In the world of macroeconomics, there are two major components that investors must understand: monetary policy and fiscal policy. Monetary policy is the act of controlling the amount of money in circulation and the interest rates.

In the world of macroeconomics, there are two major components that investors must understand: monetary policy and fiscal policy. Monetary policy is the act of controlling the amount of money in circulation and the interest rates.

Fiscal policy, on the other hand, is more about the amount of spending and taxation that occurs in a country and how money is invested by the government. Fiscal policy is generally more politically loaded than monetary policy because of the different beliefs that back up the decisions being made.

Understanding monetary and fiscal policy is particularly important to understand for the United States because of the weight of the decisions being made can be felt around the globe.

Ten years ago, when the world went through the massive financial crisis that was rooted in the United States’ housing industry, we saw how interconnected everything truly was. This is why so much attention is paid to the FOMC meeting news, and the decisions being made in regard to the United States’ monetary policy.

The Fed and the FOMC

The central bank of the United States is called the Federal Reserve, which is colloquially referred to as the “Fed”, while the Fed’s body that is in charge of controlling the money supply and monetary policy is called the Federal Open Market Committee, or FOMC.

When the housing system collapsed, the FOMC intervened and made several drastic moves in order to reinvigorate the economy. The changes made were called quantitative easing and acted as measures to control the interest rates, effectively changing the way incentives were set up.

The goal was to get more spending to occur across the board, and even though debates still rage on about whether this was the right move or not, it seems to have been effective.

As mentioned, the Federal Open Market Committee is the body which creates the Fed’s monetary policy. Monetary policy includes actions undertaken by central banks to affect the supply and cost of money, in order to achieve sustainable economic growth. The Federal Reserve has been in charge to set the U.S. monetary policy since 1913 with the Federal Reserve Act.

The Federal Open Market Committee (FOMC) is in charge of overseeing the United States’ open market operations. They are essentially the decision-makers at the Fed. Their main function is to set the monetary policy by way of specifying the short-term federal funds rate. This is the rate that commercial banks usually charge each other for overnight loans.

The FOMC consists of 12 members with voting rights, namely the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four other Reserve Bank presidents who serve on a rotating basis with one-year terms. Even though other Reserve Bank presidents are not designated voting members, they attend all FOMC meetings.

A change in the committee membership is announced at the first scheduled meeting of the year. The membership rotation for the next three years that shows the members with voting rights at Fed interest rates meetings is presented in the following table.

| Table: Rotation in the FOMC membership | |||

| 2018 | 2019 | 2020 | |

| Members | New York Cleveland Richmond Atlanta San Francisco |

New York Chicago Boston St. Louis Kansas City |

New York Cleveland Philadelphia Dallas Minneapolis |

| Alternate Members |

New York† Chicago Boston St. Louis Kansas City |

New York† Cleveland Philadelphia Dallas Minneapolis |

New York† Chicago Richmond Atlanta San Francisco |

The FOMC Meetings and Why They’re Important

The scheduled meetings of the FOMC are held eight times a year in Washington D.C., but the FOMC can meet more often if economic conditions require additional meetings. At the FOMC meetings, the committee assesses the past and prospective economic developments in order to make well-informed decisions. Factors that are considered include trends in prices and wages, the income and spending habits of consumers, interest rates, GDP growth, lending trends, and fiscal policy.

All of this helps each member to build an opinion and present it. At the end of each US FOMC meeting, a consensus is reached in terms of the appropriate policy, and the Fed makes the changes necessary in order to implement it. Usually, additional guidelines are given in terms of operating guidelines the Fed will follow in the future when deciding whether to restrict or ease monetary conditions.

The Fed announcement dates and FOMC meeting schedule for 2017 are presented in the following table. Traders should be very cautious around these dates as these meetings can have a high market impact. Usually it is prudent to stay away from trading on FOMC meeting dates and wait for the dust to settle to get a clearer picture on where the market will be heading after the Fed meeting announcement.

| FOMC Meeting Schedule 2017 | ||

| Month | Date | Event |

| Jan/Feb | 31-1 | FOMC Meeting (Jan/Feb) |

| March | 14-15* | FOMC Meeting (Mar) |

| May | 2-3 | FOMC Meeting (May) |

| June | 13-14* | FOMC Meeting (Jun) |

| July | 25-26 | FOMC Meeting (Jul) |

| September | 19-20* | FOMC Meeting (Sep) |

| Oct/Nov | 31-1 | FOMC Meeting (Oct/Nov) |

| December | 12-13* | FOMC Meeting (Dec) |

* Meeting associated with a Summary of Economic Projections and a press conference by the Chair

At each meeting, the representative of the Federal Reserve Bank of New York gives an overview of the current developments in the global foreign exchange market and activities of the Fed’s Trading Desk in New York.

