Trading exotic currencies can be a way of diversifying risk by putting on trades in currencies that are not highly correlated to the major pairs. Most traders start with the majors, which are very liquid and have plenty of relevant news. These currencies make for a good place to start trading in forex and also supply a moderate amount of volatility.

However, these currencies are also highly correlated with each other. If the EUR/USD is experiencing a major bull rally it is most likely that GBP/USD, and AUD/USD are also experiencing an upward trend of some sort. Whereas exotics tend to be less correlated to the major currencies. This is due to the fact that their economies have less in common than developed economies. Clearly, the US, the Eurozone, the UK, and Australia have more similar economies than say, Turkey, China, or Hungary.

Exotic pairs in forex are represented by a foreign currency from a developing or previously developing country, while the domestic currency is usually the US dollar. With some exceptions, exotic currency pairs are also quoted against the Euro.

An exotic currency is defined as coming from a country in regions like South America, Africa, East Europe, or Asia. Some countries may be very underdeveloped such as South Africa or Mexico, but other more developed countries such as Hungary, Poland, and South Korea are also considered exotics.

The most exchanged exotic currency pair is the USD/CNY, CNY stands for the Chinese Yuan. According to data from the Bank of International Settlements, this exotic pair accounts for 4.2% of all daily trades, or $270.6 billion.

Over the years, trading exotic pairs has become ever more popular as the economies of these countries expand. Economic expansion creates more demand for their currencies and also attracts more speculators, especially hedge funds and trading houses.

Exotic Currency List

The following list is based on retail trader interest alone. As we saw above the most traded exotic currency pair is the USD/CNY. The second and third most traded exotic pairs are USD/HKD (Hong Kong dollar) 3.3% or $217.8 billion, and USD/KRW (Korean won) 1.9% or $125.4 billion of traded volume daily. However, from personal experience and exposure to trading exotics, I feel the following list may be more appropriate when considering retail trader interest.

USD/MXN US Dollar / Mexican Peso

USD/BRL US Dollar / Brazilian Real

USD/HUF US Dollar / Hungarian Forint

USD/DKK US Dollar / Danish Krone

USD/CZK US Dollar / Czech Koruna

USD/PLN US Dollar / Polish Zloty

USD/SEK US Dollar / Swedish Krona

USD/TRY US Dollar / Turkish Lira

USD/ZAR US Dollar / South African Rand

USD/RUB US Dollar / Russian Ruble

EUR/TRY Euro / Turkish Lira

EUR/DKK Euro / Danish Krone

EUR/SEK Euro / Swedish Krona

EUR/HUF Euro / Hungarian Forint

EUR/PLN Euro / Polish Zloty

Economic Data

The ability to access economic data in a timely and accurate fashion is fundamental in trading forex. It may sometimes be challenging to stay on top of all the economic events and geopolitical news for the major currencies. And when trading exotic currencies this may even be more of a problem.

Accessing the relevant economic data for each exotic currency to trade should not be too much of an issue. All the currencies mentioned above are included in online economic calendars such as DailyFx, Trading Economics, and Forex Factory.

However, do not be surprised to see excessive and heightened volatility straight after economic data being released. True, this happens at times in the majors, but it is usually due to over-expectations in the data release.

When trading exotic pairs, you may still see a sell-off when expectations are met or even exceeded. This may be due to various publishers of market expectations for the data release not being able to acquire an accurate consensus. This means the market was expecting a very different number, so it looks like the expectations shown online were matched when in reality they weren’t.

There is also the question of data reliability. Some countries with closed political regimes are subject to releasing data according to their needs rather than the actual facts. Some countries have a poor reputation when it comes to data publication as all the process is in the hands of the government. This is particularly true of countries where extra-governmental oversight is limited or nonexistent.

Local Government Intervention

Another aspect of certain forex exotic pairs is government intervention. In some countries, the local government may intervene to defend the value of their domestic currency. This has been happening recently in China, through the Peoples Bank of China (PBOC). Others countries also partake in interventionism, such as Turkey or Brazil. In general, in less developed economies it is quite frequent to see the local central bank buying the domestic currency to prop up the price in the market.

The problem here is the absence of information, sometimes the intervention is leaked by local authorities to create a greater effect in their buying. Other times, a lot of buying happens at lower prices and the information of central bank intervention is leaked later on.

