Silver is considered one of the most valuable commodities in the world. It is traded across the globe by many different class of investors and traders. Some of the major venues for trading silver include the futures market, the forex market, and the equities market. We’ll discuss why you should consider adding silver to your watchlist, and compare and contrast the best ways to trade silver.

Why Trade Silver Online?

Silver is a highly coveted precious metal with a long-standing trading history. Silver has many different applications. Two of the more widespread uses of silver include being used within jewelry, and industrial products. In addition to its practical applications, silver is often viewed as a store of value. As such, it is an important commodity that many investors should include within their overall portfolio.

Silver trading is popular both among day traders and long-term passive investors. Short-term traders will seek to profit from day-to-day price movements within the silver market. Longer-term investors may include silver as part of their investment portfolio, as a way to hedge against adverse moves in the stock market, or they may simply want to protect themselves from deflating currency values.

During a market shaking event, most stocks will tend to fall in unison. As such, equities traders typically have nowhere to hide when black swan type events hit the market. Allocating a portion of your portfolio to the metals market, particularly the gold and silver commodity market, can help alleviate some of this downside risk.

This is because the price of gold and silver can increase during periods of turmoil, as traders and investors shift from risk assets to safer asset classes such as precious metals. Having said that, gold tends to have a stronger inverse relationship to the equities market than does silver.

There is also a fairly sizable group of market participants, who place lower and lower confidence in their government and central banks ability to manage their money supply. These ardent precious metals investors advocate allocating a large percentage of one’s holdings to gold and silver bullion. From time to time, these investors can drive prices higher within various metals markets. There are many different reasons why traders participate in the silver market.

Trading Silver Futures

Many traders prefer to trade the silver commodity via the futures market. Some of the benefits of trading silver through a futures exchange include increased transparency and standardized contract values. Additionally, within the futures market, a trader can just as easily take advantage of shorting opportunities as they can long opportunities. There are several major trading exchanges that offer silver trading. One of the most well-known is the COMEX exchange, which is now under the umbrella of the Chicago Mercantile exchange, the CME Group.

There are three primary Silver futures contract types available through the CME. This includes the full-size silver contract, the E-mini silver contract, and the micro silver contract. The full silver contract i is comprised of 5000 Troy ounces of silver. The E-mini silver contract is half the size of the full silver contract; thus it comprises 2500 Troy ounces of silver. And finally, the smallest silver contract at the CME, the micro contract, is comprised of 1000 Troy ounces of silver. These different denominations make it quite manageable for even the smallest trader to participate in silver futures trading.

Below you can see a snapshot of Silver commodity trading volume on the CME.

Now that we have outlined the different types of silver contracts that can be traded at the CME, let’s illustrate an example of what the notional values would be for the various contract sizes. Assuming that the price of silver is currently trading at $20, here’s what the contract value would be for each:

Full silver contract – 5000 Troy ounces times $20 equals $100,000 contract value

E-mini silver contract – 2500 Troy ounces times $20 equals $50,000 contract value

Micro silver contract – 1000 Troy ounces times $20 equals $20,000 contract value

So we can see, based on the silver price of $20, what the notional value of the contract would be for each. Essentially, when we refer to silver contract value or notional value we are referring to the total amount of silver that we are actually controlling for each different contract type.

But this is not necessarily the amount of funds that we will need to put up in order to trade one contract of silver. That is because within the futures market, we are able to utilize leverage on our positions. This can greatly reduce the amount of upfront capital required for controlling one contract of a commodity. As such, we can amplify our returns on our silver trades through this facility available within the futures market.

The CME typically sets the minimum initial and maintenance margin required to control one silver contract. Depending on the volatility within the market, this margin requirement will change from time to time. Futures brokers can also set lower margins for their clients who are just interested in day trading silver. In any case, the minimum margin required to trade will be only a small fraction of the nominal contract value.

Silver traders who engage in the futures market do need to be cognizant of the settlement process involved. In other words, you want to ensure that your trades are either cash settled prior to the contract expiration date, or rolled over to the next delivery month. This way you will bypass any of the delivery procedures inherent within the silver commodity futures market.

Silver Trading And Investing Via ETFs

Another way for traders and investors to participate in the silver market is through Exchange Traded Funds, commonly referred to as ETFs. ETFs trade similar to individual stocks, but they are comprised of a basket of similar instruments, rather than a single holding.

For example, there are silver ETFs that are comprised of physical silver bullions. In addition, certain silver ETFs are made up of various silver mining companies. And last but not least, there are silver ETFs that are focused on purchasing silver futures contracts spanning various lengths of contract expirations.

