Exchange Traded Funds, better known as ETFs, have exploded in popularity in recent years. They offer a fast and cost-efficient way to invest in a group of securities in a particular market sector, high-yielding or sovereign bonds, emerging markets, commodities, precious metals, and even real estate.

Here, we are focusing on ETFs that invest either in physical silver, silver futures, or companies that have a high correlation with the silver market (i.e. mining companies.) Each ETF has its advantages and disadvantages and comes with different expense ratios, and some of them even use leverage to magnify the potential returns (but potential losses are magnified as well.)

Choosing the best silver ETF is difficult, so here is our top silver ETF list that you should consider investing in.

Investing in Silver ETFs

ETFs, or Exchange Traded Funds, are funds that invest in an asset class and that can be traded on regular exchanges. They often combine hundreds, or even thousands of securities from a particular sector they track, making it easy for investors to get exposure to a specific index without having to diversify themselves.

There are ETFs that track industrials, tech, emerging market bonds, gold, currencies, silver, and any other asset class. Here, we are focusing on silver ETFs.

Silver exchange traded funds invest in physical silver and securities that track the price of silver, such as mining companies.

By investing in silver ETFs, each investor has a right to a particular quantity of silver ounces, although there can be some restrictions regarding the minimal investment an investor needs to make in order to get physical silver shipped by the ETF.

Silver ETFs have seen a surge in popularity given their higher liquidity compared to investing in physical silver, their high accessibility, and the fact that investors don’t need to worry about storing their hard silver, transporting it, and paying for insurance.

Some ETFs, called inverse silver ETF or short silver ETF, perform in the opposite direction of the price of physical silver.

Benefits of Investing in Silver ETFs

Precious metal ETFs are not as old as someone might believe. Gold and silver ETFs entered the markets in the early 2000s, and the first silver ETF was the iShares Silver Trust introduced in 2006 and managed by Barclays Global Investors.

Nevertheless, they offer amazing benefits to investors. Besides the higher liquidity than investing in physical assets, silver (and gold) ETFs also have the following advantages:

Diversification: Silver is a great way to diversify a portfolio. During times of high market volatility and a sell-off of risk assets (such as equities, for example) silver tends to be stable and even increase in value due to its safe haven status.

Inflation hedge: There aren’t many asset classes that can efficiently hedge against inflation, but silver is one of them. Precious metals have been used as money for thousands of years, and they are still used to protect against inflation during times of market stress.

Capital preservation: Fiat currencies generally lose value over time. Central banks print billions of brand-new currency notes every single day, but the same can’t be done with silver. That’s why silver is often used by investors for capital preservation purposes.

Economic growth exposure: Even though silver is a popular safe haven, it also tends to rise in value when the global economy is booming.

Silver is used in many industries, from solar panels to rechargeable batteries, and as demand picks up during expansionary phases, so does the price of silver. That’s why you can benefit from expansionary phases in the economy if you buy silver ETF funds.

Best Silver ETFs to Invest In

Vanguard Global Capital Cycles Fund

While there is no dedicated Vanguard Silver ETF, the fund has some other options for silver investors to get exposure to the precious metal. In 2008, Vanguard announced a restructuring of its Precious Metals and Mining Fund and changed its name to the Vanguard Global Capital Cycles Fund.

The new fund is intended for long-term investors who want to complement their equity investments with a low-correlated fund, Vanguard said in a press release following the restructuring.

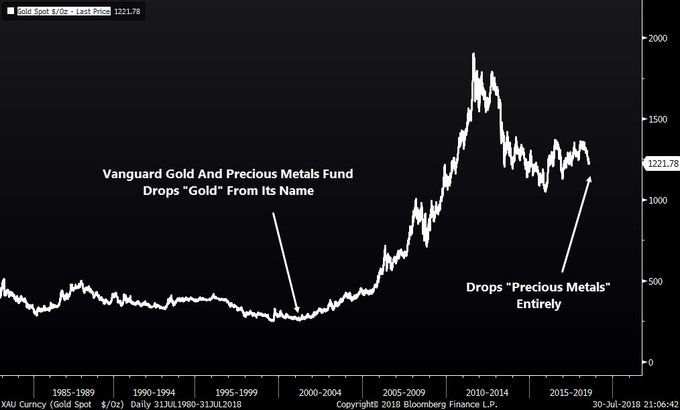

Figure 1 Source: Twitter @Sentimentrader

It’s interesting to note that Vanguard first dropped the word “gold” from its precious metals fund, after which a decade-long bull run in the commodity market started. Now that the fund completed dropped the words “precious metals”, some analysts argue that this could signal a bottom in the market and that both gold and silver could see a new and long-lasting uptrend.

