Bitcoin Cash is a popular altcoin that was created in 2017. Bitcoin Cash shares many similarities with Bitcoin, including the blockchain, algorithm, and transaction history.

However, unlike Bitcoin, the younger digital currency allows for faster processing speeds and lower transaction costs, which makes it an interesting alternative to Bitcoin and other cryptocurrencies.

Here is what you need to know about Bitcoin Cash (BCH) and how to invest in the popular coin.

Bitcoin Cash Explained

Bitcoin Cash, also known as BCH, is both a cryptocurrency and a peer-to-peer payment system. It was formed in 2017 after a hard Bitcoin fork, designed to resolve some of the disadvantages of the original Bitcoin, such as slow transaction speeds.

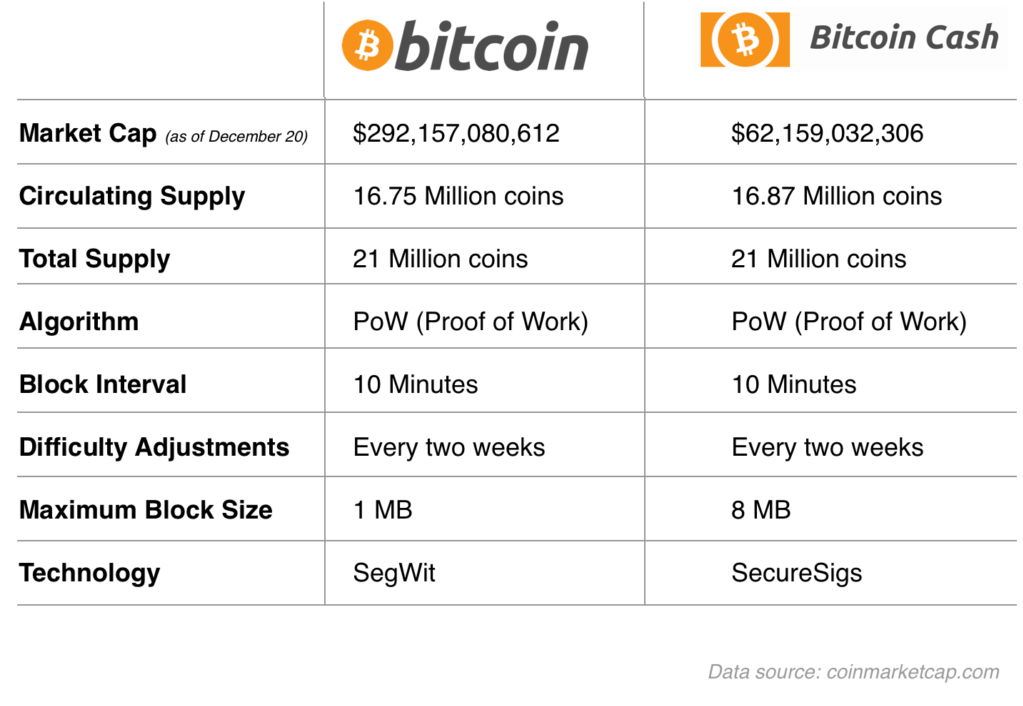

Bitcoin Cash is considered an “altcoin”, but it shares many similarities with the older and more popular Bitcoin. Both cryptocurrencies use the same blockchain network and consensus mechanism, and the total supply for both Bitcoin and Bitcoin Cash is capped at 21 million tokens.

The Beginnings of Bitcoin Cash

Back in 2008, Bitcoin was created as a distributed and decentralized peer-to-peer digital currency network. The network doesn’t require any third-party to verify transactions, such as governments or central banks in the case of fiat currencies. Instead, a large pool of individual computers would be used to perform verification and process the transactions.

Initially, Bitcoin was limited to processing 7 transactions per second, due to its small block size of only 1 MB. The total number of transactions that could be accommodated in a single block was around 2,000 (in comparison, Visa handles around 25,000 transactions per second.) The relatively small number of transactions would also increase transaction costs during times of high network activity.

