Market manipulation is an intentional distortion of price action to deceive market participants through illegal or unethical means for selfish interest.

This could either be to falsely inflate or deflate price. The goal of market manipulation is to capitalize on favorable artificial market movements for personal gain.

A definition of what market manipulation means might not just do enough justice for the question you are most probably craving to be answered –

How and Why is the Market Manipulated?

But before we go into that, I would like you to understand what a market manipulation zone means.

By definition, a manipulation zone is simply an area where the market has been manipulated and has taken out certain traders.

Now, let me give an example.

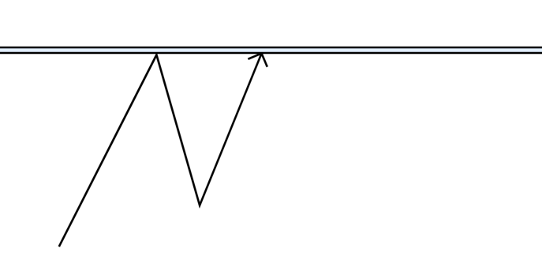

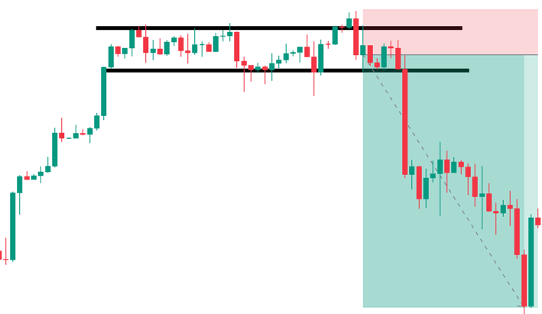

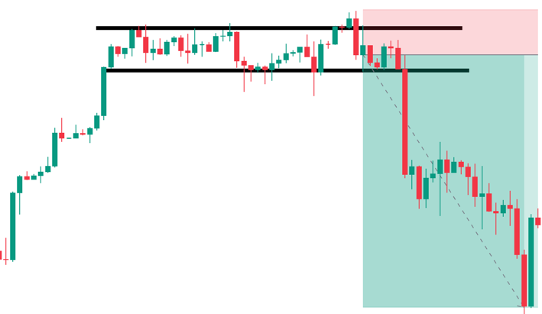

For instance, when traders spot a potential double tops like this,

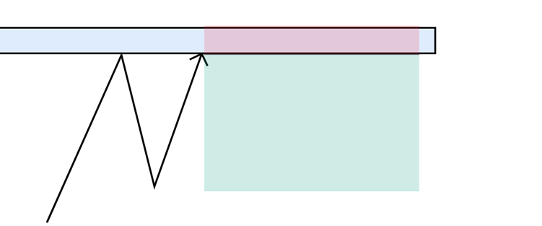

They will generally like to put a sell order at the resistance level and their stops just above it like this,

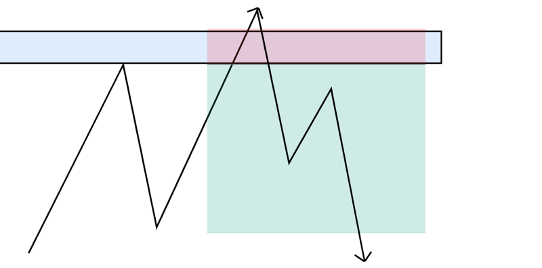

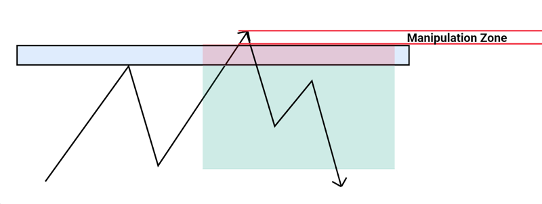

The market then hits their stop loss, and almost immediately after taking them out, the market then reverses in their intended direction.

This zone is called the manipulation zone.

Why and How has the market been Manipulated?

First of all, individual retail traders do not have a major impact on the movements of price. It is those with the big pockets that move and manipulate price action. Those with the big pockets like the banks and other big investors, manipulate prices.

The manipulation of the market is due to the need for large sums to be filled in the market. For instance, a bank wants to buy 300 million dollars’ worth of stock. It would be difficult for their orders to be filled immediately and often they suffer some losses if they simply execute their order like every other retail trader would.

What they normally tend to do is to induce some bearish pressure in the market by using a quota of their investment fund– say 20 million dollars. Thereby, creating some bearish sentiment in the market in turn, making traders take short positions. So that they would be able to get in at a lower or more discounted price. When price gets to their desired targets, they then place the rest of their 280 million dollars on their intended stock to buy.

