A cross currency pair is one that does not include the U.S. dollar. While the U.S. dollar is the most liquid currency, making up the majority of the volume traded throughout the globe, there are additional opportunities available for traders who are willing to include cross currency pairs.

A cross currency pair is one that does not include the U.S. dollar. While the U.S. dollar is the most liquid currency, making up the majority of the volume traded throughout the globe, there are additional opportunities available for traders who are willing to include cross currency pairs.

By trading cross pairs in conjunction with the major currency pairs, you will be able to substantially increase the number of available trading instruments at your disposal, thus providing you more trading opportunities. While the pros of trading the cross currency markets outweigh the cons, there are a number of speed bumps you should know about before initiating a strategy that incorporates cross currency trading.

Some History

Currency trading has evolved over the years. Following the breakup of the gold standard, the U.S. dollar became the primary reserve currency. Over time, the dollar has become the most liquid currency, forming the basis for all major currency pairs. The most active cross currency pairs are those that make up the major currency pairs.

The Euro, Yen (JPY), British Pound (GBP), Australian dollar (AUD), Canadian dollar (CAD) and Swiss Franc (CHF) are the currencies that when traded against the U.S. dollar are referred to as major currencies. Major currency crosses such as the EUR/JPY, or the EUR/GBP provide traders with robust trading liquidity.

Highly Correlated Trading Pairs

While the dollar represents the currency of the largest economy in the world, there are dozens of currency pair trades that can take advantage of the relative value of one currency versus another. A great example of two currencies that were tied at the hip until June 23, 2016 when the U.K. Citizens voted to exit the European Union, are the Euro and the British Pound.

The upshot of the Brexit vote was to catapult the EUR/GBP currency pair higher by 13% over the course of 2-weeks. These active trading partners generate billions of dollars in transaction value that require an exchange of currency on a daily basis. The liquidity you experience when trading the EUR/GBP make it one of the best currency cross pairs to trade.

Generally, countries that are economically intertwined have currencies that move in tandem. You can consider trading this type of currency pair in two ways. Highly correlated trading pairs offer opportunities to range trade using technical indicators such as the Bollinger bands, or the relative strength index. Alternatively, you can look for periods when complacency has set in and an unexpected event is likely to provide volatility.

The upside to trading some highly correlated forex cross currency pairs is they offer great liquidity in most time zones. You should expect the bid offer spread in Asia, Europe and New York for highly correlated major crosses such as the EUR/GBP, to be relatively tight and provide ample liquidity to enter and exit your positions.

Settlement Might not be So Simple

The settlement of a cross pair trade is not as simple as the actual transaction. Since there is ample liquidity on a major cross trade, most brokers will execute your trade using a relatively tight bid offer spread. But, when you exit the position your profits could now be in a currency that is not your home currency. For example, if your home currency is U.S. dollar and you have a successful EUR/GBP trade, your profits could be in euros, which you now need to be trade back into U.S. dollars.

More Trading Instruments

One major benefit of utilizing forex cross currency pairs is that these instruments produce more opportunities for you to trade by increasing the breath of available trading instruments. If you are only trading the major currency pairs, you have 6-different securities to generate a trading view. If you add cross currency pairs to the mix you can generate dozens of different combinations to express your forex trading view.

Experienced traders are constantly looking for opportunities within fx cross pairs. Historically currency markets will trend approximately 30% of the time. This means that 70% of the time, currency markets are range-bound. This occurs especially within the highly correlated forex crosses.

By adding cross currency pairs to the arsenal of instruments you watch, you are opening the door to a wide range of products that provide sufficient volatility for you to formulate and incorporate your trading strategy.

