, traders that offer their signals to the community would be compensated from some of the earnings that MyDigiTrade makes. MyDigitrade generates it’s income from adding a fixed amount to the broker spread as part of their fee structure.

The MyDigiTrade social trading platform allows you to view and sort performance statistics of various signal providers in a myriad of ways. They offer their proprietary MDT Ranking system, which analyzes various statistical metrics and rates traders from highest to lowest.

As with other similar copy trading programs, the user can hone in on the performance metrics and evaluate a traders historical trading performance by evaluating such data as total pips gained, maximum drawdown, growth per month, total trades taken, trade duration, and other relevant data. If you are someone who prefers to crunch this data in a spreadsheet format, then you will have the ability to download the data in .csv format as well.

DigiTrade offers several money management options to choose from. A trader can allocate a fixed percentage of equity, a fixed size, or create an automated setting. An interesting feature within their social trading program is a user’s ability to select the worst performing trading strategies, and initiate trades against these strategies. For example, if Strategy A and Strategy B are among the lowest performing strategies, then a copy trader on the platform can initiate trades automatically in their accounts in the opposite direction to those strategies. When these low performing strategies are initiating a sell, this would trigger and initiate a buy in your account and vice versa.

Unlike eToro, where only traders with a live account with real money are eligible to have their trades copied, MyDigiTrade doesn’t put such a restriction on the signal providers on their copy trading investment network. As such, the quality of the signal providers on DigiTrade may not be up to the same standards as eToro.

Ayondo Social Trading Network

Ayondo is a reputable social trading and copying platform established in 2008. They are regulated by the Financial Conduct Authority of the United Kingdom. Client accounts are held at top Tier 1 banks in segregated fashion. Ayondo seeks to bridge the gap between small investors and top-tier traders. They offer a host of trading instruments including more than 25 currency pairs, contracts for difference or CFD’s, cryptocurrencies, precious metals, stock indices, and individual stocks. As such, traders and investors have access to a host of different trading instruments at their disposal.

There are quite a few traders that are well-recognized on their platform. These traders have been able to achieve a solid return over time. Traders who wish to trade with these top-level traders can do so, and set various criteria to adjust trading size, risk level and more to meet their particular comfort level.

Clients at Ayondo are not charged commissions for executed trades, but rather are charged via the bid ask spread on the instruments traded. Something that is unique to Ayondo is that they offer a cash bonus to new clients who decide to switch over their existing account from another broker to them.

On the provider side, there are various levels that the signal provider will move through as they progress with Ayondo. The better the performance that the signal provider achieves, the higher the level, he or she will be placed into. The most obvious benefit of moving up the ladder is that the provider will enjoy a better compensation structure with each higher level.

Those that are interested in joining Ayondo and get started copy trading top-tier traders, the minimum to open an account is just $100. Ayondo isn’t one of the largest social trading platforms around, however, it appears to be a solid choice for those interested in a reputable platform, that offers a low barrier to entry, and provides access to a handful of trading partners to copy signals from.

Darwinex Social Trading Network

Darwinex is a UK based social trading network that was founded in 2012, and is regulated by the FCA. Darwinex has its roots in asset management, however, it has shifted its focus into the forex brokerage business model with a concentration in copy trading.

Currently there are over 1100 strategies within the Darwin exchange network that traders and investors can access to build customized portfolios within their own Darwinex account. Strategy providers would use the Metatrader 4 platform for signal generation.

The pricing model at Darwinex is based on a variable spread and commission model. These aggregate costs appear to be in line with other major competitors. Now in addition to these trading costs, investors and traders who use Darwinex to follow and copy strategies within the network will be charged a 20% performance fee on a quarterly basis.

It’s important to note that, this performance fee is based on reaching a new high watermark level. Essentially this means that the profits must meet or exceed a prior level in order for the performance fee to kick in.

If you’re into data crunching, then you will have plenty of tools to work with within the Darwinex platform. There are dozens and dozens of parameters and variables that you can study and sort through in order to find the best strategy or strategies that meet your predefined criteria.

Traders can opt for the Metatrader 4 platform or Darwinex’s proprietary web-based platform as well. The web-based platform is visually appealing with a simple minimalist design built on HTML 5. It’s robust yet lightweight enough to be able to navigate around quickly.

Within the Darwinex dashboard you are able to set custom risk management parameters for use with any Darwin strategy that you choose to follow. Darwinex offers a professional social copy trading experience and can prove advantageous for both the novice and more experienced traders out there.

