Many individuals that first venture into the world of Forex trading do so because they believe that it is a lucrative way to make fast money. Some may even see early success thru demo trading.

Many individuals that first venture into the world of Forex trading do so because they believe that it is a lucrative way to make fast money. Some may even see early success thru demo trading.

However, the chances are that as soon they jump from being a demo trader to trading with a real money account, they begin to realize the cold hard truth that making consistent profits in the FX market is not as easy as they originally envisioned, and in fact requires quite a bit of knowledge and hard work.

This is not to say that you cannot become a profitable trader over time, but rather to dispel the myth that forex trading is some sort of easy side gig. So in this lesson, I will offer you a vantage point that will help you understand that profitable trading in the fx market is possible, but that you must start by following some simple guidelines. Furthermore, keep in mind that while consistent profits trading forex can be a simple process, it rarely is an easy one.

Learn the Basics About the Global Forex Market

If you are just starting out as a Forex trader, it is a no-brainer that you should invest your time and effort to learn the basics of currency trading. No doubt, learning to read charts, understanding the functions of different types of technical indicators, and how money management plays a crucial role in determining the effectiveness of a trading method is vital.

You should start by learning about the history of the stock, futures, and foreign exchange markets and read the original works of some of the great early thinkers of technical analysis including R.N. Elliott, W.D. Gann, Richard Wyckoff, Charles Dow, and H.M. Gartley

These great thought leaders were the pioneers of technical analysis. You should take the time to understand and conceptualize market structure and the supply and demand influences that drive price movement. Without doing this, you cannot gain a meaningful insight into the markets.

You should be aware of how supply and demand creates organic market structures, how modern Forex markets came to be, how central banks play a significant role in adjusting the value of a fiat currency, etc. In addition, you must study key economic metrics such as interest rates, unemployment rate, manufacturing production, Gross Domestic Product, and housing market statistics.

Once you develop a basic understanding of how global foreign exchange market function, what drives the price, and how economics plays a significant role in price movements, then you can begin to narrow in on specific technical and/or fundamental approaches that best suit your own beliefs about the market.

Taking a Systematic Approach to Forex Trading

When we see professional traders depicted in Hollywood movies, with their multiple monitor setups that show a dozen different price charts, where they are constantly on the phone yelling at someone, making an endless number of trades every day, and then going home in a Lamborghini, it gives us a very sexy impression of what it means to be a trader.

However, if you have read any fact-based books about “real” traders, such as the Market Wizards series by Jack D. Schwager, you will come to recognize that the most successful traders are, and behave, very differently in real life. Although most of these top traders interviewed by Schwager had different trading approaches, the common thread that gives them the edge over the majority of market participants does not come from their larger than life personalities, but rather to their ability to stick with their trading strategy thru thick and thin, and by having the utmost respect for risk.

Also, you don’t have to be a genius to be a great trader. Yes, being smart does help, but the simple fact is that if you want to be a consistently profitable forex trader, you need to start by taking a systematic and disciplined approach to trading Forex.

Now I should mention that being a systematic trader does not necessarily mean that you must be a system trader. You can trade in a discretionary manner and be a systematic trader. By a systematic approach, we mean a holistic approach that includes your overall psychology, realistic expectations regarding risk-adjusted currency trading profits, a rock-solid money management plan, and of course, a trading strategy that offers you a real edge over the market under different and constantly changing market conditions.

Treat Forex Trading as a Business

Treat Forex Trading as a Business

To become a profitable forex trader, you need to have a trading strategy or system that gives you a real and defined edge in the market. It must define not only when and where you enter and exit a trade, but also as importantly when to stay away as well!

You see, most newbie traders start with considerable enthusiasm, and they spend a lot of time trying to master the art of trading forex profitably. However, they end up losing money because they either never find a trading system that offers a real edge in the market, or in fact they do find one that does offer an edge, but they do not allow sufficient time for the system to work over a longer time period. The latter case being because the system most likely does not suit their personality or psychological makeup of the trader.

Some people also make the mistake of misunderstanding their true drive to trade Forex in the first place. Many are merely attracted by the gambling aspect and are really only in it for the action. They risk more than what is prudent or statistically viable, because in doing so, they are able to experience a bigger thrill, a higher high with every up and down tick. And subconsciously, that excitement is what they truly desire from the market. Most times it does not end well for these types of gambling mindset traders.

Before you get in the business of trading, you need to understand that it is a business. Unfortunately, trading Forex is often times marketed as a “get rich quick” scheme by some shady brokers, and many people have substituted going to Las Vegas by trading Forex.

