As a forex trader, you have come to appreciate the value of trends in the market. Today we will discuss one of the techniques to analyze and trade price tendency in Forex, specifically the price channel method. The price channel, is a version of the

The Channel Trading Method

So how do we go about drawing a channel on the chart? We start by looking at the price action and try to spot a trending price move where the tops and the bottoms are moving with the same intensity. In the case of an uptrend, we can draw a line which goes through the bottoms and another line parallel to it, which goes through the tops of the price action. Voila! You have just drawn a channel on the chart!

Above you see a standard trend channel drawn on a bullish tendency. The lower level of the channel is a typical bullish trendline which goes through the bottoms of the price action. The upper level is parallel to the lower trendline and connects the diagonal boundary for the topping price action. This creates the classic price channel.

Let take a closer look at the example above. The lower level of the channel plays the role of a support and the upper level acts as a resistance. The black arrows on the chart point to the support and resistance channel function on the chart. See that when the price decreases to the lower level of the channel, it bounces upwards. Then the price seeks interaction with the upper level of the channel and tends to bounce downwards and vice versa.

Knowing this, traders can use channel levels for entry and exit points. When the channel is bullish, you can look for opportunities to buy the Forex pair as price bounces from the lower level. You can hold the trade until the price approaches the upper level of the channel.

In this manner are seeking to trade the impulse move of the channel. When the price bounces from the upper level of the channel, you can trade the potential bearish move to the lower level. However, this is generally less desirable, since the corrective price moves are relatively smaller than the impulse price moves of a trend.

Channel Breakout

As with all price trends, the tendency within a price channel must also come to an eventual end. We have a channel breakout when the price goes through its upper or lower level, and closes strongly beyond that level. In this manner, the price action exits the channel, and ceases to conform within its previous contained structure. Here is an example of a trend channel breakout:

Above you see the continuation of the channel we were discussing earlier. As you see, the price stops conforming to its levels at some point and breaks through its lower level (red circle). This is the channel breakout. The price goes through the lower level, indicating that the bearish influence on the Forex pair is strong enough to interrupt the bullish trend. A new bearish tendency starts afterwards. The price enters a bearish trend and accounts for a strong decrease.

Channel breakouts warn of a termination of the existing trend, and a potential price moves in the direction of the break. As such, traders can prepare to enter deals in the direction of the breakout in order to catch a new upcoming price move. This is a simplified explanation of a channel breakout trading strategy.

Price Action Trading Using Channels

As we have touched on earlier, price action channel trading in Forex involves trading the inside bounces of the channel. In addition, when the channel has matured, you can then prepare to trade the eventual breakout as well, which could lead to a reversal price move. Let me now show you how this works:

Above you see the hourly chart of the EUR/USD for May 5-12, 2016. The image illustrates a price action system using a channel.

The chart starts with a rapid price decrease, which creates a bottom (1). This is actually the first point of the channel, which is currently being created.

The further price action sends the price upwards, creating a top (2). Then we see a push lower, which sends the price downwards to point (3). The further price increase stops at point (4), confirming the channel.

This is the first trading opportunity on the chart – at point (4). When the price touches the upper level of the bearish channel for second time, it creates a potential for a short trade. The further price bounces create two more long trades and two more short trades. Though we should note, once again, that since this is a bearish channel, we would prefer to trade to the short side, and wait for a channel breakout prior to looking for a long trade.

Take a look at the last short opportunity in the channel. See that the price bounces downwards, but it doesn’t reach the lower level. The price returns back to the upper level and breaks it upwards (red circle). Breaking the upper level the price action creates a close signal for this short trade. However, at the same time, the price creates a long signal for a new trade, since we now have a bullish breakout of the bearish channel.

The price moves sharply higher after the breakout. You would have two options to exit this long breakout trade. The first one is when the price reaches the $1.1435 resistance and bounces downwards. The second option to close the long breakout trade is when the price breaks the support created after the bounce from $1.1435. In both exit options the trade would have been profitable.

Linear Regression Channel

One of the more popular channel indicators is the Linear Regression Channel. This type of channel indicator looks similar to a standard channel however, the Linear Regression Channel indicator has a middle line, which is a median price value. The upper and the lower level are evenly distanced from the median line.

