Public interest in trading forex has grown considerably in recent years with the advent of online forex trading. Prior to this development, most individuals either had to trade quite large amounts of currencies with their banks or trade currency futures contracts on exchanges like the Chicago Mercantile Exchange’s International Monetary Market.

Most online forex brokers now allow retail traders to deal currencies in much smaller amounts in the spot currency market, so many individual traders might wish to explore their options for trading spot currencies and foreign currency futures.

Furthermore, since considerable differences exist between dealing currency futures and forex trading in the spot market, it makes sense for traders to learn about the characteristics, benefits and drawbacks of each market.

The following sections of this article will compare and contrast the main currency dealing methods, including dealing in the Interbank market, dealing via online forex brokers, and dealing in a currency futures market like the Chicago IMM.

Quotation Conventions

Each of the currency pairs quoted in the Interbank spot forex market have a standardized quotation convention so that all currency traders operating in it know what the quotes they receive mean. The convention is generally the number of counter currency units per one unit of the base currency.

The base currency is the first currency in a currency pair, while the counter currency is the second currency in the pair. So for the EUR/USD currency pair, for example, the EUR or Euro is the base currency, while the USD or U.S. Dollar is the counter currency.

Following this convention, the standard Interbank quote for the EUR/USD currency pair is typically the number of U.S. Dollars per Euro. Furthermore, the convention for quoting the USD/JPY currency pair is generally the number of Japanese Yen per U.S. Dollar. Similarly, USD/CAD is quoted as the number of Canadian Dollars per U.S. Dollar, while GBP/USD is the number of U.S. Dollars per Pounds Sterling.

Currency futures contract quotation conventions are sometimes reversed from those Interbank forex traders commonly use, so it is very important to know which pairs are reversed when comparing quotes between the two markets. In general, the Chicago currency futures market quotes all currencies in U.S. Dollar terms, which means that the futures contract will be quoted in U.S. Dollars per currency.

This means that the quotation for buying currency futures contracts for the Pound Sterling versus the U.S. Dollar is going to be very similar to the Interbank forex market quote for GBP/USD for the same delivery date. On the other hand, the quotation for the Japanese Yen versus the U.S. Dollar currency futures contract is going to be the inverse of the normal Interbank quote for USD/JPY.

As an example, the Interbank quote for USD/JPY for delivery on the same date as the June Chicago futures contract might be 100.00, while the quote for the June Japanese Yen futures contract on the Chicago IMM would be similar to the inverse of that number or 0.0100.

To compute the inverse of a quote so that you can compare Interbank and futures market quotes, you either enter the quote and hit the 1/x button on your calculator, or you can divide the number 1 by the quote you wish to invert.

Delivery Date

Most currency transactions in the Interbank market are done value spot, which means that delivery takes place two business days from the transaction date. Since currencies trade in pairs, the spot value date must be a business day in both currencies. All of the major currency pairs and crosses, with the exception of USD/CAD typically trade for value spot.

Funds transactions occur when delivery of the currencies being exchanged will take place in one business day. This is the most common delivery period for USD/CAD transactions in the Interbank market.

Forward contracts are also used when delivery takes place beyond two business days. Typical forward contract date tenors are 30, 60, 90, 120 and 360 days, although custom dates are readily available and are interpolated from the rates for the standard tenors.

Swap contracts are also entered into when a trader desires to exchange one delivery date for another. Tom Next swaps are especially common when forex traders need to move the delivery date of a position held overnight out to the current spot delivery date.

Currency futures contracts differ in terms of their delivery date from the aforementioned forward contracts since their delivery dates are typically standardized and occur on a quarterly basis, rather than on a certain number of days from the date of the trade. For example, a futures trader might be able to transact a currency futures contract with a delivery date in March, June, September or December.

Trading Volume

The forex market is the largest financial market in the world, with its primary trading centers based in London, New York and Tokyo, with additional significant trading volume seen in Sydney, Auckland, Hong Kong and Singapore.

The forex market is the largest financial market in the world, with its primary trading centers based in London, New York and Tokyo, with additional significant trading volume seen in Sydney, Auckland, Hong Kong and Singapore.

One significant difference between the forex spot and currency futures markets is that of trading volume. Spot transactions have traditionally made up the lion’s share of currency transactions around the world.