However, despite the fact that you can make considerable profits by making a few clicks on your screen, you can just as easily lose it. Trading Forex successfully over the long run requires a business mindset rather than a gamblers mindset.

So essentially, you need to take a step back and just reflect for a moment. Try to observe your inner thought process to figure out what you are trying to accomplish in the first place. If you truly believe that you are ready to approach trading Forex as a business, then you are probably ready to start trading for profit rather than for excitement.

Understanding Different Market Conditions to Make Consistent Profit

Most traders would agree with the “Buy Low, Sell High” or “Sell High, Buy Low” adage common in trading. Although common sense dictates that this is the only way to make profit trading, let’s take a close look at how this idea can a bit more complicated than it sounds.

If you have observed a price chart of any currency pair, you would agree that the price can only do three things:

1 – The price can continue to go up and form an uptrend

2 – The price can continue to go down and form a downtrend

3 – The price can remain within a defined range and establish a range bound market

Therefore, there are essentially two major types of strategies to profit from the market. Either you can trade with a trend based approach during an uptrend or a downtrend. Otherwise, you can trade with a strategy which is suitable for a range bound market condition.

Figure 1: “Buy Low and Sell High” Strategy Works Well During a Range Bound Market

When you can clearly define two price points along the horizontal price axis, where the Forex pair’s price finds support and resistance, you can be confident that the market is consolidating and it is in a range bound condition. When you find such a market condition, as demonstrated in Figure 1, it makes sense to buy around the support area and sell it higher near the resistance area to earn a profit.

Hence, the common sense approach to trading that dictates buy low and sell high works well when the currency pair you are trading remains range bound.

However, when the Forex pair’s price is in an uptrend or in a downtrend, how might we play those instances?

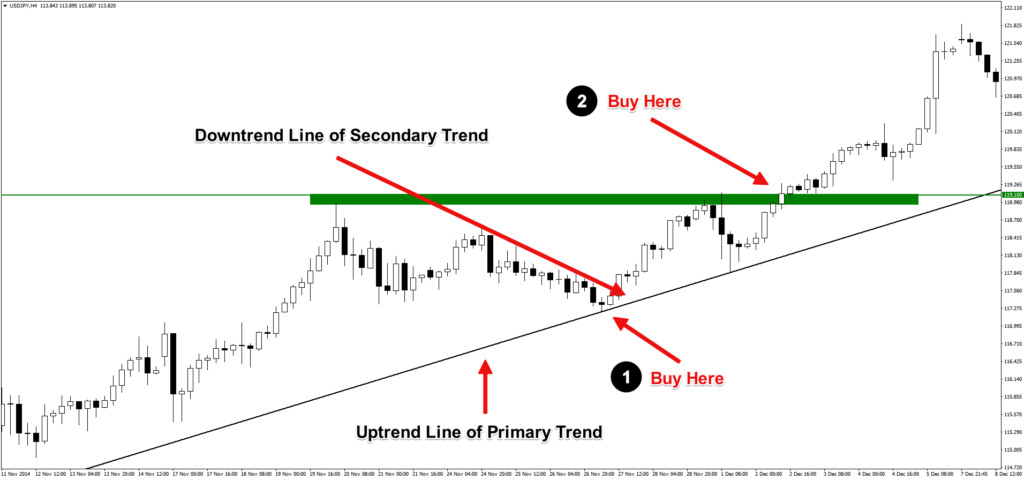

Figure 2: A “Buy High” Strategy Works Well During an Uptrend

In Figure 2, the USDJPY is clearly in an uptrend that has formed a well-respected uptrend line, which we have labeled as the primary trend. However, when the pair starts a downward retracement, it creates a secondary downtrend line.

During an uptrend, you have mainly two ways to profit from the market. The first option is to buy low around the uptrend line. The second option is to buy high once the pair breaks above the resistance. When you try to buy low during an uptrend, you are going against the secondary trend. Although you are trading with the primary trend, there is always a chance that the price would break below the uptrend line and hit your stop-loss, forcing you out of the market with a loss.

When you trade on the side of the primary trend and wait for the price to break above the resistance, your odds of winning would increase. In this case, you would not only trade on the side of the primary trend, but the momentum created by the secondary uptrend would be on your side as well.

