Whether you are a bullion investor or active trader, you can take advantage of the gold-silver ratio and incorporate it into your trading strategy. In the following lesson, we’ll explain what the gold-silver ratio is, why it rises or falls, and how the ratio can provide valuable hints for your future investments.

What is the Gold-Silver Ratio?

You don’t have to be a math whiz to understand the simplicity behind the gold-silver ratio. The ratio is simply a measure of how much one ounce of gold costs in terms of silver, or how many ounces of silver you would need to buy one ounce of gold.

The calculation is quite simple – to get the current ratio between gold and silver, you just need to divide the current price of one ounce of gold by the current price of one ounce of silver. For example, if the current price of gold is $2,000, and one ounce of silver costs $20, the gold-silver ratio would be equal to 100, i.e. gold is 100 times more expensive than silver.

While understanding the gold-silver ratio is quite easy, most investors and traders don’t pay attention to the ratio. The ratio is mostly used by precious metals traders and investors who want to accumulate their holdings of gold and silver as the ratio fluctuates from extreme highs to extreme lows (more on this later.)

Still, the gold-silver ratio can be a great measure to identify the current market cycle and can help in making better investment decisions. For example, gold prices will often rise when the value of the US dollar falls, or when inflation expectations surge since gold has been traditionally used as an asset to protect against rising prices in the market.

While silver is also a popular asset to hedge against inflation, its industrial applications make it a good buying candidate when the economy is booming which leads to a higher demand for physical silver. This implies that the gold-silver ratio tends to fall when demand for silver rises as the result of higher industrial demand.

What Drives the Prices of Gold and Silver?

For thousands of years, both gold and silver have been used as money, as a store of value, and as a hedge against rising prices in the economy. Their attractiveness during times of rising inflationary expectations is still present to this day.

Gold has an a very high correlation with the real yields in the economy. The real yield is simply the current nominal yield minus the current inflation rate (for example, CPI). When real yields fall, investors look for other asset classes to park their capital. Gold has traditionally been the asset of choice for investors when real yields are low and inflation threatens to erode their capital.

The price of gold tends also to rise when major central banks start increasing their gold reserves. The central bank of Russia and China are two examples for the last decade of how countries can push the demand for gold higher and increase its price.

Gold is also an extremely valuable metal in the industrial and manufacturing process. One use is in conducting tiny electrical charges in smartphones, PCs, and medical equipment, for example.

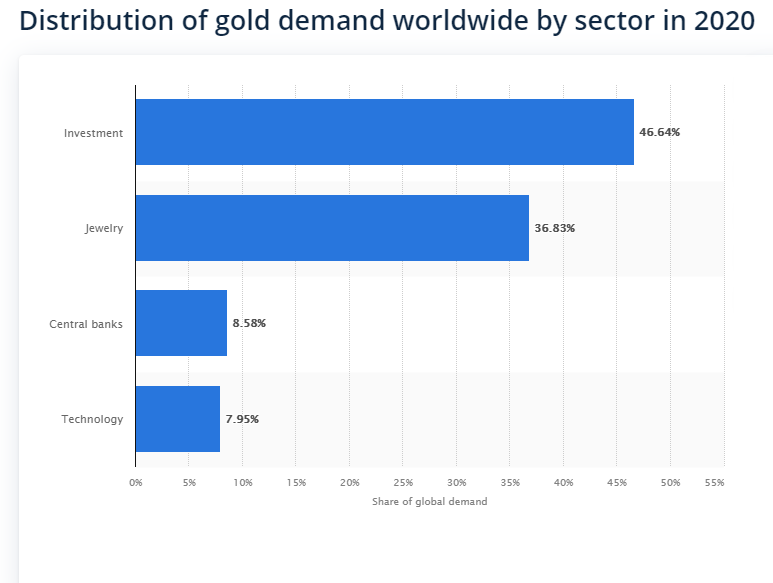

In 2020, the amount of gold used in technology accounted for almost 8% of the global gold demand. Jewelry accounted for 37%, and investments for almost 47% of the total gold demand.

Figure 1 Source: statista.com

Besides gold, silver is also an extremely popular industrial and investment metal.

High-tech products, like PCs, tablets, and phones, used around $20 billion worth of gold and silver, with the amount of the latter being almost 25 times higher than the amount of gold.

