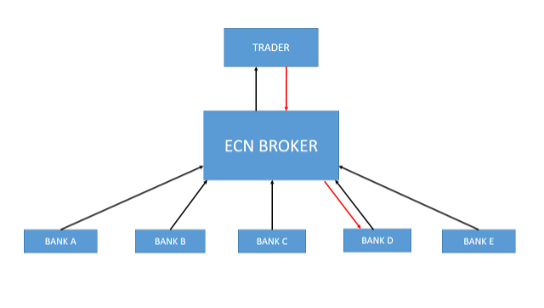

ECN stands for Electronic Communications Network. Simply, it a network of computers which are connected together. In the case of an ECN forex broker, the broker is connected to a network of market makers. The market makers provide price liquidity to the ECN FX broker. This liquidity allows the broker to offer tighter bid offer spreads than a standard dealing desk broker.

A true ECN broker receives prices from several interbank market players through the electronically connected network. This can reduce the bid offer spread at times to as low as 0.1 pips or even zero pips.

A big feature in pure ECN brokers is that they do not take the other side of your trade. This means they will never trade against you or have any possible conflict of interest. The ECN network of market makers will always be the other side of your trade.

A true ECN account means that you will trade with no human intervention whatsoever. The ECN is computerized and a totally automated process meaning no dealing desk is necessary.

Direct Advantages

As we have seen, the ECN forex broker gets their prices from several market players. These prices are passed on to the traders as they are. This is why the bid offer spread can sometimes be so minimal. However, the broker will of course charge a fee as a commission. The fee is usually a smaller cost than most dealing desk brokers charge.

A standard broker will receive prices from one or two market makers and widen them. The difference between the price received and the price quoted is the mark-up the broker makes. This mark-up is usually larger than the fees charged by ECN brokers.

An ECN broker is also set up for STP, Straight Through Processing, which means your trade is sent directly to the counterparty quoting the price. With ECN STP brokers you have some of the fastest execution speeds as well as the tightest possible bid offer spreads available.

Some traders don’t like seeing fees charged to their accounts. With standard brokers, the fee is quoted in the bid offer spread. So, although invisible on your P/L it may hit your bottom line in a bigger way.

The chart above shows the price flow from the Banks to the Broker, the broker then passes these prices on as they are. The trader receives the highest bid and lowest ask that the broker gets from his network.

During out of market hours, you may see the bid offer spread widen with most dealing desk brokers. With ECN forex brokers this is less likely, because most banks have international desks, covering the three main financial centers. This means you will be able to trade with the same price liquidity offered by the market, rather than that offered by the broker.

Top ECN Forex Brokers

Let’s have a look at some of the best ECN brokers. When you approach any broker the first question that should be asked is, are they regulated? The broker must be under the supervision of a tier-1 national regulator. A regulator will help to guarantee transparency and assure there is no malpractice on behalf of the broker. Choosing among ECN regulated brokers means that you can rest assured your money is safe.

It is not easy to determine which brokers are the best MT4 ECN brokers. However, we feel this is a comprehensive list of what could be the best ECN forex brokers, although there may be others that have escaped our attention.

Generally, brokers will offer two types of accounts – raw & standard. The raw account type means that prices are passed on to the trader as they are and a fee is charged separately. A standard account widens the bid offer spread slightly, and there is no extra fee to pay, as the broker makes their commission through the mark-up in the spread.

List of ECN brokers with MT4

Pepperstone

IC Markets

FP Markets

FxPro

IG

HotForex

Pepperstone

Pepperstone is a UK-based broker and regulated by the FCA (Financial Conduct Authority). The broker also has an outside auditor, namely Ernst & Young. The oversight of the central authority and review from a top-four audit firm make this broker a highly reliable one. The broker has a very strong presence in the UK, where it is based and is also well recognized globally.

A standard account offers MT5 as well as cTrader along with MT4 platforms. You can also implement automated trading and copy trading. The copy trading is offered through 2 different services MyFxBook, and MetaTrader Signals.

