ETFs have sky-rocketed in popularity in the last few decades, making them the go-to asset class for investing. They are easy to understand, are able to follow a broad selection of market securities, and come with very low management fees.

However, even when investing in ETFs, investors need to perform their due diligence and form an optimal ETF portfolio based on their risk investment goals, risk tolerance, investment horizon, and lifecycle. Not all investors have the same goals in the markets, so there is no one-size-fits-all in ETF investing. Here, we’ll shed some light on the best asset allocation ETF strategies when it comes to investing in ETFs.

Asset Allocation Strategies Explained

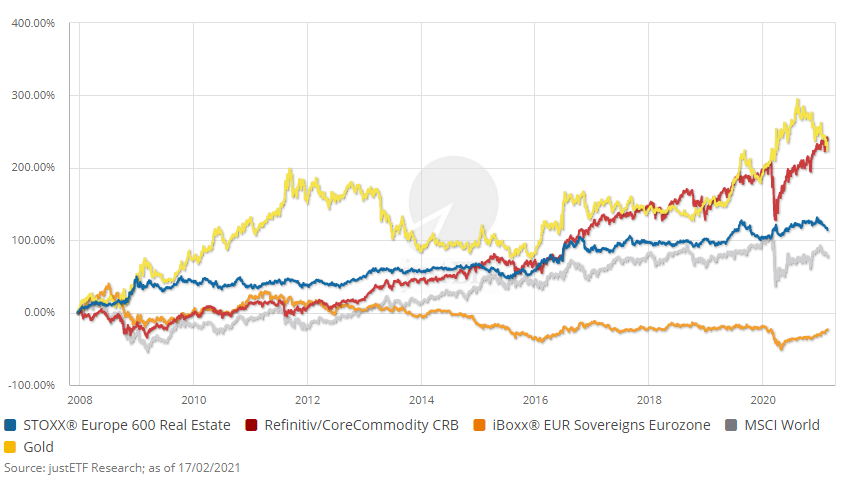

Whether you are investing in stocks, bonds, commodities, or ETFs, asset allocation strategies can help you reduce your overall market risk by diversifying and selecting an optimal asset allocation for your portfolio. Asset allocation ETF strategies are designed to meet the specific goals of an investor, whether it is capital preservation, capital growth, or regular income. The following chart shows the correlation of different asset classes over time and the importance of diversification when investing in ETFs.

ETFs, or Exchange Traded Funds, are exchange-traded financial products that can be bought and sold on a regular stock exchange, and that invest in a group of financial instruments based on the underlying index that they track. You can find ETFs that track almost anything, from value stocks to precious metals, and from emerging market bonds to exotic currencies.

Understanding where you want to invest and what risk you want to take is the first step in creating a well-rounded ETF portfolio. Asset allocation strategies allow you to pick the right asset classes to meet your investment goals.

Questions to Ask Yourself Before Investing

Before we dig deeper into the main types of ETF asset allocation strategies, we first need to answer some important questions. Those questions will help you understand your ultimate investment goals, which in turn narrows your investment decisions and makes it easier to form an optimal portfolio mix.

Investment Goals – What are your investment goals? Are you looking for maximum growth of your capital, regular income, or capital preservation?

Balancing these three goals is extremely important when investing in ETFs since you’ll have a hard time getting the best of all three worlds. Your investment goals are usually determined by your risk tolerance, investment horizon, and lifecycle.

Risk Tolerance – Every investor has a different tolerance of risk. Some are risk-takers and put more emphasis on ETFs that track stocks, while others are extremely risk-averse and invest more of their funds into ETFs that track bonds and less-volatile asset classes. An important takeaway here is that, in general, higher profits come hand in hand with higher risks, while low-risk investments generally produce a lower rate of return.

Investment Horizon – Another important point is your expected investment horizon. Do you want to stick to your investment for many years, even decades, or do you need your money back in a few months?