Talks about a hard Bitcoin fork started in Summer 2017. Bitcoin miners and developers were concerned about the future of the cryptocurrency and its ability to grow as the number of transactions was capped at 1,500-2,200. Bitcoin Cash was designed to eliminate this bottleneck by increasing the block size and transaction speed of Bitcoin.

The actual fork took place in August 2017 with the creation of a new cryptocurrency – Bitcoin Cash (BCH). The following year, another fork happened which created Bitcoin Cash ABC and Bitcoin Cash SV (Satoshi Vision). Today, when we refer to Bitcoin Cash, we are actually talking about Bitcoin Cash ABC.

Whereas Bitcoin’s block size is 1MB, allowing the currency to handle around 1,000 – 1,500 transactions per block, the block size of Bitcoin Cash was initially set at 8MB. Later, the block size increased to 32MB, making Bitcoin Cash one of the fastest processing coins. The Bitcoin offspring, BCH, is able to handle up to 25,000 transactions per block compared to the original 1,500 transactions per block for Bitcoin.

When Bitcoin Cash saw the day of light, existing Bitcoin owners could choose to exchange their Bitcoins for the new Bitcoin Cash. Some owners who chose not to do so in 2017 still have the ability to exchange their Bitcoins for the new cryptocurrency.

Bitcoin Cash reached a record high of $3,800 shortly after it was created, but entered into a long-term downtrend with the price bottoming around $80. At the time of writing, Bitcoin Cash traded at $620 with a total market capitalization of $11.7 billion, making it the 11th largest cryptocurrency in terms of market cap.

BCH vs BTC: What’s the Difference?

While the block size is one of the most important differences between Bitcoin and Bitcoin Cash, there are also some other concepts that differ between these two tokens.

- Algorithms – The underlying algorithms that drive Bitcoin and Bitcoin Cash are different. This means replication between the two cryptocurrencies is no longer possible. Bitcoin Cash has also created a safety mechanism that should help stabilize the cryptocurrency in times of potential troubles, even in the case of BCH forks.

However, both Bitcoin and Bitcoin Cash use the same proof-of-work algorithm to timestamp new blocks, with new blocks being generated every 10 minutes on average. To keep the block time roughly constant, BTC and BCH use a parameter called mining difficulty which increases with the increase in mining power. Similarly, the mining difficulty parameter decreases when the number of miners and their mining power fall.

- Block size – The differences in block size allow Bitcoin Cash to achieve a significantly higher number of transactions within a single block compared to Bitcoin. In 2017, many developers and large miners (mostly China-based) were unhappy with Bitcoin’s SegWit plans, which was a soft fork change that later changed the transaction format of Bitcoin. Instead, they pushed for a hard fork which increased the block size from 1 MB to 8 MB and later to 32 MB.

However, even with a shared algorithm and transaction history, the value of a single Bitcoin was still many times higher in comparison to Bitcoin Cash. To incentivize mining on the Bitcoin Cash blockchain, its developers created another algorithm, called the Emergency Difficulty Adjustment.

- Emergency Difficulty Adjustment (EDA) – When explaining the differences in algorithms between Bitcoin and Bitcoin Cash, we mentioned the parameter called “mining difficulty” that makes sure that new blocks are generated every 10 minutes on average. The algorithm that adjusts the mining difficulty is called the Difficulty Adjustment Algorithm (DAA), which is shared by both the original Bitcoin and Bitcoin Cash.

Since August 2017, BCH also used an additional algorithm called the Emergency Difficulty Adjustment (EDA). EDA was designed to decrease the mining difficulty of BCH by 20% in case the time difference between six consecutive blocks was greater than 12 hours. However, Bitcoin Cash canceled EDA after some instability problems and started to adjust the mining difficulty after each block since the end of 2017.

Pros and Cons of Investing in Bitcoin Cash

Just like with other cryptocurrencies, BCH investing comes with a number of advantages and risks associated with the investment.

Safety – Blockchain technology has proved to be extremely stable and safe. Once a block is recorded, it can’t be altered or deleted, making all peer-to-peer transactions safe, without the need for a government or central bank. Blockchain is a decentralized network, which ensures that no single entity has excessive power over the cryptocurrency.