In EUR/USD Pepperstone offers as low as zero bid offer spread with its Razor account, or raw account. The average EURUSD spread with a standard account is 0.6 pips, with the Razor account the average spread is 0.09 pips. Commissions start from as low as $3.76 per lot per trade, or $7.53 per round trip, buy and sell.

Swap fees are charged at the ongoing rate as passed on by the liquidity provider that executed the trade. These rates are published and viewable on the Pepperstone website. This broker also offers trading in other financial markets such as indices, commodities, and cryptocurrencies. They have a wide spectrum of markets covering a total of 180 different financial products.

Pepperstone also has one of the fastest execution speeds, very useful for scalpers or automated high-frequency traders. UK traders can be at a disadvantage when it comes to execution speed if the liquidity providers are based in New York. The broker has made up for this by installing a direct fiber-optic connection from London to New York. The response rate has also been improved. Pepperstone has partnered with Equinox whose servers are in New York and very close to the banks providing liquidity, thus decreasing latency even further.

IC Markets

This broker is based in Australia but also operates from its EU affiliate based in Cyprus. They also have their MetaTrader server located in New York, as well as London, with Equinox. This connection ensures very low execution speeds for its traders.

In Australia, the broker is regulated by the ASIC (Australian Securities and Investments Commission) and also complies with FSA regulatory requirements. While the EU entity is regulated by the CySEC (Cyprus Securities and Exchange Commission) this authority is based in the EU and maintains implementation of MiFID II rules for increased transparency and fairness.

The broker offers MT5, cTrader as well as MT4, all these platforms allow for automated trading. Along with forex, traders also have access to a full array of financial markets including stocks, bonds, indices, commodities, futures, and cryptocurrencies.

Opening an ECN account with this broker gives you access to a network of 25 banks and other market makers that provide price liquidity. Spreads can run as low as zero pips, with an average of 0.1 pip, in EUR/USD depending on the ECN market price availability.

Commissions are also very low, with $3.0 per $100,000 using cTrader and $3.5 per lot when using MetaTrader platforms. The cTrader platform does not calculate per lot, rather it calculates per dollar. For example, if you open a trade in EURUSD in 1 lot at 1.3000 your fee will be equal to 100,000 X 1.3000 X 0.00003 = $3.90, if you close the trade at 1.3100 your fee will be equal to 100,000 X 1.3100 X 0.00003 = $3.93, for a round trip fee of $7.83

The broker offers 3 types of accounts:

cTrader Raw Spread

MetaTrader Raw Spread

MetaTrader Standard

All three have a minimum deposit of $200 and 1:500 leverage. They also offer automated trading, 64 different forex pairs, CFDs for trading indices, and Islamic accounts. The Standard account does not charge commissions, as the fee is incorporated in the bid offer spread which starts at 0.6 pips. The server for the cTrader account is located in London while the two MetaTrader servers are located in New York.

FP Markets

FP Markets is also based in Australia with operations in Cyprus. The Australian entity is regulated by the ASIC while the Cyprus entity is regulated by the CySEC. The broker offers MetaTrader platforms 4 & 5, plus MT4 and MT5 Webtrader. Webtrader allows you to trade on any browser on any device without downloading extra trading software.

Servers are connected to the Equinox grid in New York. The broker offers a service, VPS (Virtual Private Server), through which their partner Liquidity Connect allows you to achieve low latency times in order execution.

This is a CFD broker and offers trading on hundreds of financial products, with 60+ forex pairs, indices, metals, and commodities. Two account types are available: Raw and Standard. Both have a minimum deposit of AUD100 or equivalent, 1:500 leverage, ECN pricing, and cover all markets. Commissions for the Raw account are $3.00 per trade buy or sell, while standard accounts have spreads starting at 1.0 pips.

Social or copy trading is also available with this broker. You can set up a copy trading account directly through their portal for social trading. Using your login details for MT4 or MT5 you can access their portal to set up risk parameters like stop loss or take profit and choose the traders you want to follow. Their traders are listed by rank based on their performance over a given period, with the trader’s full performance history available.

FxPro

FxPro was founded in 2006, is based in the UK, and is regulated by the FSA. In the EU it is regulated by the CySEC, in South Africa by the FSCA (Financial Sector Conduct Authority), and internationally by the Securities Commission of the Bahamas.

