Gold is the most actively traded precious metal, with approximately 125 billion dollars of gold derivatives traded daily around the globe. The volume has accelerated over the past 10-years, as retail investors have been given more opportunities and mediums to trade gold.

Gold is the most actively traded precious metal, with approximately 125 billion dollars of gold derivatives traded daily around the globe. The volume has accelerated over the past 10-years, as retail investors have been given more opportunities and mediums to trade gold.

While gold derivatives have been accessible for decades, and physical gold trading has been around for centuries, it has been the relatively recent rapid growth in spot gold trading that has brought in many new speculators into this market.

The benchmark for spot gold is the London Interbank rate. This spot market is settled twice a day. The trades that are reported that are used to calculate the rate, are physically settled gold trades, however, most gold trading is financially settled using derivative products. Physically settled gold is the process of swapping gold for U.S. dollars, while a financial settlement of gold is the exchange of profits and losses.

Why Investors, Institutions and Banks Trade Gold

Gold is traded by investors for several reasons. Many believe gold is a hard currency that can be used to hedge against future inflation expectations. Gold can also be used as a hedge against currency depreciation. Most of the gold that is traded, is backed by physical gold that is held in vaults around the globe. The gold that is traded via forex brokers, is an over the counter product were you never actually take delivery of the metal.

The largest holders of precious metals are global central banks. These institutions hold gold as a hard asset, and in less developed countries gold can act as a hedge against the devaluation of their paper currency. Gold trades actively in the over the counter market and is priced in U.S. dollars per ounce.

History of Gold Trading

The U.S. dollar, at one time, was backed by physical gold. During this period, all banks around the globe needed to back their currencies with gold, which required a mechanism to trade gold.

Banks developed over the counter products that mimicked the futures markets and allowed producers to sell their gold at a specific point in the future. Banks created a hedging mechanism for their clients which was based on credit they extended to their gold producing customers. This process is like the margin system that is used today by futures exchanges.

Today, you can speculate and trade the price of gold with most reputable forex brokers. Gold is traded like a currency and brokers will offer margin, and leverage on gold contracts. If you want to hold your position, your broker will adjust your price to reflect the forward rate of gold, in a way that is like rolling your currency position.

How to Trade Gold

Retail access to gold trading has broadened substantially over the past decade. The concept of a non-deliverable forward has made trading a physically delivered product, simple and attainable for most retail investors. As you can imagine, it is much more difficult to trade gold bullion or gold coins relative to non-deliverable gold.

The origins of gold trading can be traced back to physical gold trading which has taken place for centuries. This evolved into the establishment of futures markets, allowing traders to take positions via an organized exchange. This was particularly attractive to producers and commercials as it allowed them to lock in prices and hedge their risk.

Much of the physical gold that is traded globally is in gold bar format and held in vaults. There are also gold coins that are actively traded throughout the world. The most liquid gold futures contract is traded on the Chicago Mercantile Exchange. Gold that is delivered to a CME regulated vault, needs to be 99.9% pure. The gold bars are evaluated and their purity is certified by a regulated entity.

There are two distinct types of vaults that are often used to store gold. You can have a private vault where only you or your designated persons has access to the gold. This would be housed at a private storage vault or at a certain bank.

A second type of vault is a commercial vault were your gold can be either separate or comingled. If your gold is to be held separately, it will be placed in a specific area, but will not be considered fungible. If you own a comingled gold account, it will be considered fungible where one gold bar that has a specific weight and purity is considered equal to another. If you plan to use your gold as a physical trading vehicle, then a commingled account is the way to go, as the cost to store gold will be cheaper than a separate account.

Gold storage trades are quite popular and keeping your costs low is a crucial component of trading physical gold bars. Some investors trade a storage arbitrate using forward rates to lock in gains. For example, if you can buy physical gold, and store it and the cost plus the current price is less than the price based on future gold (which is reflected in the futures markets or forward gold prices), then you have locked in an arbitrage. Brokerage costs need to be incorporated into your initial price to get a true cost of your physical gold.

