As with any form of speculative activity, the importance of psychology in forex trading simply cannot be overestimated. Humans are emotional beings, and they have well-defined psychological traits that often accumulate into a number of unique personality types. Furthermore, when traders group together en mass, their overall psychological behavior moves markets and creates the very chart patterns that excite technical analysts.

As with any form of speculative activity, the importance of psychology in forex trading simply cannot be overestimated. Humans are emotional beings, and they have well-defined psychological traits that often accumulate into a number of unique personality types. Furthermore, when traders group together en mass, their overall psychological behavior moves markets and creates the very chart patterns that excite technical analysts.

The fundamental psychological factors of a trader’s personality often come to the foreground when forex trading activities start to generate significant profits and losses, since many people experience strong feelings when making and losing money.

Forex trading psychology has been studied extensively by many researchers, typically to determine what type of trading mindset and personality type are most successful in terms of generating consistent trading profits.

Several of these researchers have written important books on the subject that traders can read to gain insights into their own activities and whether or not they are psychologically suitable to become a successful trader.

This discussion of the psychology of trading will start with an overview of the basic trader personality types as distinguished by Dr. Van K. Tharp.

Trading Psychology or Personality Types

In Dr. Van K. Tharp’s research on trading psychology, he separates traders into a set of fifteen personality types that can be assessed using his online Tharp Trader Test. These trader personality types each have a psychological profile that contains various weaknesses and strengths. His website contains greater detail on this subject for the interested reader.

The defining characteristics of these fifteen personality types are:

The Accurate Trader

These traders are noted for their tendency to use detailed analytical processes and keep meticulous and accurate records. Traders with this psychological profile often keep detailed notes of their decision making process in their trading journals, which tends to help them on future trades.

Due to their fastidious attention to analysis and recordkeeping, these traders can sometimes fall into the trap of paying more attention to these activities than to making profitable trades.

The Administrative Trader

This trader profile is characterized by the trader’s tendency to be practical, decisive and realistic in their approach to trading. The Administrative Trader has a tendency to be responsive to changing market environments that can result in profitable trades. In addition to adapting to different market conditions, this type of trader has strong decision making capabilities and can delegate authority when working with others.

The Artistic Trader

Artistic traders are characterized by their tendency to use their intuition and creative thinking in their trading more so than other traders. Due to their creative streak, Artistic traders tend to be more flexible and can adjust to changing market conditions. Nevertheless, this feature can be a double edged sword and cause problems for the trader if they become emotionally attached to losing trading positions.

The Adventurous Trader

This trader profile is noted for their open minded and flexible approach to trading and includes some of the most successful traders. Adventurous traders use their ability to respond effectively to market information and are generally accomplished analysts, prioritizing data and using it to make sound trading decisions. Adventurous traders often take significant risk and focus on factual information when making trading decisions.

The Detailed Trader

The Detailed Trader profile is characterized by a preliminary analytical process before taking a position in the market. Detailed Traders use logical assessment and careful analysis and often keep intricate notes on their trades and reasons for taking them.

Nevertheless, many traders with this psychological profile can fall into waiting too long to establish or liquidate trading positions, resulting in significantly lower returns.

The Facilitative Trader

This type of trader generally has a serious and sober approach to trading, preferring to trade in a social environment or interacting with other traders. Because of their focus on the social aspect of trading, these traders typically excel as part of a trading team or acting as someone’s trading partner. Facilitative Traders often observe the big picture of the market and trade in a decisive and well organized manner.

The Fun Loving Trader

This trader profile is characterized by a playful approach that includes a degree of social interaction when trading. Fun Loving Traders tend to have a positive outlook that reflects their optimistic viewpoint. However, due to their optimism and social interaction with other traders, their emotions could affect their objectivity when trading.

The Independent Trader

These traders tend to use their own interpretation of data and act independently of the crowd when trading. While their abilities to think outside the box can result in profitable trades, their lack of social skills makes them poor team players.

The Innovative Trader

This type of trader is noted for their creative and intuitive approach when analyzing information and establishing trades. Innovative traders tend to be able to process large amounts of information and react quickly in the market. In addition to their abilities in analyzing and reacting to market conditions, these traders tend to be good leaders and can excel in reading people

The Planning Trader

This trader type tends to be a competent leader and communicates well regarding trading matters. They tend to be well-organized and realistic, and they make trading decisions effectively. They tend to focus on facts to make reasonable decisions, and they can respond quickly and flexibly to new trading conditions by developing new systems.

