When the financial media starts reporting about a recession, sophisticated investors and traders prepare to buy when everyone else is selling and the market is bottoming. When markets reach fresh highs and everyone is greedy to buy, the same market participants mentioned previously are usually one of the first sellers, closing their positions just as the market forms a top.

How do they know when prices are going to rise or fall? Besides experience in the markets, they also follow an extremely powerful indicator not many traders care about: The current market cycle. Here, we’ll provide an in-depth explanation of market cycles in different asset classes and show you how to enter the league of sophisticated investors and profitable traders.

Understanding Market Cycles

Market cycles are an extremely important concept to understand, whether you’re a long-term investor or short-term trader.

Cycles, of one type or another, surround us our entire life. Some are very short, as the life cycle of a butterfly, whereas others can be so long it’s difficult to grasp, as the life cycle of our sun.

Just like in all aspects of our lives, markets also have their cycles. Recessions and expansions are types of business cycles that we all have heard of, accumulation and distribution phases are parts of the so-called Wyckoff market cycle, and the forex market has its own cycles which can be based on monetary tightening or easing cycles, a bull market cycle, or a bear market cycle.

There are many types of market cycles, and each cycle and phase has its own traits. Understanding those traits can help traders and investors make better trading decisions and significantly improve their bottom line.

Unfortunately, a common problem is that market participants don’t have the necessary experience to recognize a market cycle and the cyclical phases we are currently in, which makes it hard and somewhat abstract to trade on them. Another problem is that some traders aim to pick the exact tops or bottoms in market cycles before placing a trade, which can lead to unnecessary losses and frustration down the road.

Next, we’ll provide a detailed overview of some of the main types of cycles in the market and give some handy tips on how to identify them.

Types of Market Cycles

Here, we’ll cover the main market cycles in the stock market, forex market, and housing market. Some of the market cycles are universal (like Wyckoff cycles) while others are quite specific and tailored to the asset class they follow.

Wyckoff Market Cycle

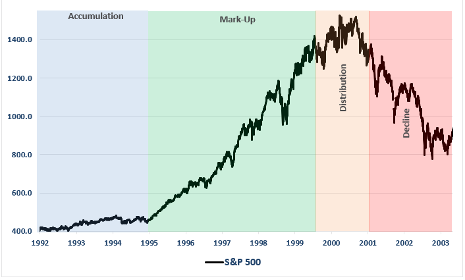

The Wyckoff market cycle is arguably one of the most popular market cycle theories. A typical market cycle according to Wyckoff consists of four phases: Accumulation, mark-up, distribution, and mark-down.

Figure 1, source: mytradingskills.com

The accumulation phase forms after a strong and prolonged bear market. Experienced traders, asset managers, and corporate insiders begin to buy at very low prices, assuming that the market has bottomed and that the worst is over.

During the accumulation phase, valuations are extremely attractive, but retail investors and less-sophisticated traders keep selling their holdings in desperation. When everyone is bearish and fear reigns the markets, this usually signals the best time to buy.

During the accumulation phase, markets avoid forming new bottoms as buying pressure keeps rising. When everyone who wanted to sell is out of the game, prices started to recover and markets enter a new bull trend.

The next phase in the Wyckoff market cycle is the mark-up phase. During this phase, markets move higher and form a fresh uptrend. Investors and traders who follow a trend-following strategy identify the new higher highs in the markets and start to buy.

During the market-up phase, many macro-fundamentals can still be weak. Unemployment rates can remain high and the economy only slowly starts to add new jobs. However, as many investors fear that they’re missing out on the big move, more and more money is being poured into the markets.

Just before the end of the mark-up phase, the majority of inexperienced investors start to buy, which can often push the market to record highs on increasing volume. Valuations break above historic norms, and greed becomes the major moving force of the markets.

When the market tops and starts to decline, discount buyers who perceive the fall in price as a great buying opportunity provide one last push to the markets. In technical analysis circles, this move is known as the selling climax.

Markets become euphoric and the financial media adds fuel to the fire by further encouraging investors to buy. This is also known as the front-cover indicator: Whenever you see extremely bullish messages that make it to the covers of large financial newspapers, this is usually a sign that the market will soon form a top.

The distribution phase comes after the mark-up phase. During the distribution phase, sellers are joining the market again and prices often form long-lasting ranges. Buyers are still interested in buying when the price reaches the lower range support, but the markets lack enough buying pressure to push above the range.