Central bank intervention is not easy to gauge as what we would expect to happen does not always materialize. In general, news of a central bank buying the local currency should cause it to rally. However, that has not always been the case. In fact, on occasion, it has caused a selloff of the currency, or many rounds of intervention have been necessary to stop the price of the local currency from falling.

Technical Analysis

Technical analysis has come to the forefront of forex trading thanks to the power of modern personal computers and high-speed internet connections. These two factors have allowed traders to access information and charting tools that only a few years ago would have been cumbersome to maintain.

We know how technical indicators work, and how reliable they are for the major currency pairs. For the majority of indicators, the major currency pairs were their testing ground. The study of technical indicators and their development based solely on a particular set of highly correlated currency pairs means that they are probably going to perform best on those pairs.

You most likely already have a set of indicators and tools that you use to trade majors and maybe minors. However, the fact is that this particular setup may or may not work as well with exotic pairs as it does with the majors.

You should preferably backtest each of your indicators and tools with each exotic currency pair. You can then proceed to see how they performed on an individual level and therefore decide which ones may be reliable enough to be included in your set of analysis tools.

Exotic Forex Volatility

Volatility is a necessary factor for traders in any market. Price movement is what creates a trading opportunity. If volatility is extremely low, it becomes very difficult to enter and exit a market. Most likely once a move in one direction occurs and your trade signal is triggered the market will revert to the original level.

Of course, you can use leverage to gain profit from even small moves, however, that may not always be possible. High leverage also leaves you exposed to potentially higher than anticipated losses when the market does move.

What we need is to understand the extent of volatility for any given market. The major currency pairs have an average daily volatility of between 60 pips and 100 pips. Exotic currencies often have very large handles. This means that their movement in terms of pips are generally much higher than it is for the major currency pairs.

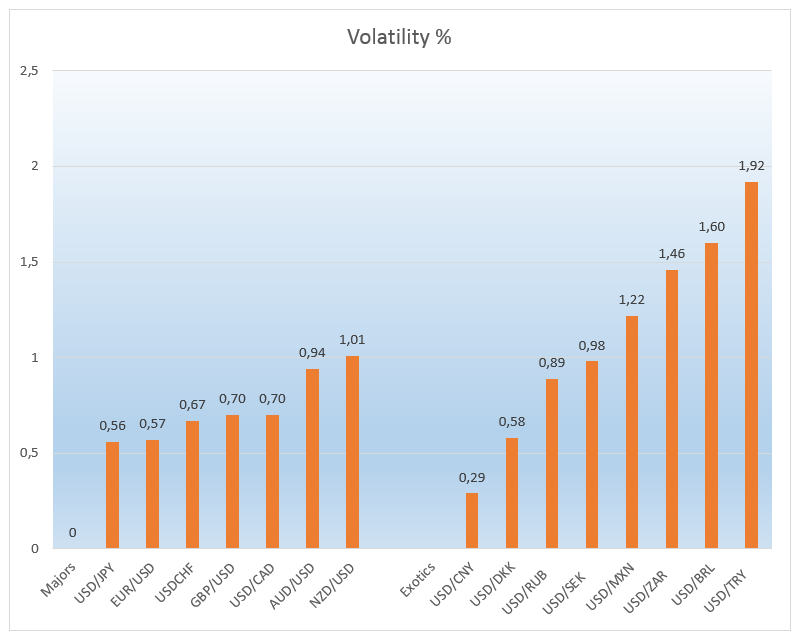

To perform a precise comparison of volatility we will need to measure volatility in percentage terms. The majors have an average daily volatility that ranges from 0.57% for EUR/USD to 1.01% for NZD/USD. These volatility averages were calculated over the past twenty weeks using the Investing.com website. Given the large sample, bouts of high volatility which occurs after important data or news events are flattened out.

The chart below, using data from Investing.com, shows the volatility for major pairs and some of the main exotic currency pairs. Excluding China, which is a currency that is underpinned by the PBOC, we can see that volatility for exotic currency pairs is in some cases four times that of say EUR/USD.

The main implication of higher volatility when trading exotic pairs is greater risk. It is very true that with greater risk comes greater reward. However, we must be concerned with how much risk we put on in each trade. This concept has to be applied to exotic pairs also.