And so, when we are talking about investing via silver ETFs, there are many different options to choose from. The best silver ETF to trade will depend on your personal preference and market knowledge.

Although silver ETFs are not as versatile as silver futures contracts, they are nevertheless a good choice for investors who have grown comfortable trading within the equities market environment. Since a large majority of people have gotten their start in the investing world through the stock market, it serves as a great starting point for your silver trades.

Here are three silver ETF’s that are worth consideration:

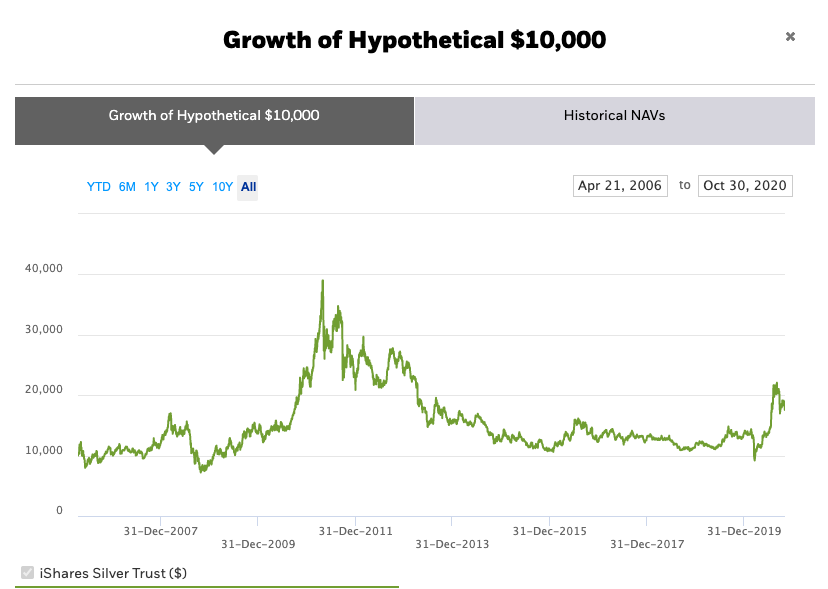

iShares Silver Trust (SLV) – SLV is the most liquid silver ETF available for trading in the market. Its primary holding is physical silver bullion. SLVs benchmark pricing comes from the London Bullion Market Association. On the chart below you can see the long term historical performance of SLV based on a pure buy and hold model.

Global X Silver Minors ETF (SIL) – The SIL ETF is comprised of various silver mining companies. Since it provides exposure to a basket of silver mining firms, investors can enjoy the benefits of investment in this specialized asset class, without the outsized risk that can often be present by committing to just one or a few of these companies within their portfolio.

Horizon Silver ETF (HUZ) – An investment in HUZ provides an investor exposure to silver through its holdings in the silver futures contracts for the following delivery month at the CME. One interesting point of consideration is that HUZ is denominated in Canadian dollars. As such, US investors should consider currency implications of holding HUZ within their portfolio.

