The capital markets of a nation generally give a good indication of its economic health, as does the relative valuation of its currency compared to other major currencies.

The capital markets of a nation generally give a good indication of its economic health, as does the relative valuation of its currency compared to other major currencies.

Furthermore, the strength of a country’s bond tend to have an impact on the worth of that nation’s currency since large international investors tend to place their money where the best bond rates can be obtained. This flow of “Big Money” can substantially move foreign exchange rates to favor higher yielding currencies that also offer safe returns.

Government bonds, which are generally issued by a nation’s treasury, play a central role in the value of a nation’s currency because their issuance typically increases the debt burden of the country. Also, their average yield and the bid to cover ratio seen when they are auctioned off can impact the forex market.

Being familiar with and understanding the way interest rates and government bond markets affect currency valuations is very important, and such factors are closely monitored by experienced forex traders to determine longer term trends. Fluctuations in U.S. Treasuries — especially U.S. Treasury bond yields — are one of the prime valuation factors behind U.S. Dollar movements that many novice traders tend to ignore — at least until they find out how important they are.

A forex trader needs to be aware that a change in the yield of U.S. Treasury bonds will have a direct impact on the valuation of the U.S. Dollar. Because of how closely these two markets tend to be correlated, knowledge of how Treasury bond yields and other government bond yields affect their respective currency’s valuations can be a powerful tool for currency traders.

What are Bonds?

Bonds are debt instruments that can be used by corporations and governments to access relatively low rates of interest on funds they need to borrow.

Governments issue bonds at all levels, such as the Federal, State and Municipal levels in the United States.

Bonds provide governments and corporations with a cheaper source for borrowing funds than other types of loans.

The issuer of the bond generally sets the terms for financing and borrowing, which includes setting the bond repayment period and the coupon payments at levels they find convenient. At the subsequent bond auction, investors will agree to pay a price for the bonds that will then determine its average yield observed at the auction. Bond buyers generally get coupon payments that is basically interest on their principal amount invested, which is paid periodically in intervals of 30 days, 60 days, 90 days, 120 days, 3 years, 5 years, 10 years and 30 years, for example.

The bond’s yield is its annualized effective return given the price that was paid for the bond and the coupons that are still due to be paid on it.

Furthermore, the price of the bond refers to the amount the buyer paid for the bond, or its current market valuation, while the bond coupon is the amount of interest that the buyer of the bond is periodically paid by the bond issuer for using the bond buyer’s principal.

Note that the price of a bond has an inverse relationship to its yield. When the price of the bond rises, the yield declines, and when the bond’s price falls, the yield rises. This is an important concept for forex traders to realize regarding Treasury bonds. Generally, if investors are bearish on bonds, the yield on the bond increases and implies higher future rates of interest, which is typically bullish for the U.S. Dollar, while if investors are bullish on bonds, the yield declines and suggests lower future interest rates, which is generally U.S. Dollar bearish.

U.S. Government Bills, Notes and Bonds

For this section, we will examine U.S. Treasury bills, notes and bonds, the yields of which tend to have the most impact on the major forex market currency pairs that include the U.S. Dollar. In general, bills mature in one year or less, notes mature in two to ten years, and bonds mature in ten to thirty years.

Furthermore, a few additional bond related terms need to be defined. In the bond market, the term “zero coupon” means that the debt instrument does not pay any coupons. Such assets are sold at a value less than “par” or 100 percent of their notional or face amount.

For example, if a Treasury bill has a notional amount of $1,000, the investor will pay an amount lower than par or $1,000 for the bond and will then receive the full $1,000 at maturity without having otherwise received any coupon payments. For a six month Treasury bill, if the amount initially paid for the instrument was 98 percent of the par value or $980, then the return of $1,000 minus $980 or $20 on the investment would represent an annualized return of four percent without compounding.