Investors who have a longer investment horizon are generally better off investing in more volatile asset classes like stocks, as they have more time to weather any market turbulence or bear markets. Investors with shorter time horizons should consider ETFs that track corporate or government bonds, and even hold part of their portfolio in cash.

Lifecycle – Last but not least, younger investors usually have fewer financial resources but a larger capacity to work and more time to recover from economic recessions compared to older investors. As a result, younger investors are generally more risk-tolerant and allocate most of their funds in riskier ETFs, while older investors prefer low-risk income-generating portfolios.

As a rule of thumb: percentage of risky asset classes in an ETF portfolio = 100 minus the investor’s age. So if you’re 30, you could invest around 70% of your funds in ETFs that track stock indices, for example. A 70-year-old investor, on the other hand, should allocate only a small percentage of his wealth to risky assets.

Main Types of ETF Asset Allocation Strategies

ETF asset allocation strategies are often grouped by their risk and investment goals. Depending on your risk tolerance, you can choose from conservative allocation strategies to strategies that aim for maximum growth. Here’s how to invest with each of them.

- Conservative ETF Asset Allocation Strategies

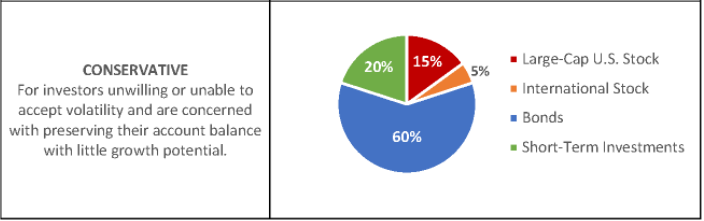

Risk-averse investors are best off using conservative ETF asset allocation strategies. These strategies usually have lower expected returns but are also less risky than strategies that focus on capital growth. Conservative asset allocation strategies put emphasis on bonds and other fixed-income securities, while equities are underweighted.

A typical conservative portfolio would put around 20-40% in equities, and around 60-80% in fixed income ETFs. Real estate is another asset class that is underweighted in conservative strategies given the volatility in housing prices.

On the equities side, conservative allocation strategies prefer the more stable large-cap stocks. A popular ETF for large-cap stocks is the SPDR Portfolio Large Cap ETF. Those stocks can account for up to 30% of a conservative portfolio, while the remaining equities exposure is achieved by investing in small-caps and developed world stocks. Popular ETFs include the SPDR Portfolio Small Cap ETF, and the SPDR Portfolio Developed World ex-US ETF.

The core of a conservative ETF portfolio consists of fixed income, which accounts for up to 80% of the portfolio. The SPDR Portfolio Aggregate Bond ETF is a popular choice. Investors who want protection against inflation can also invest in Treasury inflation-protected securities through the SPDR Portfolio TIPS ETF.

Emerging markets bond exposure can be achieved by investing in the Bloomberg Barclays Emerging Market Local Bond ETF, but try to keep the largest part of your fixed-income investments in ETFs that track developed markets. A Vanguard asset allocation ETF is also a popular choice among active investors. Just like with SPDR or iShares, a Vanguard asset mix portfolio can be created to meet your investment goals.

- Moderate ETF Asset Allocation Strategies

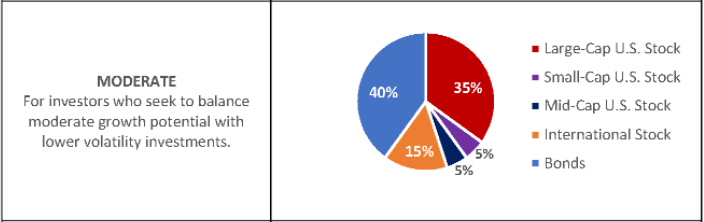

A widespread asset allocation strategy is the moderate approach, also known as the “60/40”. This strategy invests around 60% in stock ETFs and around 40% in fixed income ETFs. Moderate ETF asset allocation strategies are a balance between riskier growth strategies and conservative capital preservation strategies, which makes them a popular choice among investors of any age and risk tolerance.

