Bitcoin is a relatively new cryptocurrency, which is defined as a digital asset that can be used as a medium of exchange. The Bitcoin system uses cryptography for the creation and management of Bitcoins instead of relying on a central authority, such as a central bank.

Bitcoin is a relatively new cryptocurrency, which is defined as a digital asset that can be used as a medium of exchange. The Bitcoin system uses cryptography for the creation and management of Bitcoins instead of relying on a central authority, such as a central bank.

The first Bitcoins were issued when the network began operation in January of 2009. The network was based on a paper that was posted to a cryptography mailing list by Satoshi Nakamoto in November of 2008 entitled Bitcoin: A Peer to Peer Electronic Cash System.

The network was created with the release of the first open source Bitcoin client and the issuing of the first Bitcoins. The so-called genesis block was the first block of 50 Bitcoins mined by Satoshi Nakamoto, which at the time were completely worthless. The value of Bitcoins has since risen dramatically.

How Bitcoin Works

While in essence still being a cryptocurrency, Bitcoin has become an actual currency that can now be spent, invested, saved and traded. Bitcoins can even be stolen if the QR code and key information for an account is somehow revealed. Bitcoin transactions use private keys and signatures that are protected with strong cryptography, and each exchange of hands is recorded on a shared public ledger called a “block chain”.

Transactions consist of a transfer of value between Bitcoin wallets that get added to the block chain. Bitcoin wallets have a piece of secret data called a seed or private key that is used for signing transactions. The seed is also used to provide mathematical proof of the owner of the wallet.

The signature prevents transactions from being altered once issued, and all transactions are broadcast among users and confirmed by the network beginning as soon as ten minutes from the time the transaction took place. The transactions are then processed through a distributed consensus system known as mining.

Mining is used to confirm waiting transactions by adding them to the block chain. To be confirmed, transactions must be placed in a block that meets strict cryptographic standards that are verified by the network. This is done to prevent blocks from being altered that would invalidate the following blocks, and it also prevents individuals from adding new blocks consecutively in the chain.

In more technical terms, mining is basically the calculation of a hash of the A block header, which also includes a reference to the previous block, a nonce and a hash of a transaction set.

If the value of the hash is less than the current target’s, then a new block is created and the miner gets the new Bitcoins that were generated. If the hash is not less than the target’s, a new nonce is attempted, and a new hash is calculated. This calculation is then repeated a million times per second by every miner.

The Bitcoin Market

The Bitcoin Market

Transactions using Bitcoins have exploded in the last three years. The number of daily transactions using Bitcoins went from around 65,000 in June of 2014 to more than 300,000 in June of 2017.

Trading in Bitcoins has also seen considerable growth. Bitcoin trading volume has increased from about one million Bitcoins traded per day in late 2012 on just one exchange, to more than 170 million per day traded by the end of 2016. Bitcoin deals are now being executed on roughly 35 different exchanges situated around the world.

The number of exchanges that trade Bitcoin has also shown notable growth since 2011, when Mt. Gox was the only major Bitcoin trading exchange. While the number of notably active Bitcoin exchanges is around 35, and they are located all over the world, the largest and highest ranked exchanges are located in the United States. Fifteen of these U.S. Bitcoin exchanges are listed below in the order of their ranking, which is based on their order book:

- Bitfinex

- Bitstamp

- GDAX

- BTC-e

- Kraken

- Bit-x

- IO

- Gemini

- itBit

- EXMO

- HitBTC

- BitBay

- TheRockTrading

- CampBX

- OKCoin

Monthly Bitcoin transaction volume ranges from 400,000 to 600,000 Bitcoins per month for the top three exchanges, to a few hundred for the four exchanges at the bottom of the list.

Each exchange has their own standard bid/offer dealing spread. This spread is calculated as a percentage, with spreads quoted for dealing amounts of 10 and 100 Bitcoins.

The spread percentage can vary considerably at the different exchanges. For example, GDAX quotes a dealing spread of as little as 0.03% which is quite competitive, while CampBX charges a dealing spread of 25.86% and perhaps understandably had the lowest trading volume figures of the U.S. exchanges listed above.

Activity is gauged by trades per minute, with GDAX executing 29.25 trades per minute, while OKCoin showed an average of just 7.12 trades per minute.

Bitcoin trading hours are generally around the clock all days a week, although many Bitcoin exchanges take a one-hour break period on Sunday when no transactions are made. Many of the larger U.S. Bitcoin exchange names listed above also do business in Europe and the United Kingdom, while Japan and China currently have access to just two Bitcoin exchanges.

