There are countless different trading strategies and techniques that can be employed in the financial markets. Some individuals prefer to use a technical based approach, while others prefer a fundamental based approach. Regardless of your style of trading, it is essential that you work on getting an edge in trading and realize what your trading edge is.

Trading Edge Definition

The word trading edge gets tossed around quite a bit in discussions around market speculation. But what exactly does it mean to gain a trading edge? Well, a trading edge is a methodology or approach applied to the markets wherein there is a discernible statistical advantage in its application. This advantage is what is commonly referred to as the edge, and it is this advantage that provides the trader or investor a monetary benefit in terms of trading or investment profits.

Sometimes a trader may have an edge in the market but may not be able to articulate that edge in a meaningful way. That is to say that these traders realize that they possess some clear advantage via their trading strategy or system that provides them profitable results over other market participants, but it may be difficult for them to express. This is often true of discretionary based traders.

Other traders, particularly systems traders, can more clearly define their trading edge. Systems traders will usually have a clear set of rules that encompass all aspects of their decision processes in the market. This includes trade set up qualification, entry and exit mechanisms, along with risk and money management parameters. As such, systems traders have a much easier time objectively measuring their edge in the market.

A meaningful way to illustrate what an edge looks like is to apply the concept to Casino gambling. As we all know, the casinos have a distinct and discernible edge in all the gambling games that they offer to their customers. The casino edge at each game of chance will differ a bit.

However, each of these games will have a certain statistical edge for the casino that will play out and be realized over the longer run. For example, depending on the type of roulette wheel offered at a casino, the casino will generally have a 5% or so edge. Now what this means is that over a long series of events, in this case, the spin of the wheel, the casino will take in $1.00 for every $0.95 that it pays out.

Understanding this casino concept will make it easier for traders to translate what an edge entails when applied to trading the markets. And so, one of the integral aspects of a statistical edge, whether it is being applied to games of chance at the casino, or trading activity in the markets is realizing that a true edge must only be measured over a long sequence of events.

That is to say that casinos and traders with an edge may lose in the short term during a smaller sequence of events, however, they will usually if not always come out ahead over the longer term during a larger sequence of events. And this is especially true of casinos since their edge is constant. Trading edges in the market can be temporary and as such cannot always be relied on with mathematical certainty.

Know Your Trading Edge

Know Your Trading Edge

Many traders never give a second thought to what their trading edge actually is. As we mentioned, some traders intuitively believe and feel that they have an edge over other market participants. This could be derived from their analytical skills or some other process within their trading regiment. But it is important to try to define your edge in concrete terms as much as possible. Many discretionary traders may find this to be a difficult task to accomplish.

One way experienced discretionary based traders can try to pinpoint their trading edge is by performing a thorough review their trades as far back as possible to find the commonalities between winning trades and losing trades. Once they go through this process, they will have a better idea as to those factors that are contributing most to consistency and profitability in the markets.

Data should be at the heart of all your trading improvement and refinement processes. That is to say that in order to make incremental improvements to your strategy and overall bottom line, you must know where you need to improve in your trading. And this information can only be gathered from the data and statistics around each of your completed trades.

Traders that rely on automated strategies can often quickly understand and know what their trading edge is. This is because many of the parameters within mechanical trading systems tend to be objective and easily measurable. This characteristic among systems traders allows them to evaluate and get in-depth trade metrics quickly and efficiently.

The vast majority of market traders, particularly, newer more inexperienced traders will generally have no idea what their statistical trading edge is. And to be quite blunt most of these traders will have no real positive edge in the market and may actually be trading with a negative edge without even realizing it. One of the best ways for newer traders to overcome this is by first taking the time to learn and apply different market strategies until they start to become comfortable with a single strategy.

At this point, they should practice the chosen methodology rigorously on a demo or practice account. Only once they have demonstrated the ability to make profits on a demo account, should they graduate to trading a real money account. During their initial education phase trading the demo account, they should complete at least 100 or so trades before they began to evaluate the statistical significance of their performance.

Build A Trading Edge

By now, you should have a good understanding of why it’s important to have a trading edge and knowing what that trading edge is in concrete terms. Let’s now move on to discussing the different ways that you can create a trading edge, and how you can use that edge to extract profits from the markets on a consistent basis.

Before we get into the details of creating a trading edge, let’s briefly discuss one way that you should avoid pursuing such an edge. Specifically, what I’m referring to is going out and buying a commercially available trading system or EA. Many of these publicly available systems tend to show over exaggerated performance results, which are often the result of over optimizing parameters. This creates a curve fitted trading system that looks great on paper but will more than likely perform far worse in real dynamic market conditions going forward.

Some trading system developers are actually quite transparent in trying to present realistic performance metrics. However, even these systems will generally fail over the long run, as markets change and evolve, and more and more users begin to exploit the same edges, if they ever existed, within the system. Traders just need to apply some good old fashion common sense when evaluating commercially available trading systems. Consider this, if there was a robust, consistently profitable trading system out there, do you think the developers would be selling it for $100, $200, or even $1000 or more? Not likely to say the least.