Substantial Volatility

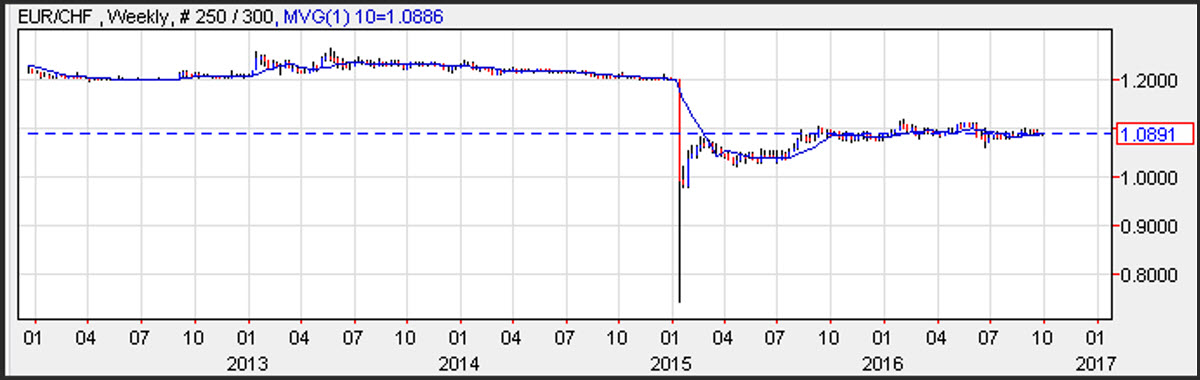

Both fundamental and technical traders may recognize this price chart, which represents a historical moment in the Foreign Exchange market. The image above depicts the EURCHF chart from early 2013 to late 2016. The EUR/CHF is a perfect example of a cross currency pair that traded in a range for a long period only to experience massive volatility and then revert back to a historical calm. The surge in the value of the Swiss France occurred in early 2015, when the Swiss National Bank announced they will scrap its previous 3 year old peg of 1.20 Swiss Francs per Euro.

This scenario had wide ranging negative implications for brokers in the currency market. This Black Swan event generated losses for traders beyond the equity held in their currency accounts. Brokers were put in a situation where they needed to claw back money from clients, who were in no mood to pony up additional funds to their brokers after just getting wiped out. Obviously not everyone was a loser, and there were those currency cross traders that were positioned on the right side and benefitted substantially from this historic volatility.

Pair Trading

Another benefit of trading forex cross pairs is that cross pairs provide you the opportunity of buying along with selling the strongest and weakest currencies that exist in the market. The concept is similar to pair trading as you are attempting to find securities that are poised to gain, along with securities that are poised to underperform.

Economies that have similar exports are also great pairs to combine. For example, both the Canadian dollar and the Australian dollar are commodity currencies. Their economies are reliant on commodity prices to experience growth. If you believe that the Canadian dollar is poised to appreciate but want to remove the commodity component you might consider a cross trade where you sell the AUD/CAD.

Cross Currency Spread

While nearly all of the major currencies provide ample liquidity with minor transaction costs, cross currencies, can be costlier to trade. This is generally not the case for a currency such as the EUR/GBP, but if you decide you want to trade a currency pair where liquidity is weaker, you will likely pay a few additional pips to enter and exit each trade.

Additionally, currency pairs that experience volatility against the dollar are also likely to see increased volatility as a cross pair. With these type of crosses, such as the AUD/JPY or the CAD/JPY, the bid offer spread will be wider.

The time zone and trading session where you place your transaction needs to be considered when trading fx currency crosses. During early Asian hours, many of the European crosses and the Canadian dollar have weak liquidity. To protect themselves from low liquidity, forex brokers will charge a larger than normal spread to make a market in a cross that is not liquid in their time zone.

Just as a refresher, many Forex brokers make money by taking advantage of the bid offer spread on currency trades. The difference between the sale and the purchase price is the spread and this is the incremental value, which the broker uses, to make money from transacting currency trades. Generally, there is some risk involved in making a market. But if a broker makes a price and can exit the trade with a back to back transaction, then there is no market risk.

For example, if market making broker ABC, quotes a EUR/GBP rate of 0.8601 – 0.8604 to their client on a forex order, but receives a quote from their liquidity provider at EUR/GBP 0.8602 – 0.8603, they can exit with a gain. If a back to back situation does not exist, the market maker may need to hold the position for some time and be exposed to some market risk.

The spread on major currency pairs, such as the EUR/USD could be as low as 0.5 pips. On many cross currencies pairs the spread could be as much as 5 or even 10 pips. This allows a dealer to purchase on the bid, and attempt to sell on the offer or even at the mid-price to generate profits. Of course the market could quickly move against the dealer, but in general this is a robust way for dealers to generate income.

Trading Currency Cross Pairs and the Forward Rate

The currency markets are generally driven by interest rates over the long term. Higher relative interest rates attract big institutions and investors to a currency. Investors are faced with a question when they evaluate a currency pair as to which currency will provide income if the market does not move. The carry is a term that describes whether you will earn interest or pay away interest when you transact. The currency with the higher rate will earn what is referred to as the interest rate differential or the carry.

