Many traders do not place very much attention on the actual time frame that they intend to trade or how long they intend to hold a position for. They may set a stop loss and take profit order levels, but otherwise have no particular time frame in mind for closing out their position.

Many traders do not place very much attention on the actual time frame that they intend to trade or how long they intend to hold a position for. They may set a stop loss and take profit order levels, but otherwise have no particular time frame in mind for closing out their position.

This article will delve into the topic of what the best time frames for trading in the forex market are. It will also explore how the answer to that question may vary depending on the primary type of trading strategy you prefer to employ to manage your trading activities with.

The Three Basic Trading Time Frames

Most traders and analysts will agree that trading time frames can be broken into three broad categories. These time frames are typically known as the short, medium and long term time periods.

The first thing that seems important to note about this terminology is that each of these time frame categories does not have a precise definition among forex traders, other financial market participants and authors.

Perhaps the best way to explain this variation is that the time periods these commonly used terms refer to tend to depend on the usual time a position is held given the type of trading strategy that a trader employs.

Hence, if a trader uses a trading strategy that tends to have a relatively short holding period, like a day trading strategy, for example, where all positions are closed out prior to the end of the trading day, then the length of time associated with each time frame term will be proportionally shorter than the length of time for a swing or trend trader, for instance, who might hold positions for a considerably longer period.

Forex Time Frames by Trading Strategy

Although trading time frame terminology is not especially precise, it can nevertheless help to get a general understanding of what phrases like long term, medium term and short term actually mean to traders who use different trading strategies.

For example, the time period that each of these categories tends to cover that is most relevant for day traders, who generally seek to close out trading positions the same day they were initiated and so do not usually hold positions overnight, can be described as follows:

- The Long Term – This time frame for a day trader covers a period lasting from several hours to an entire day session.

- The Medium Term – This time frame for a day trader covers a period lasting from ten minutes to around an hour.

- The Short Term – This time frame for a day trader covers a period lasting from seconds to several minutes in duration.

In contrast, swing traders are those who look to take advantage of bigger fluctuations in market exchange rates. They are usually more than fine with holding positions overnight.

The time period each of these time frame categories tends to cover that is most relevant for swing traders can be described as follows:

- The Long Term – This time frame for swing traders covers a period lasting from several months to a year or more in duration.

- The Medium Term – This time frame for swing traders covers a period lasting from several weeks to a month or so.

- The Short Term – This time frame for swing traders covers a rather brief period lasting from a few days to a week or so.

Finally, those engaged in long term foreign exchange trend trading or foreign currency investment activities tend to have a much lengthier time frame that they are willing to hold positions for.

- The Long Term – This time frame for trend traders or investors covers a period lasting a few months to more than a few years in duration.

- The Medium Term – This time frame for trend traders or investors covers a period lasting from several weeks to as long as a few months.

- The Short Term – This time frame for trend traders or investors covers a period lasting a few weeks.

A List of Common Forex Trading Time Frame and Analysis Options

When a technical forex trader is analyzing exchange rate data for a particular currency pair, they will often view this information in the form of close, bar or candlestick charts that are plotted at several different time frames or intervals.

These intervals of time are also sometimes called time frames or periods, and analysts tend to select a range of multiple time frames in order to be able to assess the currency pair’s short, medium and long term trends and other price action behavior with associated time frames appropriate for their own trading strategy.

