In financial economics, there is a heated debate among academics over whether it’s possible to generate excess returns above the average market return. Because, if a group of traders or investors is able to outperform the general market, that market couldn’t be described as efficient.

That’s where the Efficient Market Hypothesis comes into play. Can you really outperform the market on a consistent basis or are markets fully efficient in reacting to all available news and information? Let’s find out in the following section.

What is the Efficient Market Hypothesis?

The Efficient Market Hypothesis, also known as the efficient market theory, is a financial economics hypothesis that states that prices of financial instruments reflect all publicly and non-publicly available information and that generating excess risk-adjusted returns in the markets is thus impossible.

According to the EMH, it’s not worth trying to beat the overall market, and investors are better off investing in an index fund or ETF than trying to outperform the market. The idea that it doesn’t make much sense to predict financial market returns goes back to the beginning of the 20th century. More recently, the American economist Eugene Fama is often closely associated with the efficient market hypothesis due to his seminal work from 1970, “Efficient Capital Markets.”

What are Efficient Markets?

According to the Efficient Market Theory, financial instruments always trade at their fair value on exchanges. Since the prices of stocks, currencies, commodities and other asset classes reflect all available information, it’s impossible for investors to buy undervalued securities and sell overvalued ones. The theory states that it’s not worth trying to outperform the overall market, even through expert stock selection or various trading strategies.

The fact that many investors and traders consistently generate excess market returns is often dismissed by proponents of the EMH market theory. Those strong performances are often attributed to luck, as there will always be someone who outperforms the market and someone who underperforms the market (over a large sample size of market participants.)

In this regard, efficient markets are markets in which it’s impossible to beat the market, as all pieces of information are already discounted by the price – including non-publicly available insider information. Investors who want to generate excess market returns have therefore to invest in securities that carry higher risks, as this is the only way to obtain higher returns.

Criticism of the Efficient Market Hypothesis

Critics of the efficient market hypothesis, including famous investors like Warren Buffet and George Soros, have disputed the EMH market theory. In his 1984 presentation, Warren Buffet said that the preponderance of value investors who have repeatedly generated excess market returns rebuts the claim that luck is the reason behind that.

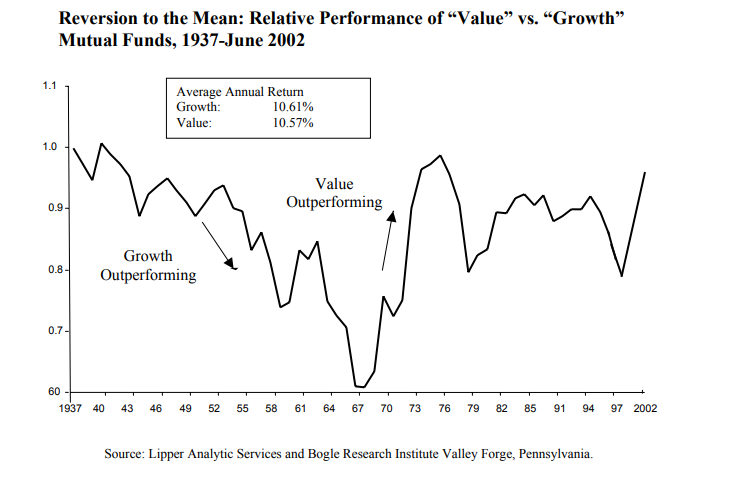

Here is a chart of the performance of value stocks vs growth stocks. A portfolio of value stocks has clearly outperformed a portfolio of growth stocks during the 1967-1977 period, and again in the early 2000s.

Another investor who more than doubled the average market returns for decades, Peter Lynch, argued that the EMH theory is contradictory to the random walk theory of prices. To recall, the random walk theory states that market prices move randomly and without a predictable pattern, making it impossible to predict future price movements. Although both market theories are often taught hand in hand in business schools, the EMH theory proposes that prices are rational and based on all available information, which means they are not random.

The Australian economist John Quiggin has claimed that Bitcoin is a fine example against the EMH theory. According to Quiggin, the sky-rocketing price of Bitcoin isn’t supported by an underlying value of the cryptocurrency, which makes the uptrend basically a bubble. But, the efficient market hypothesis says that there shouldn’t be any market bubbles as prices are rational.