Trading Gold via the Futures Market

The process of trading gold online via the futures market requires the purchase a specific minimum value of gold based on the available futures contracts. Generally, each gold futures contract holds 100 ounces of gold. The total value of each futures contract is 100 ounces multiplied by the price of gold per ounce. With gold prices near $1,250 per ounce, the notional value of a futures contract is close to $125,000. Futures contracts can be purchased using a margin agreement which allows investors to use leverage and only post a fraction of the money needed to purchase the gold.

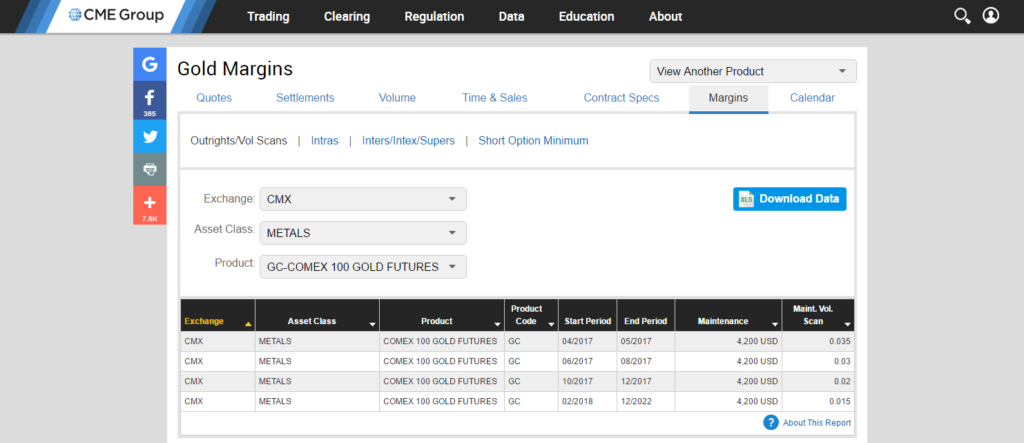

Margin on futures is calculated by your broker. Most futures brokers follow the guidelines set by the exchanges they clear through. Margin requirements can change based on market conditions and volatility.

The minimum margin is generally a fraction of the notional value of the contract. The minimum margins acts to protect the broker and cover a loss from a potential outsized move that may occur in the instrument.

Exchanges will post the level of margin required on their websites. For example, based on the above CME Group gold margin data, the maintenance margin needed to trade 1-gold-contract, on the Chicago Mercantile Exchange, is $4,200 dollars. All the pertinent information you will need to specifically determine what you are trading is listed by the exchange. This includes the settlement, the contract specifications, as well as the volume and open interest data.

The exchange will describe the position limits, as well as, the settlement method. If the settlement is deliverable, then if you hold the contracts (long or short) through the settlement period you will be obligated to deliver or receive the physical gold bars that are described in the grade by the exchange. There are settlement procedures that you should be aware of if you determine you want to trade gold physically using an exchange. Gold futures trading is very liquid, but there are other ways that you can gain exposure to gold market, which we will discuss next.

Trading Gold in the Spot Forex Market

An alternative medium for investors to initiate positions in gold is by using an over the counter platform. The spot forex market has become one of the most popular ways for the individual investors to trade Gold and Silver precious metals. In these cases, an investor is not actually purchasing or selling the physical precious metal but rather gaining exposure to the change in the price of the instrument.

The institutional over the counter market, has provided the framework for retail over the counter trading. Gold OTC trading is active in the banking space, but hedge funds and pension funds also participate in this arena. Fx gold trading was developed to assist both gold producers and consumers, along with central banks and commercial banks to facilitate trade.

Gold Trades Like a Currency

Gold is viewed by many as a quasi-currency. The price in gold is quoted in U.S. dollar and trades much like a currency pair.