The broker offers trading on four platforms, MT4, MT5, cTrader, and its proprietary FxPro Trading Platform. Spreads can vary greatly depending on the platform chosen. Fixed spread accounts are offered on the following pairs:

EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/USD, USD/CAD, and USD/JPY

For example, the fixed spread for EUR/USD on MT4 between 8 a.m. and 8 p.m. is 1.6 pips, while during a news event that spread could widen to as much as 2.7 pips.

Financial products offered include forex, futures, indices, stocks, precious metals, energies, and cryptocurrencies. The range of markets numbers 270 different CFD products in the 7 different financial classes.

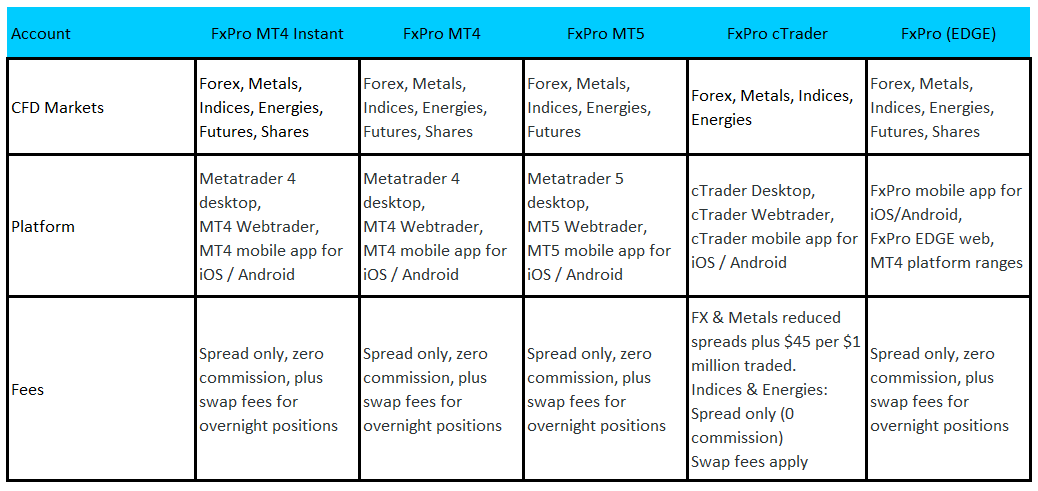

The broker offers 5 different account types with different spreads or commissions, certain assets types, and platforms. Two accounts are offered on MT4, one of them offers instant order execution or a requote. The others are one each for the remaining platforms, cTrader, MT5, and their FxPro Platform.

As you can see from the table above FxPro is a commissions free broker on all accounts except for the FxPro cTrader. On this account, the spread is reduced and they charge $4.50 per $100,000 traded. Note, again this $100,000 is not a lot size, but a dollar amount.

IG

IG is a global broker for CFDs in over 17,000 products with award-winning reviews from Investopedia, ForexBrokers, Online Personal Wealth Awards, and ADVFN International Financial Awards. It is regulated by the Bermuda Monetary Authority with offices in 17 countries across the world. Each local office is authorized and regulated by the pertinent authority. For example, in the USA IG is registered with the CFTC, and in the UK with the FSA. The company was founded in 1974 and currently has over 239,000 clients worldwide.

The broker offers their own in-house trading platform as well as MT4 and ProRealTime trading platforms. Through APIs (Application Programming Interface) you can access their trading platforms to automate your trading.

For forex trading, IG offers a commission-free environment. The commission is included in the bid offer spread. Spreads start at a minimum of 0.6 pips for EUR/USD with an average spread of 1.04 pips. GBP/USD has a minimum spread of 0.9 pips and an average spread of 1.83 pips.

The broker also offers CFD trading in indices, shares, and commodities. They also quote markets in various derivatives such as options and futures. The list of shares quoted is probably one of the most extensive with over 16,000 available. However, for trading shares, commissions do apply rather than the broker taking a cut in the spread.