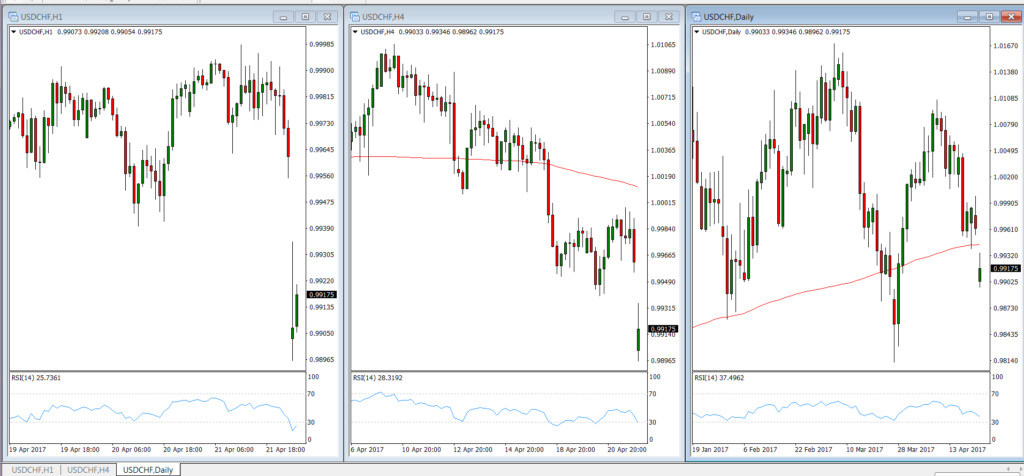

Below is an example of a typical series of three exchange rate charts for the USD/CHF currency pair covering short, medium and long term time frames that might be suitable for a swing trader are shown below in Figure 1.

Figure 1: Three candlestick exchange rate charts for USD/CHF plotted using time intervals of one hour, four hours and one day. The RSI is shown in the indicator box below in pale blue, while the 200 day moving average is superimposed over the exchange rate in red.

Some of the most common incremental time frames used by technical analysts when reviewing exchange rate movements for forex currency pairs include the following:

- The one minute time frame

- The five minute time frame

- The fifteen minute time frame

- The thirty minute

- The one hour time frame

- The four hour or 240 minute timeframe:

- The one day or daily time frame

- The one week time frame

- The one month time frame

- The one year time frame

In addition, some very short term traders like scalpers might look at tick charts, which do not have a particular fixed time interval between data points. They instead show a new data point every time a certain number of trades take place or some other measurable criteria is fulfilled.

Traditional Trading Timeframes for Forex Strategies

A number of different strategies with varying timeframes are typically employed by forex traders. These strategies can be profitable depending in large part on the plan the trader has devised to govern their activities, as well as on the trader’s level of discipline in adhering to the specific rules in their trading plan.

The timeframes for holding positions in the strategies to be mentioned below vary from less than a minute for scalp trading, to weeks or even months for long-term trend trading. Swing and range trading time frames can vary depending on market movements, although positions are often liquidated within several trading sessions.

As the name implies, those using a day trading strategy customarily liquidate their positions by the end of the trading day. The ending time of which is specified in advance due to the forex market being open 24 hours a day throughout the trading week that starts on Sunday afternoon with the Auckland, New Zealand open and runs until the New York close on Friday afternoon.

In addition to scalping, swing trading, range trading and trend trading, another type of strategy consists of news trading. News traders typically use fundamental analysis for the objective of profiting from market volatility seen after major news announcements. For example, the volatility that news traders thrive on might depend on the results seen for the release of a nation’s economic data, as well as the outcome of macroeconomic or geopolitical events that directly affect the valuation of that nation’s currency.

Trading Strategy Time Frames

What follows is a list of the more popular trading styles and their respective trading timeframes:

- Scalping – The market adage, “long term is noon” aptly describes the scalping trader’s approach to time spent in the market. Scalping is a strategy that is often popular with market makers, since they can quickly offset the risk of positions they receive from customers at advantageous rates due to the bid/offer spread they quote. They can also take small profits by simply quoting prices to other market makers and via professional forex brokers. Other scalping traders consist of proprietary desks and retail traders with access to very tight market spreads and who pay very low per trade commissions, if any.

The timeframe for scalp traders is generally very short, since traders liquidate positions as soon as they make a small profit. Conversely, if the market is moving against them, successful scalpers tend to take their losses just as fast.

- Day Trading – This short-term trading strategy requires that the trader only take positions during their pre-determined trading day, which would typically be specified by the trader ahead of time in their trading plan. By the end of their trading day, the day trader would generally need to flatten out all of their positions regardless of their profit or loss.

