We have introduced many different trading strategies and concepts around trade entries and exits. Today we will discuss the one trading component, which is an integral part of every successful Forex trading strategy. This is the stop loss order, which you need to use to protect each and every trade you execute in the market. We will dedicate this article to learning about this all important order type and how you should be using it to manage your risk in the currency market.

What is a Stop Loss Order?

The stop loss is an order, which you add to your trading position during or after the time of initiating your trade. Traders use the stop loss order to request an automatic exit from a trade in cases where the price reaches a specific level. This way, if the price action moves against your trade, your position will be closed automatically upon reaching the pre-defined specified level.

Imagine you buy the EUR/USD at the price of $1.1500 on the assumption that the pair will increase in price. Yes, but no one and nothing can guarantee you that the price will actually increase as per your projection, right? Therefore, you would look to protect this trade with a Stop Loss order. If you place your stop loss below the market at $1.1470, this means that your trade will be automatically closed if the price decreases to $1.1470. This way, the Stop Loss order ensures that your loss in case of an adverse move would be limited to 30 pips theoretically (1.1500 – 1.1470).

Types of Stop Loss Orders

There are two basic types of Stop Loss orders. They include the Hard Stop Loss and the Trailing Stop Loss. We will now discuss each of these separately.

Hard Stop Loss Order

The Hard Stop order is a stop out order in its simplest form. You place your order at a specific level, and your trade gets automatically closed at the market price when this Stop Loss level is reached by the price action. Nothing more happens. Hard Stop Losses are typically used to contain risk on a losing trade.

Trailing Stop Loss Order

The Trailing Stop Loss order is a bit different. The Trailing Stop order stays still in case the price action moves against you, just like with the Hard Stop Loss. However, if the price moves in your favor, the Stop Loss moves incrementally in the same direction. This is why the order is called a “Trailing Stop” because it trails the price action as prices move in your intended direction.

Typically, when you use a Trailing Stop Loss order, you would manually choose the distance between the Trailing Stop and the price action. So, if you choose the stop to trail 30 pips behind the price, it will follow the price action conforming to this distance when the Forex pair moves in your favor. But if the price moves against your trade, the Trailing Stop remains still.

The Trailing Stop is a particularly useful when you pursue trending price moves. When a currency pair enters a trend, the Trailing Stop will follow the price action, and it will be triggered when the trend begins to lose steam or change direction. This way the Trailing Stop Loss order reduces the human factor when trading.

How to Place a Stop Loss Order on MetaTrader 4

Now that you are familiar with the basic types of stop loss orders, we will talk about placing stop loss orders on one of the most-widely used trading terminals – MetaTrader 4.

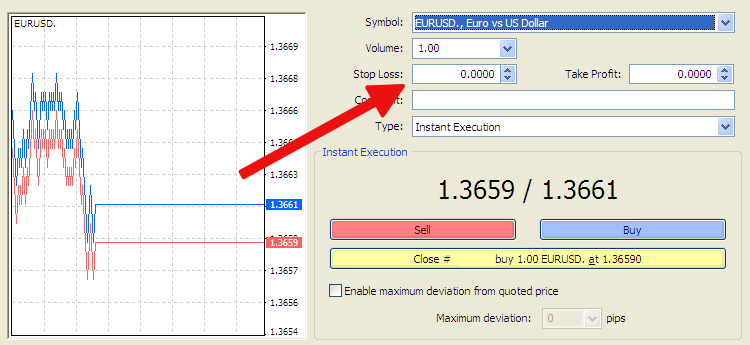

The first way you can place a Stop Loss order on the MT4 platform is simulatenously while opening a new trade. When you choose to buy or sell a currency pair, you will get a pop-up window, to confirm the level at which you are entering. You will see a Stop Loss field on this window as well.

Simply type the desired level, and the Stop Loss will appear automatically on the chart when you confirm the trade.

The other ways to place a stop on the MetaTrader 4 platform is by right clicking the entry line of your trade on the chart or the trade info in the order list in the lower part of the MT4 terminal. Then you should choose “modify,” which will get you to the same pop-up window we discussed above.

Stop Loss Order Example

The Stop Loss order usually appears as a visual level on your chart. On the MT4 platform, the Stop Level appears as a dashed horizontal line. The image below will show you how the Stop order appears.