The largest stock exposure in moderate asset allocation strategies consists again of large-cap stocks, followed by stocks from the developed world. However, in this strategy, investors may also allocate a small portion of their capital into emerging markets, international small-cap, and emerging markets small-cap.

Popular ETFs for those instruments include the SPDR Emerging Markets ETF, the S&P International Small Cap ETF, and the S&P Emerging Markets Small Cap ETF. Even though fixed income is underweighted in moderate allocation strategies, they still play an important part of the portfolio with around 40% of asset allocation. The SPDR Portfolio Aggregate Bond ETF and the SPDR Portfolio TIPS ETF remain popular choices in moderate allocation strategies, followed by the SPDR Bloomberg Barclays Short Term High Yield Bond ETF.

- Growth ETF Asset Allocation Strategies

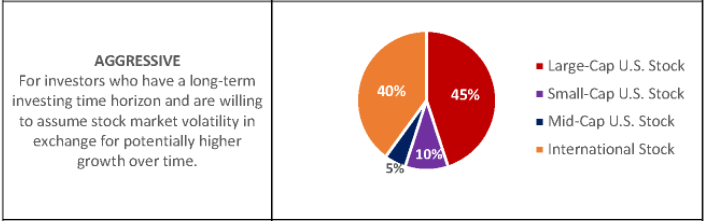

While conservative and moderate asset allocation strategies are the preferred type of portfolios for risk-averse and risk-neutral investors, risk-seeking investors will likely feel that those portfolios don’t generate enough return. That’s where asset allocation strategies that are focused on growth come into play.

In a growth ETF asset allocation strategy, investors can put anywhere between 70% and up to 100% of their funds into ETFs that track the stock market. The remaining part of their funds should be invested into fixed income and global real estate.

Besides the already mentioned large-cap and small-cap ETFs, risk-tolerant investors may also invest a smaller portion of their funds into emerging market ETFs, international small-cap ETFs, and – the riskiest type of stocks – emerging market small-caps.

To form an optimal international asset allocation portfolio, the iShares Emerging Markets Dividend ETF is an excellent choice. This iShares asset allocation ETF also comes with moderate fees of 0.49%.

To achieve maximum growth of their capital, investors can allocate 95% of their capital to stock ETFs, with large-caps still accounting for the majority of their investments. The remaining 5% of capital can be invested in global real estate in maximum growth global asset allocation ETF strategies.

Besides grouping asset allocation strategies by risk tolerance, investors can also form their optimal portfolio allocation based on their investment goals. Do you want regular monthly income or maximum growth over the long run? Here are the main types of asset allocation models depending on your goal.

- Growth-Oriented Strategies

As their name implies, growth-oriented strategies are designed for maximum growth of your capital over the long run. In those strategies, regular income is not a major concern as investors have enough funds to cover their regular expenses.

Since growth-oriented strategies have higher expected returns than other strategies, the majority of funds are invested in stocks. Large-caps still outweigh riskier stocks, but growth-oriented investors may also allocate a significant portion of their funds to younger companies with volatile prices and earnings.

- Capital Preservation Strategies

In capital preservation ETF strategies, the major consideration is reducing the risk of even the slightest loss of capital. In addition, these investors pay a lot of attention to liquidity, which means they want to have access to their funds within the next 12 months.

Capital preservation strategies are heavily invested into very liquid money market instruments, government bonds, investment-grade commercial papers, and municipal notes. Fixed income can account for up to 80% of a capital preservation ETF portfolio. Since the 2008 Financial Crisis, interest rates on bonds and fixed income have been rather low, which made capital preservation models underperform most other tactical asset allocation ETF strategies.