The broker has 24 hours 7 days a week markets for a wide range of global indices and also makes markets in bonds and interest rates for those who are macro traders.

HotForex

This global broker was founded in 2010 and is regulated by top-tier authorities. In the EU by the CySEC, in the UK by the FCA, in South Africa by the FSCA, in Dubai by the DFSA (Dubai Financial Services Authority), and in the Seychelles by the FSA (Financial Services Authority)

HotForex offers trading in over 1000 CFD financial products, covering forex, metals, energies, indices, shares, commodities, bonds, and ETFs. Prices and analytical tools are offered via MT4, MT5, and HotForex platforms. Web trading is also available across all platforms and devices.

This broker also offers VPS services to ensure fast and reliable order execution. A feature that is particularly useful if you’re going to run automated trading programs. The VPS will guarantee up-time and avoid the possibility of unexpected shutdowns of your PC or internet service.

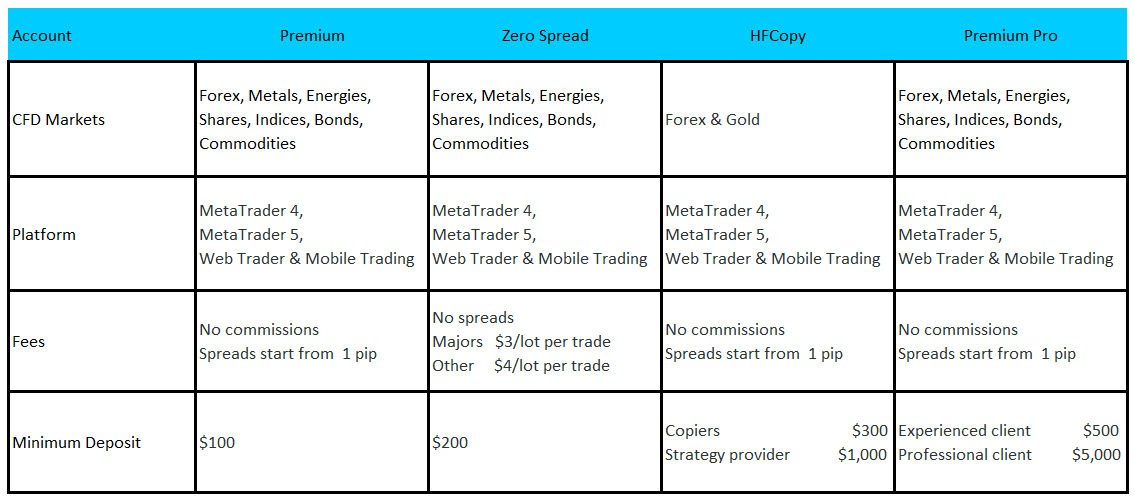

Four account types are available with varying minimum deposits, starting at $100 and rising to $5,000. HotForex also caters for copy trading with an account solely dedicated for that purpose.

The premium Pro account also comes with a wide variety of tools for order and position management, market analysis, market correlation, and messaging systems.

There are two features included in the package which stand out. One is the Correlation Matrix, which shows how price movements in two symbols can create trading opportunities. The second feature is the Sentiment Trader. This feature shows open long and short positions for each market and plots historic sentiment against price.

Conclusion

The market for online forex broker services is wide and plentiful. Having grown by exponential proportions over the past years as internet connections have become faster and computer power cheaper. However, there a few variables that can be common to all ECN forex brokers. If the raw spread is passed on to the trader then clearly a broker needs to charge a fee. Whereas, if the spread is widened then the broker’s margin is included in the bid offer spread. In this case, no fee should be charged.

All of the above brokers offer the MT4 trading platform, others do not but if you have your eyes on a broker that doesn’t work with MT4, it may be worth giving the platform they use a try. Nowadays, most platforms are user-friendly and have an extensive array of technical indicators and tools.

This is not meant to be an extensive look at all ECN brokers. However, we do consider it a true ECN broker list. The takeaway here should be a general understanding of what the best ECN brokers should be able to offer. You may find a broker that is not included in the list. In any case, you should have enough information here to determine if the broker under examination is up to the general standards of the industry.