FX trading may involve keeping positions open overnight, or for several days or even longer. This means we are keeping a currency on our accounts, while at the same time we are short of the currency we sold to buy the first one. This situation needs to be balanced out as accounts need to be flat at the end of the day. When you sell a currency to buy another your broker will balance the account at the end of the day by doing the opposite. This is often known as rollover, and the cost it may generate is also known as rollover fee or swap fee.

We will take a look at what this means for your trading and how it can create a cost or benefit for your account. We will also look at how to understand a priori when a buy or a sell trade is going to generate a benefit or a charge when holding the position open overnight or longer.

A quick glimpse at what foreign exchange swaps are exactly is also necessary, and an introduction to the math behind their calculation will be discussed. This calculation is going to give us the forward rate and the benefit or cost number for holding positions open longer than intra-day. It can also be useful if you are thinking of trading on forward FX rates.

Many traders will open and close their trades within the same day, for which these costs do not apply. However, the knowledge is always useful. As an FX trader you need to understand all aspects of your field.

Forex Swap Fee

This is the cost, or benefit, generated when holding a trade open overnight or longer. As mentioned above we will be short of one currency and long of another. However, accounts need to balance and the broker will perform the opposite operation to ensure the account is flat at the end of the day.

If the above operation creates a cost, it is known as a forex swap fee, some brokers may waive this fee usually in exchange for wider bid-offer spreads or commissions. However, swap charges in forex have to be accounted for in some form or other. Swap free forex brokers do exist but they will have to make up for the cost of keeping positions open overnight or longer.

Some brokers may only deduct costs and not apply revenue when the overnight position generates a benefit. It is worth looking into if you are going to hold positions open for several days.

For example, let’s say we buy EUR/USD; we now hold Euros, for which in exchange we sold US dollars. The dollars we sold in exchange for US dollars will not have been on our account to begin with. This creates what is known as a short. We have sold something we don’t actually hold. We, therefore, need to borrow this currency and lend Euros to balance the account.

If we bought €10,000 at an exchange rate of 1.2000, we will have sold $12,000 which we didn’t initially have. We would therefore need to borrow the $12,000 to deliver them in exchange for the €10,000. This is done automatically by the broker handling your account. This cost can be offset by lending the Euros we hold for the same period.

In the above example, US dollar interest rates are currently higher than that of Euros. Therefore, borrowing US dollars and lending Euros will generate a cost. Of course, if we were to sell Euros and buy US dollars the opposite would be true. We would need to borrow Euros and lend US dollars, as we would receive more interest for lending the US dollars than the interest we would pay to borrow the Euros. This would generate a benefit for our account, known as positive carry.

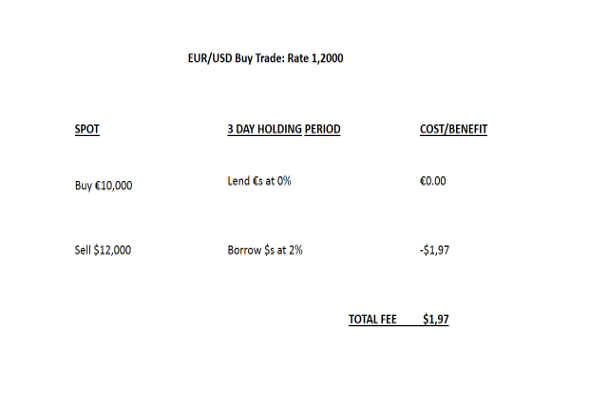

We can have a look at a numerical example for clarity. Let’s say we buy €10,000 EUR/USD and we hold the position for 3 days. We will be long Euros and short US dollars, this means we will need to lend Euro and borrow US dollars to balance our account.

Let’s say the Euro interest rate for lending is 0% and for ease of exercise the US dollar interest rate for borrowing is 2%. We now have the following flow of currencies and cost:

As we can see from the table above holding this long EUR/USD position for 3 days would generate a cost of $1.97. In terms of FX rate, this amount translates into 1.97 pips, which might not be so significant, but allows you to compare how much your broker is charging you. To do so, you would need to be able to determine what the respective interest rates are for each currency, as the difference in these rates is what ultimately generates a positive or negative carry for your position. How did I calculate the pips the swap fee of $1.97 translated into? Simply divide the swap fee by the trade size and add that to the spot price i.e. (1.97 / 10,000) + 1.20000 = 1.200197.

The interest rate for each currency is set by the respective central bank. This is a good guideline to know what interest rate should be applied for each currency. Bear in mind that the broker will be using the interest rate offered by the bank used to settle FX trades. The bank will be using inter-bank interest rates which will necessarily differ slightly from those set by central banks.

Researching the corresponding interest rates for the currencies you are trading will allow you to determine which positions will have a positive or negative carry. In the example above, we saw that selling EUR/USD creates a positive carry. This is due to the fact that while we hold US dollars that earn higher interest than the interest paid on borrowing Euros we will be receiving revenue.

