If you’re an average investor, chances are that you’re invested in a few blue-chip stocks, some bonds, or an ETF that tracks the broader market like the S&P 500.

However, did you know that investing in commodity ETFs can provide a cost-efficient layer of diversification to your portfolio, and even hedge against inflation and economic recessions?

Here is how to get started with investing in commodity ETFs.

Why Should You Invest in Commodities?

Shiny precious metals, agricultural products, gas, and oil are all part of a specific asset class called commodities. The commodities market is huge, with most of the trading volume taking place in the futures market. In fact, the futures market was developed for commodities and their producers in the first place, to help them hedge against falling prices and make future income more predictable.

Today, a huge chunk of the trading volume in the commodities market is speculative in nature. Investors buy commodities for various reasons, but the most notable are hedging against inflation, hedging investments in other asset classes, or simply getting exposure to a hot market in times of economic expansion.

Each commodity has its own traits: Gold, for example, is a well-known hedge against rising prices in the real economy. Silver, as a metal widely used in various industries, provides exposure during times of a global industrial boom.

Oil and gas are necessary commodities for the heating season, and agricultural products like orange crops and wheat increase in value during periods of drought, or simply due to the rising global population. An ETF that invests in agricultural products is also known as a soft commodities ETF.

When Should You Invest in Commodities?

The best approach for a long-term trader is to be constantly invested in commodities. The prices of all commodities have risen for the last few decades, and increasing global demand suggests this bull-run won’t stop any time soon.

Monetary reasons, such as the falling purchasing power of fiat currencies, also add to the attractiveness of commodities (more precisely, precious metals) to investors.

Active investors who want to pick shorter-term trends in commodities by avoiding the inevitable corrections in prices could follow the business cycle to do so. Commodities tend to boom during the expansionary phase of the business cycle, which is exactly the phase when stock markets reach record highs, bond prices fall due to the access to higher-yielding markets, and inflationary pressures start to pick up in the real economy.

Graphic: Commodities boom when economic activity reaches its peak. Source: commodityetfguide.com

You can determine the current phase of the business cycle by following leading economic indicators, like building permits and PMIs, or by analyzing the slope of the yield curve. The expansionary phase of the business cycle tends to favor long-term interest rates over short-term ones as markets prepare for rising inflationary expectations in the future (a so-called bear steepener.)

How to Invest in Commodities

Now that you know what commodities are why you should invest in them, let’s dive into the fun part: How to invest in commodities? There are a few options.

- Buying physical commodities – The first option that comes to mind to most new investors is to buy actual, physical commodities. While this works for gold and silver bullions and coins, it becomes significantly harder to store barrels of oil or have live cattle in your back yard. Even all precious metals aren’t well suited for storage.

For example, $100,000 worth of gold could be easily placed in a drawer as the total weight, at current prices, would be around 2 kg or 4.5 pounds. However, the same value of silver would weigh around 120 kg or 265 pounds! Try putting that in your home office drawer.

- Buying commodity futures – Another popular option to invest in commodities is to buy futures contracts or other derivative contracts in commodities. While these are widely-used instruments to get exposure to commodities, they are not always the most cost-efficient option, or the easiest to invest in. If you don’t want to take physical delivery of the futures contract’s underlying commodity, you’ll have to sell the contract and buy new contracts with another expiry date.

In addition, if you want to build a specific portfolio of commodities or companies that deal with commodities, you’ll have to do your homework and find all the companies you’re interested in, check their financial performance, and then manually allocate your funds to each of them. All of this can be done much simpler and cheaper by investing in commodity ETFs.

- Investing in commodity ETFs – Commodity Exchange Traded Funds (ETFs) allow investors to expose their capital to the commodities market, without actually owning the commodity itself. A commodity-based ETF trades on the exchange like a regular stock, so it can be easily bought and sold in a matter of seconds.

What are Commodity ETFs?

Commodity ETFs are Exchange Traded Funds that are designed to track the price of an underlying commodity (like gold), group of commodities (like precious metals), or even energies (like solar energy ETFs).

Commodity ETFs achieve a high correlation with the actual price of commodities by investing in physical commodities (unlike your drawer, they have the needed storage capacities), or by investing in futures contracts, or in companies that produce, transport, or store commodities.

ETFs regularly update their list of stocks and instruments they invest in, allowing investors to focus on other investment matters. For their services, ETFs usually charge a small fee in the form of investment management fees. While choosing the best commodity ETF is not an easy task, a popular commodity ETF that tracks a variety of commodities is the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG).

