As the name “foreign exchange” implies, transactions in the forex market all involve an exchange of currencies, so currencies are priced relative to other currencies and are transacted at a certain rate known as an exchange rate.

As the name “foreign exchange” implies, transactions in the forex market all involve an exchange of currencies, so currencies are priced relative to other currencies and are transacted at a certain rate known as an exchange rate.

Hence, a currency will generally be quoted relative to another currency for which it can be exchanged. For this reason, all currencies exchanged in the forex market transact in pairs that are commonly known among forex traders as currency pairs.

The following sections introduce some of the basic concepts associated with currency pairs, including their notation convention and the significance of the order the currencies appear in. Market liquidity and popular nomenclature topics are also discussed below, and lists of the major, minor and exotic currency pairs and crosses are provided.

Currency Pair Notation

Forex currency pairs are often written by separating the three letter ISO 4217 currency code for each currency by a slash (“/”). For example, EUR/USD is the typical forex market notation for the currency pair consisting of European Union Euros for which the ISO code is EUR being quoted in U.S. Dollar terms for which the ISO code is USD.

Furthermore, each currency pair consists of a base currency that appears before the slash and a counter currency or quote currency that appears after the slash in the common market shorthand.

For the EUR/USD currency pair, the euro or EUR is the base currency in the pair, while the U.S. Dollar or USD is the counter currency in the pair that is being quoted relative to the base currency.

The Pecking Order in Currency Pairs

The prevailing forex market quotation convention gives precedence to certain currencies over others that affects whether they are usually quoted as the base currency or the counter currency in a currency pair.

This established priority ranking or “pecking order” for six of the most commonly traded currencies is as follows:

EUR > GBP > AUD > NZD > USD > CHF > JPY

According to this traditional pecking order, the foreign exchange market usually quotes the EUR/GBP and USD/CHF currency pairs in that order, rather than as GBP/EUR or CHF/USD. In the case of the EUR/GBP currency pair, the EUR appears first in the currency pair because it is situated higher in the aforementioned pecking order than the GBP.

Furthermore, most minor currencies are quoted as the counter currency in currency pairs with U.S. Dollars acting as the base currency. Examples are USD/SGD for the U.S. Dollar/Singapore Dollar exchange rate and USD/SEK for the U.S. Dollar Swedish Krona exchange rate.

How are Currency Pairs Quoted?

Before making a foreign exchange transaction, a trader must first obtain a quotation from a market maker. They would typically do this by communicating the desired currency pair and the amount of one of the currencies to be exchanged to their counterparty.

Retail forex traders will typically have an online forex broker as their counterparty for the transaction and may use an electronic trading platform such as Metatrader to obtain the quotation they require.

In contrast, professional Interbank traders will typically deal directly with other professional forex market counterparties at banks and other financial institutions.

The quotation received will generally be expressed as the number of base currency units required to purchase one unit of the counter currency. For example, an exchange rate quotation of 1.1500 for the EUR/USD currency pair means that each European Union Euro is worth 1.1500 U.S. Dollars. Hence, 10 million Euros could be exchanged for 11.5 million U.S. Dollars at that exchange rate.

Liquidity in the Major, Minor and Exotic Currency Pairs

Participants in the forex market sometimes differ as to exactly which currency pairs they consider to be major, minor or exotic. Nevertheless, in most cases, these general categories describe currency pairs that respectively tend to be very liquid, quite liquid or relatively illiquid.

Furthermore, in the context of the currency market, the term “liquidity” refers to the degree to which forex market is able to handle a purchase or sale transaction without causing a substantial change in the exchange rate for the currency pair in question.

In practice, forex market liquidity tends to be a function of the number of market markers available to make quotations for a particular currency pair and their readiness to absorb large transactions without moving the exchange rate much.

The forex market for major currencies — such as the EUR, GBP, CHF, JPY, AUD, CAD and NZD — quoted against the USD tends to be very liquid, so the EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, USD/CAD and USD/JPY currency pairs are considered by most forex traders to be major currency pairs.

The next lower tier of liquidity is shared by the minor currency pairs, which include the so-called cross currency exchange rates that do not involve the U.S. Dollar. Some traders include the NZD/USD in this classification, while others place it among the major FX pairs since it remains popular among traders and tends to enjoy quite liquid markets as a result.

Traders of cross currency pairs typically experience less liquid trading conditions and wider spreads than those enjoyed for the forex major pairs. Cross exchange rates can be derived from the more liquid markets of their component currencies quoted versus the U.S. Dollar.

Highly liquid examples of cross currency pairs that do not involve the U.S. Dollar include the EUR/JPY, EUR/CHF, EUR/GBP and GBP/JPY currency pairs. Less liquid cross currency pairs include the AUD/JPY and GBP/CAD currency pairs, for example.