The Vanguard Global Capital Cycles Fund (VGPMX) looks for opportunities based on investor sentiment and cycles of under- and overinvestment in capital-intensive industries. According to Vanguard, at least 25% of the fund will be invested in precious metals and mining securities. The minimum investment in the ETF is set at $3,000, and there is an account service fee per year of $20 for certain account balances below $10,000.

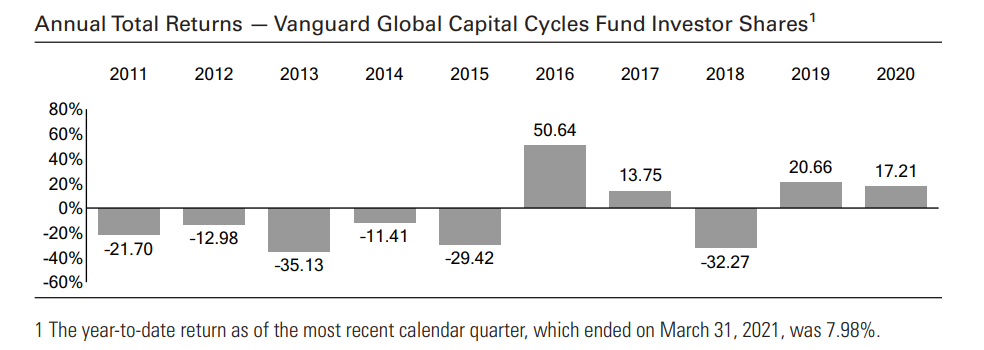

The fund’s management fees are 0.33%, other expenses are set at 0.02%, which equals to total annual fund operating expenses of 0.35%. Here is the performance of the fund for the last 10 years.

Figure 2 Source: vanguard.com

As you can see, the returns are pretty much uncorrelated with the broader stock market, which makes the Vanguard Global Capital Cycles Fund a viable option for long-term investors who want to add a fund with low equity correlation and relatively high exposure to precious metals to their portfolio.

iShares Silver Trust (silver ETF ticker: SLV)

The iShares Silver Trust is arguably one of the most popular names and the largest silver ETF out there. Introduced in 2006, this silver bullion ETF provides exposure to the day-to-day movement of silver prices in a convenient and cost-effective manner.

Investors are also able to request access to physical silver if their investment exceeds a certain threshold. The iShares Silver Trust is a great way to diversify a portfolio with silver, protect against currency devaluation and hedge against inflation in the markets.

The iShares Silver Trust manages around $14 billion of funds and has around 555 million silver ounces in trust. The fund trades on the NYSE Arca, comes with a sponsor fee of 0.50% and has a beta vs the S&P 500 of 0.65.

Beta is a measure of the tendency of a security to move with the market as a whole, i.e. a beta above 1 means that security is more volatile than the market, and a beta below 1 means that the security is less volatile than the market. A beta of 0.65 of the silver ETF SLV vs the S&P 500 therefore offers a good diversification and less exposure to the market’s volatility.

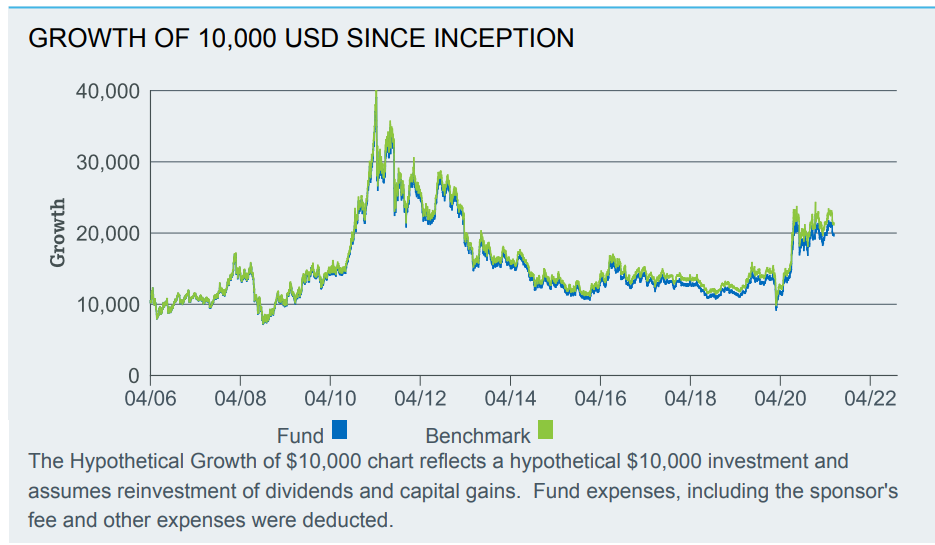

Figure 3 Source: ishares.com

The iShares Silver Trust closely follows the spot price of silver. In 2011, a hypothetical investment of $10,000 would have returned almost $40,000, when the price of silver peaked due to concerns about the monetary and fiscal stability of some European countries.