The one thing that is left to be desired within this social trading platform is the absence of self-directed trading accounts. Unlike many of its competitors that offer both copy trading and self-directed trading options, Darwinex has remained focused on providing social trading as its primary product offering.

Tradeo Social Trading Network

Tradeo is a popular forex social network for traders that was started in 2012. Originally it was started as purely a copy trading network, but it soon expanded its services as a straight through processing brokerage firm.

To open an account with Tradeo requires a minimum deposit of $250. The sign-up process is fairly easy. Once you provide your required documents you can expect your account to be activated within a day or two. As an added plus you will also be assigned an account manager who can assist you in becoming familiar with their trading platform and begin using it.

Tradeo offers more than 150 trading instruments to choose from including most FX currency pairs and CFD products. Their social platform is called the Social Web Trader interface. This is where you can interact with other social traders and set up your preferences for communications and follow more experienced traders on the platform.

Within their social trading platform dashboard you will find a social feed where you can find messages and signals provided by other Tradeo traders. You will also a tab for trading feed where you can see actual trades placed by other traders. From here you can copy trades from those posted in the stream. Additionally you will see a chat screen and a social news feed as well within the tab selections.

Copying the trades of other traders is very easy within the platform, and there are few restrictions on whom you can follow. Unlike many other social platforms that allow for copy trading, strategy providers are not paid or compensated when others follow their trades.

This can be seen as quite positive because it provides a more authentic experience knowing that signal providers do not have a purely monetary motive for issuing trade signals.

There is however a flipside to this as well, because, the most successful signal providers will want to benefit from their proprietary trading models, and as such may look elsewhere. The effect of this would be that the quality of traders from which you can copy trades may be lower than on other competitor platforms.

In any case, Tradeo allows their clients to sort and categorize traders using different variables. For example you can search for traders using the following selects – top traders, most followed, risktakers, lower risk, and recommended for you.

As for the costs of using their social trading services, the primary costs are absorbed within the quoted spreads. On average, it appears that the bid ask spreads that Tradeo offers is a bit higher than some of its other competitors. And finally it’s important to note, that their auto copy trading feature is no longer available on the platform.