Relatively illiquid markets exist for the least liquid tier of currency pairs commonly known as the exotic currency pairs, and dealing spreads can be considerably wider for these pairs as a result. Exotic currency pairs typically consist of the currency of a smaller or emerging economy paired as the counter currency with a major currency like the U.S. Dollar or Euro that acts as the base currency. Examples of exotic currency pairs include: USD/SGD that refers to the U.S. Dollar/Singapore Dollar exchange rate and EUR/TRY that refers to the European Union Euro/Turkish Lira exchange rate.

Tables of Major, Minor and Exotic Currency Pairs

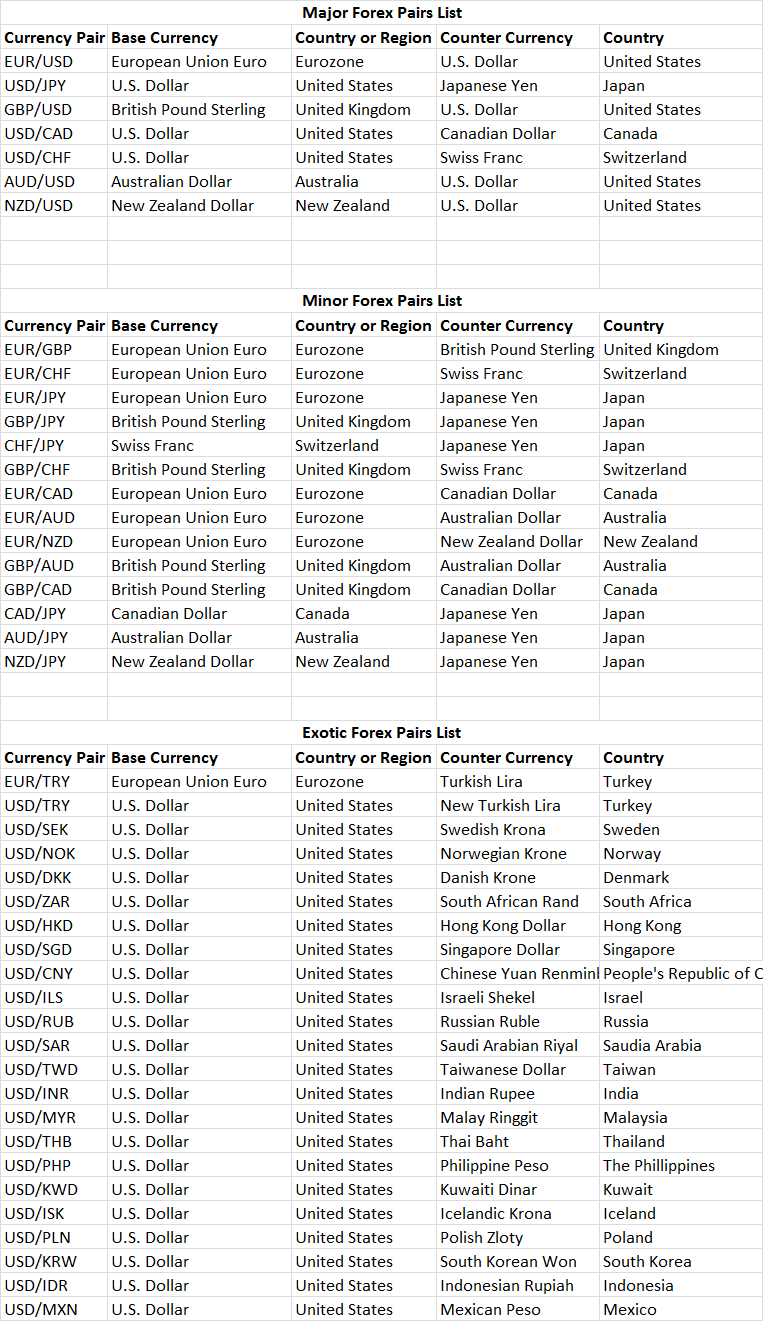

The three tables below contain this author’s attempt to create a major forex pairs list, a minor forex pairs list, and an exotic forex pairs list. Taken together, they fairly accurately reflect the main forex pairs currently traded in today’s foreign exchange market.

Best Currency Pairs to Trade

Those new to trading forex often ask seasoned traders what the best forex pairs to trade are. A wise trader will explain that the best answer will often differ depending on an individual’s preferred trading style, the strength of the trading opportunity they have identified, and the time frame that they expect to hold the position for.

For example, a trader using a scalping strategy that has a short average trade duration will usually be looking for the best dealing spreads and the ability to trade significant amounts very quickly. Such traders will probably want to confine their trading activities to highly liquid top traded currency pairs like EUR/USD and USD/JPY. These popular forex pairs feature the tightest dealing spreads and their markets can handle very large amounts due to the significant number of well capitalized market makers and other participants.

