A managed forex account is a trading account whereby the owner of the account deposits funds and allows an account manager the right to trade on the owner’s behalf. While the goal for having an account manager is generally to alleviate the owner from getting involved in trading related decisions, nevertheless, having a good understanding of how the forex market works and the dynamics involved are very helpful in attempting to identify a suitable account manager.

A managed forex account is a trading account whereby the owner of the account deposits funds and allows an account manager the right to trade on the owner’s behalf. While the goal for having an account manager is generally to alleviate the owner from getting involved in trading related decisions, nevertheless, having a good understanding of how the forex market works and the dynamics involved are very helpful in attempting to identify a suitable account manager.

The forex market can be especially unforgiving in that the underlying volatility and extreme movements sometimes seen in the market can literally wipe out an overleveraged trading account with a surprise news event or economic data release. Without a basic understanding of how the Foreign exchange market works, a person would be challenged in selecting a managed account executive. A certain depth of knowledge of how the forex market reacts and operates can be advantageous in a search for the right account manager.

With a good understanding of the market dynamics, the owner of a trading account can have a clearer idea whether another person could do a better job trading the market than they could themselves. Opening an account with a competent forex account manager is not only potentially useful for trading novices, but it could be an ideal solution for an investor familiar with the market, but that knows their limitations as a trader and prefers that their trading be handled by a professional.

Unfortunately, most people that open managed forex accounts seem to have little to no background or experience in the forex market. Therefore, they have a hard time making an informed decision when it comes to selecting the right account manager appropriate for their unique situation.

Basic Forex Investment Concepts

FX investing seems to be something of a misnomer, since an investment generally involves placing money with the expectation of receiving a return on the investment. Holding a currency pair can offer a nominal return in the form of the swap points that reflect the interest differential between the two currencies.

Nevertheless, an expected return — such as in a stock dividend, an interest rate on a certificate of deposit or a coupon payment on a bond — does not otherwise exist in the forex market. Aside from engaging in hedging activities against some form of currency exposure, trading in the forex market would be better described as speculation than traditional investing.

Every transaction made in the forex market consists of simultaneously buying one currency and selling another at a certain rate of exchange, where traders effectively use the currency that is being sold to purchase the other currency. This leaves the trader with a long position in one currency for which an interest rate is received, and a short position in the other currency for which an interest rate is paid. The difference between these interest rates is known as the interest rate differential and is used to compute the rollover swap points that a trader either receives or pays away to hold their position overnight.

These two interest rates are set by the central banks of the countries where these national currencies originate. Rolling outstanding positions over is an obligation that traders need to meet every day in the forex market. While interest rates have been historically stable at quite low levels in the developed world over the past decade, they can make an enormous difference in the valuation of currencies and can affect forex positions as they start to rise and perhaps even become more volatile.

The Pros and Cons of Letting Others Manage Your Money

An important advantage of letting someone else manage your money, is that it allows you the freedom to use your time to engage in other endeavors. A person that has a career or is involved in another business that cannot deal with the day to day trade analysis, execution and other activities required for effective trading in the forex market, can be an ideal candidate for opening a managed account. By hiring another individual to manage their personal forex account, the owner of that account does not have to personally deal with the decision processes and challenges of day to day trading.

On the negative side, only you have the motivation to treat your investments and positions with the utmost care. Having a professional manage your funds means that they may not pay quite as much attention to your money as you would yourself. Also, you do not benefit from learning how to trade the forex market if you have someone else do it for you.

While account managers typically use online foreign exchange brokers to trade under a managed forex account agreement, the owner generally is not allowed to trade their own funds in the same account. Once the funds are placed into a managed forex account, certain conditions, which are set forth in the agreement, may limit the owner’s access to their funds immediately. In addition, some management firms will charge a penalty for early withdrawal of funds, as well as a percentage fee that depends on the profits generated by their trading activities.

