The US Non-farm payroll report, which is part of the Department of Labor’s monthly release of employment figures, is considered one of the most important economic data points released during the course of the month. Changes in job growth can alter the direction of multiple markets, change overall sentiment and effect how investors view economic growth. Job growth directly feeds into consumer sentiment providing the backdrop for increased consumer spending. With consumer spending making up approximately 65% of Growth Domestic Product (GDP) in the United States, the payroll report becomes an increasing important piece of the economic puzzle.

The US Non-farm payroll report, which is part of the Department of Labor’s monthly release of employment figures, is considered one of the most important economic data points released during the course of the month. Changes in job growth can alter the direction of multiple markets, change overall sentiment and effect how investors view economic growth. Job growth directly feeds into consumer sentiment providing the backdrop for increased consumer spending. With consumer spending making up approximately 65% of Growth Domestic Product (GDP) in the United States, the payroll report becomes an increasing important piece of the economic puzzle.

The Non-farm payroll release date occurs on the first Friday of every month. If the first Friday is the first day of a month, for example November 1, then the Non-Farm Payroll data will be released by the Bureau of Labor Statistics on the second Friday of the month. Another scenario for the NFP dates is if the first Friday is a national holiday in the United States, the US NFP data will be released on the second Friday of the month.

The monthly NFP report describes the employment situation in the United States by reflecting the number of net new jobs that have been produced during the course of the past month. The NFP figures is timely, and is calculated by using a survey that is taken by corporations about their employment practices during the prior month. The non-farm payroll numbers are released alongside the unemployment rate, which is measured by a household survey of employment.

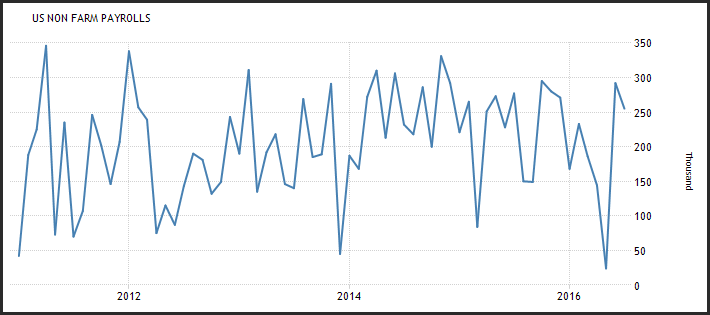

The NFP news report is a time series that is reported by the Bureau of Labor Statistics (BLS), and is considered to be one of the best guides to total employment in the United States. The Non-farm payroll numbers are based on a monthly sampling of specific corporate businesses. Then the government interprets these numbers in a few days against quarterly numbers that are less timely. The monthly payroll figures involve some forecasting by the BLS. While these estimates are reasonable, the month to month changes are quite noisy generating volatility within the time series.

The reason the NFP is so important is that jobs data drives momentum in economic growth. When jobs are produced, sentiment starts to gain momentum and consumers will begin to spend more freely. Since nearly two-thirds of gross domestic product in the United States is driven by consumer spending, it is clear why job gains are so important.

The biggest challenge for the BLS in generating a monthly report is in taking into account companies that go out of business and others which are newly formed. The initial calculation is rendered using the revised employment figures from the prior month to generate a benchmark for comparison purposes. The BLS assumes that employment is continuous. Once the prior month’s revision is calculated the BLS can use a ‘birth-death model’, which is the government’s estimate of net new businesses vs closed businesses for the period.

The Unemployment Rate

On the same day the BLS reports the NFP, they also report a separate employment report called the household survey. The U.S. unemployment rate is defined as the number of individuals actively searching for a job calculated in terms of the percent of the entire labor force. This figure is calculated separately from the non-farm payroll report. Each month, the BSL announces the total number of unemployed as well as employed individuals based on the number of employed and unemployed people in the United States for the previous month. This analysis reflects the percentage of the labor force that is unemployed.

