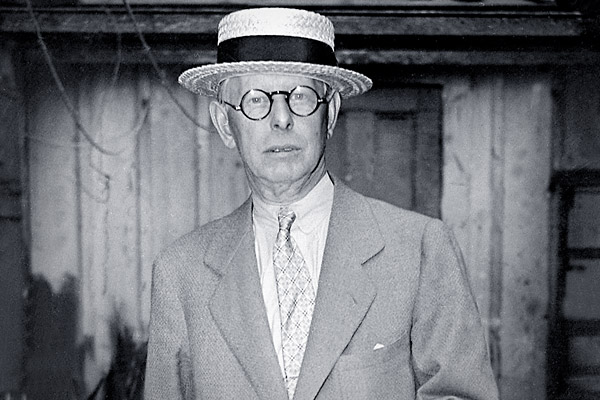

If you were to ask a group of veteran traders who they believe best epitomize the essence of a market speculator, that person would most likely be Jesse Livermore. Livermore is a trading legend and well known among students of the financial markets. The insights that he provided on trading and speculation in the markets are invaluable. In this article, we will detail the life of Jesse Livermore, and teach you how you can trade like Jesse Livermore, using many of his own words.

Who Was Jesse Livermore?

Jesse Livermore was a renown stock trader who lived through the Great Depression era. His life and times were highlighted in a semi-biographical book entitled – Reminiscences Of A Stock Operator. This book is one of the most entertaining and insightful books written on the subject of market speculation. The book has influenced many aspiring and veteran traders alike. It is a must read for anyone interested in entering into the world of financial market speculation.

Jesse Livermore reached spectacular highs and lows in his trading career, and his story is more aspirational than virtually any other in the trading world past and present. And although, Livermore traded during a very different time in history, the lessons that can be learned from his experiences in the market are timeless. The many observations that he made during his trading career ring as clear today as they did a century ago.

Jesse Livermore was born in 1877 in Massachusetts to parents of humble means. At an early age, Livermore excelled in his studies and received excellent grades through his early school years. He excelled in all subjects, but math was particularly well suited to his personality. He just had a knack for numbers. When Jesse was in his early teens he left home and was out on his own from that point onwards.

At that ripe age of 14, Livermore was able to land a low level job as a chalk boy at a company named Paine Webber. Essentially his job entailed writing down the most recent quotes that came in through the ticker tape onto a chalkboard, so that the brokerages clients could see those quotes. It was here that Livermore began to gain a deeper appreciation for price movements in the market. Eventually, he became interested in trading the markets for his own account, even though his funds were quite limited at the time.

It was around this time that he became introduced to different bucket shops within the area. Bucket shops allow clients to take bets on the direction of a stock, without having the requirement of owning the stock outright. Essentially, these shops worked similar to how CFD contracts work today. This was an ideal venue for Livermore since he had a very limited capital base.

From the outset, Jesse did quite well trading at the bucket shops, and began to grow his account steadily. Eventually, he was winning so consistently at the bucket shops that he was barred from betting at most of those establishments altogether. Essentially, the bucket shops didn’t want to take the other side of his trade.

As a result, Livermore started to look for venues outside of Boston where he could apply his trading skills. And so the next stop in his trading journey led him to New York City. Here he would start trading on the NYSE.

Whatever system Livermore was using worked okay for him for a little while, however, soon his luck began to change in New York. He soon realized that whatever skills that he developed in Boston that helped him to excel there at the bucket shops would not be viable on the NYSE.

After a stint of bad trades, Livermore decided to go back to his roots by trading once again at the bucket shops where he was most successful. He couldn’t go back to Boston since he was barred there for the most part. So, he decided to give it a go in St. Louis. After some time, his notoriety in Boston led him to be recognized in St. Louis, and so then many of the bucket shops banned him there as well. As a result, Livermore decides to go back to New York, and give it another go there.

Livermore’s big payday came during the crash of 1907. Livermore had taken a massive short position in the market prior to the crash. It is speculated that he earned a seven-figure payday, $1 million within one day during the crash of 1907. This really put Livermore on the map, and he was able to enjoy financial fortune and social status. Livermore began to live it up during this time and indulged in all the vices available to him at the time.

The good times however would not last for very long. Livermore would go on to lose almost the entirety of his windfall profits of 1907. This was a result of a big cotton trade gone awry, along with some other smaller mishaps along the way. Within eight years of the historic trade that put him on the map, he was deep in debt and was forced to declare bankruptcy.

Livermore was offered a small trading facility, and with that he was able to start getting back on his feet. Amazingly, within just a short couple of years, Livermore was able to pay back all of his debts, and managed to earn another fortune from his trading adventures. This feat made him more well-known than ever, earning him the title, Boy Plunger. Newspapers ran the story of the young man who made millions in the market, gave it all back, and then made millions once again.