As such, the best way to create a trading edge is by learning a proven trade methodology, adapting it to fit your personal style and risk parameters and then applying your own version of those principles and techniques in the market. In this way, although the general principles and guidelines of the trading methodology that you’re incorporating may be widely studied by other technical analysts, you have put your own spin on the methodology to suit your specific purpose and goals. And the more unique your execution model is, the more likely that the strategy or system will perform as expected over the longer haul.

Building a trading edge can feel daunting to many inexperienced traders. However, this does not need to be a complicated process. Although the process can be quite time-consuming due to the nature of strategy development, refinement, and optimization. Nevertheless, it is a task that will inevitably need to be performed if you want to achieve consistent profitability in the markets. Discretionary traders will need to rely on manual back testing, while systems traders should be able to perform their back testing using a back testing engine within their automated trading software.

Optimize Your Trading Edge

Optimize Your Trading Edge

Once you’ve created a strategy that appears to have a discernible trading edge, you have accomplished a great feat, however, your work will not end at this point. You will need to continually refine and make reasonable optimizations to your methodology from time to time. This is because markets are dynamic and as such refinements are needed periodically.

The process of trading strategy optimization must start with the strict habit of trade journaling. Trade journaling entails taking detailed notes of each trade execution including entries, stoploss placements, and profit targets. Additionally, traders should jot down the reason for initiating the trade in the first place and whether all the rules were followed according to the trading plan.

Furthermore, you should note the current market condition in which you are executing your trade and your risk and money management parameters used. This will help you to build a solid history of your completed trades which is essential during the review and optimization stage.

So, what are some of the different ways of going about optimizing your current trading edge? Well this is an evolving process and the steps and procedures that you follow may be very different than those of other traders trying to accomplish the same task. Nevertheless, there are a few common areas that traders can focus on to improve their trading strategy. The first is testing and tweaking different parameters within your rule set to find an optimal setting.

For example, traders that utilize a mean reversion strategy may consider testing different momentum indicators and varying overbought and oversold levels to find a range that works best for a specific indicator. Along the same lines, trend traders may consider testing different breakout signals. As an example, some trend traders like to use a 20 day breakout from a range to establish a new position. One can optimize such an entry signal by testing 15 day breakouts, 25 day breakouts, and 30 day breakouts for example and see if there are any major improvements.

In addition to testing different variables or parameters within a strategy, traders can test the strategy on different financial instruments or securities to find those that offer more consistent profitability. As an example, one strategy that we will be discussing in the later section is the gap fill strategy. This particular strategy tends to work very well on stock market indices such as the S&P 500, the NASDAQ, and the Dow. The same strategy, however, does not provide an overall edge when applied to some other types of markets.

Trading Edge Example Strategy

Now look at a trading strategy that has performed well historically and can be seen to have a viable edge. The strategy that will be describing is a gap fill strategy that is best applied to broad stock market indices. More specifically, the S&P 500, the NASDAQ, and the Dow.

A gap fill strategy is a simple method of trading the market open. Essentially, you would wait for a minimum price gap between yesterday’s closing price and today’s opening price, and then trade in the direction of the gap fill. In other words, you would fade the gap and be expecting price to close the opening gap.

Opening gaps are often created due to unexpected news announcements during the overnight session. And so, when the markets open in the morning, which is when the most amount of volume enters the market, traders would have positions entered into the market based on their assessment of the overnight news announcements.

This can often create a supply and demand imbalance which can lead prices to moves sharply in one direction or the other, creating the opening market gap that we often see on the price chart. Often these price movements are exaggerated and as such tend to revert back to the mean, closing a large portion of or the entire opening gap. This is the general psychology behind the gap fill strategy.

It’s important to note that the version of the gap fill strategy that will be described here is a long only strategy. And so, we will only be taking buy set ups, meaning that we are only looking for gap downs to enter a long position. We will ignore any and all gap ups.

Let’s now outline the exact rules for this long only gap fill strategy.

- Open the 15 minute price chart of the SPY ETF.

- If the opening price creates A downside gap of between 3 and 6 points, then immediately enter a market order to buy.

- The stop loss should be placed at a distance that is equal to half the price gap.

- The target will be set at 100% of the gap fill, meaning that we will exit the trade once the gap is completely filled.

- If neither the stop loss nor target is reached by the end of the day, the trade will be exited 5 minutes before the close of the session.