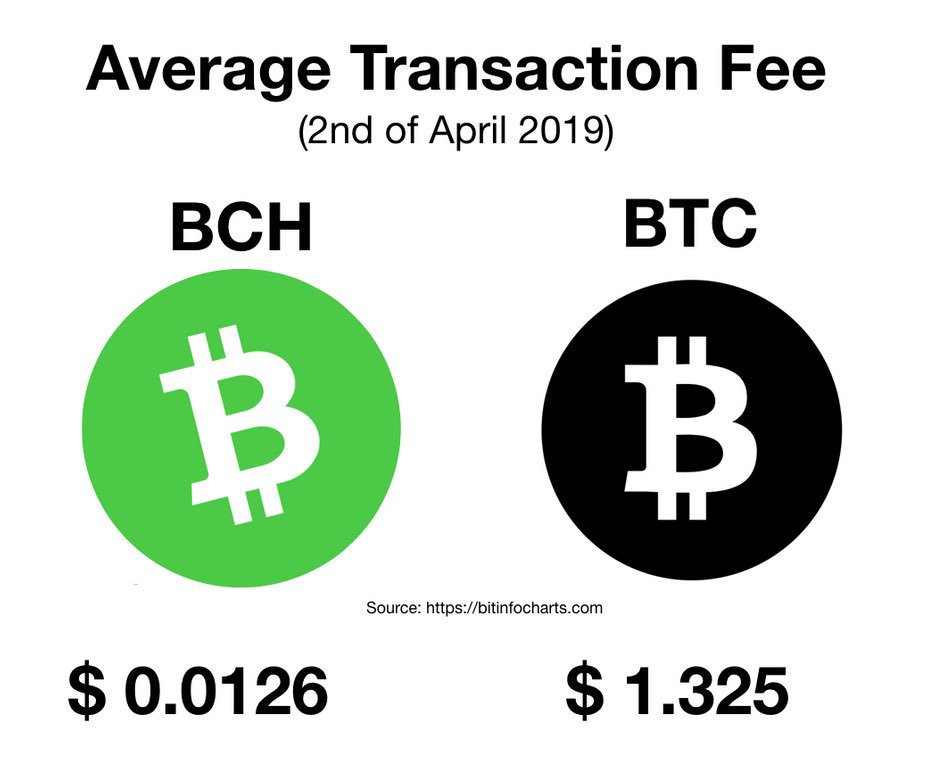

Transaction costs – While many miners, developers, and users have been attracted to Bitcoin for its investment value, Bitcoin Cash was created with another goal in mind: To be a medium of exchange. The increased block size allows for a very cost-efficient way to send and receive any amount of money.

Speed – With Bitcoin Cash, funds can be sent to any corner of the world in a matter of seconds. Miners use the 32MB block size to process more transactions, allowing for up to 25,000 transactions in 10 minutes.

Profit potential – Given the skyrocketing price of cryptocurrencies in the last few years, it’s not hard to tell that cryptocurrency investments have sent shockwaves through the investment world. Nobody really knows how fast will the world adopt digital currencies and what their real value is. Some argue that we have barely scratched the surface of digital currencies.

Volatility – A major disadvantage of cryptocurrencies as an investment asset is their volatility. It’s not unusual for the price of Bitcoin Cash to fluctuate dozens of percentage points in a single day.

Do you want to hold an asset that can gain, but also lose 30% of its value in a single day? This aspect of cryptocurrencies makes them more suitable to risk-tolerant investors. So, is Bitcoin Cash a good investment? If you can stomach the swings in its price, the cryptocurrency could have a bright future.

- Stay up-to-date on crypto news – Since blockchain and digital currencies are still a relatively new technology, headlines and news can quickly create turmoil in the market.

Some countries have completely banned trading and investing in digital currencies, and some central banks have announced that they will create their own, national digital currencies on blockchain technology. Large companies, such as Microsoft and Tesla, announced they would accept digital currencies as a means of payment for their goods and services. Such news can have long-lasting implications on the price of Bitcoin Cash and other digital currencies.

