The futures markets offer an excellent opportunity for traders that are seeking a centralized marketplace for doing business, and for those that are interested in utilizing leverage in their trading business. We will be discussing the relationship between futures margin and leverage, and detail the different types of margin within the futures market.

How Futures Margin Works

One of the biggest benefits to trading in the futures market is that you can take advantage of the high levels of leverage that are available within it. Futures margin refers to the amount of funds that are required to open up a new position or maintain a current position.

There are different types of futures margin, however, the general idea is that a trader need only deposit a small fraction of the total contract value to initiate a position. This fractional amount can vary based on the volatility of a particular futures instrument. But generally speaking, this margin amount will range from 3% to 10% of the notional value.

It’s also important to understand that these margin amounts that are typically set by the exchange, such as the CME, can and do fluctuate regularly based on current or future expected volatility. On top of this, a futures broker may adjust the minimum futures margin requirements higher if they perceive additional risk that warrants them doing so.

And so, futures margin calculations for each instrument can be seen as a dynamic process, fluctuating with market volatility. Those futures trading instruments that have low volatility will generally have lower margin requirements, than those futures trading instruments that display high levels of volatility.

On the Equites side, most traders will typically have access to a max leverage of two to one. Conversely, futures traders can tap into much higher levels of leverage, often as high as 30 to 1 in some cases. This can help amplify returns for futures traders, but, at the same time it will also amplify any losses incurred on trades.

Experienced traders realize this, and view leverage as a double-edged sword. Traders should use caution when trading futures, and try to contain their risk by limiting the maximum leverage on any given position or portfolio.

Futures Initial Margin

There are two types of futures margin. The first is referred to as initial margin. And the second is referred to as maintenance margin. Initial margin is the amount of funds that needs to be deposited with your broker in order to initiate a new futures position. The initial margin will vary with each futures instrument based on the volatility characteristics of that instrument.

The initial margin is set by the futures exchange, and the primary purpose for requiring it is to minimize any risk of loss that could lead to the inability of a party to perform their obligations under the futures contract.

Essentially, it limits the risk for the clearinghouse, who guarantees the full payment by all parties pursuant to a futures contract agreement. It is this very guarantee by the clearinghouse that provides confidence to all market participants to engage in the futures market, without the need to worry about counterparty risk.

Let’s look at an example of futures initial margin using the Silver contract.

A single CME silver contract, SI, has a contract size of 5000 ounces. If the current price of silver is trading at $30 an ounce, then the notional value of a single futures contract in silver would be equal to $150,000. Now assuming, that the initial CME margin for Silver, is $7500, then it would be possible to control $150,000 worth of silver for only $7500. This would equate to a max allowable leverage ratio of 20 to 1 based on the initial margin.

Let’s look at in another example using the gold futures initial margin requirements.

A single CME gold contract, GC, has a contract size of 100 ounces. If the current price of gold is trading at $2000 an ounce, then the notional value of a single futures contract of gold would be equivalent to $200,000. If we assume that the initial margin for gold is set to $8000, then a trader would be able to control $200,000 worth of gold for just $8000. As such, this would mean that a trader could have access to a max allowable leverage of 25 to 1 based on initial margin.

Futures Maintenance Margin

Maintenance margin refers to the minimum amount of funds that you need to deposit with your futures broker in order to maintain a current position. In the event that your capital falls below this minimum threshold, then you will either be forced to close your position, or be required to deposit additional funds to cover the minimum maintenance margin threshold. This is often referred to as a margin call.

As with the initial margin, the primary purpose of the maintenance margin is to ensure that you have enough funds in your account to cover any potential losses that you may incur from an open position. Futures traders can find details regarding initial and maintenance margin requirements at the exchange’s website, or at their futures broker’s website. In either case, the initial margin and maintenance margin requirements will typically be shown on side-by-side basis.

And it’s important to note that the maintenance margin requirements can change between the time you enter a position and the time that you exit the position. As such, you want to make sure that you have sufficient capital to compensate for any sudden increases in the maintenance margin requirement for your trading instrument.

Let’s look at an example of futures maintenance margin using the silver contract as referenced in our previous example.