In this manner, the middle line of the Linear Regression Channel also acts as a support or a resistance. Furthermore, this line could be used as a trigger to enter trades in the direction of the trend. Have a look at the image below:

This is a standard Linear Regression Channel. You see the upper level, the lower level and the median line. The black arrows on the chart image point to moments when the channeling price action reacts to the median as a support or a resistance.

After a bounce from the median line, the price usually returns to where it came from. At the same time, when the price breaks the median level, we see a further move to the opposite channel line.

Traders can use the median level of the Linear Regression Channel as a confirmation for their trades. At the same time, the median line could be used to attain exit signals as well.

Donchian Channel

The Donchian Channel is another channel trading indicator. The Donchian channel indicator is calculated by taking the highest high and the lowest low of N periods. These highs and lows are marked by horizontal lines, with dynamically changing levels depending on the highest high and the lowest low for the progressing periods. As such, the price action is encapsulated by the Donchian price channel.

The Donchian trading indicator also has a middle line. This line is simply the average between the upper and the lower Donchian levels.

The upper and the lower level have support/resistance functions. However, when the price starts to continuously hit the upper band, and prices continue to rise, then we get a long signal on the chart. The same is in force for the lower band. If the price action starts hitting the lower band of the Donchian channel and pushes it downwards, then you get a short signal.

In other words, expanding the distance between the upper and the lower channels gives us a bias on the price dynamics and the formation of a trend. At the same time, the middle band can be used as a further confirmation of entry or exit signals.

You may have noticed that the Donchian channel indicator resembles the Bollinger Bands indicator. Indeed, they are used in a similar way. However, we must understand the difference between the two. The Donchian indicator is based on the price high and low over x periods, while the Bollinger Bands indicator has a volatility based configuration.

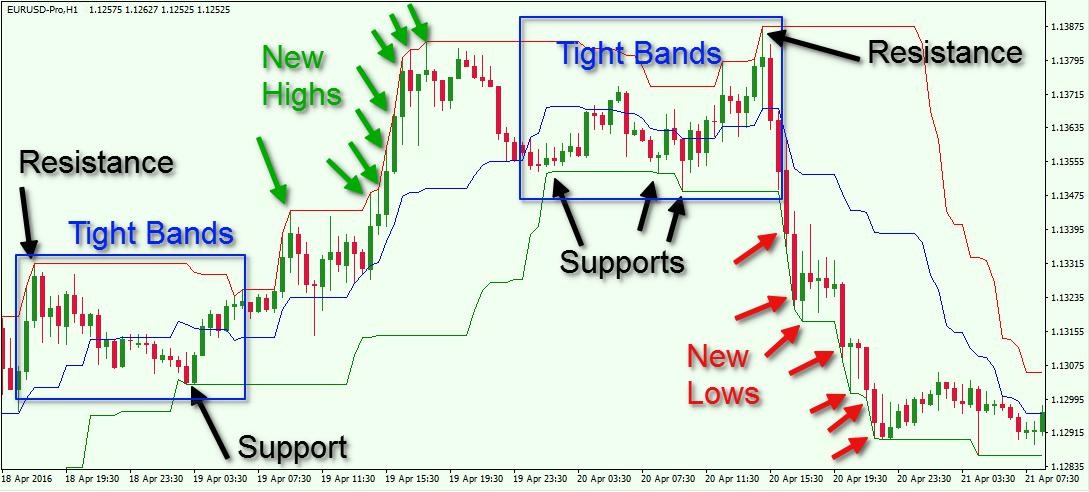

The image below will show you the Donchian channel indicator and illustrate a Forex channel trading scenario:

Above you see the Donchian channel strategy. It looks pretty chaotic, however, once you understand what to look for, this initial chaos begins to make sense. When the two bands are tight, the Donchian bands act as support and resistance. In this phase, price bounces up and down between the two bands. We consider this a consolidation period or ranging market condition. You can still trade the bouncing price moves between the two bands, but this is not the best application of the Donchian trading method.