If the exotic currency pair we are trading is four times more volatile than a major pair we trade, we could potentially lose four times the amount we would usually lose when trading. It makes sense to reduce your trade size accordingly. If you are trading EUR/USD for $50,000 per trade and you are looking to trade USD/TRY you would need to trade this pair for $12,500 at a time.

The size reduction is determined by the extra volatility in USD/TRY compared to EUR/USD. If the exotic pair has volatility four times that of the major pair then you will need to divide your trade size by four to keep approximately the same amount of risk on your trades for the exotic pair.

Top 3 Forex Exotic Pairs to Trade

Let’s have a look at a list of the best exotic currency pairs to trade. This is a list to get an idea of what you are looking for. Not all exotic currencies make a good choice for a retail trader. Access to news and geopolitical events related to the currency are of essence. Depending on your geographical location you may or may not be in front of your computer when this exotic pair is trading with the highest liquidity.

USD/MXN Exotic Currency Pair

This exotic pair is beginning to gain traction among many retail traders. The Mexican economy has been growing at a steady rate over the past decade. Cross-border trade with the USA has also been a big factor in bringing this currency to the forefront. Exports-imports with Mexico’s northern neighbor have been in continuous expansion. Greater international commerce creates a higher demand for a currency.

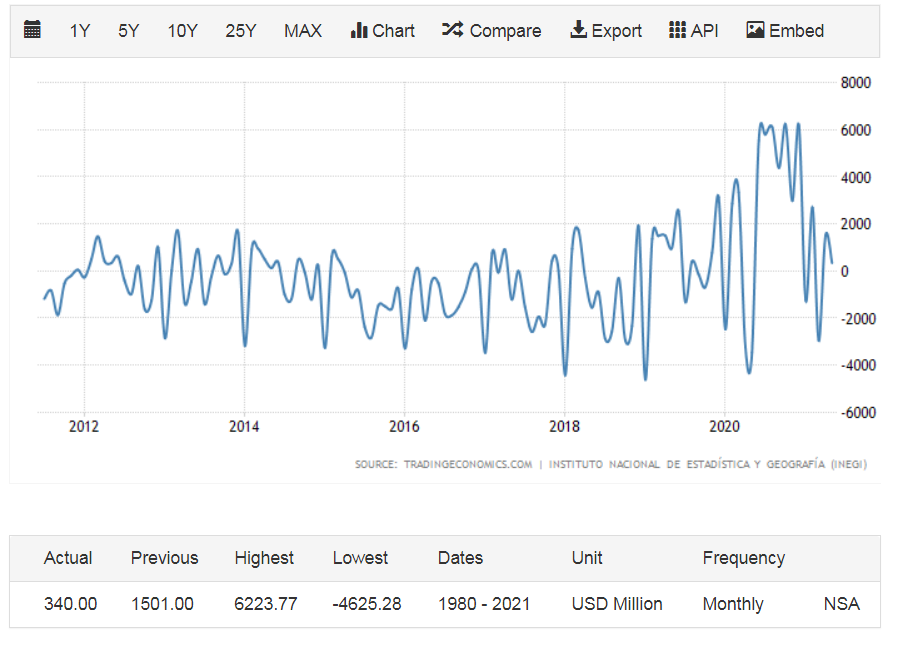

The chart above shows the balance of trade for Mexico over the past 10 years. Showing a continuous expansion in trade as the peaks and troughs get wider.

Economic data is accessible with ease, although it is not always certain that the forecasts for the data release have always been on target. This can make things tricky when you are looking to trade this currency over a data event as you may get some surprises.

The following periods of the day are best to trade this currency pair, with higher liquidity and therefore tighter bid offer spreads: London & New York trading sessions. The London session is certainly a good period, but the most prominent moves are made in the New York trading session. This currency pair’s price action tends to flatten after the New York close as it does not seem to be very active during Tokyo hours.

Overall, this is a promising exotic pair because traders can get relatively easy access to geopolitical events and news. Also, it has an expanding economic and international trade characteristic. Additionally, this pair is fairly liquid market during London and New York trading hours which should continue and increase its share of the market.