This chart gives you an example of a long trade with the GBP/USD Forex pair. After a breakout through a resistance level (black), you could buy the GBP/USD on the assumption that the price is going to increase. A good place for your Stop Loss order will be the zone below a previous big bottom on the chart, as shown in the image.

The red arrow shows you the distance between your entry zone and your Stop placement. This is what you will be risking on the trade. The trade will be in the positive as long as the price is above your entry point, and will be in the negative as long as the price is below your entry point. The Stop Loss order serves to limit your loss up to the price of $1.40834 while theoretically, your potential profit is unlimited.

Moving your Stop Loss

If you use a Hard Stop Loss, you can always adjust the order. This is advisable when you are trying to lock in profits on a winning trade, but this is not a good idea when trying to deal with losing trades, as it defeats the purpose of limiting risk by placing the Hard Stop Loss order in the first place.

Let’s say you are short the USD/JPY Forex pair. You sell the pair on the assumption that the price will drop and you will generate profit. At the same time, you place a stop loss order slightly above your entry point to protect your trade in case of an unexpected increase. The price action creates a rapid drop afterward. In this case, you can manually move your Stop Loss order downward so that you will lock in some of the generated profit. Remember this, if you are SHORT and your Stop Loss order is already BELOW your entry point, then your trade is a guaranteed winner. The same is in force if you are long and you move your Stop Loss order above the entry point.

Moving your Stop Loss is very easy on the MetaTrader 4 platform. You simply drag the line up or down with the left mouse button. When you choose the desired location, you release the mouse button, and the Stop Loss order relocates by itself.

Stop Loss Placement Rules

You now know how to operate with a Stop Loss order. But you are probably asking yourself “What distance should I place my Stop Loss at?” For this reason, I will explain some basic Stop Loss rules and best practices.

Never risk more than 1-2% of your total bankroll on a trade. If you are a newbie trader, I would encourage you to stick to the 1% account risk rule. If you are a more experienced trader, then you can play it a little bit looser, taking the 2% rule.

Let’s illustrate this concept with a basic calculation. Let’s take the 1% rule to start. What should you do in order not to risk more than 1% of your bankroll on a trade? To explain this, you should consider several factors – account size, trade allocation and leverage.

Let’s say your bankroll is $10,000, and you use a leverage of 50:1. This means that whatever amount you allocate to the trade, it will be multiplied by 50 – a “credit” which is lent to you from your broker. Let’s say you put 20% of your $10,000 capital in a trade. This means that you will be investing $2,000 in every Forex trade you are taking. And after the 50:1 leverage, the $2,000 will have a buying power of 2,000 x 50 = $100,000.

To calculate a 1% risk on a $2,000 trade, which is leveraged by 50:1, you will first need to calculate 1% of your $10,000 capital: 10,000 x 0.01 = $100. This means that you should not risk more than $100 on your trade.

Your $2,000 buys $100,000 after the leverage of 50;1. Now you need to calculate the percentage which $100 takes from $100,000: 100 / 100,000 = 0.001, or 0.1%. This means that your Stop Loss order is 0.1% distance from your entry price. If you buy the EUR/USD at $1.0500, then you could put your Stop Loss at: 1.0500 x (1 – 0.001) = 1.0500 x 0.999 = 1.04895. When you set your Stop at $1.04895, it will be 0.1% below your $1.0500 entry price. This is 10.5 pips below your entry level.

The calculation acts the same way with the 2% rule, but here you will need to calculate a 2% loss of your $10,000 bank, which is $200. Then you will need to calculate the percentage $200 takes from your $100,000 investment ($2,000 leveraged by 50:1): 200 / 100,000 = 0.002, or 0.2%.

Then you calculate 0.2% from your $1.0500 entry: 1.0500 x (1 – 0.002) = 1.0500 x 0.998 = 1.0479. This is the level at which you could place your stop loss, which is 21 pips below the $1.0500 entry. Obviously, the risk you take with the 2% rule is twice the risk you take with the 1% rule (We did expect that, didn’t we?): 10.5 pips risk vs. 21 pips risk.

These example are shown to illustrate the basic concept, but traders can and should also look at reducing position size and allowing for wider stops based on price action to achieve similar max % risk limits.

Trading with a Stop Loss

Let’s now demonstrate a trading situation and how you can adjust a Stop Loss order on a price chart.

This is the hourly chart of the USD/JPY Forex pair for Dec 6th – Dec 13th 2016. The image gives an example of a long trade.