Another major consideration when researching fund managers, is how secure will your funds be? Make sure that whichever broker you and your manager choose to hold your deposit in is fully regulated by a major regulating agency such as the CFTC or the NFA in the United States or the FSA in the United Kingdom. Due to some fraud that exists in the field of managed forex accounts, those interested in investing their money in such ventures need to be especially wary of companies domiciled in places like the Russian Republic, the Bahamas, Panama or other regions where a major regulating body is non- existent.

Also remember to beware of companies or individual traders that offer unusually high returns on managed accounts. Typically, these types of managers may be taking excessive risk in order to achieve such high advertised returns. An investor should always look at risk adjusted returns, rather than absolute returns. Make sure to research what other companies offer and decide for yourself what seems like a realistic return to expect based on the risks you are willing to take.

How Managed Forex Accounts Work

How Managed Forex Accounts Work

As we have discussed, Forex managed accounts involve having an experienced forex trader with an established and profitable track record enter trades in an account that you own. This trader is usually not able to make deposits into or withdraw funds from your account, but you do grant them a limited power of attorney or LPOA to execute deals in your account on your behalf.

This power of attorney agreement allows a forex account manager to trade your money in a transparent manner. Not only do you maintain full control over your account, but you can also check the account balance whenever you like, get a full breakdown of all trading activities, and adjust the account funding as desired. Such LPOA agreements can also generally be revoked if you wish to no longer use the services of a particular forex account manager.

Before selecting a particular forex managed account provider, you will want to look over the various fee schedules they offer. These are typically free of commissions but do usually include a substantial incentive fee for the manager that might vary between 20 and 30 percent of the net profits they generate in your account. There might also be different incentive fees depending on the minimum account balance you are able to maintain.

To move ahead, you will first need to feel comfortable with the concept of managed forex accounts and the fee structure offered by a particular account manager or provider. At that point, it makes sense to see what managed forex account options are available, since most companies will offer a selection between several different account types.

You will want to open an account at a reputable broker that is compatible with and meets with the approval of the forex account manager you have selected. You will then need to fund the account with enough money to qualify for the fee schedule plan you wish to participate in.

Discount or Full-Service Brokers for a Managed Forex Trading Account

In addition, with your managed FX account, you will want to select among the two basic types of broker: either a discount broker that just executes deals in your account or a full-service broker that provides extra services, like market advice or additional trading tools, for example, in addition to executing transactions.

Keep in mind that the latter type of broker tends to charge a greater commission because of the higher level of service provided. If you do decide to go with a full-service broker, then make sure that their extra services are relevant to your needs so that paying an additional amount to have access to them will make financial sense for you.

Choosing Among Forex Account Managers

Since managed trading accounts will require a forex account manager to execute transactions, you will want to make sure that you have done your necessary due diligence, and reviewed the past performance of the account manager you wish to hire. If you have never done this before, you can start by looking for managers with consistent overall profitability combined with a relatively low maximum drawdown level.

One of the best performance metrics to look for is the Calmer Ratio, which compares the average annual compound rate of return to the max drawdown over the period. The higher the Calmer Ratio the better the risk adjusted return, and the lower the Calmer Ratio the poorer the risk adjusted return. The Calmer Ratio is usually calculated for a 3 year period.

Once you have narrowed down the choices to a few managers based on their profitability and drawdown parameters, you will want to check that their risk profiles are consistent with your financial goals. Finally, it also makes sense to determine if they have a good reputation when it comes to dealing with their clients and providing good customer service and maintaining effective communication.

Investing in a Managed Forex Fund

Some investors feel more comfortable pooling their resources with other investors in a managed forex fund. Chances are, if you have previously invested in a mutual fund or hedge fund, then you may already be familiar with the basic concepts behind the managed forex fund.

Foreign Exchange funds are usually operated by companies who hire professional fund managers to trade and manage one or more portfolios. In the case of a managed forex fund, these portfolios will typically consist of a basket of currencies.