Livermore’s next big trade came during the market crash of 1929. It was during this time that Livermore began to recognize certain price patterns that mimicked the prior 1907 panic. As a result, he went on a short selling spree and took a very large short position in the market, betting on a deep price correction.

Amazingly, Livermore was correct once again in his assessment and this time he made many times more profits than he did in the 1907 panic. As unlikely as it sounds, Livermore was not only able to pinpoint the near top leading to the 1907 panic but also the 1929 panic. The odds of that are just astronomical, but he managed to pull it off.

After he called the top of the 1929 market, and made millions of dollars in the process, Livermore’s life began to go downhill once again. This time it was not only his performance in the market that was waning, but his private life was beginning to unravel as well. This was the darkest time in Livermore’s life.

With all the pressures of the markets and his personal life taking a toll, he eventually succumbed and was forced to declare bankruptcy for the third time in his career. In 1940, at the age of 63, Livermore committed suicide by shooting himself inside a Manhattan hotel.

Jesse Livemore Quotes And Lessons

“Trade only when the market is clearly bullish or bearish”

Jesse Livermore was a big believer in trading with the overall trend of the market whenever possible. Although, he had the wherewithal to fade the market during the run up to the 1907 and 1929 price highs, he was an ardent believer in trading in the direction of the trend. If that trend was showing signs of being clearly bullish, then he would prefer to state on the long side, and when market was showing signs of being clearly bearish, then he would prefer to stay to the short side.

As such, only in some rare instances does it pay to fade the current market momentum. The safer bet is always to align yourself with the current market phase. At its core, Jesse Livermore’s trading system was rooted in following trends.

“End trades when it is clear that the trend you are profiting from is over”

Although it’s a good practice to try to ride out the trend for as long as possible, there will be some point in time where the weight of evidence favors a reversal of the current trend. Sometimes this is not always clear-cut. However we must be aware of all of the information around us both from the technical and fundamental standpoint to ensure that we are not holding onto positions, just for the sake of hope and optimism.

Some traders prefer to use some technical based approach such as a trailing stop to exit a winning position. Others rely more on fundamental information to help them achieve this goal. Regardless, whichever methodology that you choose, you must have a clear plan for exiting your winners.

“The human side of every person is the greatest enemy of the average investor or speculator”

Through this quote, Livermore is saying that trading goes well beyond strategy. That is to say that regardless of your strategy, your number one obstacle to success will generally lie in your own abilities to control your emotions in the market, and maintain discipline during the process.

This is much easier said than done, because when it comes to matters of money, it’s only a rare investor that can stay calm in the face of deteriorating profits or accruing losses. But that is the very thing that traders and investors need to do during losing streaks or market turmoil. A trader has to account for his own personal psychology and reign in those traits that can lead to negatively charged emotions in the market.

“It is not good to be too curious about all the reasons behind price movements”

The Jesse Livermore method of trading focuses on knowing the what rather than the why. There are a myriad of financial market theories that seek to explain the reasons behind price movements. Although it’s important to know why prices may be moving in a particular direction, it’s more important to just acknowledge that a price movement is occurring, and be prepared to take advantage of that price movement. In other words, traders should trade based on the current price action, rather than spending too much time on pondering the reasons behind that price action.

After all, the job of a market speculator is to profit from price movements rather than rationalize the reasons behind them. And this requires a certain amount of comfort with uncertainty. We must act in accordance with the underlying market conditions and recognize that we will never know all the influences behind price movements.

“Do not trade every day of every year”

Jesse Livermore’s trading method relied on isolating the best, highest probability trade setups. One of the misconceptions that many traders have is that the more often that you trade, the more money that you can make. In addition, there is a perception that the more time that you spend on trading, the more profits you’ll realize from it as well.

This type of thinking comes from the traditional work model. More specifically, in society we have been trained to think in terms of dollars for hours. The more time that we spend on an activity the more money that we can make from it. Although this applies to a varying extent in the world outside of trading, it is completely flawed thinking when it comes to market speculation. In fact, the opposite is often true. That is to say that if you get in the habit of taking only the best set ups it will have the effect of boosting your overall profits.

“There is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

This is one of the most revealing quotes by Jesse Livermore. What he is conveying here is that the game of trading can never materially change. The players may be different, the technology may be different, the speed of execution may be different, the venues might be different, but the inherent game of trading will remain the same.

This is because human nature is predictable, and this plays out over and over again in the financial markets. As such, so long as human beings as a group, will act in a predictable manner, so too will the patterns that appear on the price charts.

“Continue with trades that show you a profit, end trades that show a loss”

This is one of the most simplistic of Livermore’s axioms. But do not let the simplicity fool you. That is to say that although it is easy to understand in theory, it is extremely difficult to implement in practice. The very process of holding onto our winners, and cutting our losses short goes counter to everything in our being.