Furthermore, the vast majority of currency transactions take place in the unregulated Over the Counter Interbank forex market where dealing occurs via an extensive phone and electronic network among financial institutions and their clients.

In recent years, the growing availability of online forex brokers has made spot forex trading accessible to the masses. Retail traders who previously would not have been able to participate due to their lower investment amounts can now trade forex on margin in modest amounts using these Internet based brokers. Nevertheless, the volume of these currency transactions traded remains small in comparison to that observed in the Interbank forex market.

Of all currency transactions, less than 10 percent take place on exchanges in the form of currency futures trades. Most of the world’s currency futures trading volume occurs in Chicago and takes place on the Chicago International Money Market, which is a division of the Chicago Mercantile Exchange or CME. Other exchanges beside the CME’s IMM that list currency futures contracts include: the BM&F, the DGCX, the EUREX, the EURONEXTFPE, the HKEx, the ICEUS and the SGX.

Currency Pairs, Transaction Sizes and Tick Sizes

In the Interbank forex market, transaction sizes can be just about any amount, but they are typically more than USD 1 million in order to qualify for consideration to be quoted by most Interbank market makers and dealing desks at major financial institutions. Some banks and finance companies do provide a forex quotation service in smaller amounts to favored clients that usually trade larger amounts, as well as to middle market clients from smaller corporations or high net worth individuals. Pricing for smaller transaction sizes is generally not as competitive, so dealing spreads may widen for these lesser amounts.

Interbank quotations on especially large transactions above USD 50 million may also widen since the market maker may move the market when executing transactions of this size or higher. The wider spread allows them to reduce their risk somewhat after agreeing to execute such a sizeable trade for a client or a fellow professional trader.

Just about any major financial institution with a strong foreign exchange department will offer pricing on virtually all major and minor currency pairs and crosses. Most will also offer pricing on more exotic currencies quoted against the U.S. Dollar. In addition, the minimum tick size for most of the major currency pairs quoted in the Interbank market has recently declined to 0.00005 from 0.0001, except for USD/JPY, which has declined to 0.005 from 0.01.

In the retail forex market, which is typically accessible via online forex brokers, a standard transaction size or lot is 100,000 units of the base currency. Nevertheless, since retail traders often wish to trade forex in smaller amounts, transaction sizes can also be as small as a micro lot or 0.01 of a standard lot or 1,000 base currency units. In addition, a mini lot size is also usually available at most brokers, which is 0.1 of a standard lot or 10,000 base currency units. Minimum tick sizes are typically the same as in the Interbank forex market.

Retail forex traders are generally only able to trade the currency pairs offered by their broker. If their broker does not offer cross trading in the cross currency pairs they desire directly, they will need to execute two transactions using the U.S. Dollar pair for each currency to establish the desired cross currency position. Many online brokers do not offer pricing in exotic currencies.

Currency futures contracts generally have set trading amounts or lots that vary among the specific currency pairs available for trading on a particular exchange for delivery on standardized dates, usually quarterly. In addition, exchange rates for the currency pairs can vary by a minimum amount known as a tick size.

