Many price action traders are familiar with various candlestick patterns, however, not too many are well-versed in the application of narrow range bars. Narrow range bars can offer insights into the development of future price action, and thus are important price action signals that should be studied alongside candlestick formations.

We’re going to be studying three types of narrow range bar formations in this lesson. This includes the NR4 bar, the NR7 bar, and the NR4/ID bar. Each of these three formations can offer solid trading opportunities, as they help us catch the next most likely price swing after a period of consolidation.

Understanding Market Volatility

Market volatility measures the relative price movements within a financial instrument. Volatility is an important consideration to make money in the markets.

Without it, the opportunity to take advantage of price swings would not exist. This is something that most traders understand intuitively, however, many are not aware that volatility tends to be mean reverting.

There is a distinct rhythm in the financial markets, and this appears as repeating cycles that are constantly moving between periods of calm and periods of excitement.

More specifically in technical analysis terms, the periods of calm are often seen on the price chart as trading ranges and consolidations; and periods of excitement are often associated with strong directional price movement.

This is the essence of market volatility. Markets move between periods of high volatility to low volatility, and from periods of low volatility to high volatility.

Many times it’s easier to predict future volatility than it is to predict future price movement. Once we’re able to recognize this rhythm, we can take steps in trying to locate periods of low volatility in expectation of a volatility expansion which can lead to the next directional price leg.

And along the same lines, we can use this information to begin scaling out of our position. After a period of high volatility has ensued, we can anticipate a slowdown in the form of price congestion. Knowing when to exit a trade is equally important as knowing when to enter a trade.

Generally speaking, most traders will tend to make money during trending periods, which is characterized by higher volatility periods.

And on the flipside, there will tend to lose the most amount of money during consolidations or range bound market conditions. It’s during these times of consolidation when volatility is often at the lowest point in the cycle.

As so, it’s important to pay attention to where we are within the overall volatility cycle. By doing so, It will help prepare you for the upcoming market terrain and allow you to better position into solid trading opportunities.

Now that you understand what market volatility is, how can we go about measuring it? Well, there are many different techniques at the trader’s disposal for measuring volatility in a particular market.

A popular measure of volatility in the equities market is the VIX. And options traders often use implied and historical volatility as well.

Price action forex traders often rely on candlestick and bar patterns to help them measure volatility trends. And that’s what we’re going to focus on here; the use of specific bar patterns on the price chart to measure and trade volatility setups.

Introduction To Narrow Range Bars

The concept of narrow range bars was popularized by Toby Crabel in his excellent book entitled “Day Trading With Short-Term Price Patterns And Opening Range Breakout”.

Several other authors have expanded on the concepts that he originally discussed in his book. Two of the more notable ones include Linda Bradford Raschke and Lawrence Connors, who cowrote “Street Smarts: High Probability Short-Term Trading Strategies”.

Essentially the idea behind narrow range bars is that a trend day or multi-day trend will often be preceded by a period of contraction, which can be easily seen and quantified on a price chart.

Though the original concept of narrow range bars was applied to intraday trading strategies, I have found that they are just as useful in their application for swing trading.

The narrow range bar strategy is a simple breakout strategy, that enters at a predefined high for a long entry, and at a predefined low for a short entry. These predefined levels are typically the high and low of the narrow range bar formation.

The beauty of the strategy lies in its simplicity. And although narrow range bar breakouts are simple to execute, they are nevertheless highly effective patterns when traded correctly.

The three main variations of the narrow range bar breakout strategy is the NR4 breakout, which is a breakout from the narrowest bar of the last four days. The second variation is the NR4/ID set up, and this entails a breakout from the narrowest range bar of the last four days which is also an inside day bar.

And the last variation of the strategy is the NR7 breakout, which is essentially the same as the NR4 breakout, however in the case of the NR7, we would look for a breakout from the narrowest range bar of the last seven days.

In addition to the different narrow range patterns, there are number of ways that a trader can filter the setups further in order to achieve the best results. One type of filter that’s typically used with narrow range bar set ups is a trend filter.

The trend filter only allow trades wherein the longer-term trend is in sync with the direction of the narrow range breakout. One of the more effective trend filters that can be incorporated with this strategy is a moving average.

We’ll be taking a closer look at each of three different variations on the price chart, and discuss a method for filtering and trading these narrow range bar setups.

Trading the NR4 Bar

The narrow range 4 or NR4 bar is the narrowest range bar over the last four trading days. As such, the NR4 pattern consists of four bars in total. The fourth or last bar will have a range that is less than the range of each of the previous three bars. Let’s take a look at what the NR4 pattern appears like on the price chart.