Only around 15% of the precious metals used in the technology are recycled and recovered, which means that unless we see a huge improvement in the recycling process, the total amount of available gold and silver is only going to shrink.

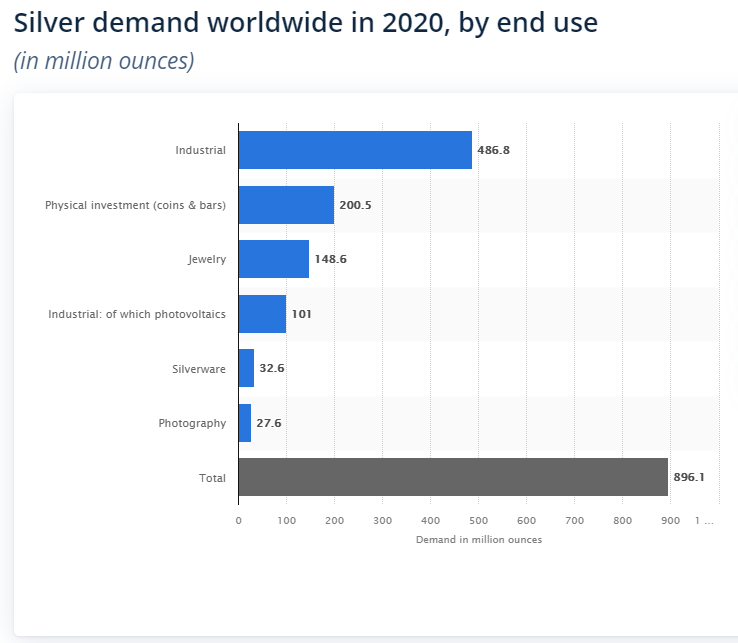

While the industry is the main driver of silver demand, the metal is also used for investments (around 200 million ounces in 2020), jewelry (around 150 million ounces in 2020), solar panels (slightly more than 100 million ounces), and photography (27 million ounces).

Figure 2 Source: statista.com

This means, increasing economic output and booming industrial manufacturing tend to support the prices of both gold and silver. Rising inflation rates, which lowers the real yields of investments, are also the main driver of gold and silver investments.

Finally, gold is also a popular safe haven that tends to attract global capital during times of economic or political turmoil, making it an important allocation in every investor’s portfolio during times of crisis.

Historical Gold and Silver Ratio

Historically, the gold-silver ratio was mostly fixed and set by governments for purposes of monetary stability.

During the Roman Empire, the historical ratio of silver to gold was fixed at 12, which means that 12 ounces of silver bought 1 ounce of gold. The US Coinage Act of 1792 was also an important event in the gold and silver ratio history which set the ratio at 15:1. In the 19th century, the US government moved the ratio to 16:1.

Since the end of the Bretton Wood agreement in the 1970s, currencies have left the bi-metallic standard and become freely floating on the global market. Gold and silver have also started to trade on exchanges, and the gold-silver ratio has started to float influenced by supply and demand.