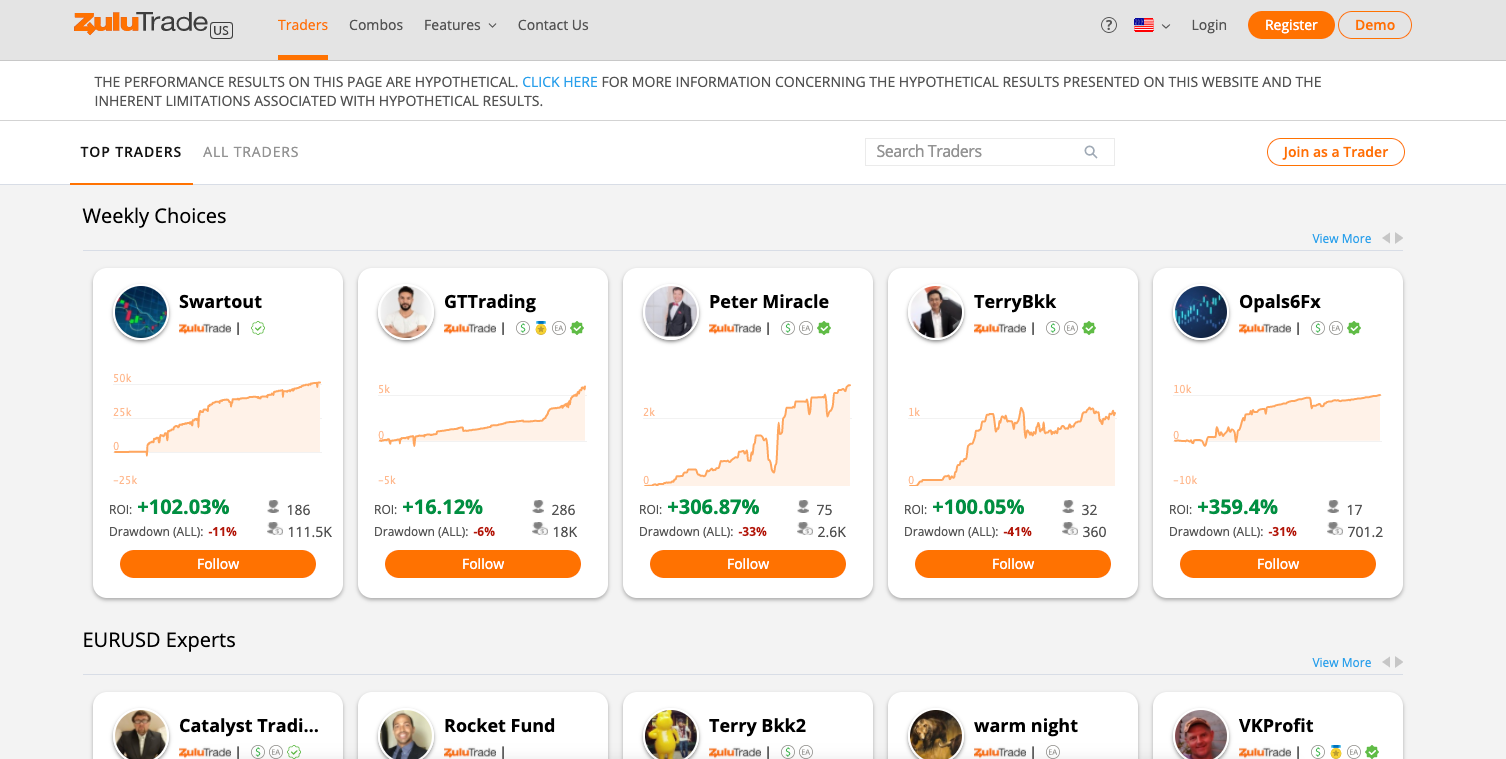

ZuluTrade Social Trading Network

ZuluTrade is one of the more familiar social trading sites in the industry. The company was organized originally as a forex copy trade platform. But as of 2015, ZuluTrade also provides binary options signal services on their platform.

One of the benefits of ZuluTrade is that it offers a fully functional demo to interested clients to test drive the platform. Once you’re ready for a live account, you can sign up with as little as $250. Signal providers can also sign up to the network and began issuing signals on the platform. One criticism of the ZuluTrade network is that signal providers are not required to have a real live trading account in order to issue trade alerts. And so, even traders with only a demo account can become a signal provider on this network.

Because of the low barrier of entry for signal providers, there are typically a very large base of traders set up to issue trade alerts. Many times this number can be in excess of 10,000 to 12,000 providers. While this makes it challenging to find a suitable signal provider, their search capabilities are quite useful, which can help you narrow in on the best traders from which to copy trade from. ZuluTrade has also introduced a feature called User Lists which allows you to manage a list of providers that you’re most interested in.

In recent years new legislation has required ZuluTrade to update its algorithm somewhat for European Union residents. This was done with the hope of providing additional protection and reduce excess risk for clients on the platform. And so EU residents can only see and follow the top 1000 traders on the network, and these traders must meet some additional risk reduction parameters.

The performance and tracking metrics that are available within the ZuluTrade platform are quite good. Every trade that a provider takes is detailed along with all relevant data regarding the transaction. This makes the process of selecting traders to follow more efficient and transparent.

You can choose from a larger list of forex brokers to connect to your ZuluTrade account. They do have a default broker that they prefer clients connect to. This broker is AAA FX, and they are based in Greece. You should realize that the performance that you achieve within your account may be slightly different than that of the signal provider. And this is due to the differing spread cost and slippage that can be experienced at different brokerage firms.

ZuluTrade has been working diligently over the years in introducing a complete set of risk management tools to help its clients customize various risk parameters across the portfolio and at the strategy level. In this regard it goes above and beyond most other copy trading platforms.

Tradency Social Trading Network

The Tradency Mirror Trader platform is available through its broker partners. In this way it is unique from other social trading platforms. Since Tradency is essentially a technology provider, its license agreement is directly with its various broker partners, and its through these brokers that you can access Mirror Trader.

Because of this arrangement, there is no direct cost for using Tradency Mirror Trader platform. However depending on your broker, you may pay additional fees for the privilege of having access to Mirror Trader.

You can access Tradency Mirror Trader platform via both a demo and live trading environment. The primary advantage of using Mirror Trader is that it allows you to gain access to various strategy providers that provide live social trading signals that you can copy inside your own account as well. One of the more advanced features within Mirror Trader is the portfolio section. Within the portfolio area, you can build various trading strategies and apply specific rules for implementing them inside your own account.