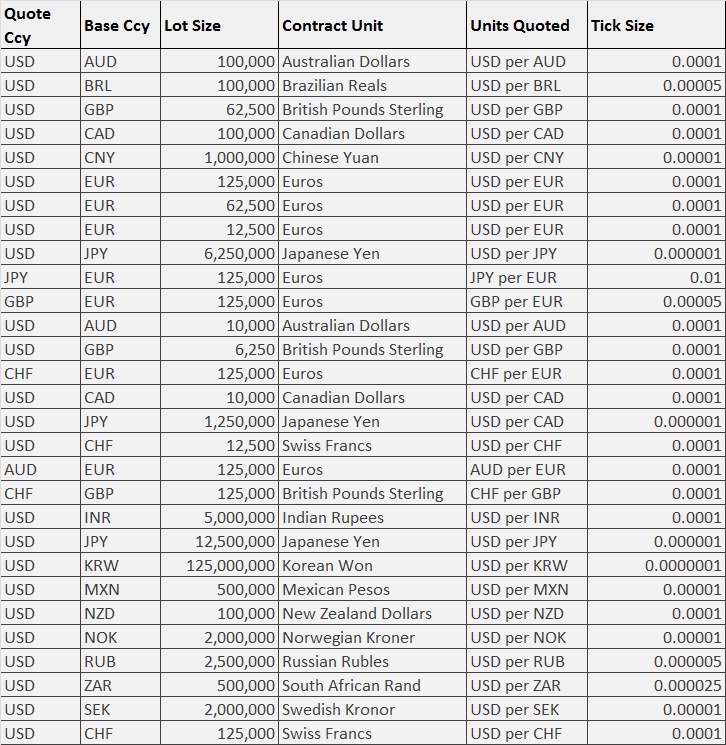

As an example for illustration purposes of one exchange’s currency futures offerings, the following table lists the current standard lot size, currency pairs and tick size for CME traded currency futures:

Table 1: CME currency future pairs, lot sizes, lot currency, quotation conventions and tick sizes as of June 2016.

Regulation

The Interbank forex market remains a generally unregulated over the counter market that operates between financial institutions and their clients that can be situated in different legal jurisdictions. Participants in this market are typically finance professionals who are not seen as requiring regulation to protect.

Nevertheless, this lack of regulation and transparency means quotes given to clients by market makers and dealing desks can be substantially different from the exchange rate levels actually prevailing in the professional forex market.

Some steps have been taken in recent years to regulate transactions by retail forex traders made via the online forex brokers that operate over the Internet. This was considered a necessary protection due to the fact that these brokers are typically dealing with the general public who may not have acquired professional expertise. Such regulation has thus far targeted things like prohibiting hedged trading and reducing high leverage ratios. Despite exceptions of that type, this growing currency market still remains relatively unregulated outside of jurisdictions like the United States where such protective regulations have been enacted. Some online forex brokers refuse to accept potential clients residing in regulated jurisdictions.

In contrast, trading in the currency futures markets takes place on an exchange that is generally highly regulated by a financial regulatory body within the country it is located in. This means that dealing exchange rates and quotations all need to be in line with the current market, in which pricing is fully transparent both to clients and market makers.

Currency futures trading volumes are also recorded and can be reviewed to provide positioning data to analysts. The COT or Commitment of Traders report produced each Friday by the Commodities Futures Trading Commission or CFTC is an especially popular market sentiment tool for forex traders that lists outstanding currency futures by trader type.

Currency Futures Versus Spot Forex – Other Considerations:

Traders or hedgers who need to trade exact amounts might do better trading the spot forex market with Interbank counterparties or trading micro lots via an online forex broker than with futures contracts. Basically, if precise amounts of currency are required for a forex transaction, the fixed denomination of a futures contract or contracts may not suffice or it may exceed the amount required.

Traders or hedgers who need to trade exact amounts might do better trading the spot forex market with Interbank counterparties or trading micro lots via an online forex broker than with futures contracts. Basically, if precise amounts of currency are required for a forex transaction, the fixed denomination of a futures contract or contracts may not suffice or it may exceed the amount required.

Most Interbank and retail forex transactions are free of fees for a spot FX trade other than the quoted dealing spread. Nevertheless, all forex futures transactions involve additional costs, such as exchange fees and brokerage charges.

Price differentials between the spot and futures markets may offer a quick currency trader some modest arbitrage opportunities. Of course, they do need to remember to add or subtract the swap points for the futures contract delivery date to the forex spot rate in order to compute a comparable exchange rate between the markets.

Also, many nimble cross currency traders arbitrage the directly quoted price for cross currency pairs against the quoted rates for each of the cross’ component currencies quoted against the U.S. Dollar, and this arbitrage can be done between crosses quoted on futures exchanges and in the FX spot market.

Some professional traders also use currency futures as a hedging vehicle. For example, some larger traders and financial institutions buy or sell currency futures contracts against their spot and forward forex positions as a means of reducing their market risk.

Finally, trading hours for spot forex and currency futures are quite similar now that electronic futures trading is available. Spot forex trades continuously from 17:00 Eastern Time on Sunday to 17:00 Eastern Time on Friday. For CME currency futures traded via ClearPort Clearing, trading hours run from Sunday to Friday from 18:00 to 17:00 Eastern Time. Note that CME futures trading has a one hour break starting at 17:00 Eastern Time.