With valuations still extremely high, value investors start selling to the masses who hope for one last bull run in the markets.

The distribution phase can last anywhere from a few weeks to a few months. Unexpected news, weak economic reports, or lower risk appetite are often the trigger that ends a distribution phase by pushing the market below the established range.

Finally, the large phase of the Wyckoff market cycle is the mark-down phase. This phase is characterized by a new bear market as investors who bought at the top surrender. An increasing number of market participants realize that fundamentals start to weaken and that a bear market is imminent. Those who bought at the beginning of the mark-down phase start to sell to avoid larger losses, which further accelerates the fall of prices, completing a market crash cycle.

Valuations start to become attractive again near the end of the mark-down phase, which is exactly the point when sophisticated investors start buying again. Notice the pattern here: Successful investors are optimistic when everyone else is fearful, and fearful when everyone else is optimistic.

Forex Market Cycle

While the Wyckoff market cycle can be applied to any market given its foundation in investment psychology, there also some cycles that are specific for a particular asset class.

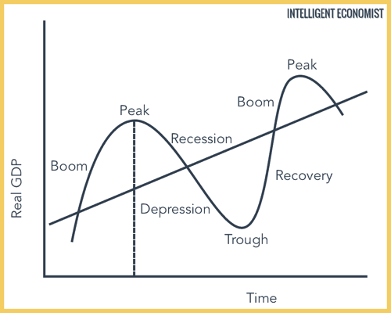

In the forex market, a popular market cycle is the central bank tightening and easing cycle. This cycle has many similarities with the usual business cycle of a country that includes the expansionary phase (or boom), the peak, the recessionary phase, and the bottom (or trough).

Figure 2, source: intelligenteconomist.com

During the expansionary phase of the business cycle, stock markets start to recover from previous bottoms and economic indicators begin to improve. The expansionary phase starts after the economy has already bottomed, signaling a fresh start for the economy.

The expansionary phase is usually characterized by a very loose monetary policy. Central banks lower interest rates during recessions to stimulate economic activity, make borrowing cheaper, help companies to invest in new business facilities and individuals to increase their retail spending.

In the stock markets, prices start to rise again and attract new buyers, similar to the mark-up phase of the Wyckoff cycle. Investors and traders who follow technical signals begin buying stocks again, which further accelerates the bull run.

The expansionary phase ends with the peak phase, marked by full employment, high business activity, and stagnating economic indicators. During the peak phase, inflationary pressures also start to build up, prompting a response from the central bank in the form of tighter monetary policy. By hiking interest rates, central banks aim to cool down an overheating economy and keep prices under control.

However, higher interest rates also lead to higher borrowing costs, which in turn reduce corporate investments and individual retail spending. This marks the beginning of the next phase, which is the recessionary phase.

The domestic currency usually reaches its top against other major currencies by the end of the peak phase as traders prepare for lower interest rates in the future. Lower-yielding currencies are less attractive to investors, which is also why they lose in value against other major currencies.

While markets top out during the peak phase, similar to the distribution phase of the Wyckoff cycle, the recessionary phase is characterized by falling stock prices as investors start to move their capital to safer asset classes, such as bonds or gold. Demand for bonds increases their price but pushes interest rates down. A recession refers to two quarters of falling economic activity, as measured by a country’s GDP.

The recessionary phase ends with the bottom phase, during which markets and currencies form a fresh low. The central bank also starts to lower interest rates by adopting an accommodative monetary policy during the recessionary phase, helping businesses and individuals fund their investments and purchases with cheaper loans. During the bottom phase, the policies of the central bank finally start to kick in and help the economy recover again.

Wall Street Market Cycle

Another popular market cycle is the one related to an asset class most investors are familiar with – stocks. The Wall Street market cycle is closely related to the Wyckoff market cycle that consists of the accumulation phase, mark-up, distribution phase, and mark-down. The Wall Street market cycle breaks those phases down into pieces that are more connected with the actual stock market and how investors behave during bull and bear phases.

Figure 3, source: thegoldandoilguy.com

The Wall Street market cycle starts with the stealth phase, which is a metaphor for rising stock prices in an early uptrend, similar to the accumulation phase of the Wyckoff cycle.