The Fed meeting on interest rates is secret in nature, and Wall Street and analysts try to guess how the market will react to the meeting. If the Fed tightens or loosens the money supply, interest rates will rise or fall.

The seven governors of the FOMC’s board and all Reserve Bank presidents, give their views on the economic outlook and fundamentals. Once the information on national and international economic conditions are discussed, the FOMC tunes its monetary policy to achieve sustainable economic growth and the targeted inflation rate of 2%.

After a change in monetary policy is voted on, the FOMC forwards the information for open market operations to the Fed’s Trading Desk in New York, where the Desk then executes this order by buying or selling U.S. government securities on the open market to achieve the objectives of the FOMC.

The Federal Reserve has three tools to control the monetary policy. These are: open market operations, the discount rate and reserve requirements. The Federal Open Market Committee is responsible for open market operations, while the Board of Governors is responsible for the discount rate and reserve requirements.

The buying and selling of government securities in order to influence money supply and other economic indicators is called open market operations. For example, the Fed sells government securities if the FOMC decides to tighten money supply, and buys government securities to increase money supply. The buying of government securities initiates an increase in money supply and is referred to as expansionary monetary policy, while the selling of government securities reduces money supply, also known as contractionary monetary policy.

Using the three mentioned tools – open market operations, discount rates and reserve requirements – the Federal Reserve influences the supply and demand of balances that other financial institutions hold at Federal Reserve Banks, ultimately influencing the federal funds rate – the rate at which financial institutions lend their balances held at the Federal Reserve to other financial institutions overnight. The FOMC seeks to achieve a positive economic performance by targeting the federal funds rate through its open market operations. The Fed interest rate decision is published after each meeting.

Overnight loans are the shortest-term loans possible. The borrower is just borrowing funds to meet liquidity requirements until the next day and only a small amount of interest is actually charged.

The Fed aims to enact some sort of control over the economic system and smooth out economic activity and deal with financial panics. It was conceived in 1913, and has had a role in handling the aftermath of nearly every financial crisis since the Great Depression. The United States has always said that their three key objectives for monetary policy are to maximize employment, stabilize prices, and moderate long-term interest rates. Sometimes these goals come into conflict and as such challenges can often arise in striking a balance.

The US Fed rate announcement affects other interest rates, exchange rates and the supply of money and credit, which ultimately influences employment levels, economic output and inflation rates. Traders should be aware of the Fed interest rate decision dates, as they can move the markets substantially. The FOMC news release after each meeting can also be found on the Fed’s website.

The US Federal Funds Rate

For a quite some time, the overnight rate has been effectively set at zero, and the result has been easy money for anyone who wished to invest. Easy money is the phenomenon of being able to borrow much at such a low rate that more projects become feasible due to the lower costs.

This worked to change the incentives in the economy and create a world where it made more sense to spend than to save. Users of retail banks had no reason to horde lots of money for the future because they weren’t going to be compensated for leaving it there, and as such they have either taken on more risk, or just spent more.

The climate this has created has been determined to be too dangerous and it seems as if the FOMC is ready to start raising rate in 2017. They would like to shrink the $4.5 trillion balance sheet the Fed is carrying and buy back more of the bonds outstanding. A rate hike is thought to be in the works, especially as the Canadian government has just taken action to start to increase their rates as well.