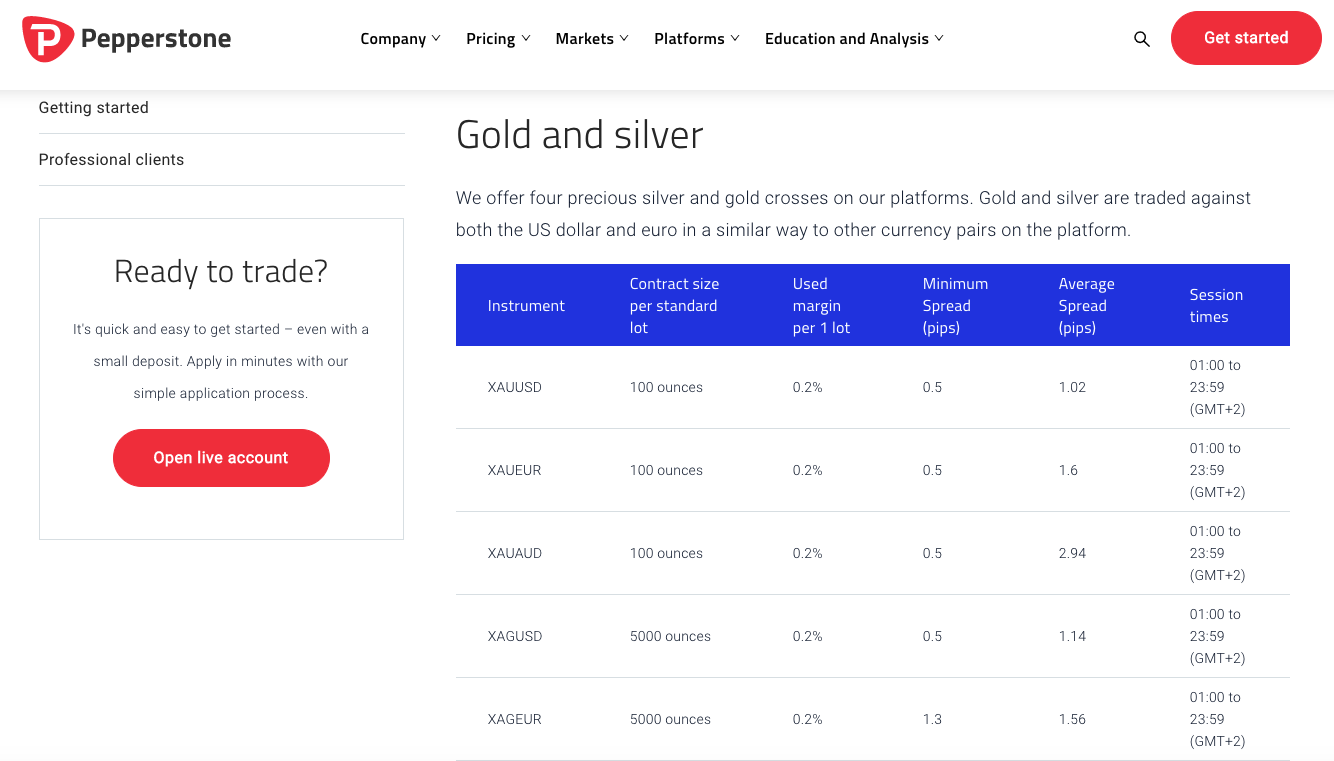

Trading Silver In Forex

An excellent vehicle for trading silver is through the Forex market. Unlike the futures market, which may not be available to all market participants, and wherein there can be complications of physical delivery, the spot Forex market offers a simpler way to express your silver trade. The spot Forex market is one of the most accessible markets in the world, and there are reputable brokers in nearly every major country or region.

Within the currency markets, a trader can speculate on the price of silver through a product known as contracts for difference, or CFD. The benefit of CFDs is that there is no requirement for owning the underlying instrument. But with the CFD you would still be able to benefit from fluctuations in the price of the instrument, in this case the price of silver.

Depending on your jurisdiction, you can access varying degrees of leverage for trading Silver CFDs. Some Forex brokers will offer upwards of 200 to 1 or 500 to 1 leverage on silver contracts. While others may only offer 20 to 1 or 50 to 1 leverage on these products. You’ll need to check with your broker or its regulatory body for specific leverage limits allowed within your region.

Since forex market transactions are not done through any centralized exchange, you will need to ensure that you’re working with a reputable Forex broker. Additionally, it pays to perform some additional due diligence on a few Forex brokers to see which one offers the most competitive bid ask spreads. Usually, ECN brokers will offer the best pricing model to its clients, while dealing desk brokers will tend to have a less attractive pricing model.

Gold Silver Ratio

The gold to silver ratio is an important indicator that is widely watched by major market players. Before we can elaborate on the benefits of utilizing the gold silver ratio for analysis purposes, let’s take a moment to define exactly what it is. It’s a fairly simple indicator to understand. Essentially, the gold to silver ratio represents the amount of silver in ounces required to purchase 1 ounce of gold.

To calculate the gold to silver ratio, you would simply divide the current price of gold by the current price of silver. And that’s it. Below are a few examples of the gold to silver ratio calculation.

Assuming that the gold price is $1500 an ounce, and the silver prices $20 an ounce, the gold to silver ratio would equal 75.

In this case, it would take 75 ounces of silver to purchase 1 ounce of gold.

If the gold price is trading at $1800 an ounce, and the silver price is trading at $15 an ounce, the gold to silver ratio would equal 120.

In this scenario, it would require 120 ounces of silver to purchase 1 ounce of gold.

So now that we understand how the gold to silver ratio is calculated, what can we extract from this metric? Well, there are a few different ways that traders and analysts that specialize in the metals complex typically use this information.

But as a general guideline, when the gold silver ratio is relatively high, it would indicate that silver is undervalued in relation to gold. And since, the gold the silver ratio tends to be mean reverting, we would expect either silver prices to increase, gold prices to decrease, or both.