During the stealth phase, the market takes off and smart money and sophisticated investors identify excellent buying opportunities based on extremely cheap valuations and the prospects that the worst in the market is over.

The stealth phase is also the longest one, characterized by slowly rising prices, as less-sophisticated investors keep selling to cover their losses.

Once the market recovers from the bottom, the awareness phase begins. Investors who bought at the top start selling their holdings at a smaller loss than if they had sold at the bottom of the market. This creates a small correction of the uptrend, called the bear trap.

As the bull market gets traction, institutional investors join the market and financial media starts to cover the new opportunities in the stock market. The market forms fresh higher highs, which attracts retail traders and investors who accelerate the bull run in a phase popularly known as the mania phase.

Enthusiasm replaces fears which were the predominant emotion when the market bottomed a few months ago.

However, enthusiasm quickly turns into greed, and greed into delusion. This is usually the time when your aunt or taxi driver gives you hot stock tips, which usually aligns exactly with the market topping out.

Smart money and sophisticated investors start selling at the top, forming a correction in the market. Less sophisticated investors perceive the lower prices as an excellent buying opportunity and add to their existing holdings.

However, as selling pressure exceeds buying pressure in the market, prices keep falling, and enthusiasm quickly turns into fear and despair. This blow-off phase is usually the fastest of the four and the most devastating to inexperienced traders and investors.

Housing Market Cycle

The housing or real estate market cycle is another cycle that investors and traders need to know about. Not only is the housing market extremely important for the economy, but central banks also follow housing market statistics in their economic outlook reports, which can have an impact on future interest rates.

The housing market consists of four phases: recovery, expansion, hyper supply, and recession.

Just like other market cycles mentioned earlier, the housing market cycle is circular, meaning that each phase occurs after the end of the previous phase to form a full market cycle.

The recovery phase in the housing market starts after the recessionary phase and is marked by a gradual rise in new construction and occupancy. Individual homeowners may have a tough time distinguishing the recovery phase from the recessionary phase, as rents and occupancy are generally low during both phases.

Real estate investors follow specific market indicators, such as gradual increases in occupancy and rising demand, which help them identify the recovery phase early in the beginning. Investments in real estate are extremely popular during this phase, as prices are still low, especially for distressed properties.

The expansion phase follows the recovery phase. During the expansion phase, the housing market is completely recovered, demand is strong, occupancy high, and rents keep rising. It’s very easy for homeowners to find new tenants, and new construction sites can be seen across the country. The expansion phase typically overlaps with the distribution phase of the Wyckoff cycle, the peak phase of the business cycle, and the mania phase of the stock market cycle.

The next phase in the housing cycle is hyper supply. As more and more houses enter the real estate market, supply slowly starts to exceed demand, and rent growth slows. Unemployment rates also start to rise in the economy as the business cycle enters the recessionary phase, and demand for homes slows down. However, remember that the central bank will start its monetary easing cycle by lowering interest rates, which will hopefully stimulate home buyers to take cheap loans and buy their properties.

Finally, the recessionary phase of the housing market overlaps with the recessionary phase in the overall economy. Rents start falling and demand plummets. Real estate investors start buying at a discount, with the goal of selling for a profit after the recessionary phase ends and the expansionary phase starts over again.

Final Words

Cycles are common in all aspects of our life and can also be observed in the form of financial market cycles. A cycle consists of different phases, each with its own characteristics and implications on prices.

Popular market cycles include the Wyckoff market cycle (often used by technical traders), the stock market cycle (also known as the Wall Street cycle), the forex market cycle, the business cycle, and the housing market cycle.

To summarize, here are their main phases again:

- Wyckoff market cycle: accumulation, mark-up, distribution, mark-down

- Forex market cycle: monetary tightening, monetary easing

- Business cycle: expansion, peak, recession, bottom (or trough)

- Wall Street market cycle: stealth, awareness, mania, blow-off

- Housing market cycle: recovery, expansion, hyper supply, recession

Bear in mind that all markets are circular in nature, which means they repeat over and over again. When the last phase of a cycle ends, the first phase begins and the cycle of market starts over again.

Understanding market cycles and their different phases is invaluable for investors and traders. Active investors can keep an eye on the current phase and avoid buying in the market when a potential bear market is around the corner.

However, short-term traders can also benefit from understanding market cycles by buying on pullbacks during expansionary phases and trading the market from the sell side during recessionary phases.