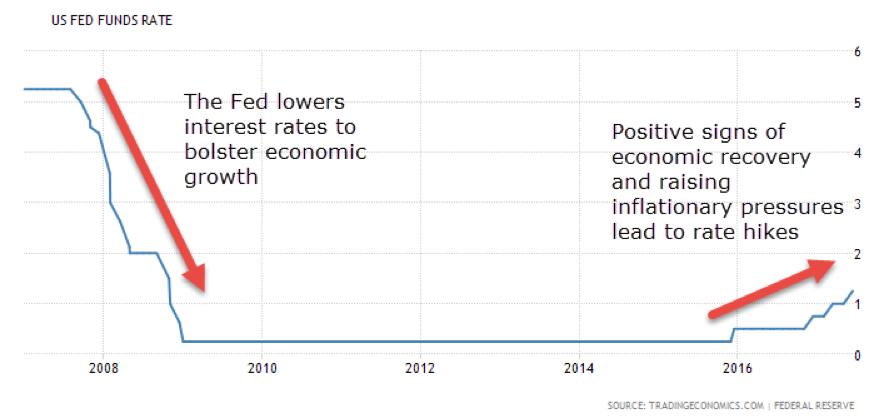

As the graph above shows, the FOMC lowers interest rates in time of weak economic indicators to spur economic growth, as was the case in 2008. The fed’s interest rate hit a record low that year of just 0.25 percent, while the average interest rate in the United States was around 5.8% from 1971 to 2017.

The current interest rate as of late 2017 is in the range between 1% and 1.25% is still well below the average interest rate in the United States.

The Interest Rate Approach

When the Fed interest rate announcement becomes public, it will usually affect the US dollar. An increase in the federal funds rate reduces inflationary pressures, and increases international cash-flow into the United States which works to appreciate the US dollar.

On the other hand, a decrease in the federal funds rate increases inflationary pressure as money becomes more easily available, which puts downward pressure on the US dollar.

Additionally, lower interest rates make the US dollar and US securities less appealing to international investors, and depreciate the US dollar even more. Traders can use these macroeconomic rules to position themselves in times when the market expects a change in the federal funds rate.

A popular approach for trying to predict exchange rates is the interest rate approach, which analyses interest rate differentials. This fundamental way of predicting exchange rates involves a series of principles that are beyond the scope of this article.

But what is important to know is that under the theory of interest rate parity, the expected interest rate returns of a currency will be equalized through speculation in other currencies once converted back to the first currency.

Of course, just like with other theoretical approaches, currencies can violate the interest rate parity theory for a substantial period of time before they meet in equilibrium.

Let’s extrapolate the interest rate parity theory one stage further and introduce what is known as the International Fisher effect:

- The difference in interest rates = the expected change in the spot exchange rate

As with the interest rate parity, the international Fisher effect also has its downsides. The main incentive of traders is directional gain rather than interest income, and market practitioners sometimes completely disregard interest rates. Still, a change in the interest rate has a long-lasting market impact as international investors decide whether it’s profitable to invest in the US economy with the changed monetary policy. These international cash-flows have a big impact on the currency market, as investors need to purchase US dollars in order to invest in the United States, creating demand (and upward pressure) for the currency.

FOMC Criticism

The FOMC has become a very politically charged topic in the last few years because of the intense “intellectualism” that many feel is not backed by a solid track record. The idea that a select group of people can make such big changes to the economy is being criticized as people wise up to the fact that macroeconomics isn’t nearly as predictable as economists would like.

This is all occurring as Bitcoin starts to receive some level of mainstream interest. Cryptocurrencies have moved from having some level of notoriety as the payment method of choice for drug dealers to spawning a whole industry built around the idea of having a decentralized system.

Centralization and top-down decision making is at the heart of the Fed, and goes directly against the ideas presented by Bitcoin proponents who believe that having a single group of people in charge of the entire economy and fate of the US dollar is haphazard at best. Basically, Bitcoin is a form of libertarianism and the concept of the FOMC is not something they think has a place in the future.

So, the question becomes “Should there be a top-down method of controlling the economy or has that proven to be ineffective and rather dangerous”? These are questions that are going to play out as the Fed continues to expound upon their plans for controlling inflation, boosting employment, and managing GDP growth.

Conclusion

Each Federal Reserve announcement can be a potentially high-impact event on the markets, and traders should prepare for high volatility during these announcements. The Federal Open Market Committee, being the main body that dictates the US monetary policy, directly and indirectly affects every economic indicator in the United States and the performance of the world’s economy.

Traders should be aware of the current situation in employment levels, inflation rates and economic growth, as the Federal Reserve considers all three of these indicators when changing and implementing monetary policies. When trading around FOMC meeting dates, traders should also implement proper risk management rules, or entirely stay away from the market, as these events will significantly increase price volatility.