- Tax – Some countries, like the US, have regulated investing in cryptocurrencies. In the United States, cryptocurrencies are considered a financial asset that falls under the capital gains tax. In case that you make a profit by exchanging your Bitcoin Cash for fiat money, there are also other tax laws that apply.

The capital gains rate also depends on how long you hold to your crypto investment, so make sure to have a chat with your financial advisor before becoming a Bitcoin Cash investor.

How to Invest in Bitcoin Cash?

To buy Bitcoin Cash with a fiat currency, you can use cryptocurrency exchanges like Coinbase or Binance.

Those exchanges act just like a regular stock exchange where buyers and sellers can exchange their digital currencies either for cash or for other digital currencies. This means, investing in BCH can even be done with other cryptocurrencies, like Ethereum, Litecoin, or Dogecoin.

To buy Bitcoin Cash on a cryptocurrency exchange, simply follow these steps:

Open an account on a cryptocurrency exchange: Not all exchanges offer the same features and tools when it comes to cryptocurrency trading, but almost all of them allow you to buy digital currencies with fiat money or to exchange existing digital currencies for other ones, like Bitcoin Cash. Find an exchange that suits your needs, and register for an account.

Find the section where digital currencies can be bought: On most cryptocurrency exchanges, finding this section is pretty straightforward. Select Bitcoin Cash, and enter the amount you want to buy.

Enter your payment details: While your payment options depend on the exchange you’ve selected, most offer credit/debit cards and bank transfers. The easiest and fastest way is using your credit/debit card, as all transactions to and from the exchange will be almost instant.

Review your order: Finally, the exchange will provide you with an order overview with the amount of BCH you’re going to buy and the total price you have to pay. Simply click on “Buy”, and you’re done. BCH BTC investing using a cryptocurrency exchange is the most direct way to invest in Bitcoin Cash.

Investing in a Cryptocurrency Index

Alternatively, you may become a BCH investor by investing in a cryptocurrency index that tracks the largest cryptocurrencies by market capitalization. This is similar to investing in ETFs that track the S&P 500 and offers many benefits to passive investors who don’t want to be involved in the market on a regular basis.

Cryptocurrency indices also offer some diversification as your investment is spread across multiple digital currencies instead of only one. However, bear in mind that not all cryptocurrency indices include Bitcoin Cash. For example, some indices invest only in the 10 largest digital currencies by market capitalization, which would exclude BCH if its price falls relative to other cryptocurrencies. So, if you want to invest specifically in Bitcoin Cash, buying on a cryptocurrency exchange may be the better option.

Another Bitcoin Cash investment strategy is to invest in a Bitcoin Cash Investment Trust, which enables investors to gain BCH exposure without worrying about buying BCH and safekeeping your Bitcoin Cash investment. The Grayscale Bitcoin Cash Trust (“BCHG”) is a popular Bitcoin Cash investment program for this purpose.

How to Store Bitcoin Cash?

Once you buy your Bitcoin Cash, you need to store it somewhere in a safe place. Cryptocurrencies are stored on storage devices called wallets. There are two types of wallets to choose from: hot wallets, and cold wallets.