The Socially Responsible Trader

Such traders tend to be loyal to social values they deem important and enjoy a social life. They seem most successful as traders when a trading opportunity presents itself that is consistent with their values.

The Spontaneous Trader

These traders typically think and react quickly when trading, although they tend to do so without having performed much analysis beforehand. They can find planning and following through difficult when it comes to their trading strategies.

The Strategic Trader

This trader group tends to make intelligent trading decisions based on factual information, and they aim to develop a suitable level of competence in their trading-related activities. They are typically seen as practical, realistic, well-organized and decisive when trading.

These traders also tend to have the ability to see the big picture when engaged in trading and they can think quickly when needing to respond to shifts in the market. They easily understand difficult concepts and learn actively.

The Supportive Trader

Such traders tend to be insightful, solemn and can be depended on for trading activities, although they lack some of the important characteristics of the best traders, so they typically either take on a support role within a trading team or offer financing to more successful traders.

The Values Driven Trader

This trader type tends to be independent and to focus on trading’s material rewards, ideas and relationships. They can also make decisions well and can see the bigger picture. If they can get beyond their emotions and value system, they can become successful as traders.

A Successful Trader’s Psychology in the Forex Market

In addition to having identified the above fifteen trader personality types, Dr. Tharp has also determined several key psychological characteristics of successful traders. His research on trading psychology led him to identify three key psychological traits shared by just about all of the best traders.

These include the following overall personality characteristics:

- Good traders have the ability to see and grasp the “big picture”. They can also make connections between events and recognize good trading opportunities as they arise.

- Such traders can ideally analyze markets logically in order to make sound trading decisions.

- They also tend to be decisive and well-organized, in addition to being able to perform operations sequentially.

Each trader’s individual success potential can be determined by assessing how many of these favorable characteristics they already have or are willing to work on developing. In particular, Dr. Tharp identified that Planning and Strategic Traders tend to show greater potential for initial trading success due to them having all of the aforementioned personality characteristics.

On the other end of the spectrum, Dr. Van Tharp indicates that the Supportive, Artistic and Fun Loving Traders tend not to have any of these characteristics. Rather than trading themselves, they can often do better by allowing other people to trade their accounts for them, unless they plan on performing considerable work on themselves to correct their sub-optimal trading mindsets and develop the personality traits necessary for success.

In between the above two groups are those trader personality types that have only two of the above characteristics. These include the Detailed, Facilitative, Innovative, Spontaneous, Independent, Administrative, Values Driven, Socially Responsible, Accurate and Adventurous Traders.

Five Important Trading Psychology Books

In order to learn about the optimal trading psychology and mindset, many novice forex traders choose to read some of the seminal literature on the subject. The following books comprise a short list of five such books that many experienced traders would recommend to a beginner interested in the subject of trading psychology.

- Reminiscences of a Stock Operator by Edwin Lefèvre

This very popular book tells the fascinating story of Jesse Livermore’s equity trading career that spanned the early part of the 20th century. Still very relevant to traders in the modern era, this book perfectly illustrates the fact that the mass psychology that drives markets — and the individual psychology that traders face each day — really do not change much. Many traders were given a copy of this book to read when they first started out in training programs at professional trading firms and I highly recommend it to others interested in the topic.

- Trading In The Zone by Mark Douglas

In this book, Mark Douglas encourages traders to take on a probabilistic approach to trading and to form a powerful “winner’s mindset” as the keys to obtaining the best results while trading. He provides his readers with concrete steps and ideas for changing a trader’s fear of losing money into achieving ultimate success as a trader. Although Mark had no formal psychological training, he wrote this book on trading psychology from his own personal experience operating in the markets. This is arguably the best book ever written on Trading Psychology, certainly one that has had a profound effect on me.

- Super Trader: Make Consistent Profits in Good and Bad Markets by Dr. Van K. Tharp

As the previous sections of this article show, Dr. Tharp has an extensive theoretical and practical understanding of what sort of personality traits make traders successful. This book expands on his insightful personality testing results to offer an overall approach for how people drawn to trading as a full-time profession can become successful financial markets traders.

- Market Wizards: Interviews with Top Traders by Jack Schwager

This well-known and classic book provides the reader with a fascinating series of interviews by some of the world’s top traders. Each of these experts provide valuable insights, trading tips and information that most traders will find illuminating. The book also contains some excellent quotes from great traders throughout history, many of whom managed to move beyond their losses and ultimately generate great wealth from trading the markets.