This would sweep the sell stops and fuel the bullish momentum in the market. Having said all this, let’s now go into various tactics that these big pockets use to manipulate price.

In this section, I would be walking you through 6 major types of market manipulation that adversely affect traders in the market.

1. Market Rumors and Fake News

One of the most widely known forms of market manipulation is something known as the creation of market rumors. Insiders would spread false information, enticing the vast majority to make certain trading decisions of which they know to be false.

Here is what they do. Some traders or investors create false information in order to drive the price of a stock up or down, For example, rumors used to make terrible companies look amazing in order to drive the price up.

It is usually difficult to make a reputable company look lawfully terrible in order to drive the price down, but that is not to say it is totally impossible. Usually, rumors or fake news can heavily affect the price, and pose greater disadvantage to short-term traders.

How Do You Avoid Failing into the trap of false market rumors?

• Confirm The Source :- Make sure to do more research on your own to be sure that the information spreading is from a legitimate source.

• Fade the initial move. This means to trade in the opposite direction after the suspicious news might have been passed.

In other words, buy the rumor and sell the news.

Note: You must be an expert of the market to be able to fade the initial move.

2. Pump and Dump

Similar to Market Rumors or Fake News, another strategy devised to manipulate the market is something called Pump and Dump.

Pump and Dump is done by the means of spam emails or messages, groups and seminars.

Let me explain,

The “pump” comes off when retail masses or investors buys into the stock. This results in the price and volume of the stock spiking higher.

Immediately the retail investors are committed to the stock, the advocates sell their shares (“the dump”), causing the price to fall.

It is usually easy for the manipulators to manipulate stocks of low volumes or volatility. From the information provided above, you can deduce that it is not a wise decision to buy into a stock of low volume or volatility. The best way to avoid this type of manipulation is to avoid new stocks that suddenly skyrocket.

3. Spoofing

Spoofing is another manipulative tactic used by sophisticated short-term traders to manipulate the market. Here’s what usually happens:

These sophisticated traders place large orders at a particular level with no intention to execute them. Their systematic means of trading (via algorithms or bots) provides them the opportunity to create high number of trades.

So, when other investors see the pending large orders, believing that some big sharks would want to sell or buy at a particular level, they would want to trade in a similar direction, therefore placing their trade at the same level.

Minutes or sometimes, seconds before the market trades at their price, the algorithm cancels the orders before they can get executed. This quick act allows the manipulators to gain short term control of the market.

After the spoofer or manipulator pulls the order, the market increases or drops, resulting in losses for anyone unfortunate enough to be tricked into buying or selling. The best way to avoid being trapped alongside many others is by avoiding very short-term trading.

If at all you want to trade short term and profit from spoofing, you have to be a sophisticated and experienced trader with the right infrastructure to compete. I however advise that for most retail traders that they do not trade short term to avoid Spoofing.

4. Bear Raiding

Bear Raiding is a manipulative technique employed by large investors to push a share price lower by placing large sell orders. After that, the manipulator spreads incorrect information in the market.

While other people sell, the price drop allows the manipulator make profit from the losses of others. Bear raiding can occur for days, weeks even months. It has more profound effect on long-term traders.

5. Wash Trading

Wash trading is when traders buy and sell orders that oppose each other. Wash trading does not make the manipulators profit, nor do they make losses from it. This technique is just to increase the volume of trade so as to make the stock or any financial instrument appear more active than it usually is.

Traders, who notice the price volume would be lured into investing due to the increased trade action. Wash trading affects short term investors like scalpers and day traders and does not typically affect long term investors or traders, since it does not last long. Since wash trading does not have a long lasting effect, therefore, long term investing is the best way to avoid wash trading.

6. Cornering The Market

From the word “corner” in this context, you would understand that it means to have “monopoly” of an asset or a stock. Cornering the Market occurs when an individual or a body or group of people tries to gain control of the majority of an asset or a stock in order to direct or dictate the stock or asset price.

It takes a long time to carry out this manipulation, therefore adversely affecting long term investors. To avoid being trapped in this, you need to do thorough research on whatever financial instrument you plan to invest in.

Other forms of manipulation

Inside trading occurs when a person who knows something impactful about the financial move of a company before it is disclosed to the public, takes action in hopes to profit when the news is disclosed.

Churning is when fund managers or brokers who are in charge of large sums take excessive trades so as to increase their trade commissions. This may not necessarily make their investors more money. This form of manipulation may not necessarily cause harm to general investors in the market, but they tend to cause harm to the individual investor.