Currently there are over 350 strategies available on the Mirror Trader platform. Tradency has a strict process for selecting signal providers. Those that are interested in becoming a signal provider with Tradency must meet certain requirements. One of which is that you must make a minimum of 30 trades in order to qualify. If upon meeting this minimum trade requirement, and passing through the evaluation process, your strategy can be made available to potential clients.

Tradency’s Mirror Trader is a fully transparent platform. You’re able to view all the historical trades initiated by each strategy provider, and sort and filter various data in a snap. In addition to viewing the data within Mirror Trader, users have the option of exporting the data to Excel for further analysis and data crunching.

One interesting feature of Mirror Trader which is quite different than many other platforms is that the performance of each strategy is evaluated at the instrument level rather than at the overall portfolio level. This can be misleading at times, and so, copy traders should at least be aware of this calculation method.

For the most part, Tradency’s Mirror Trader platform is more of a pure signal service consisting of fairly well vetted strategy providers. It however, is not a true social trading network, wherein, traders can communicate regularly with other traders or their strategy providers. In a sense, it’s more focused on its core business model, which tends to attract clients looking for a no-frills copy trading experience.

PeepTrade Social Trading Network

PeepTrade is based in Chicago and was founded in 2014. It was founded as an online platform for constructing multiple asset class portfolios.

PeepTrade is a unique player in the social trading world. It’s not considered a social trading network in the truest sense, meaning that you cannot simply copy trade of other traders on the network. PeepTrade does not offer that technical capability. Instead PeepTrade allows its users to look inside the investment portfolios of top-ranked traders within its network.

Because of this, PeepTrade tends to attract many different types of traders and investors to its social investment network. This includes those interested in forex, stocks, bonds, precious metals, and other commodities.

The platform does offer social interaction features that’s typical of other social trading platforms. This includes the ability to comment, like, and reach out to other traders on the network. In addition the user will find various pertinent information within their stream. This includes technical and fundamental data, sentiment analysis, and posts from other users.

Users can connect to their broker account from PeepTrade via an API. This will allow you to initiate positions directly from the PeepTrade platform. As mentioned, one of the biggest reasons for using the PeepTrade platform is in taking advantage of the vast array of information it makes available for various asset classes.

Furthermore, once you find a top investor that you’re interested in reviewing, you can use the peep to unlock button, which will allow you to view related data surrounding their portfolio holdings. Some of the data that you will gain access to would be the trade history, the current construction of the portfolio, and a chart which details a breakdown by asset class.

Unlike many other competitors in this space, PeepTrade’s monetization model is quite a bit different. While most other social trading platforms earn income directly from the spread or some other related fees, PeepTrade instead has decided to use advertising as its primary monetization strategy. So essentially for the end user, the platform is free to use under the current arrangement.

This platform appears to be well suited for both shorter-term traders and longer-term investors. Although the platform is not fully developed, it is in a niche of its own and has some advantages over its larger competitors.

Collective2 Social Trading Network

Collective2 is based in New York City and has been in business since 2012. The firm is regulated by the CFTC and is a member of the National futures Association, NFA. They are a very popular social trading network for US residents, and currently have over 90,000 registered users on their platform.

Once you sign up for Collective2, you can register to be either a trade leader, a follower or both. As a trade leader you’re able to create strategies which other traders can follow. You would get paid for trading social by selling your signals to your subscribers via monthly subscription fees.

Currently there are no free demo accounts for the platform, so you must be a paying member in order to participate inside the social trading platform. The fee structures are varied and depends on the level of service that you choose.

Though Collective2 is recognized as a social trading platform, their core product offering revolves around their auto trading technology. Within this feature, users are able to choose from various strategies and automatically copy those trades within their brokerage account. Currently Collective2 has arrangements with more than a dozen different brokers. This includes not only forex brokers, but also stock brokerages, futures brokerages, and options trading brokers.

Collective2’s copy trading platform offers many unique features. For example, you’re able to adjust your position size, create a portfolio of systems, and trade forex, futures, stocks, and options. Additionally, there are various risk control parameters that will allow you to control your overall exposure to any particular strategy.

Collective2 offers a very transparent tracking system for measuring the performance of each strategy provider. Users have access to a host of metrics including annual return, maximum drawdown, win loss ratio, and the proprietary heart attack index, which is an aggregate measure of a strategy’s risk profile.