In the chart above, you can see the last four bars of price action noted on the chart. If you look closely, you can see that the last bar, bar four, has a smaller range than the previous three bars, bars 1 to 3. As such, bar 4 constitutes an NR4 bar, and validates the pattern.

The process for finding an NR4 setup is fairly straightforward. First, you need to check the high and low data for each of the last four bars. This will allow you to calculate the high low range for each bar.

Then you would compare the range of today with the range seen in each of the previous three bars. If you find that today’s range is less than the range of each of the previous three days, then the pattern can be labeled as an NR4 structure.

With today’s computing technology, it’s quite easy to write a script and program this process to be done automatically. Alternatively, you can access some free pre-programmed narrow range indicators that are available to perform this task.

In any case, once you have recognized the NR4 pattern on your price chart, you can take the next step in further evaluating and consider trading the set up. At the most basic level, the signal for entering into a long trade occurs when the price breaks above the high of the NR4 bar. Alternatively the signal for entering into a short trade occurs when the price breaks below the low of the NR4 bar.

NR4 Bar Trade Examples

We will create a simple strategy for trading the NR4 setup. The rules are outlined below:

NR4 Bar Setup Rules – (Using Daily Chart Timeframe)

Rules For Long NR4 Trade Setup

- The bar following the NR4 bar must break above the NR4 bar.

- Price must be above the 89 Period Simple Moving Average at breakout.

- Buy 1 pip above the high of the NR4 Bar

- Stop loss to be placed 1 pip below the low of the NR4 Bar

- Exit Trade at the close of 3 bars following the breakout bar.

Rules For Short NR4 Trade Setup:

- The bar following the NR4 bar must break below the NR4 bar.

- Price must be below the 89 Period Simple Moving Average at breakout.

- Sell 1 pip below the low of the NR4 Bar

- Stop loss to be placed 1 pip above the high of the NR4 Bar

- Exit Trade at the close of 3 bars following the breakout bar.

Now that we have rules in place for trading the NR4 set up, let’s take a look at a price chart and apply the strategy. The chart below is a daily chart of the British Pound-US dollar currency pair. You can see there are five arrows pointing to specific bars colored in blue. These blue bars represent NR4 bars. The light blue line noted on the chart is the 89 period Simple moving average line.

So let’s now analyze each of the five NR4 trading signals that occurred on this price chart. Starting from the far left, the first signal occurred at the break below the NR4 bar. We would’ve exited the position three bars after the breakout bar, which resulted in a profitable trade.

The second signal occurs shortly after the price crosses above the 89 SMA. Here, we would wait for a break above the high of the NR4 bar. We can see that occurred on the following bar, which was our signal to go long. We would’ve closed the position three bars following this breakout bar. This would’ve occurred upon the formation of the shooting star candle that formed the swing high.

The third NR4 trade signal occurred after a short pullback. Notice how the candle following this NR4 bar broke the high and closed near the top of its range. The stop loss which would be placed at the low of the NR4 bar and was never in jeopardy. The exit was triggered three days following the breakout bar, which occurred on a day wherein the bar itself was an NR4 candle. This is shown by the fourth arrow on the chart.

The last NR4 trade set up occurred as price was rising well above the 89 SMA line. You can see how price breaks the high of this NR4 bar and continues its upward movement over the next few days. The closing price on the last candle on this chart represents the exit point.

Trading the NR4/ID Bar

The NR4/ID bar has a similar structure to the NR4 bar, with the added condition that the last bar, the fourth bar, must also be an inside bar. An inside bar is one wherein the high low range is contained within the previous bar. And so, this narrow range inside bar set up occurs when we have an NR4, wherein the high low range of fourth bar is contained within the third bar within the structure.

Here’s an example of an NR4/ID bar pattern:

As can be seen here, bar four has a smaller range then each of the previous three bars, bars 1-3. As such, bar four is considered an NR4 bar. Now in addition to that, bar four, is also contained within bar three. More specifically, the high in bar four is a lower than the high seen in bar three, and the low of bar four is a higher than the low seen in bar three. Because of this, we can say that bar four is an inside bar pattern. And so the combination of the structure being both an NR4 bar, and an inside bar, characterizes it as an NR4/ID bar structure.

The process for locating and NR4/ID bar structure is similar to that of an NR4 bar structure, with one notable added condition. That condition being that bar four must also be an inside bar.

The basic signal for entering into a long trade for the NR4/ID set up occurs when the price breaks above the high of the NR4/ID bar. And conversely, the signal for entering into a short position occurs when the price breaks below the low of the NR4/ID bar.