At the other end of the spectrum, when the gold silver ratio is relatively low it would indicate that silver is overvalued in relation to gold. And again, we would expect some mean reversion in the ratio at relatively extreme readings. And so in this case, we would expect either silver prices to decrease, gold prices to increase, or both.

The above described mechanics of analyzing the gold silver ratio is just one of many different analysis techniques can that can be employed. But keep in mind that the gold silver ratio can and does swing wildly and can remain extended for prolonged periods. To get a sense of historical perspective, it’s worth noting that over the last 100 years, the gold to silver ratio has averaged around the 45 to 55 mark.

Below you can see a chart of the Gold Silver ratio going back to mid 1997. Notice during this period the Gold Silver ratio registered a reading near 35 at it lower end, and near 125 at its higher end.

Silver Trading Strategy

Let’s now build a contrarian strategy for trading silver taking some of the concepts that we have learned thus far. Our strategy will incorporate the gold silver ratio, and the Relative Strength Index. We know that the gold silver ratio can provide us insights into the relative valuations of gold versus silver. Whenever this ratio becomes overextended, there is a tendency for a mean reversion price move. As for measuring when the gold silver ratio reaches an extreme level, we will utilize the RSI indicator for that purpose. RSI is essentially a technical oscillator that provides overbought and oversold readings for a financial instrument or symbol.

Below you’ll find the rules outlined for this silver trading strategy. This particular strategy works best on weekly price bars.

For A Long Silver Trade Setup:

- Watch for RSI (14) to cross above 70 on Gold Silver Ratio weekly chart

- Buy Silver when RSI (14) cross back below 70 on the Gold Silver Ratio weekly chart

- Stop Loss beyond recent swing low on Silver weekly price chart

- Target 2 to 1 risk to reward ratio

The logic behind this long set up is that Silver is cheap relative to Gold, and as such, we expect the price of silver to increase.

For A Short Silver Trade Setup:

- Watch for RSI (14) to cross below 30 on Gold Silver Ratio weekly chart

- Sell Silver when RSI (14) cross back above 30 on Gold Silver Ratio weekly chart

- Stop Loss above recent swing high on Silver weekly price chart

- Target 2 to 1 risk to reward ratio

The logic behind this short set up is that Silver is expensive relative to Gold, and as such, we expect the price of silver to decrease.

Forex Silver Trade Example

Let’s now illustrate the above outlined silver trading strategy using some real market charts. Below you will find two charts that we will need to refer to for this silver trade setup.

The upper chart represents the weekly chart of the gold silver ratio, along with the Relative Strength Index. The lower chart is the weekly chart of XAGUSD, which is the symbol for silver in the spot Forex market.

As per our strategy, we will be scanning the RSI indicator to spot relative extremes within the gold silver ratio. When we find that the gold silver ratio is near an overbought level, we will initiate buying in the silver commodity. Conversely, when the gold silver ratio is near an oversold level, we will initiate selling in the silver commodity.

Remember again that the higher the gold silver ratio, the cheaper the silver price relative to gold. And conversely, the lower the gold silver ratio, the more expensive the silver price is relative to gold.

If we refer to the gold silver chart above, we can see where the RSI reading reached the upper threshold above 70, and then later topped out, and began to move lower, eventually below that same 70 threshold mark. The dashed yellow vertical line illustrates exactly when that condition was met. This event would have been our signal to initiate a market buy order in the silver market, in this case in XAGUSD.

Now if we refer to the second chart above, you can see where that market buy order would have been initiated in XAGUSD. The stoploss order would be placed below the most recent swing low prior to the buy entry point. That stoploss level is referenced with the black dashed line.

As for the target, we will be using a 2 to 1 reward to risk ratio as our exit point. The vertical brackets represent that measurement. The first bracket shows the distance between the buy entry and the stoploss point. The second bracket represents a one-to-one price move of that distance, and the third bracket represents a two to one price move of that distance.

And thus the top of the third bracket would be the actual target point. As we can see, silver prices moved quickly higher following our buy entry signal, and approximately three weeks later hit our preset target level.

Final Thoughts

Along with gold, silver is one of the most sought after metal commodities in the world. There is a great demand for it because it is a component within many different types of products, and also is highly valued as means of storing wealth. As such, market participants actively trade and invest in silver through the futures, forex, and equities market.

Additionally, beyond these three major financial markets, there is also the physical bullion market, which is quite active. Whether you are interested in becoming a gold and silver trading speculator, or long-term buy-and-hold investor, trading in silver offers many lucrative opportunities that are worth pursuing.