Types of Commodity ETFs

- Equity funds

Equity ETFs which provide commodity exposure do so by investing in companies that produce, transport, or store commodities. The stock price of those companies tends to follow the underlying commodity, i.e. when the price of the related commodity rises, those companies usually see higher profits and more turnover.

Equity-based commodity ETFs can invest in multiple companies that deal in the same commodity, or in a group of companies for any specific sector. For example, a commodity ETF could invest in gold mining companies or oil transportation companies to get exposure to the price of gold and oil, or they could specifically target companies that process agricultural products.

This type of commodity ETFs often come with a lower expense ratio compared to other types of commodity ETFs, and without the risks associated with futures contracts or with the storage of physical commodities. However, investors need to pay attention to the underlying financials of the companies that make up an equity-based commodity ETF. A low-quality management board or weak balance sheets may lead to lower stock prices despite a rise in commodities.

Equity-commodity ETFs offer a “leverage-like” exposure to the commodity market. They are a cost-efficient alternative to futures-based or physically-backed funds, which may also be subject to regulatory trading restrictions. In addition, equity-commodity ETFs have better tax implications than funds that hold commodities in physical form.

Investors who want to gain exposure to the gold market through an equity-backed gold commodity ETF should take a look at Market Vectors Gold Miners (GDX) and Market Vectors Junior Gold Miners (GDXJ). These funds provide exposure to the price of gold by investing in international gold mining companies, from small-cap to large-cap. Since equity-based commodity ETFs trade on the stock market like regular stocks, they are also very attractive to short-term investors and day traders.

Other top commodity ETFs are the FlexShares Morningstar Global Upstream Natural Resources Index Fund, Global X Lithium & Battery Tech ETF, and SPDR S&P Global Natural Resources ETF. If you’re looking for a Vanguard commodity ETF, then the Vanguard Materials ETF is a great way to add exposure to stocks in the materials sector. With an expense ratio of only 0.10%, this is also a very low cost commodity ETF (A complete commodity ETF list can be found on www.etfdb.com.)

- Exchange-traded notes (ETNs)

Exchange-traded notes (ETNs) are another type of commodity ETFs, but unlike equity-based ETFs, ETNs represent a debt instrument issued by a bank. ETNs are unsecured, unsubordinated debt that is backed by the issuer of the ETN, which involves a certain type of default risk depending on the quality of the issuing institution. ETNs aim to track the price of the underlying commodity by buying bonds, stocks, or other financial instruments.

An advantage of ETNs is that they have no tracking error between the underlying index and the price. They also offer attractive tax benefits as investors who stay invested in a commodity ETN for more than a year only pay a capital gains tax of 15% when they sell their investment.

However, despite the better tax implications and the fact that ETNs don’t have a tracking error, investors still remember the wave of bankruptcies and bank failures in the 2008 financial crisis. This credit risk of the issuing institution is a major disadvantage that needs to be carefully considered when investing in ETNs.

- Physically backed funds

Physically-backed ETFs invest in physical commodities, like gold, silver, and industrial metals. These ETFs are mostly focused on precious metals, as this commodity class allows easy transportation and storage.

An investor who invests in a physically-backed gold ETF gains exposure to the gold market, without taking delivery of the gold or worrying about storing and insuring physical gold. For example, by investing in the SPDR Gold Trust, an investor gains ownership in the fund’s stockpile of physical gold.

A major drawback of physically-backed ETFs is that they usually come with higher taxes compared to other types of ETFs. Investors who invest in physically-backed gold ETFs are taxed up to 25% as collectibles, which makes them more suitable for longer-term investors.

- Futures-based funds

Futures-based commodity ETFs aim to track the price of the underlying commodity by investing in derivative contracts, like futures, forwards, and swaps. While this type of funds has lower operating costs than physically-backed funds, there are some other risks that are worth paying attention to – most notably the counter-party risk and the rolling risk.

Most ETFs that invest in commodity futures use a front-month rolling strategy, which means they are always invested in the futures contracts that are closest to expiry. By the end of the month, the ETF needs to sell their futures holdings for contracts with the next-month expiry, which creates a unique rolling risk as the existing futures contracts are rolled into the next-month contracts.

To understand rolling risk, let’s first define two major concepts of the futures market: contango and backwardation. We say that a futures contract is in contango when the futures price is higher than the current price.