NR4/ID Bar Trade Examples

Here are a simple set of the rules for trading the NR4/ID Bar Setup:

NR4/ID Bar Setup Rules – (Using Daily Chart Timeframe)

Rules For Long NR4/ID Trade Setup

- The bar following the NR4/ID bar must break above the NR4/ID bar.

- Price must be above the 89 Period Simple Moving Average at breakout.

- Buy 1 pip above the high of the NR4/ID Bar

- Stop loss to be placed 1 pip below the low of the Outside Bar. (This is the bar immediately preceding the NR4/ID Bar)

- Exit Trade at the close of 6 bars following the breakout bar.

Rules For Short NR4/ID Trade Setup:

- The bar following the NR4/ID bar must break below the NR4/ID bar.

- Price must be below the 89 Period Simple Moving Average at breakout.

- Sell 1 pip below the low of the NR4/ID Bar

- Stop loss to be placed 1 pip above the high of the Outside Bar. (This is the bar immediately preceding the NR4/ID Bar)

- Exit Trade at the close of 6 bars following the breakout bar.

Let’s now turn our attention to the chart below which illustrates how we could go about trading this Inside day strategy based on the rules above. The chart is a daily chart of the US Dollar-Swiss Franc pair. Each of the six blue arrows points to a NR 4/ID bar. You will notice that on this chart that the NR4/ID bars are filled as black candles. The downward sloping light blue line above the price action represents the 89 period Simple Moving average.

So starting from the left side of the screen, we can see that the first NR4/ID bar setup would not have executed a trade. The reason being is that the bar following this NR4/ID bar does not break below its low on the next bar. As such we would pass on this particular set up.

The second NR4/ID bar would’ve executed one pip below its low. We can see that this occurred well below the 89 SMA line and did so during the candle following the NR4/ID candle. The stop loss would’ve been placed above the outside bar, which is the bar preceding the NR 4/ID bar. We would’ve exited the trade for a profit at the close of the sixth bar following the breakout, which is the first up candle shown after the breakout.

Moving on to the third NR 4/ID set up which occurs near the middle of the price action on this chart, we would again be looking for a short opportunity. However this did not materialize because the bar following the NR4/ID candle did not break below the low on the following candle. This would’ve resulted in bypassing the trade opportunity.

Looking at the fourth potential set up, we can see a very narrow range bar that formed the NR4/ ID structure. The short entry here would have been executed on the following bar with a stop loss above the high of the previous outside candle. The trade would’ve been exited for a profit at the close of the sixth bar following the breakout bar.

The fifth NR4/ID bar set up was also a valid shorting opportunity. Notice how the bar following the NR4/ID bar breaks below the low, thus executing a short entry. We were not in any jeopardy of the stop loss being hit, and we would’ve been able to exit with a profit on the sixth candle close following the breakout, which is shown here as the first green candle following the breakout to the downside.

The last NR4/ID trading set up occurs near the far right edge of this chart. Notice how the 89 SMA is well above the short entry trigger, and we would’ve been well protected with our stop loss being placed just above the outside bar. Our take profit point would have been the sixth bar following the breakout, which was quite bearish, and is seen as the next-to-last candle shown on the chart.