Most central bank websites will have their interest rates available, or you can check Fxstreet or Tradingeconomics, which also publish interest rates for each currency. The rates published on these websites are the central bank interest rate. These rates will differ somewhat compared to those available to your broker. However, they will give you an idea of which currency pairs produce positive or negative carry with a buy or sell trade.

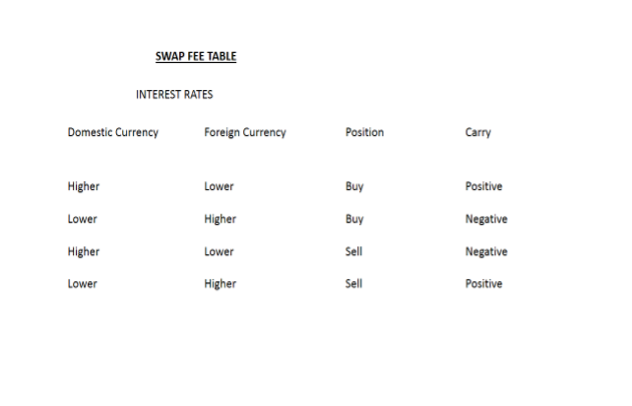

Currencies that make up an FX pair are split into two categories, the domestic currency, and the foreign currency. The domestic currency is the one mentioned first in a currency pair nomenclature. For example, in the EUR/USD pair the Euro is the domestic currency and the US dollar is the foreign currency, this means the FX rate shown for this pair indicates the number of units of US dollars needed to exchange 1 Euro.

As a rule of thumb, if you are long a domestic currency that has a lower interest rate than the foreign currency where you are short, it will create a negative carry. Similarly, if you are long a domestic currency that has a higher interest rate than the foreign currency this position will create a positive carry.

The table below shows the possible combinations of interest rates against holding buy or sell trades. A glance tells us which positions generate a positive or negative carry. The term carry is used to express holding a position in time, as in to carry forward. Just to be clear, a positive carry will generate income for your account, while a negative carry will create a cost for your account.

MT4 Swap Fees

MT4 Swap Fees

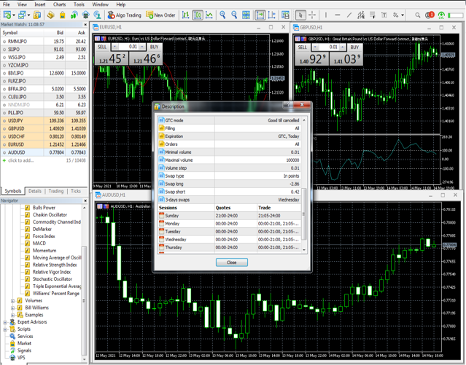

MT4 & MT5 also allow us to calculate the swap rate or rollover rate for any FX pair. This can be convenient and will also convey what our broker is actually charging us.

Understanding the swap point calculation is a little trickier on MT4 than on a website with a calculator that gives us the cost or benefit directly. However, it is still useful and allows us to see which positions would generate a cost or benefit.

The swap fee long or short is shown in the window on MT5 below. To get there we select the currency pair and right click on the mouse then select Specification, next scroll down till we see Swap long and Swap short.

These two numbers will tell us the pips to be added to or deducted from our account. From the example below, we can see that if we are long AUD/USD the broker will deduct 2.86 pips for an overnight position. This is US dollar pips, if our account is in another currency. For example, if Euros then we need to divide 2.86 by the exchange rate for EUR/USD. This leads to 2.83/1.200 would give us a deduction of 2.38 pips of euro. Trading a full lot we would see a deduction on our account of 0.000238 * 100,000 = €23.8

Foreign Exchange Swaps

Forex swaps also known as currency swaps are a two-legged trade in FX, each leg is a forex trade. The first leg is a spot trade in any given currency pair, the second leg is a forward dated trade in the same currencies but in the opposite direction.

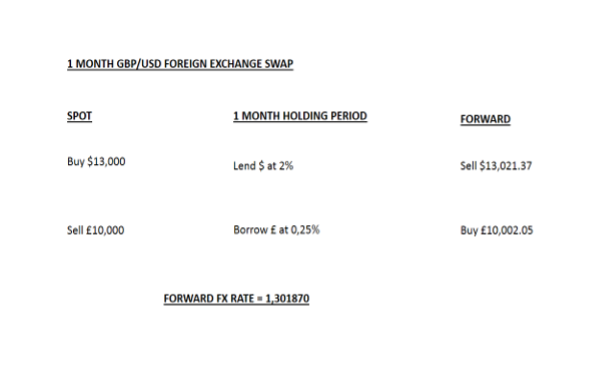

Let’s take for example a foreign exchange 1-month swap in GBP/USD. This Forex swap consists of two legs, the first one would be dated spot and would be exchanged at the going spot rate. The second leg would be forward dated by one month, and this leg would involve the opposite exchange of the first leg at the forward rate.

Buying a 1-month GBP/USD forward would mean buying pounds to sell dollars in one month from the spot date. This means that for the spot date we would buy dollars and sell pounds.

The spot exchange is at the going rate for the currency pair, the rate for the forward exchange is given by calculating the difference between the two interest rates.