Any managed forex fund you consider investing in should have a minimum track record such as three or five years, that you can review for overall profitability and have an acceptable level of drawdowns. Each forex fund may also have a prospectus that you can read to find out additional details about how the fund operates and what its particular management style is.

Common Elements of a Managed Forex Fund’s Prospectus

The prospectus of a managed forex fund contains a description of how the fund operates. For example, it could include details such as, the manager’s professional background, the type of trading strategy or analytical method used, the time frame within which most positions are closed out, and other pertinent information.

The fund’s prospectus might also clarify the degree of risk the managers tend to feel comfortable taking, perhaps by explicitly stating their drawdown policy. It might also specify whether trades are typically dictated by a trading system or discretionary method, and what proportion of trades tend to fall into each category.

Finally, you will want to review the performance fees and the minimum account deposits for the managed forex funds you are most interested in investing in to make sure that the fees are reasonable and that you have sufficient funds to invest.

Some forex managed fund companies even offer pooled funds. An example of this might be a balanced fund where the average returns of several independent funds are automatically rebalanced at the end of each investment period.

This balancing process helps introduce an element of diversification that can otherwise be missing when choosing an individual forex managed fund.

Selecting Successful Forex Fund Managers

Unlike the situation of an investor considering where they should best place their money among the vast array of equity related mutual funds, those wishing to invest in a managed forex fund currently do not have a great deal of options from which to choose.

This relatively small playing field, may however, make it a bit easier to pick a fund manager from among the top forex investment companies who make managed forex funds available to the public.

A critical consideration to take into account when choosing a forex fund manager is to compare the track records of several competing funds. You will probably want to see how each potentially suitable managed forex fund performs in terms of its overall profitability, the consistency of its profits and the depth of its drawdowns.

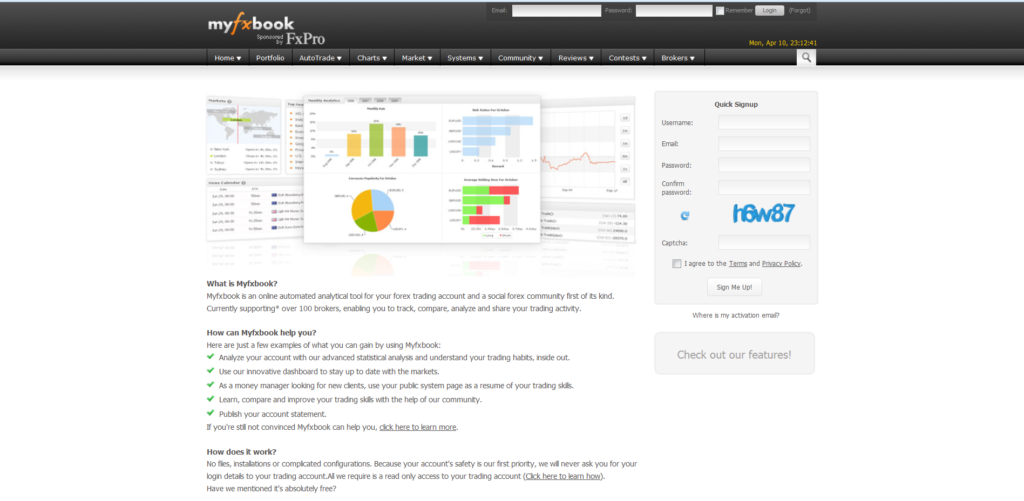

Many fund managers choose to display their performance using social forex community utility software. The most notable of which is the MyFXBook.com platform.

This innovative and free online analytical tool lets fund managers use their public system page as a resume of their trading skills.

The image below is a screenshot of MyFXBook’s home page that lists some of the key features of this useful web-based application:

Figure 1: A screenshot of the home page of MyFXBook, which is an innovative online analytical tool for forex trading accounts that supports numerous brokers and lets a fund manager compare, analyze and share their trading activity and results with others.

Furthermore, since you will probably be investing your money directly in the fund, you will want to be sure that its management company offers a reputable and secure place to hold your money while it is in the process of being managed.