Trading the NR7 Bar

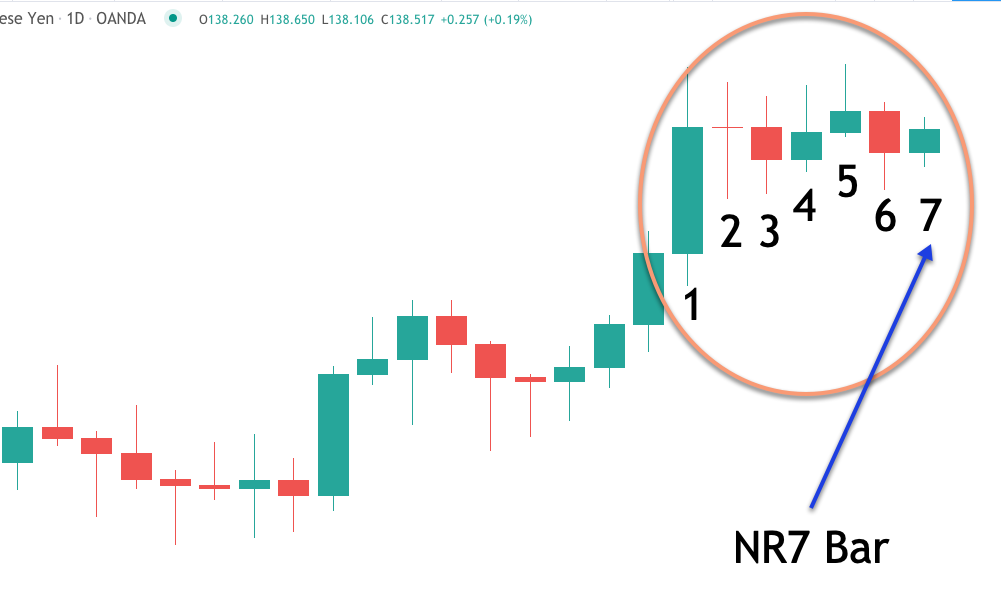

The narrow range 7 or NR7 bar is the narrowest range bar over the last seven trading days. As such, the NR7 pattern consists of seven bars in total. The seventh or last bar will have a range that is smaller than the range of each of the previous seven bars. Let’s see what the NR7 bar pattern looks like on a price chart.

In this chart example, you will notice the last seven bars of price action circled. Notice how the final bar, bar seven, has a narrower range than the previous six bars preceding it. So simply, bar seven has a smaller high low range, then each of the bars numbered one through six. As a result, bar seven can be labeled as an NR7 bar, and confirms the pattern.

As with the process for locating the NR4 pattern, we will follow the exact procedure in locating an NR7 formation as well, with one exception. Instead of confirming the high and low data points for each of the last four bars, we will lookback a total of seven bars when evaluating the NR7 pattern.

As for the entry signal, the NR7 trading set up works the same way as the NR4 set up. That is to say that a long signal occurs when the price breaks above the high of the NR7 bar. And the signal for entering into a short position occurs when the price breaks below the low of the NR7 bar.

You might be wondering at this point, what the practical difference is between trading in NR7 versus an NR4 set up, and why we might choose one over the other. Well, it should be obvious to you, that you will witness many more NR4 set ups then NR7set ups, due to the less stringent requirement for the NR4 bar versus the NR7 bar.

The NR7 bar requires a higher level of compression in the price action than does the NR4 bar. And as a result of this, we will often see a breakout following in NR7 bar to be more substantial than a breakout that occurs following an NR4 bar. This is not always the case, however, in a good percentage of cases, this guideline holds true.

NR7 Bar Trade Examples

Below you will find the rules outlined for trading the NR7 Bar Setup:

NR7 Bar Setup Rules – (Using Daily Chart Timeframe)

Rules For Long NR7 Trade Setup

- The bar following the NR7 bar must break above the NR7 bar.

- Price must be above the 89 Period Simple Moving Average at breakout.

- Buy 1 pip above the high of the NR7 Bar

- Stop loss to be placed 1 pip below the low of the NR7 Bar

- Exit Trade at the close of 6 bars following the breakout bar.

Rules For Short NR7 Trade Setup:

- The bar following the NR7 bar must break below the NR7 bar.

- Price must be below the 89 Period Simple Moving Average at breakout.

- Sell 1 pip below the low of the NR7 Bar

- Stop loss to be placed 1 pip above the high of the NR7 Bar

- Exit Trade at the close of 6 bars following the breakout bar.