Stocktwits Social Trading Network

Stocktwits was organized in 2008 by Howard Lindzon. It was created for the purpose of sharing trading and investing ideas in real time. This social trading platform is very similar in its layout to Twitter. Stocktwits users can share short messages around different trading instruments. At its inception, this was a fairly revolutionary concept but now it’s something that people have grown accustomed to.

One of the unique features of the Stocktwits platform is its use of hashtags. Hashtags on Stocktwits are used in combination with stock tickers and other financial tickers. Once you log into your Stocktwits account you will have access to a wide array of streams. These streams essentially are organized in specific categories for efficient scanning. The current streams include the following – suggested, trending, equities, futures, forex, and charts.

In addition to displaying various messages in the streams, users can also communicate with other traders through messaging. Another other feature that’s quite useful within the Stocktwits social trading platform is the inclusion of heat maps. Heat maps are useful in analyzing different sectors within the stock market to get a sense of which sector or sectors are most actively trading.

Best of all, Stocktwits is completely free to use. There is a strong sense of community within Stocktwits, and more experienced traders routinely make themselves available to questions or comments from their followers.

Since Stocktwits is designed more around sharing of trading ideas, it does not have any formal method for copying trades from other traders. Instead, you would follow those traders whom you are most interested in via their feed, and manually initiate any trades that you find appropriate within your own account.

For the most part, Stocktwits is a well-run social trading website, that gets millions of impressions every month. If you’re interested more in generating ideas for trades rather than simply copying trades from other traders within the network, then Stocktwits offers much to be desired.

Trade360 Social Trading Network

Trade360 is based in Cyprus and was founded in 2013. It is regulated by CySec, the Cyprus Securities Exchange Commission. Trade360 offers a proprietary crowd trading platform that is named Crowd Trader. The Crowd Trader platform has within it various trading tools and indicators to help users arrive at a trading decision.

One of the better known proprietary tools that they offer is a sentiment based indicator that has a fairly good track record of anticipating future price moves.

The minimum account deposit required to open an account with Trade360 is $100. Users also have the option to start with a demo account to test drive the platform. Within the crowd trader social platform, a trader has access to over 100 different trading instruments including currency pairs, stock indexes CFDs, and commodities products.

Trade360’s Crowd Trader platform has built-in alerts that users can receive when potential market reversals or trending conditions are likely to develop.

Trade360 is a unique social platform in that it provides its users with automated trade signals based on their proprietary algorithm. It is then up to each trader to decide if and how to use each of these system generated signals.

Trade360 is available both as a desktop and mobile application. In general, Trade360 offers less features than many other similar trading networks, however for those interested in sentiment based system signals, they may be worth looking into.

SwipeStox Social Trading Network

SwipeStox is an innovative mobile app. The company has set out to build the best social trading app that can connect traders. SwipeStox is the product of Naga group. They are seeking to make trading more widely available and more user-friendly for new clients.

Within the mobile app, users can vote on various trading ideas by swiping left or right. Users can also select the, copy trade option, which will automatically copy a trade idea and allow for certain customizations such as trade size.

One nice feature within the platform is the risk to reward display. Essentially this feature allows a trader to evaluate the risk reward parameters for a trade idea prior to executing it within their account.

The primary advantage of SwipeStox is its simple and clean mobile trading interface, and easy process for selecting, and evaluating a potential trade.