USD/BRL Exotic Currency Pair

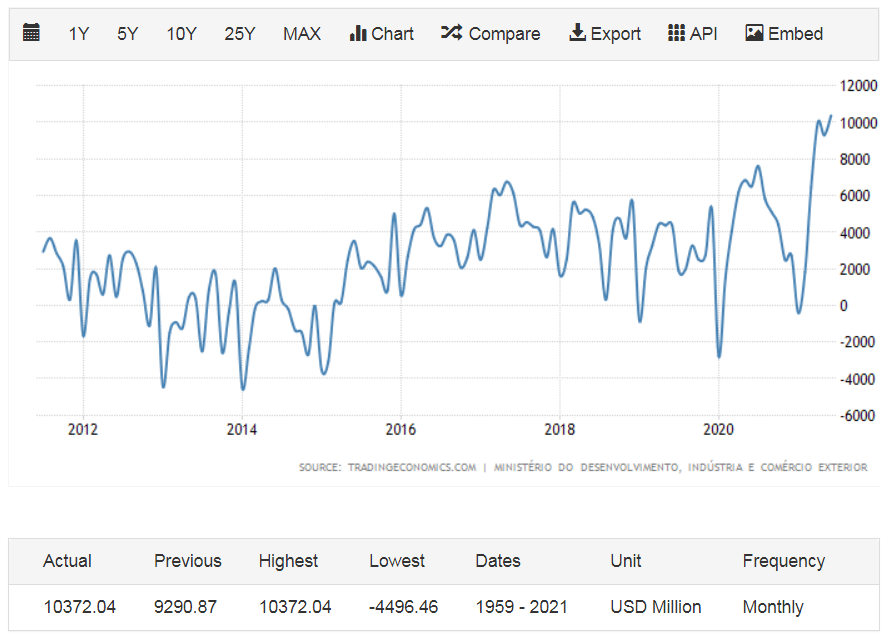

This exotic currency pair has some of the same features as the USD/MXN; an economy that historically has performed well and an expanding balance of trade. Brazil may not be as dependent as Mexico on the USA for its exports, but the chart below shows how its balance of trade has expanded even more so than Mexico’s.

This currency pair also has the same two main trading periods throughout the day. London and New York are the most liquid trading windows, with New York again bringing the bigger moves more regularly. The higher volatility is due to the local traders getting into the market about the same time as New York. This is also the case for USD/MXN.

EUR/TRY Exotic Currency Pair

This pair has been around for less time but is coming to the forefront in exotic currency pairs. The Turkish lira is possibly the trickiest to trade of the 3 exotic currencies mentioned in the top 3. This may make it the most rewarding if your appetite for risk is high. Turkey has been vying to enter the EU which is also its biggest trading partner. These factors make the Turkish lira more attractive as companies and banks begin to exchange the currency, increasing its market volume in forex.

As we saw previously the USD/TRY is the most volatile pair on our list. Spikes of volatility up to 15% are not uncommon for this currency. A lot of care is needed, and most retail traders will close their positions within the same day so as not to be exposed to swap fees. Swap fees for this currency have reached very high rates. So, even if you carry your position for just one day the fees can be excessive.

These spikes in overnight interest rates for the Turkish lira occur when there is a run on the currency. A sharp drop in price of TRY will cause the Turkish central bank to spike interest rates, used to calculate swap fees, until the market settles. The central bank has also been known for market intervention. Often buying billions of Euros worth of lira to prop up its value.

Possibly the biggest deterrent to shorting the Turkish lira is the massive increase in interest rates the central bank is willing to implement. Even in relatively calm periods, the interest rate for the Turkish lira is often around 20%, making it a costly currency to be short of overnight. That said, the easiest way to avoid these costs is to apply intraday trading strategies.

Access to information may not be as easy as with other currencies. Most of the important geopolitical news will be carried by the main media outlets. However, the correct forecasting of economic data may be a little trickier.

Wrapping up

Exotic currency pairs experience higher volatility making them interesting for those of us with a higher risk appetite. For those looking to simply diversify their trading risk, you would need to size down your trades. Reducing the size of your trades will allow you to have a similar risk to trading one of the major pairs.

Access to information for most currencies is relatively easy, although for some you may experience unexpected reactions on data releases as the forecasts may have been incorrect. Government intervention for data releases on some currencies may also mean some surprise in data events.

Overall, exotic currency pairs make a feasible way of diversifying risk as they are not highly correlated with each other or with the majors. Trading strategies that work on majors may or may not be successful for exotic pairs and should be backtested properly.