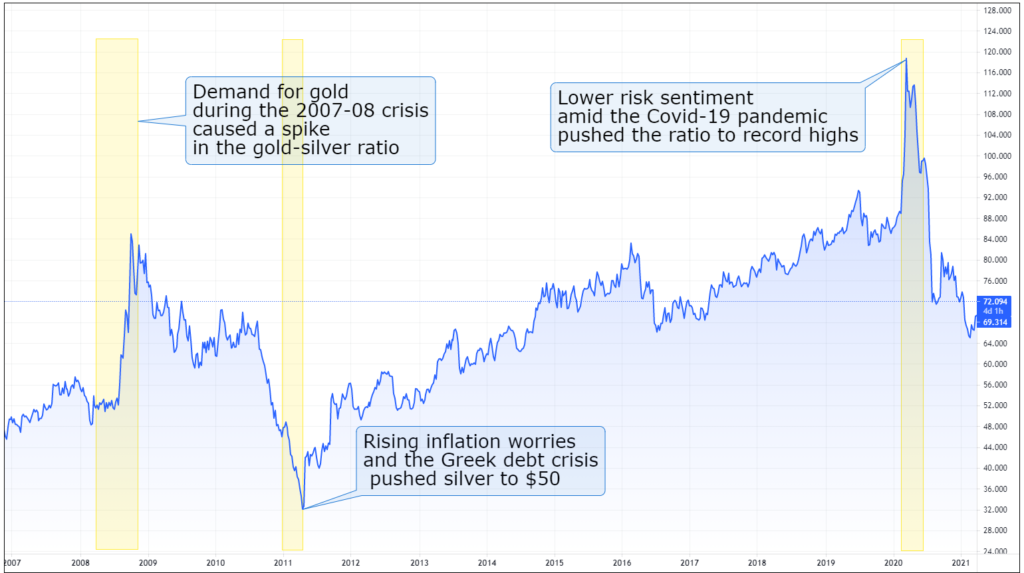

The ratio usually rises during times of bear markets in precious metals and falls during times of bull markets in precious metals. The reason behind this lies in the volatility of silver. Since silver is priced much lower than gold, its price tends to be more volatile during times of strong uptrends or downtrends. Take a look at the gold silver ratio chart below to see how the ratio has behaved since 2007.

In 2011, when silver prices peaked at almost $50 per ounce (second yellow area on the gold and silver ratio chart), the ratio stood at an extremely low level of 31.

However, during the next few years, the price of silver dropped to almost a third of its 2021 level, pushing the gold-silver ratio higher to 80:1.

During the early days of the Covid-19 pandemic and the announcements of national lockdowns, gold soared on the back of its safe-haven status, bringing the gold-silver ratio to a new record high of almost 120 (the third yellow area on the gold silver ratio graph). This was an attractive time to sell short gold and buy silver, but we’ll cover more about how to trade the ratio later in this article.

Silver proponents argue that the current gold to silver ratio is way too high and a direct result of artificially low silver prices. Their arguments are based on the ratio of silver and gold in the earth’s crust, which is 16:1. This should be the real gold-silver ratio in the markets.

Alternatively, since the amount of silver mined each year is around 9 times the size of the total gold mines, the ratio should be fluctuating around 9:1, which makes the price of silver even higher than if the ratio was 16:1. It’s also good to know that the long term gold silver ratio, when looking at its average, stood at 55.

Is the Silver Market Manipulated?

A popular belief, especially among bullion investors, is that the price of silver is artificially kept low. You’ve probably heard rumors of the Federal Reserve manipulating silver prices, together with bullion banks, in order to keep the attractiveness of the US dollar. But is this really true?

Market manipulation refers to a purposeful effort to control or artificially influence the prices of a financial instrument. This includes rigging prices or trades to create a deceptive picture of supply or demand for an asset.

Proponents of market manipulation in the silver market often refer to the heavy short positions in the market.

Some of them blame the central banks, while others say that big banks use naked short-selling techniques to short silver without actually borrowing it. They also say that, given the size of the silver market, it’s much easier manipulated than the gold market.

A popular rumor was that JP Morgan maintains outsized short position in the silver market. However, there is no real proof that the bank – one of the biggest in the world – does naked short-selling in the silver market.

After all, JP Morgan is an LBMA bank (London Bullion Market Association) and has the interest to participate in the silver market as a bullion bank. The bank is also responsible for clearing silver transactions, so it’s mandatory for the bank to be engaged in the silver market.

Finally, the Reddit and WallStreetBets short squeeze frenzy tried to corner the silver market in January 2021, just like they did with GameStop. The price of silver did jump to the highest level in years after the Reddit group announced the “mother of all short squeezes”, but it fell shortly afterward to its pre-Reddit levels.

Silver is mostly mined as a byproduct of gold, zinc, and copper. International miners then sell forward contracts in silver to lock in their profits, while bullion bankers are mostly the largest buyers of those contracts.

However, bullion bankers don’t profit on directional bets, but rather on the services they provide for matching buyers and sellers in the market. This means, once a bullion bank buys a silver forward, they hedge against falling prices by entering a short position in silver. As the price of silver rises, losses in the shorts are offset by higher prices of their silver holdings.

How to Trade the Gold-Silver Ratio?

There are a few ways to trade the gold-silver ratio. Here, we’ll cover the most popular ones:

Hoarding precious metals when the gold-silver ratio reaches extremes

This is a popular gold silver ratio trading strategy used by bullion investors and hard-asset enthusiasts who want to increase their stockpile of gold and silver. These investors buy gold with their silver holdings when the price of gold is relatively low to the price of silver, i.e. when the gold-silver ratio reaches an extremely low point.