Trading gold in the forex market can be tracked by analyzing the XAU/USD chart. Like other currency pairs, when you purchase or sell gold at some point in the future, you pay or receive the difference in the interest rates between gold and the U.S. dollar. The gold interest rate curve is called the gold forward curve or the GOFO curve. This interest rate differential extends from 2-days, which is referred to as the spot price of gold, to 10-years or even more.

Gold prices gyrate as investor sentiment changes in conjunction with inflation expectations as well as the strength of the US dollar. Inflation itself is the notion that as the value of a basket of goods or services increases in value, it decreases the discretionary spending power of consumers. The most notable types of inflationary assets are food, metals and energy prices which are generally excluded from the core inflation reported by the Federal Reserve. The bulk of core inflation includes rents, housing prices, and labor costs.

To defend against rising inflation expectations investors can purchase a hard asset that might climb in value at a rate that is greater than inflation. The most common asset used to protect an investor’s portfolio against rising inflation is gold.

The Benefits of Trading with a Forex Broker

If you trade gold via the spot forex market, you can purchase a specific dollar amount of gold, as opposed to a minimum contract value in the futures market. For example, when you want to purchase gold thru the forex market, you can buy a specified dollar amount as opposed to figuring out how much 100 ounces of gold will cost you to purchase in the futures market. Some brokers have specific contract sizes, but generally provide you with choices that will allow you to manage your upfront costs.

Forex brokers will provide you with margin requirements, and in many circumstances, the capital needed to open and trade an account can be minimal. There are a wide range of forex brokers that allow you to open an account and trade gold with deposits as low as $100.

Forex brokers also have a plethora of tools you can use to start trading gold. This includes spot gold charts to help you determine the future direction of prices. Performing technical analysis on the gold symbol in forex XAU/USD is similar to any other type of currency pair analysis.

Additionally, most brokers will offer financial calendars, and mobile platforms, which will allow you to trade while you are on the go.

Using Exchange Traded Funds (ETFs) to Trade Gold

Using Exchange Traded Funds (ETFs) to Trade Gold

You can also trade gold by using exchange trade funds commonly referred to as ETFs.

The SPRD Gold Shares ETF (GLD) would be a good choice due to its deep liquidity. Gold ETFs trade like stocks and provide easy access to retail investors who want to speculate on gold prices. The creation of Gold ETF’s has increased the liquidity of gold, and increased the volume of gold traded throughout the globe. The American Stock Exchange (AMEX) is the primary trading exchange for Gold ETF’s.

Gold ETF’s can contain assets which can include gold futures contracts and physical gold. But be careful when you are picking certain gold ETFs, as they may be products that own gold mining companies so your exposure is more geared to the value of the mining companies, rather than directly to the value of gold.

Summary

Gold is the most actively traded precious metal and over the past 10-years, gold trading has become even more popular and widely available. While some investors are interested in trading physical gold and storing it, other investors are more interested in speculating on gold prices via the futures, spot forex or stock market.

Gold futures contracts and institutional over the counter trading emerged as a mechanism for gold producers to hedge their risk exposure. Central banks as well as commercial banks were the largest holders of physical gold, and were the natural counterparts for gold producers.

Futures contracts are both physically and financially settled. If you trade a physical delivered futures contract you are obligated to deliver or accept delivery of the volume of gold specified on the futures contract upon the expiration of the contract.

Futures contracts require that you deposit margin, which is determined by your broker who must follow the exchange rules for minimum margin. Brokers can charge a greater margin than the minimum set by an exchange but not less.

In addition to futures there are now exchange traded funds that retail investors can use to trade gold. Many of these funds hold gold bullion or bars in a trust, and the price of the ETF reflects that value. ETF’s trade like stocks, but have limited liquidity when the market is closed.

Last but not least, you might consider trading spot gold using a forex broker. Forex brokers offer robust margin levels and will allow you to trade specific dollar denominations. Generally, forex brokers offer a product that is tied to the London Interbank rate, that is not physically delivered.