Random Walk Theory

The Random Walk Theory and Efficient Market Hypothesis are often cited together when discussing the efficiency of markets. The Random Walk Theory asserts that historical price information can’t be used to predict future price movements, as all prices have the same distribution and are independent of each other. In other words, yesterday’s prices can in no way affect today’s prices, and today’s prices can in no way affect tomorrow’s prices.

The Random Walk Theory suggests that, since all prices are random and unpredictable, market participants are not able to use any methods to anticipate future prices and make a profit. According to the theory, technical analysis can’t be profitable as trends can’t be consistently predicted. Likewise, fundamental analysis doesn’t help either as the quality of information is often poor and misinterpreted.

The name of the theory was coined in 1973 by Burton Malkiel and has faced a lot of criticism since then. Critics contend that markets often trade in strong and long-lasting trends and that traders and investors are able to take advantage of those trends by picking precise entry and exit points.

The Wall Street Journal tested the theory in its popular WSJ Dartboard Contest. In the test, journalists of WSJ threw darts to select a group of stocks and compared the results with the performance of professional money managers. The result – after more than 140 contests, professional managers won 87 times and the dart throwers 55 times.

Malkiel responded to the results of the test by explaining that stocks picked by professional managers received public attention, which then drove their prices higher. However, if markets were really random and efficient, those experts wouldn’t be able to beat a randomly selected group of stocks at all. The Random Walk Theory is usually associated with the weak form of the Efficient Market Hypothesis, which will be discussed later in this article.

So, Can Markets Be Inefficient?

Despite the widespread use of the EMH theory among academics, most markets exhibit a certain degree of inefficiency. Market participants, including traders, investors, hedge funds, and banks, rarely have access to the same pieces of information and don’t act immediately on it. This creates a lag in the markets during which it is possible to generate excess market returns, dismissing the premise of the EMH theory that markets are efficient.

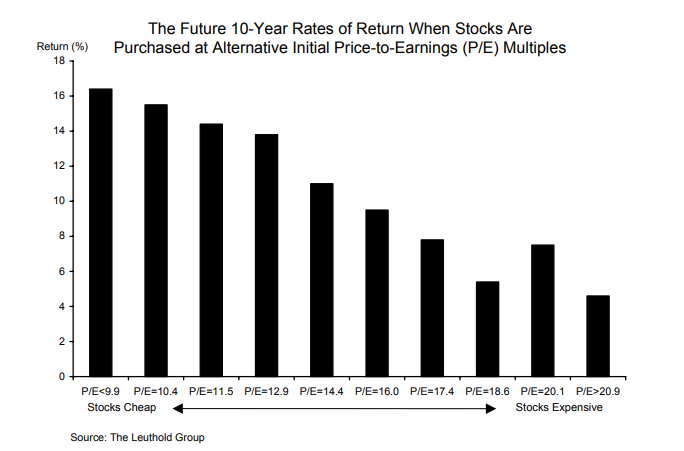

The following chart shows how stocks that are considered cheap according to P/E ratios have outperformed stocks that are considered expensive over a 10-year period.

Imagine a situation where market participants believe that gold could rise 10% in value over the next month. The price won’t shoot immediately to its target for a number of reasons, including human emotions, profit-taking activities, information asymmetries, and so on. Arbitrage opportunities would arise which would help the price on its way up, but in an efficient market, those arbitrage opportunities would be exploited immediately.

There are many reasons why most financial markets aren’t completely efficient. Here are the main ones followed by efficient market hypothesis examples:

- Low liquidity – The lower the liquidity in a market, the lower its efficiency. Liquidity refers to the number of buyers and sellers in a market who are willing to buy or sell at almost any price level. Highly liquid markets, such as Forex, are usually considered to be very efficient. Prices react very fast to new pieces of information and currency pairs quickly restore equilibrium, even after unexpected market news.

However, the Forex market is still not completely efficient as arbitrage opportunities and highly profitable trading setups still exist in this market. In addition, even the Forex market has some pairs that are less liquid than others, such as NZD/CAD for example.

An example of an illiquid market would be a penny stock or exotic currencies that don’t have many buyers or sellers. Those markets are considered to be very inefficient, as new news is discounted slowly in the price, and transaction costs are quite high.

- Transaction costs – Speaking of transaction costs, those costs bring inefficiency to a market. As a rule of thumb, the higher the transaction costs to open a trade, the less efficient that market is. Think of it this way: transaction costs need to be taken into account when participating in a market, such as when exchanging US dollars for Euros for your next holiday trip, or when investing in the Australian dollar for carry-trade returns.