Many behavioral psychologists have expounded upon our tendency to do the very opposite, because that is what feels much more natural. We naturally have the tendency to hold onto our losers rather than cutting them short. And along the same lines we have a tendency to cut our profits short, rather than letting them ride. This tendency for loss aversion is based in Prospect Theory.

“Markets are never wrong but opinions often are”

Even if you are 100% certain in your conviction around a trade, you can still be wrong. There is no certainty when it comes to market speculation. The only truth is price, and wherever the price is trading at any given moment is the only reality in the market.

As such, regardless of the level of conviction that you have on any given trade, you must not fall victim to fighting the momentum of the market. Even if you are proven right at some later juncture, is not wise to risk your hard-earned capital defending your opinion. That is a fool’s game, and will likely lead you to the poor house.

“Big movements take time to develop”

Although the markets can display highly volatile price behavior that can result in a large directional price move over a short period of time, this type of market move is less common then a trend that develops over a relatively longer period of time. Big trends typically take time to develop, as different classes of traders begin to get on board the price move.

This typically starts off with more informed institutional buyers getting aboard a trend early, followed by experienced savvy traders that recognize the institutional activity and join their ranks. And then finally, the retail public comes in to help push a trend into a late stage rally in case of a bullish price move, or panic selling in the case of a bearish price move. The cycle tends to repeat over and over again, both to the upside, and then subsequently to the downside.

“Never sell a stock because it seems high-priced”

Contrarian trading can be a difficult way to make consistent profits in the market. That is because there can only be a single print of a price high, or a single print of a price low. In contrast, trends tend to persist for relatively long periods of time. As such, traders do not necessarily have to get their timing just right to make money from trending price moves.

Most contrarian traders use some form of mean reversion techniques. The danger in this is that sometimes markets can remain overextended for long periods of time resulting in a string of losing trades for these types of traders. It’s never a good idea to sell a market just because it looks or feels overbought. Similarly, it’s never a good idea to buy a market just because it looks and feels oversold.

“Buy rising stocks and sell falling stocks”

Jesse Livermore style of trading was primarily based on a momentum approach. His system can best be described as a rudimentary momentum breakout system, which sought to trade in the direction of the breakout in an attempt to capture potentially outsized price movements. As such, he espoused buying stocks that were rising, and selling stocks that were falling.

He essentially had a trend following mindset. He realized early on that it’s much easier to go with the flow of the market, rather than trying to buck the trend. In other words, he understood that something that has been set in motion will continue moving in a certain direction, until and unless some other force acts upon it to alter its course.

“Only enter a trade after the action of the market confirms your opinion and then enter promptly”

Livermore believed that you should wait for the market to confirm your bias before entering into a trade. Confirmation can come in various forms such as a 20 day break out, moving average crossover, technical oscillator signal, to name just a few. The important thing is to ensure that you require some market confirmation before committing to a position in the market. Once the market provides you with that confirmation, then you need to act quickly.

Some traders fall into the paralysis analysis syndrome. That is to say that they will spend an inordinate amount of time analyzing a particular set up, but will have a difficult time in executing on the entry signal when the time comes to do so. Traders that fall into this category need to work on improving their execution skills.

“Never average losses by, for example, buying more of a stock that has fallen”

This Livermore quote was also similarly voiced by another great trader of more recent times, Paul Tudor Jones. One of Jones’s most famous quotes is “Only losers average losers”. In other words, traders need to recognize when it’s time to cut a losing position. No one likes to take a loss. But this single failing has led to the downfall of many otherwise good traders.

Averaging losing trades may seem logical in theory, but as a practical matter it is a high risk money management strategy, that typically goes awry sooner or later. And when that time does come, it will often take with it the vast majority of profits that a trader has earned.

“Patterns repeat, because human nature hasn’t changed for thousands of years”

Technical chartists have long recognized that there are recurring patterns that occur over and over again in the markets. And these patterns can be seen across every timescale from the smallest to the largest. In this sense we can say that the markets are fractal in nature, with self-similar patterns repeating at different degrees of scale.

The price charts reflect the emotions of traders and investors at any given point in time. In a sense, the price charts can be seen as a footprint that has been left behind revealing the actions of market participants. Because the tendency for humans to act and behave in a certain manner is fairly predictable, these price patterns are recognizable to the trained market technician. So long as human nature remains the same, so too will the footprints left behind on the price charts.

Closing Thoughts

You should now be a little more familiar with the story of the great trader, Jesse Livermore, and his exploits in the market. What’s more, you should have taken away some valuable lessons from Livermore’s famous sayings. Although he is separated by most traders today by nearly a century, much can be learned from his style of market speculation and his insights on how psychological factors influence traders in the market.