The black horizontal line is a resistance area created by the two tops, which we have marked with the two black arrows on the image. In the red circle, you see the moment when the price action breaks the resistance area upwards, creating a bullish potential on the chart. This is when you have a nice opportunity to buy the USD/JPY on the assumption that the price will increase.

Now you need to place a Stop Loss order. A nice place for your Stop would be the level of the bottom, created prior the breakout. If the price decreases to that level, then the chance for an upward bullish run is somewhat reduced. We mark the initial Stop Loss with “Stop Loss (1). This level is approximately at a 0.3% distance from our entry price.

Let’s now use some risk management rules with the conditions we discussed above. If we have a $10,000 trade account, and we allocate no more than $2,000 from our trade account to a single trade, and decide to use 50:1 leverage, then this leverages every $2,000 into $100,000. We discussed that it is best not to risk more than 1-2% on a trade based on the account size. According to the calculations under the previous heading, the Stop should be on a 0.1-0.2% distance from the entry price, which is a maximum of $100-$200 on each trade. In our case, the stop is on a 0.3% distance, which means that we will be risking around $300 for the trade, which goes beyond our Stop Loss strategy. Therefore, it is better to pass on the trade or adjust the position size lower to meet the increased stop loss distance.

Now back to the trade, notice that the price starts an increase and after finishing the impulse, the USD/JPY Forex pair creates a correction. When the correction is finished, the pair starts a new bullish impulse. You can move your Stop Loss manually in this case to the level below the first correction (Stop Loss 2). Now your Stop matches the resistance level you used to enter the trade, which means that you have moved your stop to breakeven and are currently not risking anything further on the trade, at the same time, you are still in the trade for a possible winning scenario.

The price action creates another correction afterward and starts a new bullish impulse. It’s time to move your Stop Loss again. Drag the level upwards and adjust it under the created bottom on the chart (Stop Loss 3).

After finishing this impulse, the price action decreases again. However, this time it is not a correction, but the beginning of a new reversal. The price action hits the Stop and the trade closes automatically and with a positive outcome.

Risk of Not Using Stop Loss Orders

Although you have the option not to use a Stop Loss order in your trades, it is rarely advisable to not use one.

A currency pair can move hundreds of pips in a flash. We have seen many cases when Forex pairs rapidly create huge moves. What if the move is for 5-10%? Are you ready to risk 5-10% of your capital multiplied by your leverage amount, which could effectively wipe you out? Can you afford to lose this amount from your capital in a flash? Some of you may be thinking “This is unlikely to happen!” but those that have been around the spot forex market for any decent amount of time know better.

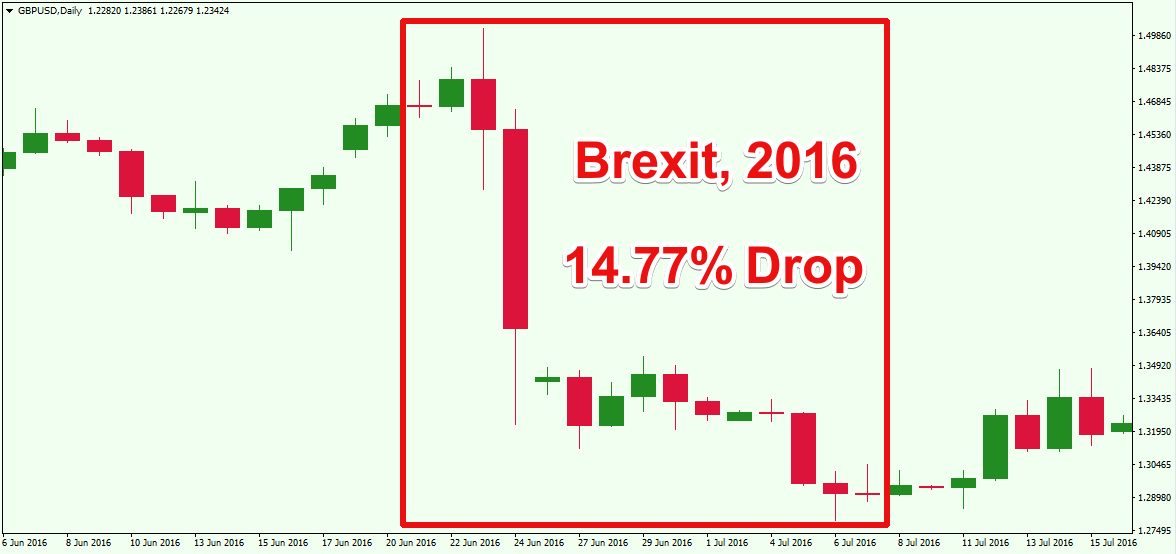

This is what the GBP/USD did after the UK citizens voted to exit the European Union. After the Brexit referendum, the GBP/USD lost around 14.77% of its value in about two weeks.