When the market is manipulated, it creates an unjust environment for investors and can destabilize financial markets, if this becomes rampant. This results in the hurting of retail traders who don’t realize these potential threats in the market.

What is Stop Hunting?

Similar to Market manipulation, Stop hunting occurs when large market manipulators target stop loss orders near a level in order to fill their own liquidity needs.

While the market manipulation tactics I’ve explained above might play a huge role in fundamental analysis, stop hunt plays an important role in technical analysis.

How Do You Avoid Stop Hunting?

Let’s get straight to it – It is impossible for you to say you can totally avoid stop hunting…. But there are techniques you can adopt to your trading system to minimize the possibilities of been stopped out.

And the major technique is strategically setting your stop loss. Don’t set your stop loss just above a major resistance or below a major support. Since liquidity rests above resistance and below support, price tends to move from one liquidity point to another and that’s where most traders place their stop loss.

Note: stop loss = Liquidity

Knowing this, it wouldn’t be wise to set your stop loss just above major resistance (or below major support).

The next question now is, Where do I place my stop loss?

A reasonable distance from the support or resistance would be a very good idea. You can employ the use of Fibonacci Retracement tool to assist in measuring your stop loss.

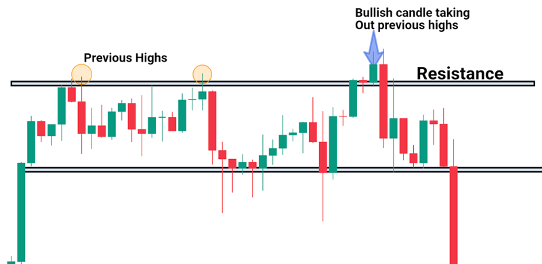

Another important point is to set your Stop Loss at a level where your trade is no longer valid. Generally, the entries for many traders are based on pullbacks, breakouts and chart patterns. When trading a pullback, the general rule is for your stop loss to be above previous high or below previous low.

Likewise, breakouts, the general rule is for your stop loss to be below or above the consolidation.

If your entries are based on chart patterns, then the stop loss should be placed where the chart pattern is no longer valid.

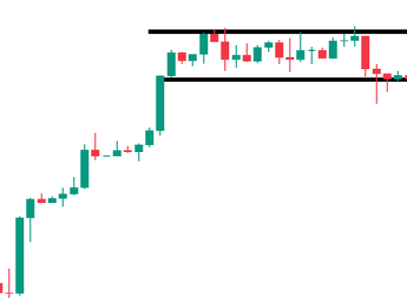

Let’s look at this breakout trade for example.

Notice that there is a bearish engulfing candle that has swept previous highs.

Do you see how the stop loss has been set above the range?

Yes! That’s a typical example of how to set your stop loss.

Regardless of how large your stop loss is, what matters the most is your position size. And you must understand risk management before you start trading.

Now, What strategy can you adopt to avoid stop hunting?

In this section, I would be divulging a strategy that can effectively help you avoid being the target of a stop hunt.

Here is what you should do –

• When price is approaching a major support or resistance level, the best thing to do is to wait for a convincing reaction on what price is likely to do

• Let price trade above previous highs or lows

• Wait for a rejection candles or engulfing candle

• And then take your position accordingly.

Frequently Asked Questions (FAQs)

1. If I use a small position size to cover my stops, wouldn’t my profit also be small?

Obviously, your profit would be small. However, the bright side to this is that your stop loss would be covered.

You have to understand that protecting your capital should be one of your major priorities, as that would be better than having unnecessary losses due to improper risk management.

2. What if I don’t set stop loss, would I fall victim of market manipulation?

Looking at this from a logical perspective, you won’t fall victim to market manipulation if you don’t set a stop loss. But guess what? You may fall victim of losing your whole trading account. Because the market might just totally reverse and never return.

3. What type of Trader is more likely to fall into the bait of Market Manipulation or Stop Hunt?

Most of the market manipulation has negative effects on short-term traders. They are more susceptible to fake news, pump or dump and so on. So, traders such as scalpers and intraday traders.

4. Do long term Traders suffer from market manipulation also?

Yes of course they do! But they are less prone to the majority of market manipulation. Most times, they do not fall victim to this trap.

5. Does market manipulation occur in all timeframes?

Yes! Market manipulation can occur in any timeframe. But the higher the timeframe, the less exposed you are to manipulation. And also, the better your trading decisions will be when you are trading on the higher timeframes.

This guest post was written by Dapo Willis. Dapo is a financial trader and coach specializing in the forex market.