On the other end of the trading spectrum, a longer term trend trader who sees an excellent directional opportunity arising in an exotic currency pair might do very well by investing some of their account capital in taking a trade in that pair consistent with their market view. Nevertheless, due to the illiquidity of many of the exotic currency pair markets, they may want to keep their position sizes modest and be prepared to trade on wider dealing spreads when entering and exiting their positions.

Those trading primarily for time frames somewhere in between those two extremes may find trading opportunities arising in any of the most traded currencies listed in the tables above offered by their forex broker or market maker. Still, if the width of the dealing spread might significantly impact the overall profitability of their trade, then they may wish to focus their trading activities on the forex majors, rather than on the minor or exotic currency pairs.

Popular Nicknames for the Major Currency Pairs and Currencies

Professional forex traders tend to be rather colorful individuals, and they often refer to the major currencies and currency pairs by their traditional nicknames. Novice traders should be prepared to understand this important forex market jargon before speaking to a dealer or market maker working at a financial institution.

Professional forex traders tend to be rather colorful individuals, and they often refer to the major currencies and currency pairs by their traditional nicknames. Novice traders should be prepared to understand this important forex market jargon before speaking to a dealer or market maker working at a financial institution.

First of all, the U.S. Dollar currency is often referred to by forex traders as the “Greenback” or “Buck” in the singular, and they add an “s” at the end of the nickname to form plurals. Also, the Pound Sterling is usually called the “Quid” by dealers, which is a plural term, while the Swiss Franc is known as the “Swiss”, which is also plural.

The European Union’s Euro currency does not have any particularly common nicknames so is just called the “Euro”. Its plural form could be “Euro” or “Euros” since it is a relatively recent currency name, and its plural has apparently not yet been standardized. Similarly, the Japanese Yen is referred to simply as the “Yen”, which is a plural term. The Canadian, Australian and New Zealand Dollars are commonly called the “Loonie”, “Aussie” and “Kiwi”, which are all plural nicknames.

In addition, the four top traded currency pairs have the following common nicknames:

- EUR/USD – typically just called the “Euro”, although apparently some traders use “Fiber” or “Fibre” to refer to this pair instead depending on their country of origin.

- USD/JPY – usually simply referred to as the “Yen”, but some dealers might use more colorful Japanese cultural references like “Sushi” or “Ninja” to refer to this pair.

- GBP/USD – this pair is often called “Cable” in many forex dealing rooms.

- USD/CHF – this pair generally called the “Swissy” among forex traders.

The less actively traded commodity currencies have these traditional nicknames:

- USD/CAD – popularly nicknamed the “Loonie” but also sometimes referred to as “Funds”.

- AUD/USD – usually referred to as the “Aussie”.

- NZD/USD – generally referred to as the “Kiwi”.

With respect to the major crosses, EUR/JPY and GBP/JPY are sometimes called “Yuppy” and “Guppy” respectively, while the EUR/GBP pair has acquired “Chunnel” as a popular nickname.

Being aware of and learning these currency pair nicknames will help novice traders better understand a conversation with professional traders about the forex market, and it will also help clarify forex market commentaries written by professional traders that often use such jargon.

Trading a New Currency Pair

Although many currency traders prefer the high liquidity, tight spreads and simplicity of trading just the six major currency pairs — or even just a subset of them — a time comes in most forex traders careers when they would like to start trading a new currency pair.

After first checking to see whether your current broker or dealer makes markets in the new currency pair, the next step to take will involve performing some fundamental analysis on the two countries that issue the currencies that make up the new pair of interest. Since currencies are something like the stock of their issuing nations or regions, it will probably help to read about the issuer’s politics and economy and to determine what goods it imports and exports.

Also watch out for fixed exchange rate policies that tend to reduce volatility or cause large exchange rate gaps when they are changed. Review each country’s central bank policies on interest rates and currency management carefully, and find out the names of key monetary, fiscal and political policymakers. Be very wary of risky geopolitical events like wars, disasters or elections.

Once the above information has been collected — and if you are still interested in trading that new pair after your research — it would then make sense to look for an economic calendar to review each country’s historical economic data and see what events are coming up that may affect each currency’s relative value.

In addition, performing a review of long term historical exchange rate charts and implied volatility can help you identify any unusual risks involved in trading the currency pair you might not otherwise have noticed. Trying out your trading strategy for the new pair in a demo account might also make sense so that you can check out the dealing spreads, execution speed, stop loss order slippage, and intraday exchange rate behavior.

Once you have done your homework, you should then be able to make a better informed decision about whether trading the new currency pair seems right for you.