You may be wondering why the BLS does not use the initial unemployment insurance figures to determine the unemployment rate. One of the reasons is that there are many individuals that are unemployed when their unemployment insurance runs out, which would make the calculation unreliable.

The Labor Department provides a plethora of data every month, but most of the information is not of interest to most traders. The unemployment rate is also known as the U-3 number, and it is defined as the total number of individuals that are unemployed as a percent of the entire labor force. While this appears on the surface to be straight forward, the U-3 does not include a wide variety of employment scenarios. A wider measure of unemployment is known as the U-6 number which some consider a more accurate description of the employment situation in the United States.

The U-6 unemployment rate is defined as the number of unemployed individuals along with people that are underemployed that are still attached to the labor market, but might be working in temporary jobs or part time jobs for specific reasons. This number is then compared to the total labor force and calculated as a percentage. The number takes into account those who are under employed.

The U-6 unemployment rate is more volatile than the U-3 rate, as calculating those who are underemployed, can shift quickly over a couple of months and can whipsaw much more than the U-3 unemployment rate.

Participation Rate

In general, you would assume that a decline in the unemployment rate usually means that there are less individuals that are unemployed. Unfortunately, this not always the case.

This is because the unemployment rate is made up of those who are unemployed as a percentage to the total number of individuals looking for a job.

If the participation rate (those looking for a job) increases, the unemployment rate can move lower if the number of unemployed as a percent stays the same. For example, if you have 100 people and 5 are unemployed your unemployment rate is 5%. If the participation rate increases to 110, but 5 are still unemployed the rate will drop to 4.5%, with the number of people unemployed remaining the same.

The participation rate is a key component because it tells you the number of people who are trying to find a job. These people are either out of work completely or underemployed. What is not included in the participation rate is those who do not want to work at all, or those who are unable to work, for example a student or a stay at home mom or dad. The unemployment rate is generally looked at in conjunction with the participation rate. The two rates will help determine who is classified as unemployed and those who are not active participants.

During a recession the participation rate is a key component. The participation level generally falls during a protracted recession as individuals become discouraged by the difficulty they are having finding a job. This could make the participation rate decline as many are not actively seeking employment or find multiple part-time jobs that satisfy the expenses they need to cover.

Wages are a Key Component of the Non-Farm Payroll Report

Job gains can also push wages higher. This is very important to the Federal Reserve as wage gains are one of the key elements tracked by the Fed to determine if they need to increase or decrease interest rates. The Fed has a dual mandate when controlling monetary policy. They use a combination of growth and inflation to determine if there needs to be a change.

While there are many economic indicators such as personal spending and retail sales, along with CPI and PCE that will alter the course of the capital markets, the NFP is the most significant, as it reflects sentiment, inflation and potential growth all in one number.

Trading the NFP

The NFP report provides keys statistics for currency traders. There can be substantial volatility in the forex market after the NFP release, which can cause large gyrations for major currency pairs. In addition during these volatile periods it may difficult to obtain tight bid ask spreads from you FX Broker, or even execute your forex orders in the market efficiently.

The combination of reporting a number that provides insight into potential consumer spending and the rate of inflation makes the NFP one of the key numbers produced on a monthly basis to capital markets traders.

A stronger than expected number will usually increase interest rate levels, which could spill over into the US dollar as well as the US equity markets. The Federal Reserve only controls the short end of the interest rate curve, but the market controls the longer end.

Since the NFP report pertains to the United States, and since the majority of the liquidity that is trading in the foreign exchange market on a daily basis involves the US Dollar, those currency pairs with the Dollar will typically show the most pronounced effects from the NFP release.

As mentioned, the non-farm payroll report is a key metrics used by the Federal Reserve to determine interest rate movements. The Federal Reserve has a dual mandate which differs from other central banks around the globe. The Fed needs to focus on inflation as well as full employment, while most other central banks only focus on inflation. The Fed evaluates the NFP headline number which reflects the total number of new jobs created in a month as well as other factors such as wage growth.