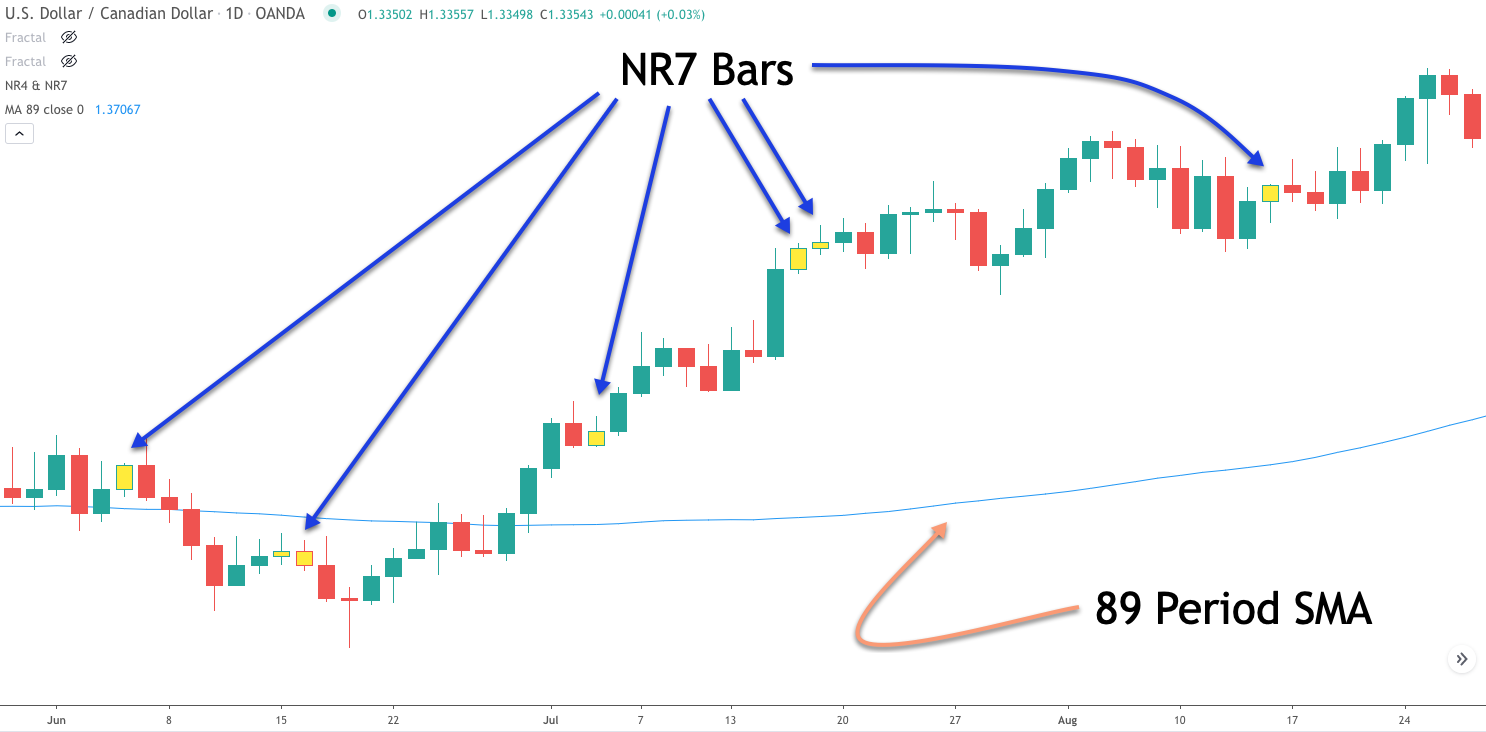

Now that we understand the rules for trading the NR7 bar set up, let’s take a look at some practical examples. The chart below displays the US Dollar-Canadian Dollar pair on the daily timeframe. There are a total of six signals shown on this chart, and the yellow candle bodies represent the actual NR7 bars. And again the light blue line towards the bottom of this chart represents the 89 period Simple moving average line, which is our trend filter.

Starting at the far left we can see that the first NR7 bar set up would’ve called for a long entry on the following bar. This would have resulted in the position being stopped out as the low of the NR7 was triggered shortly after the entry.

Moving on to the second NR7 bar set up, we would be looking for a short entry following the NR7 bar. A breakout occurred on the following bar, which got us into a short position here. Here too, the trade resulted in a loss as price eventually broke above the NR7 candle triggering our stop loss. This occurred around the same time the price was moving from below to above the 89 SMA line.

We can see that the third NR7 set up occurred shortly after a cross above the 89 Simple moving average line. A long entry was triggered on the break above the high of the NR7 bar on the next candle. We would place the stop below the low of the NR7 bar. Our exit would’ve occurred on the close of the sixth bar following the breakout bar. This can be seen by the shooting star candle formation that occurred preceding the strong green candle.

The fourth NR7 bar set up appears the day after the aforementioned strong green candle. Interestingly enough, the break above the high of this NR seven candle eventually formed an NR7 candle itself. However at this point we were already in the trade on the long side, and would have continued with the position until our exit signal, which ultimately resulted in a profitable trade.

The last NR7 candle formation is well above the 89 SMA. We can see that the price broke to the upside the next day resulting in the triggering of our buy entry order. The exit would be triggered on the sixth bar, which in this case is the sixth day, following the breakout bar. This is shown by the last green candle on this price chart.

Summary

You should now have a pretty good understanding of how volatility contraction and volatility expansion works in the market. I showed you three different bar formations that can assist you in locating periods of consolidation in the market, that can lead to a short-term price trend.

There are many different ways that you can incorporate narrow range candles into your trading, I’ve illustrated a few simple concepts for trading narrow range bars in this article, which should serve as a good starting point for you to expand on these ideas and incorporate them within your overall trading plan.