Transaction costs can make some market participants reluctant to immediately act on fresh news, which makes the absorption of new pieces of information slower than in a highly efficient market.

- Human emotions – The next reason why markets are inefficient is human emotions and behavioral patterns. According to the efficient market hypothesis, news and information are immediately discounted in the price, making it impossible to trade and make excess returns on them.

However, empirical evidence shows over and over again that this is rarely the case. Since most market participants are still human, we need to take into account that human traders have to deal with a range of emotions, such as fear and greed. Behavioral patterns that arise of those emotions form a delay between the moment the news hits the market, and the period when it gets fully discounted in the price.

Imagine a situation where Germany reports its new monthly PMI (Purchasing Manager Index) numbers. A number that comes in better than expected should have a positive impact on the Euro, and a report that misses market expectations should have a negative impact on the currency.

Let’s say the number came in better than expected, and the Euro shoots higher against the US dollar. However, as a growing number of market participants start to act on the report and reposition their portfolios, the Euro may keep trading higher for hours, or even days. Human emotions may further exaggerate the move, because of fear of missing out and greed.

- Information asymmetries – Last but not least, news and information are not equally accessible to all market participants, all the time. It takes time for traders and investors to digest new pieces of information, which forms a delay in price reaction. According to the EMH theory, there shouldn’t be a delay, as all participants have equal access to all important market news. However, in practice, that’s simply not the case. Non-public information and insider trading also add to inefficiencies in markets.

Similarly, let’s say news breaks out that the Fed may hike interest rates sooner than previously anticipated. A small group of traders and investors may be the first to get the news and act on it, followed by Bloomberg subscribers, and finally, retail traders who got the news on their Twitter feed. This information asymmetry doesn’t allow the price to immediately discount the new piece of information, and it may take hours until the news gets fully priced in by the markets.

Are Excess Returns with Trading and Investing Possible?

Many traders and investors have been able to consistently outperform the average market return. Warren Buffet’s Berkshire Hathaway has had an average annual return of 20% compared to the 10.2% of the S&P 500 since 1965.

Although there were years when the S&P 500 outperformed Berkshire Hathaway, it’s important to note that a good long-term strategy doesn’t have to beat the market every single year. Warren Buffet’s investment strategy is value investing, buying undervalued stocks and holding them for as long as possible.

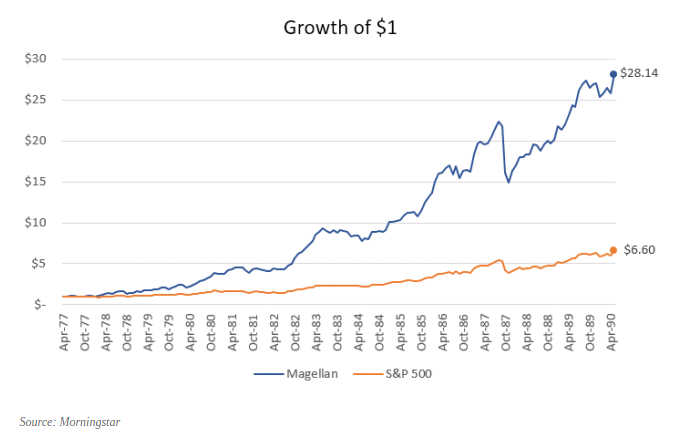

Another famous investor, Peter Lynch and his Magellan Fund, averaged around 30% annual returns between 1977 and 1990, which made it the best-performing mutual fund in the world. Peter Lynch believed that smaller individual investors had a substantial advantage over large institutions because larger firms couldn’t invest in smaller companies for a number of reasons.

For example, their trading size would be inadequate for the average daily trading volume of small-cap shares, and strict risk procedures wouldn’t allow them to buy companies with a market capitalization below a certain threshold.

Those reasons alone go against the EMH market theory, as large institutions aren’t able to act on all available information because of a number of restrictions.

This chart shows how $1 invested in the Magellan Fund would perform from 1977 to the 1990 when compared to the return of the S&P 500.

According to the EMH market theory, any investor who generates returns above the average market return is simply “lucky.” That’s why economist Phillip Pilkington has argued that the Efficient Market Hypothesis is actually a tautology or pseudoscientific construct because EMH proponents insulate the theory from falsification by describing investors who are consistently profitable as “lucky.”

Modifications to the EMH Market Theory

The original form of the EMH theory which says that all available information is immediately discounted by the market, making it impossible for traders and investors to outperform the average market return, is sometimes hard to digest. Empirical evidence showed that traders and investors can outperform the market for a significant period of time.