Historically, when the gold-silver ratio fell to 50, this usually indicated a good time to buy gold and sell silver.

Now, the genius with this approach is that the same investors would again exchange their gold holdings for silver when the price of silver is relatively low compared to the price of gold, i.e. when the gold-silver ratio reaches an extremely high level. Historically, when the ratio reached 100, this signaled a good time to buy silver and sell gold.

For example, let’s say that the current price of gold is $1,000 and silver trades at $20. The gold to silver price ratio would stand at 50, which signals that gold is relatively cheap in comparison to silver. An investor could buy an ounce of gold for 50 ounces of silver, and wait for the gold-silver ratio to increase.

After a few years, let’s say gold reached $1,500 and silver fell to $15, increasing the gold-silver ratio to 100. The same investor could now exchange his one ounce of gold for 100 ounces of silver, leaving him with double the amount of silver he had when he first started investing.

Using the Gold-Silver Ratio to Measure Market Sentiment

Gold is an extremely popular asset during times of political and economic turmoil, recessions, and soaring inflation rates. Take the Covid-19 pandemic for example, when gold sky-rocketed above $2,000 for a brief period of time, pushing the gold-silver ratio to its highest level on record.

A soaring gold-silver ratio is often an indicator of upcoming recessions or higher inflationary expectations. Silver is also used as a hedge for inflation, but not as much as gold, which is why the price of gold tends to significantly outperform the price of silver when inflation rates rise or economic output shrinks.

When trading gold silver ratio, traders can use this relationship to park their capital in safe-havens, such as gold, US Treasuries, the US dollar, the Japanese yen, or the Swiss franc, and to unwind their riskier investments, such as stocks.

How to Use the Gold-Silver Ratio in Your Portfolio?

So far, you’ve learned that buying silver when the gold-silver ratio is high and buying gold when the ratio is low yielded an attractive return for precious metals investors. However, picking the exact top or bottom (the extremes in the gold-silver ratio) isn’t always an easy task.

This is why investors and traders may also benefit by applying an average dollar value to their investments. For example, you may start buying silver with 10% of your funds as the ratio nears its extreme highs, and keep adding to your investment in your portfolio as the market tries to establish a top.

There are three popular ways for gold silver ratio investing. First, an investor may choose to buy bullion, coins, and other physical metals, although this isn’t always the most practical or efficient approach. Storing a large quantity of precious metals, paying for transportation costs, and insurance fees can quickly add up and erode your profit potential.

Another popular way is to buy gold and silver ETFs. Yes, ETFs have sky-rocketed in popularity in the last decade or two, but some ETFs simply don’t track the price of gold or silver very precisely. Also, if you do want to take physical possession of your gold or silver, some ETFs may require large minimum investments to be able to send you your precious metals.

Finally, a large number of investors choose the metals futures market to speculate on the prices of gold or silver. The CME Group offers three gold futures contracts: a 100-oz contract, a 50-oz mini contract, and a 10-oz micro contract. The largest contract is the most widely traded of the three, which also means higher liquidity and lower spreads. If you want to trade the 10-oz micro contract in the short term, you’ll likely face significant trading costs doing so.

If you prefer trading options over futures, then the CBOE GLD options are a great (and very liquid) alternative to the gold futures contracts, especially for the 10-oz micro contract.

Final Words

The gold-silver ratio represents the current price of one ounce of gold divided by the current price of one ounce of silver. It shows how many ounces of silver an investor or trader has to pay to buy one ounce of gold.

A rising gold-silver ratio means that gold is getting relatively more expensive than silver, and the opposite is true when the gold-silver ratio falls. Historically, the average gold to silver ratio is around 55. But important and unexpected market events can push the ratio to extreme levels. When the ratio is high, bullion investors prefer silver over gold, and when the ratio is low, they prefer gold over silver. They also use a strategy that takes advantage of extreme levels in the ratio to increase their stockpile of precious metals.

The gold-silver ratio can also be used to measure the current market sentiment. A rising ratio often signals that markets are worried over inflation rates or upcoming market recessions, which allows participants who follow the ratio to rebalance their portfolios accordingly.