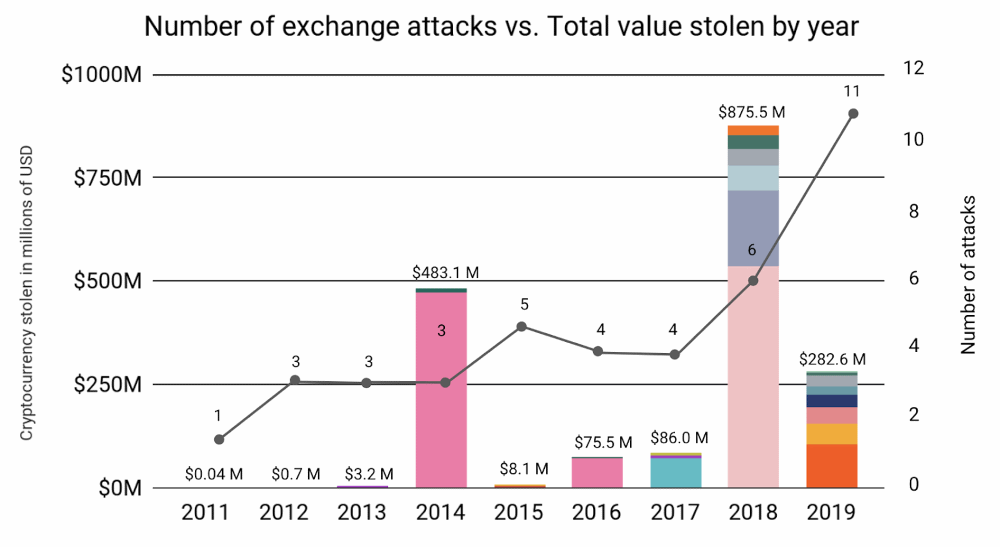

- Hot wallets – This kind of wallet is what you get when you open an account on a cryptocurrency exchange. Hot wallets allow you to save your digital currencies directly on the exchange where you bought the currencies from. While this is very convenient, cryptocurrency exchanges are often the target of high-profile hacker attacks that could potentially put your investment in danger.

Over the last few years, there have been successful attacks on Bitstamp, Bitgrail, YouBit, OKEx, and other exchanges where hackers stole millions worth of digital currencies.

Coinbase is a popular US-based cryptocurrency exchange that offers hot wallets to securely store your digital currencies, including Bitcoin Cash.

Graphic Source: ZDNet.com

- Cold wallets – Cold wallets are physical devices with high encryption that allow you to store your digital currencies outside of a cryptocurrency exchange. Cold wallets look pretty much like regular USB sticks. They are small and can be easily stored in a safe place in your house.

Bitcoin Cash does not have its own wallet and doesn’t recommend a specific type of cold wallet to store the currency. If you’re going the cold wallet route, make sure the wallet supports BCH before buying.

What’s the Future of Bitcoin Cash?

The roadmap of Bitcoin Cash is defined as becoming the most efficient medium of exchange in the cryptocurrency world. The first step was to increase the block size to allow for thousands of transactions within a single block. Upcoming technical improvements include the ability to handle lower transaction costs and to increase the speed of transactions even further.

The team behind Bitcoin Cash wants the digital currency to handle 5 million transactions per second in the future, compared to the current 100 transactions per second, and the BCH blockchain to be able to support trading of all kinds of assets.

In terms of price forecasts, it’s difficult to predict a path for the digital currency. Cryptocurrencies are generally considered a volatile and risky investment, as could be seen with the rollercoaster ride of Bitcoin in recent years.

However, given the power and potential of the underlying technology – the blockchain – it’s a no-brainer that cryptocurrencies have the ability to completely transform the way we do finance. In addition, as more and more companies start to adopt cryptocurrencies, they will become increasingly attractive for investors and small traders which could provide further support for their price.

Final Words

Bitcoin Cash is an altcoin that was created in August 2017 as an offspring of Bitcoin. As large Bitcoin miners, developers, and cryptocurrency enthusiasts became concerned about Bitcoin’s block size which was limited to around 2,000 transactions per block, a hard fork was initiated in 2017 with the new cryptocurrency – Bitcoin Cash – allowing for up to 25,000 transactions per block and significantly lower transaction costs.

Bitcoin Cash is today a major digital currency in terms of global investments and market capitalization. If you want to add cryptocurrency exposure to your portfolio, Bitcoin Cash is a viable choice as it overcame many limitations of the original Bitcoin.

Bitcoin Cash investing is extremely easy: simply open an account with a cryptocurrency exchange of your choice, like Coinbase, Binance, or Bitstamp, and buy Bitcoin Cash with fiat money using credit/debit cards or bank transfers. An alternative to using cryptocurrency exchanges is to invest in a BCH investment trust or cryptocurrency index which tracks several cryptocurrencies and adjusts for market capitalization.