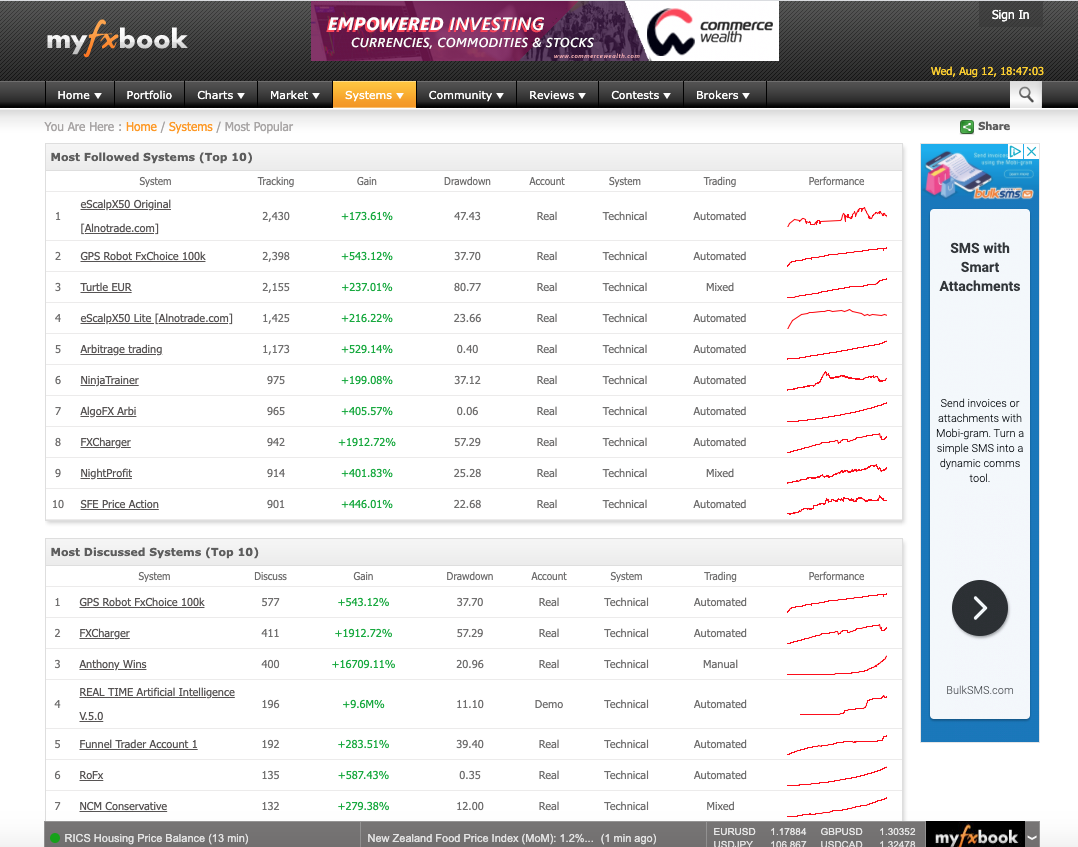

Myfxbook Social Trading Network

Myfxbook is a popular forex social trading platform. Its main product offering is an auto trading service, wherein you can choose to copy the signals of one of its many providers. This can be done by connecting your account with one of its many partner brokerage firms.

Myfxbook typically gets compensated for its services through commission rebates from its various partner brokers. Myfxbook has a higher minimum deposit requirement compared with other online social trading networks. In order to participate within the Myfxbook network, you must make a minimum deposit of $1000.

Once you have signed up and funded your account, you can begin to subscribe to one of the many systems that are listed within MyFXbook network. They have a fairly stringent vetting policy to ensure that each of the systems promoted within its network has a solid track record with acceptable risk parameters.

For example, in order for a system to qualify, it must have been traded from a real money account for a period of at least three months and have a minimum of 100 trades posted. In addition to that, the system must not have experienced a historical drawdown of more than 50%. Furthermore, the average time duration for the trade must be at least five minutes, and the average win per trade must be at least 10 pips.

These requirements make it very difficult for nonperforming systems to make it into the list, and available to potential traders for use in their own accounts. This extra hurdle is a clear benefit for trading signal consumers, as it alleviates some of the due diligence in selecting a suitable system to follow. It gives their users that added assurance that they are copying successful forex traders.

Myfxbook shares its revenue received from its broker partners with the system providers. The typical compensation structure for participating system providers is one half Pip per winning trade executed for each user that subscribes to their system.

Myfxbook offers one of the best performance tracking dashboards in the social trading marketplace. You’re able to analyze a systems average monthly gain, maximum drawdown, system type, number of subscribers, lifetime return, profit factor, and dozens of other related metrics.

When you have selected the system that you’d like to copy, you can apply a myriad of risk-management parameters and specify position sizing preferences. And as a final note, Myfxbook website has a very active forum that can be a valuable resource for both beginner and experienced traders.

Summary

To wrap up, we’ve looked at what social trading is, and detailed some of the major social trading networks. These platforms connect traders and investors interested in generating trade ideas, following other traders, and copying trade signals from more experienced traders.

Each of these social trading platforms has its pluses and minuses. The copy trading reviews above should provide you a good sense of the different types of product offerings. But it’s up to each individual trader to create a social trade plan and find the most suitable platform based on their particular requirements and preferences.