- Income-Oriented Strategies

In income-oriented strategies, regular income is the most important goal of the portfolio. These portfolios are designed to provide a steady and predictable income by investing in low-risk securities, which keeps the risk of losing money small.

Income-oriented portfolios invest primarily in fixed income securities, such as Treasury bonds and investment-grade corporate bonds, as well as in stocks of high-quality corporations (usually large-caps) that have a strong history of dividend payouts.

All of the mentioned asset classes are very liquid, which forms an excellent asset mix for income-oriented investors who want quick access to their funds. Given the low-risk characteristic and capped growth potential of income-oriented portfolios, they are best suited for investors who are risk-averse or want an effective asset mix in retirement.

A popular approach to select high-quality stocks for an income-oriented portfolio is to follow the criteria described by Benjamin Graham’s “The Intelligent Investor”. Here is a quick review of the criteria:

- Select large companies – Larger companies are usually more secure than smaller ones.

- Check financial conditions – The company should have a current ratio (total assets / total liabilities) of at least 2, which lowers the risk of bankruptcy.

- Earnings history – The company should have positive earnings in the last 10 years, at least.

- Dividend payments – Make sure the company has paid out dividends for the last 20 years and has preferably increased its dividends every few years.

- Stock valuation – The stock of the company should not be overvalued in terms of the P/E ratio. Look for a P/E ratio that is lower than 15.

- Earnings growth – Check if the company’s net income per share has increased by at least 1/3 over the last 10 years.

These criteria will allow you to select only high-quality stocks for the stock section of your income-oriented portfolio.

- Growth-Income Balanced Strategies

Some investors may want to take the best of both worlds when it comes to growth-oriented and income-oriented allocation strategies. This is where growth-income asset allocation mix strategies come into play.

In a growth-income portfolio, an investor aims to create a portfolio that delivers both regular income and that has long-term growth potential. This portfolio is usually riskier than an income-based portfolio, but less risky than a pure growth-oriented portfolio.

A growth-income portfolio invests into fixed income, like Treasuries and high-quality corporate bonds. But, the growth comes from another asset class: stocks. Dividend-payment stocks that have a strong growth potential are the best choice for these portfolios.

While established brands are good enough for income-based portfolios, they don’t provide enough growth. Younger, riskier companies in industries that have a bright future are better suited for growth-income portfolios.

When to Rebalance an ETF Portfolio?

Once the investor builds his perfect portfolio based on one of the ETF asset allocation strategies mentioned above, the work is not done just yet. Investors need to rebalance their portfolios to meet changes in the world economy, local economy, his or her investment goals, and lifecycle.

For example, a growth-oriented portfolio may be a great choice for younger investors, but as the investor nears retirement age, a less risky income-oriented or capital preservation portfolio may be a better option.

Also, when certain asset classes underperform or outperform other asset classes, an investor may want to reduce the weight of the underperforming asset class, increase the exposure to the outperforming asset class, or lock in some of the profits to reinvest the proceeds according to another asset mix strategy.

Investors who want to actively manage their investments may follow the current business cycle and make respective changes to their ETF portfolios.