Bitcoin Trading Chart

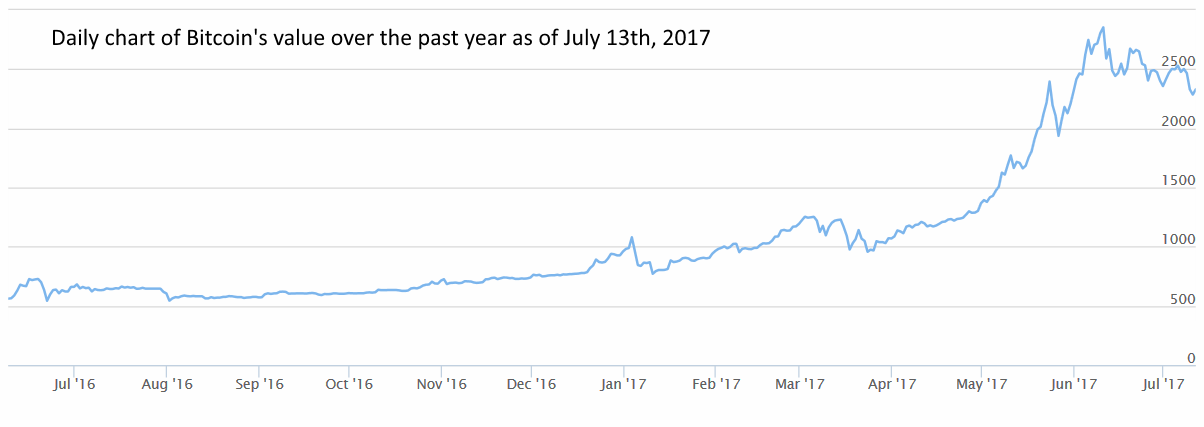

As can be seen in the chart below, the recent rise in Bitcoin’s price has been amazing. Beginning with a price of less than a penny in May of 2010, Bitcoin reached a high of $3,000 on June 12th, 2017. Furthermore, in the space of only one year as displayed in the chart below, the price of Bitcoin rose from $520 to its all-time high of $3,000.

Figure 1: Daily chart of Bitcoin over the one-year period from July 2016 – July 2017.

Where to Trade Bitcoin

Trading Bitcoins is as easy as opening an account with a major Bitcoin exchange where you can begin trading by buying and selling Bitcoins in a funded account. With the meteoric rise of the cryptocurrency market in the last two years, entering and trading the Bitcoin market might seem quite a bit more expensive than trading micro lots on the forex market.

Alternatively, the cheapest and slowest way of obtaining an inventory of Bitcoins is to mine them. To mine Bitcoins, you will need a dedicated computer and install the Bitcoin mining software that is required to decrypt Bitcoin blocks from the block chain. With a mid-range desktop computer, this decryption process could take the computer more than a year to complete the necessary calculations, but at the current price level of Bitcoins, waiting a year to obtain 25 or perhaps even 50 Bitcoins would seem well worth the wait for most people.

Several companies are making special Bitcoin mining computers. These custom built high end models start at around $2,400 and the price goes up from there. Conversely, by purchasing a Bitcoin mining card, one can build an appropriate custom rig that would mine Bitcoins at a much faster rate than you would be able to do with a mid-range desktop computer.

Another popular solution for obtaining Bitcoins is to join a mining pool. A mining pool consists of a group of people with Bitcoin mining rigs that break down the work into pieces, which are then shared by the group. When a block is decrypted by the group, the Bitcoins obtained are divided according to the amount of work each individual rig contributed to the mining process.

Opening an account with a Bitcoin exchange is by far the easiest and fastest way to begin trading Bitcoins. The first step is to select a Bitcoin exchange. Once an exchange has been selected, opening an account typically involves creating a user name and responding to a confirmation email verifying the account holder’s email address.

The system will then require a confirmation of an actual physical address where the person has been a resident for the last six months. Once the person’s physical address has been confirmed, either through a utility bill or some other acceptable form of proof, then a government issued photo ID will be requested to verify the person’s identity.

After submitting all the pertinent documents, it is only a matter of funding the account to begin trading in the Bitcoin market. Depending on the Bitcoin exchange or broker where the account is opened, Bitcoin can be traded much like other currencies on a dedicated Bitcoin trading platform or even on MetaTrader 4, which should already be familiar to most retail forex traders.

In addition to Bitcoins, many exchanges will offer traders the possibility of trading in other cryptocurrencies, such as Ethereum and Litecoin for example.

Leveraged Bitcoin Trading

Trading Bitcoins with leverage can be extremely risky given the recent volatility seen in the cryptocurrencies.