Treasury bills have the shortest term maturities and are always sold as zero coupon instruments, in contrast to Treasury notes and bonds that have longer maturities and coupon payments. In addition, interest rates on government bonds are determined as a percentage of par for those longer term debt instruments that have coupon payments, as is generally the case with Treasury notes and bonds. These coupons are paid periodically throughout the life span of the instrument and result in a certain effective rate of interest or yield that can influence and be compared to prevailing market interest rates for similar periods.

The U.S. Treasury typically announces the coupons on their bonds before the bond auction takes place. This is done so that investors can decide on the amount they wish to pay for the bond. If the Treasury is paying a coupon over the prevailing interest rates, then investors might bid up the bonds and even take the price over par, to 101 or 102 for example.

How would this affect the currency market? Well, if foreign investors plan on purchasing U.S. Treasuries at an auction, they will also need to purchase U.S. Dollars to buy those bonds with. This is the principal reason that when there is a “flight to quality” in times of geopolitical distress, U.S. Treasuries get bought up since they are considered such a safe investment, and investors buy U.S. Dollars in order to do so. The U.S. Dollar then rises in value relative to the currencies of other nations due to this increased demand.

Alternatively, when the mentality of international investors shifts towards having an increased appetite for risk, a sensible view on the price of U.S. Treasuries would be bearish and yields bullish. This is due to the fact that such investors will prioritize buying instruments with the highest return and such instruments are generally denominated in currencies other than the U.S. Dollar.

The currencies which are often favored by investors with a higher risk appetite are the higher yielding currencies like the New Zealand and Australian Dollars. These currencies are noted for their large current account deficits and offer a higher interest rate to compensate for the risk of their national currencies depreciating. The higher yield on these currencies and their government bonds is how investors are compensated for taking that extra risk. Forex carry trades tend to be profitable in this type of environment.

Conversely, during a risk averse environment, the view on prices in the U.S. Treasury market is bullish and yields bearish, since such investors are generally fearful and looking to protect their money. Currencies favored in this market environment are the so called “safe haven” currencies that include the U.S. Dollar, the Swiss Franc and the Japanese Yen. Currency carry trades are typically unwound under these risk averse investment conditions.

Using the Bid to Cover Ratio to Gauge Government Bond Demand at Auction

A key measure of the demand for U.S. Treasury bills, notes and bonds is what is known as the “bid to cover ratio”. The bid to cover ratio compares the volume of bonds that dealers and investors have made bids for with the volume of debt securities actually offered for sale. For example, if the Treasury offers $10 billion in Treasury Bills for sale at auction, and investors have entered bids for $15 billion, then the bid to cover ratio is 1.5.

A high bid to cover ratio means the auction was a success and this typically benefits the relevant currency since investors will need to buy that currency to purchase the bonds they bid for. This important piece of information is released to the public after all major Treasury auctions, as well as after bond auctions in other countries.

Typically, the success of a Treasury auction is judged based on how the bid to cover ratio of the current auction compared to that of previous auctions. If the auction significantly outperformed the previous auctions by having a higher bid to cover ratio, then that auction would be deemed successful.

Some analysts consider that a Treasury auction is extremely successful if it has a bid to cover ratio of 2.0 or more. Furthermore, a negative bid to cover ratio would indicate low demand for that particular issue. This would tend to result in a softer U.S. Dollar in the currency market since fewer foreign investors will be buying dollars to purchase the issue.

How Bond Yields Affect Currencies

Government bonds tend to have lower yields when compared to other investment assets like stocks due to their perceived safety. This is because coupon payments on government bond instruments are virtually guaranteed, so they are considered to be very safe investments.

With that noted, corporate bonds and the bonds issued by some riskier municipalities can have a significant risk of default on coupon payments or even the repayment of principal amounts.

When an increase in investor “risk aversion” results in a “flight to quality”, such investors tend to buy U.S. government bonds and their yields decline relative to those observed in other markets. When this happens, the value of the U.S. Dollar rises and the relative values of other currencies will typically decline.