Invesco DB Silver Fund (DBS)

A top silver ETF is the Invesco DB Silver Fund (DBS). Invesco is a well-known American investment management company with headquarters in Atlanta and branch offices in 20 countries. It’s a constituent of the S&P 500 and has around $1.35 trillion of assets under management, making it one of the largest investment companies in the world.

The Invesco DB Silver Fund aims to track changes in the level of the DBIQ Optimum Yield Silver Index Excess Returns, which is a fancy name for a rules-based index composed of futures contracts on silver. This silver ETF US also provides interest income from holdings of US Treasury securities and money market securities.

The index provider of the fund is Deutsche Bank AG London, and the index ticker is DBCMYESI. Regarding fees, the fund comes with a management fee of 0.75% and an estimated futures brokerage fee of 0.04%, which leads to a total expense ratio of 0.79%.

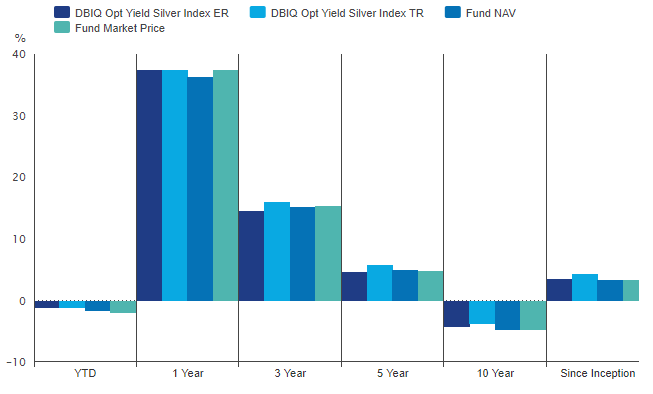

Figure 4 Source: invesco.com

Figure 4 Source: invesco.com

The chart above shows the quarterly performance of the Invesco DB Silver Fund and the Fund’s net asset value.

Investing In Silver With Fidelity

Fidelity Investments is an American multinational financial services company based in Boston. The company operates a brokerage firm, manages mutual funds, provides investment advice, wealth management, and retirement services, to name a few. This means, even though there is no “Fidelity silver ETF”, investors are able to buy silver ETFs if they have a brokerage account with Fidelity.

Fidelity also offers investments in precious metals bullion through FideliTrade or ScotiaMocatta. When trading bullion with Fidelity, the company only acts as an agent and doesn’t hold any inventory in precious metals.

Another way to invest in silver with Fidelity is to use silver futures. Futures offer an easy way to speculate on rising or falling prices in silver without the hassle of owning physical bullion. Futures also come with leverage, which allows investors to magnify their profits in case their call proves accurate. However, if silver starts to trade in the opposite direction, trading on leverage can also lead to large losses.

If you want to invest in silver ETFs through Fidelity, that’s also an option. ETFs allow you to invest in silver without owning physical silver and without the risks associated with futures trading. Popular Fidelity silver ETFs include the iShares Silver Trust, the Aberdeen Standard Physical Silver Shares ETF, and the ProShares Ultra Silver.

ProShares Ultra Silver

Talking about ProShares Ultra Silver, this ETF owns silver futures contracts which makes it more suitable for shorter-term bets on the price of silver rather than a long-term hold. The ProShares Ultra Silver seeks investment results that, before fees and expenses, correspond to two times the daily performance of the Bloomberg Silver Subindex.

It is a leveraged fund that uses 2x leverage to double the daily results of its benchmark index (hence the name 2x silver ETF). This means that daily returns are compounded, but also that losses can be far greater than without leverage. ProShares advises their investors to monitor their holdings as frequently as daily to avoid large losses and to be able to act in case their risk tolerance is exceeded.

ProShares Ultra Silver comes with an expense ratio of 0.95% which does not include brokerage commissions and related fees. The fund was introduced in 2008, trades under the ticker AGQ on NYSE Arca, and has net assets of around $570 million. The expense ratio also puts the fund at the more expensive spectrum of our silver ETF list.

Aberdeen Standard Physical Silver Shares ETF (SIVR)

Another extremely popular silver ETF is the Aberdeen Standard Physical Silver Shares ETF. The fund aims to track the price of silver bullion, less the fund’s expenses. The ETF is physically backed, which means it holds allocated silver bullion bars stored in secure vaults of JP Morgan in London, United Kingdom. There is an independent vault inspection performed twice a year, including once at random.

Aberdeen Standard reports their bar list transparently on aberdeenstandardefts.us. The silver is priced according to the LBMA’s specifications, which is an internationally recognized benchmark for silver pricing.