Nevertheless, the most widely used Bitcoin leverage ratio is 3:1, which is currently offered by Bitfinex, while Polniex offers a leverage ratio of 2.5:1.

For Bitcoin futures, a leverage ratio of 10:1 is offered on OKCoin, while Cryptofacilities’ futures leverage ratio is from 3:1 to 50:1. Also, BitMEX is currently offering a leverage ratio on Bitcoin futures of 100:1. Trading with leverage in the Bitcoin market is extremely risky since an entire trading account can be placed at risk with only a small percentage move in the value of Bitcoins.

Margin trading in Bitcoin is becoming more popular, although a large amount of money must be deposited to be eligible for margin trading with most firms. Recently, one of the Bitcoin exchanges known as GDAX began offering margin trading in Bitcoins. Nevertheless, the trading entity, corporation, partnership, organization or other entity must first be an Eligible Contract Participant or ECP as defined in Section 1a (18) of the Commodity Exchange Act. The margin amount needed to take a position in a Bitcoin account is typically one third the amount of the position you wish to take, which would be a leverage ratio of 3:1.

To qualify as an ECP, a firm or individual must prove that they have a net worth of over $1,000,000. For a corporation, partnership, trust or other entity, having more than $10,000,000 in total assets is a requirement. Other necessary qualifications can include: having an investment company subject to regulation under the Investment Company Act of 1940, being a broker/dealer, being an associated person of a registered broker, or being a futures commission merchant.

Basics of Trading Bitcoin

If Bitcoins are already owned, then trading can begin immediately, and in many cases can take place without personal verification, since the owner is in possession of a Bitcoin wallet with a unique signature and key. If no Bitcoins are owned, then many exchanges and brokers will offer Bitcoin to a potential trader using a derivative such as a CFD or Contract for Difference.

The first and foremost thing to remember about Bitcoin trading is that the cryptocurrency is extremely volatile. Since Bitcoins are not a fiat currency, their price is not directly linked to any national economy or the policies of any one nation. Also, Bitcoins are global, which means they can be sent anywhere over the Internet. Their value is also subject to fluctuation in response to news service reports from reputable economic experts.

Many different events can affect Bitcoin price levels, including events such as China’s devaluation of the Yuan, and capital controls implemented in Cyprus, which attracted attention to Bitcoin and sparked a rally. Bitcoin volatility can be a big advantage — or disadvantage — with intraday moves of as much as five percent of its value occurring on any given day.

To begin trading in Bitcoin, the first requirement consists of finding an appropriate Bitcoin trading platform to buy and sell Bitcoins. Remember, there is no central exchange for Bitcoins, but many exchanges of varying size that specialize in cryptocurrencies will provide you with a suitable trading platform.

The world’s number one Bitcoin exchange as measured by trading volume in U.S. Dollars is Bitfinex. This exchange averages a trading volume of around 25,000 Bitcoins per day, and its customers can trade without verification on the exchange if cryptocurrency is used as a method of deposit. Other large Bitcoin exchanges worthy of consideration include Bitstamp, OKCoin, Kraken and Coinbase.

MetaTrader 4 now supports Bitcoin trading through various brokers and exchanges. Using MetaTrader 4’s Expert Advisor capabilities, programs and trading bots for automated Bitcoin trading are now available for purchase. Nevertheless, with the recent volatility in cryptocurrencies, an automated trading system could have severe problems operating in the current uncertain market environment.

Trading Bitcoin for Profit

The incredible volatility of Bitcoin surpasses that of all national currencies on the market today. As an example, when China temporarily banned the cryptocurrency, the overall value of Bitcoin declined by a whopping fifty percent in the mere 36 hours that it had been banned. Also, day trading Bitcoin requires an impeccable feel for the market, as well as quick reflexes to exit any position that might be going against the trader.

Basically, the level of volatility for Bitcoins is a major challenge for any trader, no matter how much experience they may have trading in other markets. As far as the level of volatility is concerned, Bitcoin has been described as being more volatile than a jar of nitro glycerin on a merry-go-round, and for many seasoned traders, Bitcoins will be the most volatile trading asset they ever operated in.

Much like forex trading, the key to trading Bitcoin is to time the entry of a position carefully, avoid taking excessive losses, and then exit the position as soon as a significant profit is made. While this may sound easy, when put into practice, it can be considerably more difficult, especially with Bitcoin’s high level of volatility.

Another element that is extremely important to consider is that only a limited number of Bitcoins can be mined. The total number of Bitcoins that will ever be in existence is 21 million, which means that, depending on how many merchants accept the cryptocurrency as payment, the value of Bitcoin is very likely to rise in the long term.