The most attractive function of the Donchian indicator in recognizing strong momentum breakouts. We see this when the price starts hitting the upper band, moving it upwards or starts hitting the lower band, moving it downwards. The green arrows on the image point out when the price creates higher highs.

In this manner, the upper Donchian band starts moving upwards too. This means that the price is increasing with relatively high intensity, creating a suitable entry in a long trade. Then the bands get tight again. The price starts testing the upper and the lower bands as resistance and support. Suddenly, the price action starts hitting the lower Donchian band, creating lower lows (red arrows). This creates a short opportunity on the price chart.

Referring to the image above, the proper place to go long would have been with the first green arrow on the chart. This is where price has closed above the previous consolidation level, and has been testing the upper Donchian channel over the last few periods, in a possible attempt to breakout to the upside. The trade could be held until the price breaks the middle band downwards. This is the exit signal from the trade. As you see, this is actually where the bands are getting close to each other and the pair starts to range.

In order to trade the subsequent price decrease you would apply the same logic as we used for the long example. The optimal place to short the pair is marked by the first red arrow on the chart. This comes after the price bounces from the upper band and after price has closed below the Donchian support level.

Meanwhile, the two bands are just starting to expand which provides us a clue that a further price decrease is probable. We see that every bottom is lower than the previous one and the lower Donchian band is decreasing with every further period. We can conclude based on this price action behavior that the down run is relatively strong. The short trade during this price run should be held until the price breaks the middle band upwards. This happens with the last candle on the chart.

Which is the Best Channel Trading System for You?

Channel trading applied to currency pairs is a simple, effective technical analysis practice that can help forex traders stay on the right side of the market. Each of the three channel trading systems we discussed have their positives and negatives.

If you are a beginner, it might be better for you to use the simple price action channel trading method. Pick the price lows and highs during a trend and draw a channel. Then simply trade the bouncing moves inside, preferably in the direction of the existing trend. Also, do not forget to watch closely for the breakout move. After all, the channel breakout could likely lead to a sharp price move in a relatively short period of time.

If you are more of a cautious trader and you always want additional confirmation for your channel trading system, then the Linear Regression Channel might be the right channeling tool for you. Find your two highs and lows and stretch the Regression Channel over it. Then look for the bounce from the upper and the lower levels, followed by a breakout through the median level. For the conservative trader, the median line can provide that additional layer of confirmation. But be cognizant that by waiting on this additional confirmation, the profit potential will likely be lower on your trade as well.

Finally, if you feel that you are more experienced and you like the idea of using a bit more complex, dynamic, support resistance level, then you may like the Donchian Channel method. Look for times when the price has broken a recent S/R level and starts hitting the upper or lower band, creating a pressure in the respective direction. Enter a trade if the two bands are expanding. Then if your trade is properly implemented, and the price continues in the intended direction, you should look to hold your trade until the price action breaks the middle band in the opposite direction.

Conclusion

- Price channels in Forex are one of the most basic price action concepts that traders should be aware of.

- Channels are created when price action creates tops and bottoms with the same intensity.

- If you are able to draw two parallel lines through the tops and the bottoms of the price action then you have a Price Channel on the chart.

- Traders use channeling techniques to set entry and exit points for their trades.

- A basic Channel trading strategy entails entering a trade when the Forex pair bounces from one of the channel line extremes. The trade should be in the direction of the bounce and should be held until the price approaches the opposite level of the channel.

- In Channel trading the price bounces that occur in the direction of the trend are more attractive to trade. The corrective price moves are shorter and riskier.

- The end of a Channel comes with the Channel Breakout, which is likely to lead to a counter trend price move in the direction of the break.

- The Linear Regression Channel is a variation of a regular channel. The difference is that the Linear Regression channel has an additional line in the middle of the upper and the lower level. This line is parallel to the two levels and it is a median value of the channel.

- The Donchian Channel indicator creates horizontal levels for every X highest and lowest period on the chart. Therefore, the Donchian channel embraces the price action within that designated period. The preferred Donchian signal is created when the price starts hitting the upper or the lower band, moving it further. This creates a signal in the direction of the band hit. The Donchian Channel also has a middle line, which is the average between the upper and the lower band.