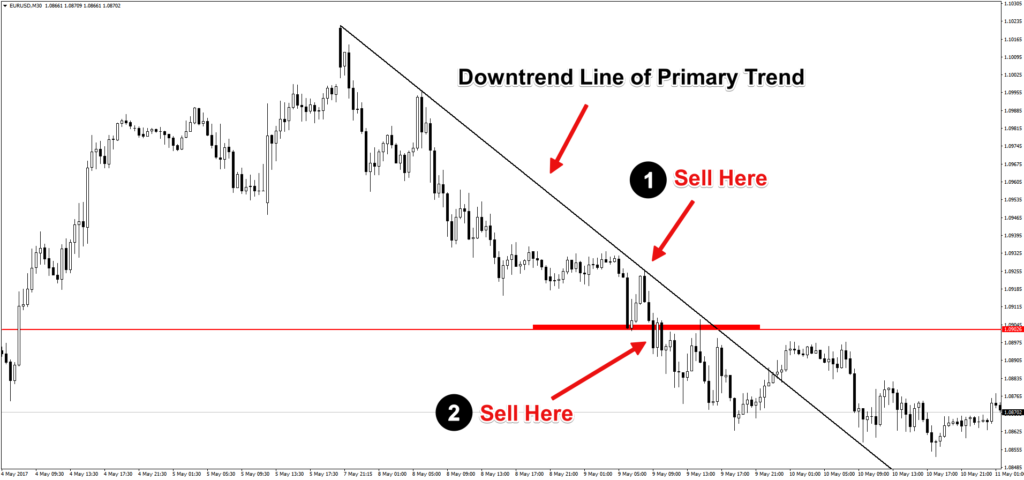

Figure 3: A “Sell Low” Strategy Works Well During a Downtrend

Similarly, during a downtrend, you should try to enter the sell order near the downtrend line as well as selling the price break below the support.

So, during an uptrend, many times it makes sense to buy high. Similarly, during a downtrend, there are conditions when it makes sense to sell low. In fact, by doing so at the right times, you would always trade on the side of both the prevailing primary trend as well as the secondary or intermediate trend.

Regardless which technical trading strategy you follow, understanding the two different kinds of market conditions and selecting an appropriate strategy for each of these two conditions would help you execute your positions more effectively and with a higher degree of accuracy.

Money Management Is an Essential Part of a Sustainable Trading System

As a forex trader, your primary job is to be a competent Risk manager. Trading forex successfully over the long term, boils down to having a positive expectancy trading strategy and applying effective risk management. You would apply a set of strict risk criteria for each trade which then allows the defined edge of your trading strategy to deliver consistent profits over a series of trades.

There are several money management strategies to choose from, such as risking a fixed percentage of your equity on each trade, risking a fixed amount, and other more complicated position sizing methods.

Regardless of which strategy you follow, the point of having a money management strategy is to allow for a systematic way of determining the position size of each trade. Your money management strategy should be crafted in a way that makes the outcome of a single trade virtually irrelevant in the long-run and liberate you from becoming psychologically attached to your open position.

Before you incorporate a sound money management strategy best suitable for your technical trading system, you need to identify two aspects of your trading strategy. The first aspect is the overall win rate of your strategy, and the second aspect is the average reward to risk ratio of your trades.

Some trading strategies have a relatively low win rate, such as 30 %, but their reward to risk ratio is quite high, like 3 to 1 or greater.

On the other hand, there are trading strategies where your win rate remains as high as 90%, which means you end up taking profits on most of your trades. The problem with these types of high win rate systems is that often, the reward to risk ratio remains very low, much less than 1:1 RVR.

You might follow very different money management techniques for these two types of trading systems. If the win rate of your system is high, but the reward to risk ratio is low, you may be comfortable with risking a slightly higher percentage of your account equity on each trade. By contrast, if the win rate of your trading system is low and it offers a high reward to risk ratio, you may want to be more conservative about your percent risk per trade. In any case, you always want to be aware of your risk of ruin to limit both your maximum drawdown and risk of blowing up your account.

Conclusion

If you are feeling frustrated because you are not earning consistent profits from your trading, then you are certainly not alone. Most successful Forex traders have paid the price of admission, in terms of losses, in their early days to gain the experience that helped them down the line.

To become a successful Forex trader, you need to spend a good deal of time on research. You must meticulously test and develop a trading system that offers the right balance in terms of win rate and a reward to risk ratio, that will be most suitable for your own temperament. Be prepared to spend lots of time analyzing your trading technique with different risk management profiles. Applying various parameters to your trading model based on historical price can reveal how the strategy has performed under varying market conditions.

Once you have a trading methodology that can make profit in different market conditions, or at least helps you stay out of the market when the conditions are not suitable for your system, then you need to apply a sound money management approach around that framework.

Most traders never get this far. If you can accomplish this feat, then you are ahead of most Forex traders and well on your way to trading Forex profitably.