As an example of how the valuation of a currency relates to its respective government bond prices when major economic data is released, consider the relationship between the U.S. 10 Year Treasury Note and the U.S. Dollar.

Upon the release of a significantly better than expected U.S. Retail Sales number, the market in the 10 Year Treasury Note will usually fall sharply, thereby causing higher bond yields.

The higher bond yields indicate a risk of higher U.S. interest rates. Also, the high yield bonds will attract foreign investors, which sell their local currency to buy the U.S. Dollar in order to purchase the bonds. This causes the U.S. Dollar to appreciate against those currencies.

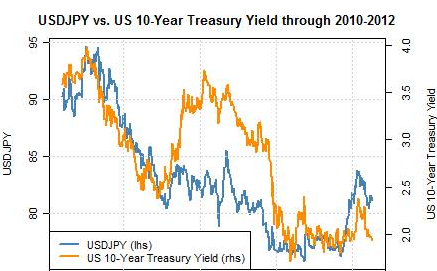

As noted in the previous example, government bond interest rates — as reflected in Treasury bond yields — can have a considerable influence on the value of the U.S. Dollar. The chart that follows shows the typically strong correlation of the U.S. 10 Year Treasury bond yield with the U.S. Dollar versus the Japanese Yen exchange rate from 2010 until 2012:

Figure #1: The U.S. 10 Year Treasury Bond yield shown in gold plotted over the USD/JPY exchange rate shown in blue over the period from 2010 to 2012.

The graph also illustrates that with an increase in the U.S. 10 Year Treasury bond yield, a corresponding rise can be seen in the USD/JPY exchange rate. Conversely, when the bond yield declines, a decline can also generally be observed in USD/JPY. This highlights the positive correlation between government bond rates and the value of the U.S. Dollar, which is 0.61 in this case.

Bond Spreads, Interest Rate Differentials and the Forex Carry Trade

Bond Spreads, Interest Rate Differentials and the Forex Carry Trade

Government bond trading and Treasury bond rates can play a significant role in the foreign exchange market. With increased access to international markets, and when bond yield and interest rate differentials are elevated, hedge fund managers remain open to investing in countries that offer higher yields.

As an example of a carry trade, consider the situation where prevailing interest rates in Australia are more than five percent, while U.S. interest rates are under two percent. Such a substantial interest rate differential would suggest an investment strategy that would take advantage of the interest rate differential between the two major economies.

The most successful carry trades have a positive interest return or carry, which involves going long the higher interest rate currency and shorting the lower interest rate currency, and also combines a directional trend strategy that would favor the higher interest rate currency over the anticipated investment horizon.

The combination of these two favorable conditions would take advantage of the direction of the currency held on the long side, while funding the trade with a short position in the low interest rate currency. This led to enormous profits for some forex carry traders, as was seen in 2000 with those going long the Australian Dollar against the U.S. Dollar.

When the yield spread between the U.S. Dollar and the Australian Dollar began to increase in 2000, the Australian Dollar began to climb within a few months. The interest rate differential was then 2.5% in favor of the Australian Dollar, which over three years would translate into a +37 percent increase in AUD/USD currency pair. In addition to the trading gains on the currency position, investors also received daily interest on the carry trade.

Besides the popular AUD/USD carry trade, the lower yielding Swiss Franc and Japanese Yen have also commonly been used to fund carry trades by being shorted against the higher yielding Australian and New Zealand Dollars. The carry trade was especially profitable in 2007 when Japan’s bond yields were just half a percent, while Australian bond yields reached 8.25 percent at one point.

By the time of the global economic crisis of 2008, the international bond market had gained significant ground. Many nations began cutting interest rates, which led to the unwinding of carry trades, putting substantial pressure on the Australian and New Zealand Dollars.

The popularity of the carry trade strategy has diminished in recent years along with narrowing yield spreads among the major currencies. Nevertheless, some hedge funds, investment banks and other financial institutions still take advantage of interest rate differentials by entering into carry trades when they think conditions are appropriate for achieving a favorable return.