If the NFP numbers are strong, the Federal Reserve is more likely to be hawkish toward interest rates, and lean toward tighter liquidity. If the NFP numbers are weak, the opposite will occur and the Fed will be dovish and lean toward adding stimulus. Job growth is essential to generating a robust U.S. economy, and therefore this report can drive market sentiment for days, weeks or even months.

If the Federal Reserve is planning on increasing interest rates, this makes the U.S. dollar more attractive relative to its peers. The differential between the U.S. interest rates and another countries interest rates will move in favor of the greenback. This makes the dollar more attractive and generally leads to an exchange rate move in favor of the dollar. Obviously the reverse is also true. If the Fed leans toward reducing interest rates, then the interest rate differential will move against the U.S. dollar and make the greenback less attractive.

Given the volatility surrounding a payroll report, there are a number of ways professional investors can trade around this report. Trading prior to the Non-farm payroll report is generally stable and active, but immediately after the report, markets that are effected can become very volatile. Here are some of the strategies used by traders ahead of or immediately after the NFP report is released.

Wait Until The Dust Settles

Stocks, interest rates, and currency pairs generally gyrate when the actual NFP report differs from what was expected by economists. Prior to the report, economists from many of the most renowned investment and commercial banks estimate what the BLS will report.

Most professional traders are aware of what is expected by the market. When the number is released by the Bureau of Labor Statistics, prices can quickly jump to new trading ranges if expectations differ substantially from the actual number. Traders must decide, at that point, the most suitable course of action. Entering a position prior to the release of the NFP number means that you believe that the actual release will be either less than or greater than expectations.

The results of the NFP data can help you determine or confirm a specific direction for a currency pair. For example, if you are already bullish on the Dollar, and the market expects a headline NFP number that is 100K and instead the actual release shows 200K, the dollar is likely to gain traction. You can then use that information to further bolster your trade conviction, and position yourself to find an appropriate trade entry after the initial volatility begins to level off.

Jump in Right After the NFP Number

Jump in Right After the NFP Number

Many times the initial move the currency pair makes over the first 5 minutes after the NFP report, is the likely direction the market will continue to move, at least in the short run.

By jumping into a position that is in line with your view that is confirmed by the NFP number can be a lucrative way to play the NFP release. The risk with this strategy is that the market can have a knee jerk reaction, and for the first half hour or hour, trades in one direction, but then eventually loses steam and moves in the opposite direction.

Prior to jumping in with the momentum right after the NFP number, you should evaluate where the market has come from. You are likely to have a better chance of success if sentiment was in the opposite direction prior to the release.

So, if the dollar had been moving lower and you receive a much better than expected number, you are more likely to generate a profitable trade, by following the initial momentum, then a scenario where the dollar was improving and then the number was better than expected.

Using Options to Trade NFP Data

Options are financial instruments that can have unlimited upside potential, but limit your downside risk.

A call options is the right but not the obligation to purchase a currency pair at a fixed strike price on or before a specific date. A put option is the right, but not the obligation to sell a currency pair at a fixed strike price on or before a certain date. For this right you pay an upfront premium, which is the most you can lose if the trade goes against you.

For trading the NFP report, some traders prefer leveraging short term Options.

For example, an option will pay an investor if the USD/JPY is greater than the current price within the next 60 minutes. If you believe that the Nonfarm payroll number will be greater than expected, you can limit your risk by purchasing a USD/JPY call option that expires soon after the NFP number. The reverse is true if you think the number will be less than expectations, and in that instance you can purchase a put option.

Conclusion

While there are many ways to trade around the NFP report, what is clear is this is likely the most important piece of economic data that is released within the U.S., on a monthly basis. And as we have discussed, the Non-farm payroll report directly feeds into the interest rate decisions that are made by the Federal Reserve. Higher interest rates relative to other countries are generally beneficial to a currency, so higher U.S. rates generally equate to a higher greenback.

The NFP report usually creates significant volatility, which means that news oriented and technical traders alike should have a specific trading plan on how will interact with the market around these trading times.