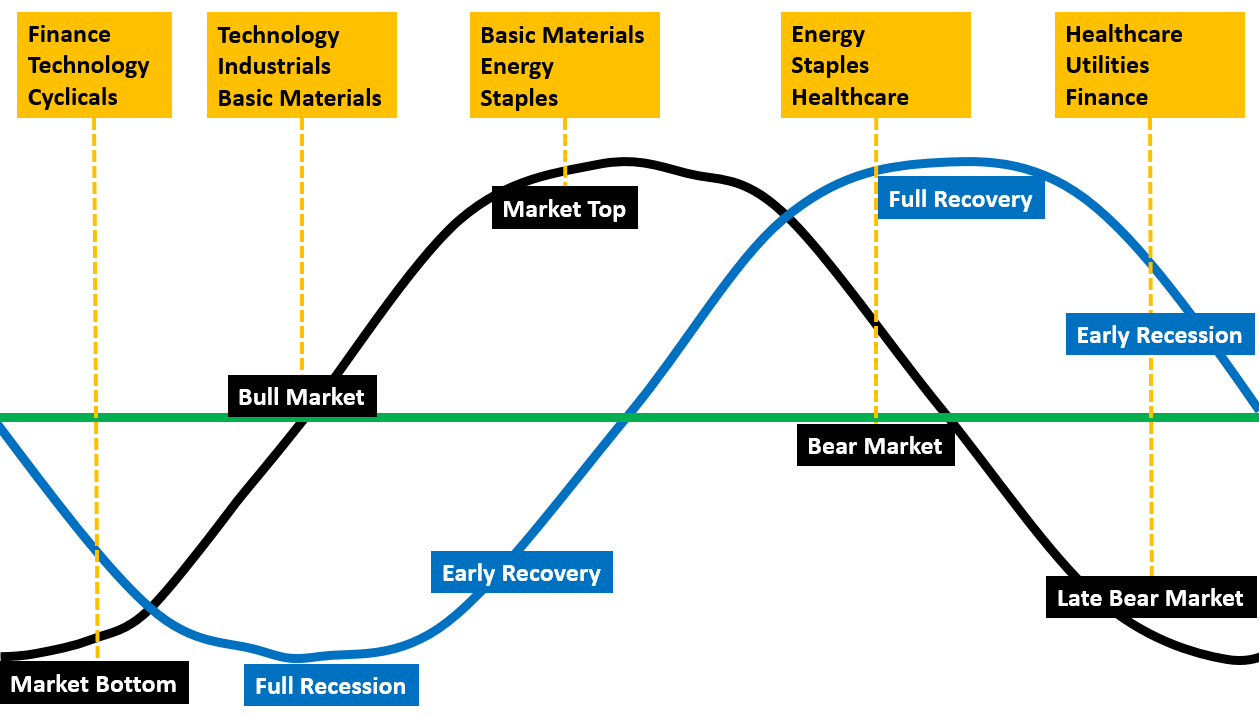

When the economy is booming, riskier asset classes tend to outperform safe-havens. This is the time when stocks reach new record highs, commodities enter a bull market, while fixed income securities fail to attract new buyers. Stock sectors also perform differently depending on the current business cycle, as can be seen on the following chart.

Chart Source: abovethegreenline.com

To cool down an overheating economy, central banks like the Fed will start to hike interest rates which makes money more expensive. As a result, business activity and investments slow down and consumer spending (loans) falls, which helps to keep inflationary pressures under control.

This is also the time when the stock market tends to peak and when interest in fixed income securities (bonds) starts to rise as higher interest rates make this asset class more attractive. Following the current business cycle by keeping an eye on leading indicators, such as PMI indices and the housing market, tremendously helps active investors in making better investment decisions.

Final Words

An asset allocation ETF portfolio helps an investor meet their investment goals based on risk tolerance, investment horizon, and current lifecycle. In terms of risk tolerance, investors may choose from the conservative capital preservation strategies to riskier capital growth strategies, with the income-oriented strategies fitting somewhere in between those two.

Capital preservation ETF asset allocation strategies are designed to provide maximum safety for investor funds. They achieve this goal by investing the majority of funds in safe asset classes, such as Treasuries and investment-grade corporate bonds. The remaining portion is invested in high-quality large-cap stocks.

Income-oriented strategies, as their name suggests, aim to provide a steady flow of income during the year. This is again achieved by investing in fixed income securities and government bonds with coupon payments, but also in high-quality stocks that have a proven track record of dividend payments.

Finally, growth-oriented strategies are designed to deliver maximum growth of the capital during the investment period. Those strategies are usually riskier than the other two as the majority of funds are invested in stocks, ranging from high-quality large-caps to small-caps, and even emerging market stock markets.