The interest rate for US dollars is higher than that for British pounds, this would create a positive carry when holding positions where we are long in US dollars. Considering the above example where we buy pounds, sell dollars forward and buy dollars, sell pounds spot: we would have to lend dollars and borrow pounds for one month. If the dollar interest rate for lending is 2% and the pound interest rate for borrowing is 0.25%, we can see that we will have a positive carry of 1.75% for one month.

Let’s set the spot rate for GBP/USD at 1.3000 for the above example, in the table below we will see the cash flow and the forward rate for the 1-month GBP/USD swap:

From the table above we can see that selling GBP/USD spot and buying it forward generated a cost on the GBP leg of £02.05 and generated a revenue of $21.37 on the USD leg. Division of the two forward amounts (13,021.37/10,000.05) gives us the FX swap rate or forward rate.

We can see that we would be selling this currency pair at a lower price (1.3000) than we will be buying it back a month later (1.30187). This is to compensate for the fact that we held a currency that had higher interest rates than the one we sold.

The US dollar interest rate for lending was 2%, while the interest rate on GBP for borrowing was 0.25. This difference in interest rates produces a positive cash flow and is therefore reflected in the forward price.

FX Swap Calculation

Let’s have a closer look at the FX swap calculation. This is easier than it might seem and will bring a better understanding of not only the forward swap rate but also of swap fees.

The forward rate will reflect the difference in interest rates between the two currencies in the FX pair. When the domestic currency has a higher interest rate than the foreign currency the forward swap rate will be lower than the spot rate. Whereas when the interest rate is lower for the domestic currency the swap rate will be higher than the spot rate.

This feature is necessary to compensate for the difference in interest rates between the two currencies. If you buy a domestic currency with a higher interest rate you will lend that money to gain a positive cash flow over the money you borrowed of the foreign currency.

The forward rate will therefore be lower when we come to sell the domestic currency, which is how the trader on the other side of your trade is compensated.

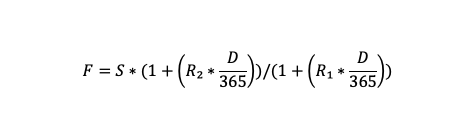

The formula for calculating a forward swap rate in FX is given below: where F = Forward rate, S = Spot rate, R1 = Interest rate domestic currency, R2 = Interest rate foreign currency, D = Number of days. Depending on the day count convention the divisor of the number of days will be 360, 365, or the actual number of days in the year.

We can see that when the interest rate for the domestic currency is higher than that of the foreign currency the formula will produce a multiplier of S lower than 1. This will give a forward price lower than the spot price, and vice versa. When the domestic interest rate is lower than that of the foreign currency it will produce a forward rate higher than the spot rate.

Swaps in Islamic FX

With the ever-increasing expansion of FX trading, there has also been a large increase in participation from the Islamic world. Most FX brokers offer an Islamic forex account and some are considered outright Islamic forex brokers catering for the specific needs in the world of FX trading for those of the Islamic faith.

Under Islamic finance, it is not possible to charge interest rates, and therefore it is not possible to be charged interest on overnight positions. Brokers catering for Islamic finance needs will therefore either waive the charge or add the charge in the form of commissions or wider bid-offer spreads.

For those practicing the Islamic faith, there are also other factors that need to be taken into account. As mentioned above, interest rate payments are not allowed, therefore trading on margin may also be off-limits. The broker may charge interest to borrow the money needed to trade in funds larger than those on your account.

Also, forward trades are not allowed as they are considered pure speculation. This means you would not be able to trade futures or forward swaps on these accounts.

As with all other brokers, these brokers should also be regulated by a reputable national regulator, such as the FCA, CFTC, or CySEC to mention a few. Bear in mind that most Islamic accounts will not waive the swap fee indefinitely. Many will place a restriction or limit as to how many days you may keep your position open overnight.

Before opening an Islamic account you should find out what fees and charges there are for keeping positions open overnight, what time limit they have for keeping positions open, and whether they require a higher deposit. The bid-offer spread may also be wider and the leverage ratio is also something you would need to check.

Wrapping Up

We need to be aware of what positions, buy or sell, generate negative or positive carry for each currency pair. For some pairs, when the difference in interest rates between the two currencies is small, the swap fee is also trivial. However, some currency pairs, for example, EUR/TRY have an extremely wide spread between the two interest rates. Turkish lira interest rates at the moment are at 19%, while the Euro is at 0%. A difference of 19% adds up very quickly when you keep positions open overnight in this currency pair.

It is important then to have a firm understanding as to how much the swap fee will incur a difference to your bottom line when keeping trades open for more than the day. To make things easier you will find various websites that show tables for Forex swap rates. This will allow you to see quickly which currency pairs are going to generate a positive or negative carry for your buy or sell trades.

Most brokers are Swap fee brokers and will apply a cost when appropriate. You need to check that they also apply a benefit to your account when you hold a higher interest rate currency. For those brokers that that waive the swap fee, you need to ask what fees they are charging or if they have wider bid-offer spreads.