That’s why modifications of the EMH theory exist to reflect the true and practical nature of markets.

Here are the main forms of EMH:

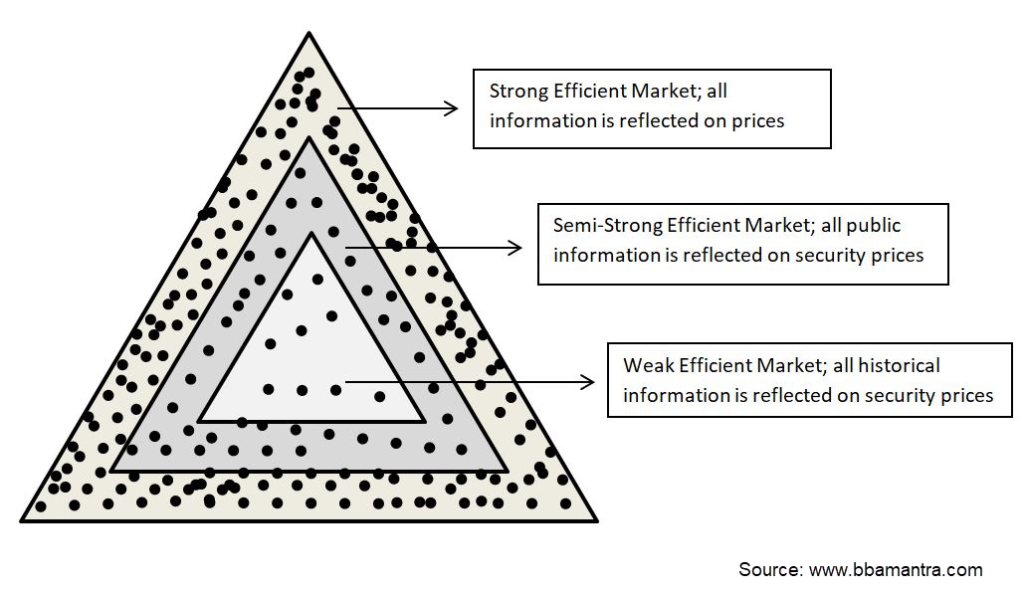

Strong efficiency – The strong form of EMH asserts that all available information is immediately reflected in a financial instrument’s price. Not even those with insider information can use it to gain an upper hand and make superior investment results. This is the standard form of EMH.

Semi-strong efficiency – The semi-strong form of EMH asserts that current prices reflect not only historical price information but also all publicly available information of a financial instrument. This means that any type of fundamental or technical analysis won’t be able to generate outsized returns, including the analysis of balance sheets, income statements, earnings reports, and chart patterns. Only those with privileged information (insider traders) who have access to non-publicly available data are able to take advantage of that information.

Weak efficiency – The weak form of EMH asserts that only historical prices are fully reflected in the current market price. This means that traders aren’t able to generate above-average returns using technical analysis tools, such as trendlines, support and resistance levels, and breakouts.

However, fundamental analysis could be used to generate excess market returns as not all available information gets immediately discounted by the price. It is this form of the EMH theory that is often associated with the “Random Walk Hypothesis.”

Final Words

The efficiency hypothesis is a popular theory that states that all publicly and non-publicly available information is immediately reflected in the price and discounted by the market, making it futile for market participants to aim for excess market returns. Therefore, any type of fundamental or technical analysis won’t be able to generate returns that are above the average market return.

Critics of the theory contend that there are many market participants who have been able to consistently generate high returns over a long period of time, like Warren Buffet’s Berkshire Hathaway, Peter Lynch’s Magellan Fund, Jim Simon’s Renaissance Technologies, and George Soros’ Quantum Fund. Besides those famous investors, a large number of individual traders and investors have also been able to reach consistent profitability in the markets.

Proponents of the efficient capital market hypothesis often reply that the main reason why a group of investors outperform the average market is luck. However, describing excess market returns generated over a period of decades simply as luck doesn’t give credit where it’s necessary.

To apply the efficient market hypothesis theory to the practical world of investing and trading, academics have made certain modifications to the original market efficiency theory. Besides the strong form of EMH, there is a semi-strong form that asserts that all historical prices and public information is already discounted in the price, but not non-public insider information. And there is the weak form of the EMH theory that states that only historical prices are fully priced in, but not new pieces of information.