Still not convinced? Let’s take a look at another example:

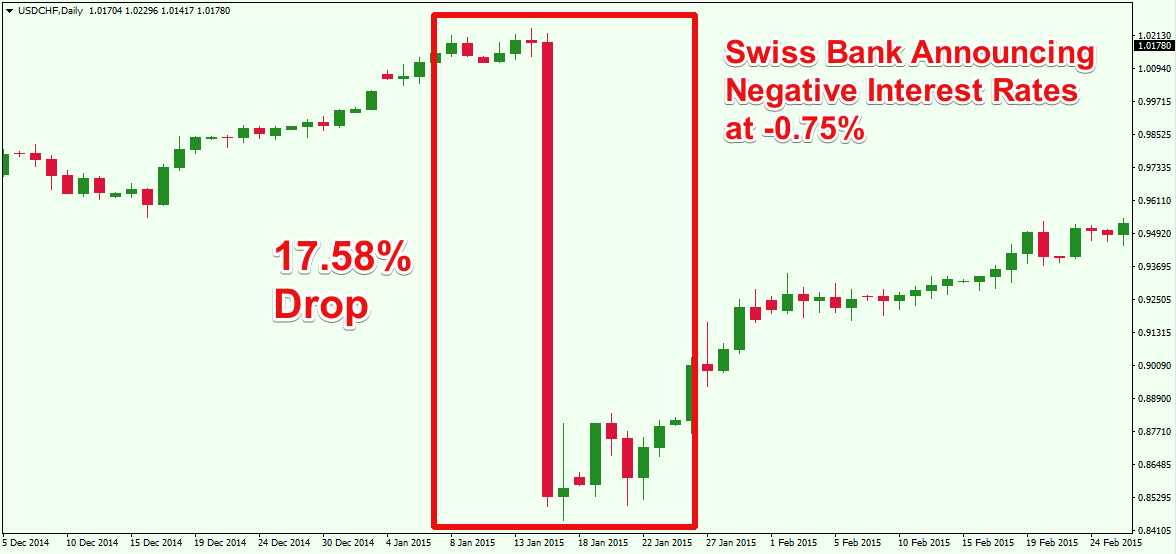

This was at the beginning of 2015 when the Swiss National Bank announced negative interest rates at -0.75%. As a result of this, the CHF gained drastically versus all other Forex majors. This led to a 17.58% decrease in the USD/CHF Forex price.

In other words, you want to everything you can to avoid being hit by such a big price move against your trade. The easiest way you can protect your trading account is to place a Stop Loss order on each trade. Now keep in mind that a Stop Loss order will not always fully protect you from every adverse move or Black Swan event, but it is always better to be protected with one than being naked in the market.

Conclusion

- A Stop Loss is an additional order to your initial entry order, which is used to protect your trade from adverse price moves.

- The Stop order appears on the MT4 chart as a dashed horizontal level.

- When the price reaches a Stop Loss order, the trade closes automatically.

- The distance between the Stop Loss order and your entry price is the amount you are risking.

- There are two basic types of Stop Loss orders:

- Hard Stop Loss – Stays still on the chart and closes your trade in cases where the price reaches this predefined level.

- Trailing Stop – Stays still when the price action moves against your trade and moves along with the price action when the Forex pair is moving in your favor. You choose the distance between the Stop and the price.

- If you are not a fan of the Trailing Stop, you can manually move the Hard Stop yourself as a trade management technique.

- The proper adjustment of a Stop order predetermines the maximum amount you are risking in your Forex trade:

- Try not to risk more than 1% of your account on a single trade if you are a beginner.

- Try to limit your risk to 2% of your account on your trade if you are a more experienced trader.

- You always have the option not to use a Stop Loss order for your trade. But if you choose not to use a Stop, you could be risking your full account on a single trade.