- Trading in the Zone: Maximizing Performance with Focus and Discipline by Ari Kiev

In this book, Dr. Kiev describes a set of proven ways to get into and then remain in the “Zone”, which describes an optimal trading state for success. Dr. Kiev offers various beneficial psychological tools that traders can use to benefit and enhance their trading skills no matter what sort of trading style they prefer to employ. This book seems especially useful for those who feel they need help reviewing, managing and optimizing their emotional responses when trading. It also contains an interesting set of trader case studies that explain how they deal with their emotions while trading and which provide useful insights into how to go about developing an optimal trading psychology and mindset.

Speculation Psychology and The Optimal Trading Mindset

Speculation Psychology and The Optimal Trading Mindset

The psychology and emotional discipline of the successful market speculator has been the subject of many interesting books, such as those listed above.

Although not all experts agree, the research that has been done on this topic tends to point to a number of beneficial psychological factors and behaviors that people need to engage in to stand the best chance of success as a trader.

These can be summarized as follows:

- Avoid trying to beat the market. Instead try to be sensitive to its direction and align yourself with it.

- Learn to put fear and greed in the right place. Feel fear when you are losing money so that you cut losses short and greed when you are making money so that you let profits run.

- Avoid getting over confident and taking excessive trading risks.

- Avoid letting losses destroy your confidence and ruin your day, and start to see taking losses as a simple cost of doing business as a forex trader.

- Keep a positive mindset.

- Focus on maintaining trading discipline and good money management practices. Stick to your trading plan no matter what the market does. Refine your plan if necessary, but only do so once your trading positions are closed to avoid having them influence your plan.

The basic idea here is to look at your forex market speculation activities as a business. Certainly, you will win on some trades, and you will lose on some trades, so see that as part of the process of trading. Overall, you should always seek to manage your business and your trading funds so that you will be able to remain in the game long term.

Mass Psychology and Its Measures

Many traders use measures of mass market psychology to influence their trading decisions as part of their trade plan. Most chart patterns used by technical analysts are considered reflections of some aspect of mass psychology that tends to repeat itself.

Some technical traders also use Elliott Wave Theory, which takes into account the psychology of the market as its trending movements typically unfold in five successive waves, followed by a counter-trend correction that usually unfolds in three waves.

Another popular measure of mass psychology in the financial market is the Commitment of Traders or COT report that is published each Friday for the preceding Tuesday’s contracts by the U.S. Commodities Futures Trading Commission or CFTC.

The results of this weekly report inform traders regarding the net amount of outstanding positions in each contract where twenty or more traders hold positions near the CFTC’s reporting limits, and which are broken down by several category of trader, including Commercial and Non-Commercial traders.

Commercial traders are those who are generally hedging their exposures that arise in the course of doing business. In contrast, Non-Commercial traders are typically speculating in the futures market. They consist of financial institutions, individual traders and hedge funds.

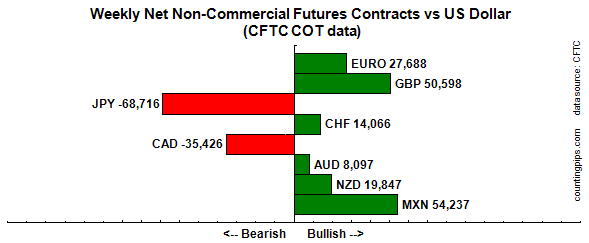

As an example of the data made available on the weekly COT report, the graph shown in Figure 1 depicts the net weekly results of this report for each of the major currencies traded on the Chicago IMM futures exchange for Non-Commercial traders.

Figure 1: A bar graph of net weekly outstanding futures contracts traded on the Chicago IMM futures exchange for each of the major currencies that are held by Non-Commercial traders.

Many traders use the COT report to learn about the direction and magnitude of currency futures positioning in the markets they are interested in. This can be used as a measure of market sentiment to provide analysts with information about how sizeable futures traders are positioning themselves.

An item of special focus for traders is how the current positions listed differ from those listed the previous week. Determining these weekly changes gives traders a guide to how market sentiment is developing in the futures and option markets they wish to follow.

As an example, when many Non-Commercial traders are positioned in a particular way, this can signal a market reversal may soon be forthcoming as these extreme positions start to unwind. Also, when the COT positions change from positive to negative that tends to be a signal to short the market, while a switch from negative to positive might signal taking a long position in that market.