Similarly, we say that a futures contract is in backwardation when the futures price is lower than the current price. When the market is in contango, the ETF faces a negative rolling risk, as it has to sell lower-priced futures to buy higher-priced futures with next-month expiration.

However, when the market is in backwardation, the rolling risk gets positive as the ETF sells higher-priced front-month futures and buys lower-priced futures. There are some strategies that are designed to reduce the costs of a negative rolling risk. The laddered strategy, for example, invests into futures contracts with multiple expiry dates so that not all futures contracts have the be sold on the same day.

This need to “roll over” futures contracts by the end of each month is the main reason why futures-based ETFs carry higher expenses and fees than other types of ETFs.

In addition, since futures-based ETFs buy and sell large quantities of contracts in the futures market, they are able to move the prices in the market. That’s why the Commodities Futures Trading Commission (CFTC) recently proposed restrictions and trading limits on futures-based ETFs, which reduced their overall profit potential.

Should You Invest in Commodity ETFs?

Commodity ETFs offer investors exposure to commodities without worrying about taking delivery and storing the asset. Commodity ETFs are a great way to diversify a portfolio as some commodities are inversely correlated with other asset classes, such as stocks, bonds, or currencies.

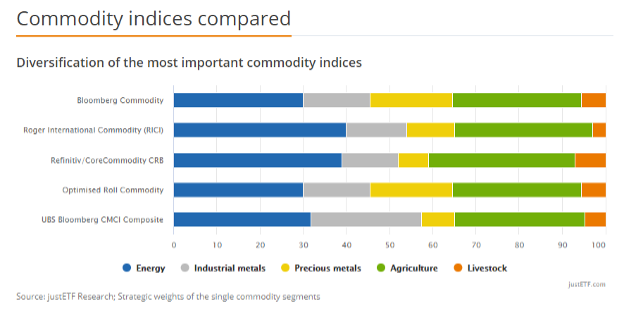

Other commodities show a strong correlation with the mentioned asset classes, so it’s a function of what an investor wants to diversify or hedge by investing in commodity ETFs. Long-term investors can follow the broader commodity market by following one of the commodity indices shown in the graphic below.

Gold is considered the safest type of money for thousands of years. When political turmoil or economic recessions hit the markets, gold shines the brightest. That’s why adding a commodity ETF that tracks gold can offer a great hedge against falling prices in the stock market, for example.

Silver, oil, agricultural products, natural gas, and other commodities also have their own traits and correlations with other markets which can help you diversify your portfolio.

To get exposure to a wide range of commodities, consider buying a broad commodity ETF like the PowerShares DB Commodity Index Tracking Fund (with over $2.5 billion in AUM, this is also the largest commodity ETF.) A diversified commodity ETF helps in reducing risks associated with investing in a single commodity.

Pros and Cons of Investing in Commodity ETFs

Diversification – As mentioned, one of the most important benefits of investing in commodities is the diversification aspect. Commodities are often inversely correlated to other asset classes, which protects your downside risks in case your initial investment plan doesn’t work out.

Profit potential – As commodity ETFs track an underlying commodity and trade directly on an exchange, investing in commodity ETFs provides huge profit potential if the underlying commodity enters a bull run.

Commodities that are used for industrial purposes, like Brent crude, silver, and iron ore, tend to rise in value with the growth of global industrial output. On the other hand, shorting gold (or buying an inversed gold ETF) offers investors exposure to a potential bull market in gold during times of risk aversion in other markets.

Inflation hedge – Another benefit of investing in commodities is their protection against inflation. When inflation rises, many commodities skyrocket, while stocks tend to fall (due to expectations of interest rate hikes by central banks.) Gold is often considered a great hedge against inflation in the long term.

Learning curve – An important disadvantage of investing in commodity ETFs is that investors often need to have a good understanding of market dynamics to know in which commodity to invest. Make sure to understand how different commodities react to different phases of the business cycle before making your final investment decision.

Volatility – Risk-averse investors may find some commodities to be too volatile to include them in their portfolios. In addition, natural disasters, terror attacks, or political turmoil can have a significant impact on certain commodities as they directly influence their supply (for example, oil and Iran sanctions, or natural gas and Russian foreign affairs can have a large impact on the price of an oil commodity ETF.)

Final Words

Whether you invest in physically-backed, futures-based, equity-backed ETFs, or ETNs, choosing the right fund can have a significantly positive impact on the performance of your portfolio. In this article, we have covered the main pros and cons of each ETF type and explained what commodities may outperform other asset classes during specific economic conditions.