Again, a single CME silver contract, SI, has a contract value of 5000 ounces. If the current price of silver is trading at $25 an ounce, then the notional value of a single futures contract in silver would be equivalent to $125,000. If the maintenance margin for silver is set to $5000, then it would be possible to control $125,000 worth of silver for only $5000. And this will translate to a max allowable leverage ratio of 25 to 1 based on the maintenance margin.

Intraday Futures Margin

Intraday Futures Margin

We’ve touched upon the two types of exchange margins in the earlier sections. Now, let’s discuss what is referred to as intraday or day trading futures margin. Intraday margin is the minimum amount of funds required to initiate a futures contract during the normal day trading session.

Generally speaking, day trading margins are set by the futures broker, and they are usually less than the initial margin requirement set by the exchange. This amount is less because the day trading session is generally much more liquid than the overnight session for most futures instruments. Traders can visit their broker’s website directly to find out the specific intraday futures trading margin amounts set for each futures instrument.

Day traders can access tremendous levels of leverage with certain low margin futures brokers. For example, some futures brokers are known to offer $500 day trading margins for certain equity index products such as the E-mini S&P, E-mini Dow, and E-mini NASDAQ. Let’s see what type of leverage can be achieved with these types of futures brokers.

Let’s assume that the E-mini Dow is currently trading at 25,000. We know that every point is worth five dollars. As such, under this scenario, the notional value of one E-mini Dow contract is equivalent to $125,000. And so, if you’re trading with a futures broker that has set their intraday margin for the E-mini Dow at $500, then you would be able to control $125,000 position for only $500. That is an astounding leverage of 250 to 1.

Let’s look at another example using the ES margin requirements. The ES represents the symbol for the E-mini S&P futures contract. Let’s assume that the E-mini S&P is currently trading at 3000. And we know that the point value for the ES is $50. As such, this would mean that the notional value of one E-mini S&P contract would equal $150,000. Based on this, and an intraday margin of $500 for the E-mini S&P, a day trader could control $150,000 position for only $500. This would provide for a max allowable leverage ratio of 300 to 1.

Day traders are in and out of positions many times throughout the day, and will often utilize very tight stop losses. With this type of leverage, it is paramount that intraday traders incorporate a very strict risk management plan.

This is because, even the smallest of moves can lead to a margin call for those that are using the upper limits of the allowable leverage. However, this is never recommended, and traders should always consider using only a conservative level of leverage whenever possible.

Futures Overnight Margin

Futures overnight margin refers to the amount of funds required to hold a position beyond the close of the day session. These margin requirements are set by the exchange as was noted earlier. The two types of futures overnight margin include the initial margin and maintenance margin. And to recap, the initial margin refers to the amount of funds required to enter into a new position, while the maintenance margin refers to the amount of funds required to maintain an existing position.

Depending on when the day session is scheduled to end is when the overnight margin would kick in. This is different for each market, and so, it’s important that futures traders are aware of the various cut off times for day trading margin so that they can ensure that they have sufficient funds to carry a position overnight.

Additionally, some brokers will require day traders utilizing intraday margin rates to exit a position a half-hour to one hour prior to the official end of the trading session. As such, it’s best to contact your futures broker directly to find out when they typically transition from day trading margins to overnight margins.