The LBMA (London Bullion Market Association) Good Delivery rules describe the physical characteristics of gold and silver bars for international investments and settlement. Good delivery bars are famous for their size (gold bars are 12.4 kilograms or 400 ozt, and silver bars are 31.1 kilograms or 1,000 ozt) and are the type normally used in the gold reserves of governments and central banks.

The fund, which was introduced in 2009, comes with a relatively low expense ratio of 0.30% and controls net assets of more than $1 billion (around 40.5 million ounces or 41 thousand bars.)

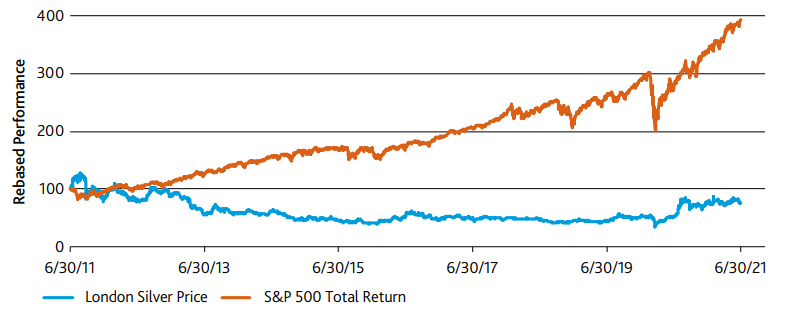

With a ten-year correlation of 0.068 of the fund vs the S&P 500 Total Return, the ETF is a great way to diversify an investor’s portfolio against falling equity prices, inflation, and currency devaluation.

Figure 5 Source: Aberdeen Standard Physical Silver Shares fact sheet

Global X Silver Miners ETF

The Global X Silver Miners ETF is a slightly different fund than the other funds mentioned earlier. Instead of owning physical silver bullion, or investing in silver futures, the Global X Silver Miners ETF provides access to a broad range of silver mining companies. The fund aims to provide investment results that reflect the price, before fees and expenses, of the Solactive Global Silver Miners Total Return Index.

Investors who choose to invest in the ETF take advantage of a cost-efficient way to get exposure to a basket of companies involved in silver mining. While mining companies are often highly correlated to the price of silver, they also offer a unique way to diversify a portfolio or profit on relative value trades.

The Global X Silver Miners ETF was introduced in 2010 and trades under the ticker “SIL”. The fund controls around $1.25 billion of assets and has a total expense ratio of 0.65%, which is slightly higher than some of the other funds mentioned earlier. However, since this ETF has to continually manage its holdings of mining companies, the higher expense ratio is a direct result of the fund’s active investing strategy.

Some of the top holdings of the fund include Wheaton Precious with 25% of net assets, Polymetal with 12.39%, Pan American Silver Corp. with 9.39%, Korea Zinc Co Ltd with 6.28%, and Hecla Mining Co with 5.25%.

The fund also invests in various countries across the world, which also provides investors a unique country-risk diversification. The majority of funds are invested in Canada, followed by Russia, United States, United Kingdom, and South Korea. It’s no surprise that major commodity-exporting countries account for the majority of investments made by the fund.

To Summarize…

- Vanguard Global Capital Cycles Fund (former Precious Metals and Mining Fund)

- Invests at least 25% in precious metals and mining securities

- Expense fee: 0.35%

- Best for long-term investors who want to diversify their equity investments

- iShares Silver Trust

- Invests in physical silver

- 555 million silver ounces in trust

- Sponsor fee: 0.50%

- 65 beta with the S&P 500 = Good for equity diversification

- Invesco DB Silver Fund

- Tracks changes in the DBIQ Optimum Yield Silver Index Excess Returns

- Also holds US Treasuries for interest income

- Total Expense Ratio: 0.79%

- Fidelity Investments

- As a brokerage company, offers various silver investments

- Bullion, futures, options, and silver ETFs included

- ProShares Ultra Silver

- Seeks returns of 2x the performance of Bloomberg Silver Subindex (includes leverage)

- Expense ratio: 0.95%

- Best for short-term investors who want to profit on strong directional movements in silver

- Aberdeen Standard Physical Silver Shares ETF

- Invests in physical silver bullion

- Regular vault inspections in London, UK

- Expense ratio: 0.30%

- Low correlation with the S&P 500 (0.068)

- Global X Silver Miners ETF

- Invests in silver mining companies across the world

- Expense ratio of 0.65%

- Offers unique diversification through mining companies in Canada, Russia, the United States, and other commodity-exporting countries

Final Words

ETFs have exploded in popularity in the last decade or two. They offer a cost-efficient way to get exposure to a variety of asset classes and market sectors, including precious metals. Silver ETF funds have the advantage that investors can get exposure to the precious metal without the hassle of buying physical bullion or paying for storage and transportation. Silver ETFs come with a small expense fee, but the costs are in most cases smaller than if investors would buy bullion or invest in a basket of mining companies by themselves.