Each country has its own sovereign interest rate. For example, the Japanese Government Bond has a specific interest rate based on the value of the bond. The British 10-year bond also has a corresponding interest rate. If the yield on the British 10-year bond is higher than the interest rate on the Japanese government bond, you would earn the difference between the two interest rates if you purchase the GBP/JPY with a settlement date in 10-years. Obviously, most forex traders do not plan to hold a currency transaction for 10-years, but the concept exists for any period beyond spot.

Recall, the spot rate is the most common delivery period. If you place a spot currency transaction, you are agreeing to swap physical currency in two business days. Any settlement period beyond two business days requires adding forward points. The forward points are added or subtracted from the currency transaction to incorporate the interest rate differential.

Cross Forward Point Spread

One of the drawbacks of trading cross rates for a period beyond spot is you are now subject to a bid offer spread for the forward points. Not only are you likely to pay a larger bid offer spread on your spot cross currency transaction, but you are likely to pay a greater spread when rolling your spot cross currency rate out to a date beyond spot.

If you do this process multiple times during the life of the trade, the spread can erode a portion of the profits you are forecasting.

Fundamental Analysis

It is helpful to analyze economic data when trading cross pairs, as the interest rate differential could play a role in determining the future direction of the currency pair. The process of evaluating the interest rates and other relevant economic data points is often referred to as fundamental analysis. When reviewing economic data for a specific country, you should investigate and determine what factors are contributing to economic growth and how that growth will impact the country’s economy moving forward.

Usually, when a country’s economy is doing well, the demand for the country’s currency and the resulting exchange rate should be expected to rise in value. On the other hand, if a country’s economy is underperforming and producing weak economic data the demand for that country’s currency might decline. Using fundamental analysis, you are able to analyze the correlation between economic data and the value of a country’s currency.

Additional Risks

Usually traders take for granted the stability of the U.S. economy over other economies. Cross pairs have an added layer of risk because instead of evaluating the political and financial instability on one country vs the US dollar, you are now analyzing two other economies against each. Taking your eye off the ball can sometimes wreak havoc on your positions if you are not in tune with the political and economic conditions within the countries of the currencies you are evaluating.

Exotic Forex Cross Currency Pairs

Currency pairs are loosely broken down into multiple categories. You have your major currency pairs, major cross pairs, minor currency pairs, minor cross pairs and exotic currency pairs.

Exotic currency pairs are currency pairs that are not as commonly traded in the foreign exchange market. Usually, exotic currency pairs are those from developing countries such as areas of Asia, the Middle East, South America and Africa. Exotic currency pairs generally have large bid offer spreads and usually require a longer term strategy where the profit projections greatly exceed the bid offer spread.

One of the pros of trading exotic cross currencies pairs is that the yield differential is in favor of the less stable currency. You are getting paid to hold on to a currency that can be volatile, and unstable. This type of strategy is very enticing but can be quite risky.

As an aside, when a country has a relatively weak currency, their goods and services are inexpensive relative to its competitors. This can be very attractive for a central bank that is attempting to spur growth.

Many times a country will tie its currency to other countries’ currencies, and avoid having their currency float, to avoid appreciation, which can reduce export growth. If a country pegs its currency to other currencies, the central bank is usually responsible for the daily trading activity that keeps the currency in line.

An example of this scenario used to be the Thai Bhat, which pegged its currency to the yen, dollar and Euro. This peg was in place until 1998, when the Thai government decided it was too expensive to hold the peg to other currencies.

Prior to this period, a strategy that was used by some traders was to purchase Thai Bhats and simultaneous sell the USD, EUR and JPY to earn an interest rate differential. This is considered a type of carry trade. When the peg was finally broken, many traders lost millions of dollars as the currency tumbled.

Conclusion

While there are a number of costs associated with trading cross currency pairs, expanding into this realm will provide you with a number of benefits which can help you generate additional opportunities. By adding cross currency pairs, you can find pairs that are on the move, which might not be the case if you are just evaluating the majors. Many cross currency pairs are highly correlated and move in lock step which can provide range trading opportunities.

Exotic cross currency pairs can be relatively unpredictable and highly volatile, sometimes well beyond the historical volatility that you would experience by trading the major currency pairs.

Of course, trading crosses do have their own unique drawbacks. Cross currency pairs usually have a higher transaction cost relative to major currency pairs as the bid offer spread on the spot rate and forward rate are wider. The time zone were you transact your trades will also play a role in determining the cost of a transaction. The risks associated with trading crosses can also be significant, because many times you are dealing with less developed economies, so you need to monitor multiple political and economic situations more carefully.

While the trading risks and costs can be higher, the benefits of adding the more liquid cross currency pairs to your arsenal are worth it.