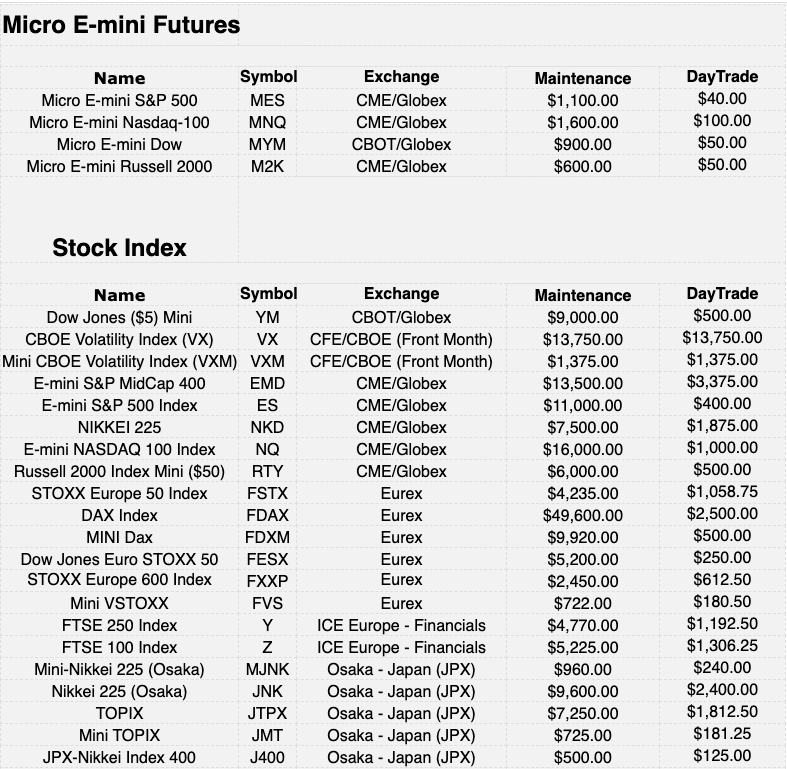

As of this writing, you can see the CME overnight margin requirements and the day trade margin requirements for the popular Micro E mini futures and E-mini equity index products as shown on the AMP Futures broker website.

Futures Margin Call

As we have briefly noted earlier, a futures margin call refers to a notice from your futures brokerage firm for demand of additional funds to cover the difference between your current balance and that which is required by the maintenance margin requirement. If this notice goes unheeded, then your broker can and will automatically close out a portion of or the entirety of your position.

Let’s look at an example of a futures margin call.

Let’s say that you are taking a long position in a crude oil commodity futures contract which has a CME initial margin requirement of $4000, and a maintenance margin requirement of $3500. If the current account balance in your trading account is $5000, you will be allowed to enter into that position because the funds in your account exceed the initial margin requirement.

Let’s now say that the price of crude oil has gone down abruptly, and you experience an open trade loss of $2000, This results in your account balance falling to $3000. In this case, you will fall below the minimum maintenance margin requirement of $3500. As such, your broker will notify you immediately and require a minimum deposit of $500 to cover this maintenance margin requirement deficiency.

In this case, you can wire transfer that minimum balance required to your broker, and they will typically agree to keeping your position open. If however, you do not inform your broker of your intention to cover the deficiency, then they will simply close out a portion of your position, or the entire position, without additional notice.

Pros And Cons Of Futures Margin Trading

Traders interested in futures should be aware of the pluses and minuses of participating in a highly leveraged market environment. One of the primary advantages of engaging in futures trading on margin is the ability to make relatively large gains. If for example, you have a futures trading strategy that yields 7% on a non-leveraged cash basis, you can easily increase your leverage utilization on that strategy to achieve many multiples of that return.

Additionally, because trading in the futures market is organized around a centralized exchange, it is much more transparent than other over-the-counter markets such as the Forex market. Because of this transparency, traders can rest assured that they will enjoy fair pricing and execution for their orders.

As for the downsides of trading futures, the very attribute that provides for its distinct advantage, can be a drawback for some less disciplined traders. That is to say that unless and until you have a strict risk management plan, you can easily let a futures trade get out of hand, and possibly even jeopardize your trading account. And so, futures traders need to have a healthy respect for risk and use leverage very responsibly.

An additional downside to trading futures relates to those that are interested in single stock futures. Single stock futures are essentially individual stock derivatives products that can be traded on a futures exchange. Single stock futures offer much less liquidity then the underlying stock traded within the equities market, which can result in wide market spreads and excessive slippage costs.

Summary

We have looked at how future contract margin works, and the different types of margin. We presented various examples for calculating max leverage based on initial and maintenance margin requirements. Moreover, we have explained the difference between day trading margin, and overnight margin and how to keep abreast these changing requirements.

Aspiring futures traders should consider starting with a single market and learn as much as they can about the technicals and fundamentals that drive that market. As you gain more experience, you can add additional futures products into your trading watchlist. And as a final note, it’s important to realize that although the futures market offers an enormous amount of leverage capacity, that does not mean that you should utilize anywhere near the max allowable limits.