Gap Trading Edge Setup In Action

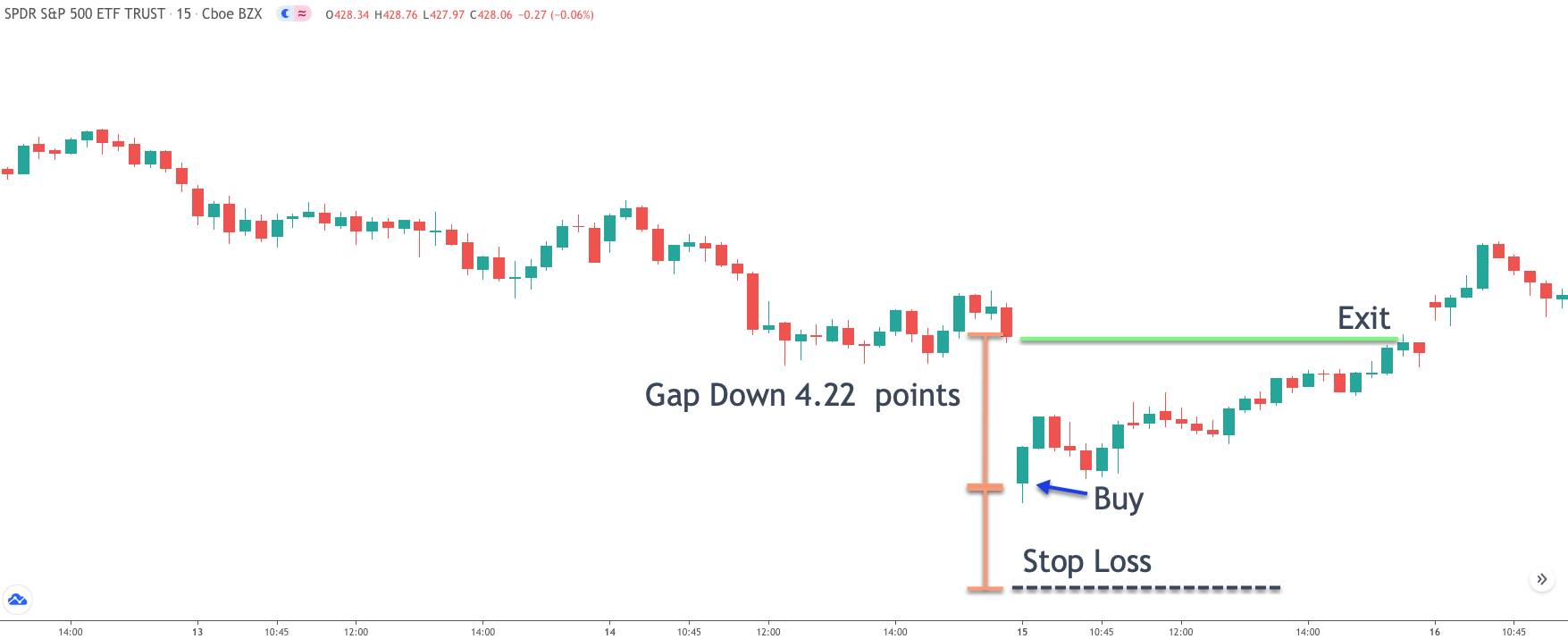

Let’s now look at a real price chart that illustrates our gap trading set up outlined earlier. In the chart below you can see the price action for the SPDR S&P 500 ETF shown on the 15 minute timeframe.

We can see that the price action was forming a downtrend just prior to the major gap down. This gap measured 4.22 points which is within our accepted range based on our strategy rules. Remember we are looking for gap downs that measure between three and six points.

During the opening of this morning session, when we were able to confirm this sizable gap down price move, we would’ve immediately entered a market order to buy. The stop loss should be placed below the buy entry at a level that is one half the length of the bearish price gap. Since the price gap measured 4.22 points, the stoploss would be placed at 2.11 points below the entry point. This is shown with the black dashed line below the buy entry.

At this point, we would’ve entered the trade and placed our stoploss order. The focus now will be on the trade exit. As you should recall, we will exit the trade upon the price moving higher to fill the entire gap. You can see where that occurs by referencing the green horizontal line noted as exit. Our exit occurs just prior to the end of the day session. If our target was not triggered 5 minutes prior to the end of the session we would have exited the trade at that time.

As you can see, this is a fairly simple trading set up that can be utilized on most major stock market indices. The strategy provides a reasonable edge and has performed relatively well over the long run. Keep in mind though that even though it has performed well historically, it does not mean that it will continue to do so in the future. As such, traders need to keep in mind that they should always be seeking to refine and improve their strategies as the markets evolve.

Summary

Trading the markets is one of the most challenging activities that one can engage in. To consistently make profits trading, you must have a discernible trading edge. In other words, you must trade with an edge. Without it, you are most likely going to be part of the losing group of traders that either have no idea what a trading edge is or how to acquire it.

And so regardless of whether you consider yourself a discretionary trader or systems trader, you would be well advised to take the necessary time to fully understand the most important metrics behind your trading strategy and look for ways to refine and improve upon it. Experienced traders have come to realize that trading edges can come and go, and that it is their job to adapt to changing market conditions to stay on top of their game.