The timeframes relevant for day traders generally range from several minutes to several hours, depending on market dynamics and the trader’s objectives. Day trading is popular among many traders in the forex market, as it allows the trader to have no open positions to worry about overnight.

- Range Trading – As its name implies, this type of strategy is based on trading ranges. Such patterns are identified using technical analysis methods and based on the establishment of clear levels of support and resistance on an exchange rate chart. Once the levels of supply and demand are identified by the trader, they then initiate and liquidate positions according to these levels, buying at levels of support and selling at levels of resistance.

The timeframe for range traders varies widely and can be from a few hours to extending into the following trading session and beyond. Once a position is established at the lower or higher end of a range, the trader then needs to either wait for the position to go to the target level, or conversely take a loss if the position has gone in the opposite direction.

- Swing Trading – this strategy typically involves using technical analysis for the intermediate term to determine entry and exit points on a chart and subsequently establishing positions based on this analysis.

Much like the range trader, the swing trader’s timeframe typically varies from a few days to a week or so. Many swing traders try to exploit multi day price patterns in the market.

- Trend Trading – the longest-term of the trading strategies, trend traders identify the overall trend in the market, establish a position and wait for the trend to play out. The trend trader can be a technical analyst buy may also look at underlying currency market fundamentals to establish their criteria for establishing a forex position.

Typically, currency trend traders look for long term trends and relative movements in benchmark interest rates. It can take several weeks to months or even years for the trend they have identified to fully unfold before liquidating their positions when they think the time is right. Although taking this long term trend following perspective can involve increased risk of prolonged drawdown periods, successful trend traders are some of the highest earners among forex traders when the conditions are right.

Choosing the Best Trading Timeframes

Choosing the Best Trading Timeframes

Selecting the best time frame to trade forex will really depend on the trader’s level of experience, the type of trading strategy they employ, and how they approach the forex market.

While most novice traders tend to shun the approach, at least initially, taking a swing trading or long term outlook is generally recommended for newer traders, especially since their reaction times tend to be longer due to their relative inexperience in the market.

Although beneficial, another reason for the reluctance among novice traders to consider longer term strategies is that most novice traders tend to be impatient and may equate “long term” with having to wait for profitability. Nevertheless, the truth of the matter is that short-term trading is considerably more difficult and usually takes the trader quite a long time to master since they need to evolve their reactions and emotional states to the point where they can be successful.

New traders therefore should consider beginning to trade with a longer term outlook, since this will also generally reduce their trading frequency and teach them the importance of operating strategically. Once their trading methods have proven successful, they can then move on to dealing in the shorter time frames is they wish.

Furthermore, many profitable traders who use technical analysis will review charts that represent several different time frames when approaching a relatively new currency pair to get a sense for the short, medium and long term picture for that pair. And so regardless of the preferred trading time frame, using a multi time frame analysis approach is always recommended.

Novice traders must also be made aware that the shorter the time frame they trade in, the more market volatility they can experience. The incidence of trading mistakes also tends to increase with trading frequency and the need for quick reaction times.

Trading higher time frames also tends to reduce the impact that short term exchange rate variability or noise has when it comes to taking advantage of the overall market trends, which can in turn increase the potential for steady profits if positions are managed appropriately by the trader.

When using a long term strategy, the trader can use a weekly chart to establish the long term trend and use the daily or 4 hour chart to better time the initiation of positions.

Until this longer timeframe analysis is mastered, a novice trader should generally avoid trading the shorter time frames. As the trader gets used to dealing with increased market variability associated with the shortening time frames, they can become more experienced in trading the forex market.

For day trading, scalping and other forms of extremely short term trading, many traders use the fifteen minute, five minute, and even one minute or tick charts. Market volatility and trading frequency tends to increase significantly as the trader operates in these shorter time frames, often requiring more focus and concentration. Taking frequent small profits and exiting the market the moment one recognizes they are on the wrong side are part of the basic mindset needed to succeed at very short term trading, which can be quite challenging to say the least.