The weekend gap is a fairly common occurrence within the Forex market. As such, you should be aware of the risks associated with holding a position into the weekend and the potential effects that it can have on your trading account. Furthermore, there are specific weekend gap setups that provide for a viable trading opportunity. We’ll discuss where trading gaps can appear, present some risk reduction strategies for holding positions when the markets are closed, and disclose a strategy for trading forex weekend gaps.

Gaps In Technical Analysis

It's important that we start with a strong foundation around the concept of gaps in the financial markets. So what exactly are gaps and what do they appear like on the price chart? Well, gaps appear as a blank space in the price action where no trading has taken place. For the most part, gaps can be seen in various financial markets when there is a distinct closing time, and an opening time.

Since the Forex market is traded 24 hours a day, five days a week, gaps within this market are often seen during the Sunday open following the Friday’s close EST. Now, it's also important to realize that gaps can and do occur during market hours. More specifically, these types of gaps occur most often immediately after an important economic news release, or unexpected geopolitical event during the trading session.

Market gaps can provide valuable insights into the minds of market participants. For example, when the price of a currency pair gaps up on a particular economic report, that tells us that there were no traders willing to sell within a specified range defined by the last closing candle and the following candle’s open. And the same occurs in reverse for a gap down move.

Now it's important to realize that the bullish or bearish sentiment created by a price may only be temporary. It's our job as traders to decipher between the various types of trading gaps within the market, so that we can choose the best course of action, if any with regards to trading gaps in the market.

There are three major types of trading gaps within the realm of technical analysis. The first is known as the breakaway gap, the second is referred to as the continuation gap, and the third is called the exhaustion gap. There are different implications to each of these types of gap formations, and so, it's critical that we understand the context in which a gap occurs in order to realize its potential.

The breakaway gap typically occurs at the beginning of a new trend move. One of the most important characteristics of a breakaway gap is that it will usually break out of a trading range or consolidation phase. The momentum following a breakaway gap will often be quite strong and can lead to a parabolic style price move. Breakaway gaps tend to be fast and furious, and require a good amount of skill in trading them effectively.

Below is an example of a breakaway gap:

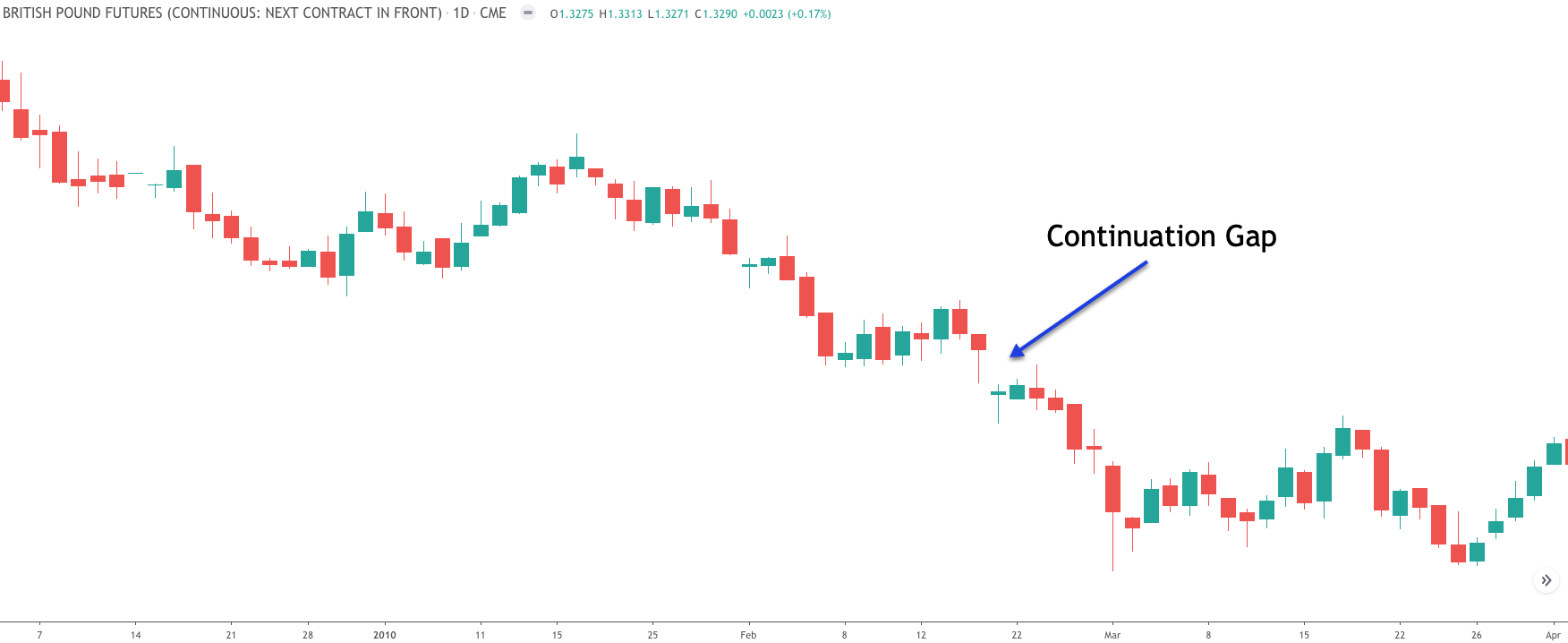

The continuation gap is another type of gap that occurs frequently within the financial markets. The continuation gap occurs within the context of an existing trend. Some technical analysts refer to the continuation gap as a runaway gap. In any case, the implications are the same. That is to say that the continuation gap up will occur after a market has been trending for at least some period of time, and a continuation gap down will occur after the market has been trending down for at least some period of time.

Below is an example of a continuation gap:

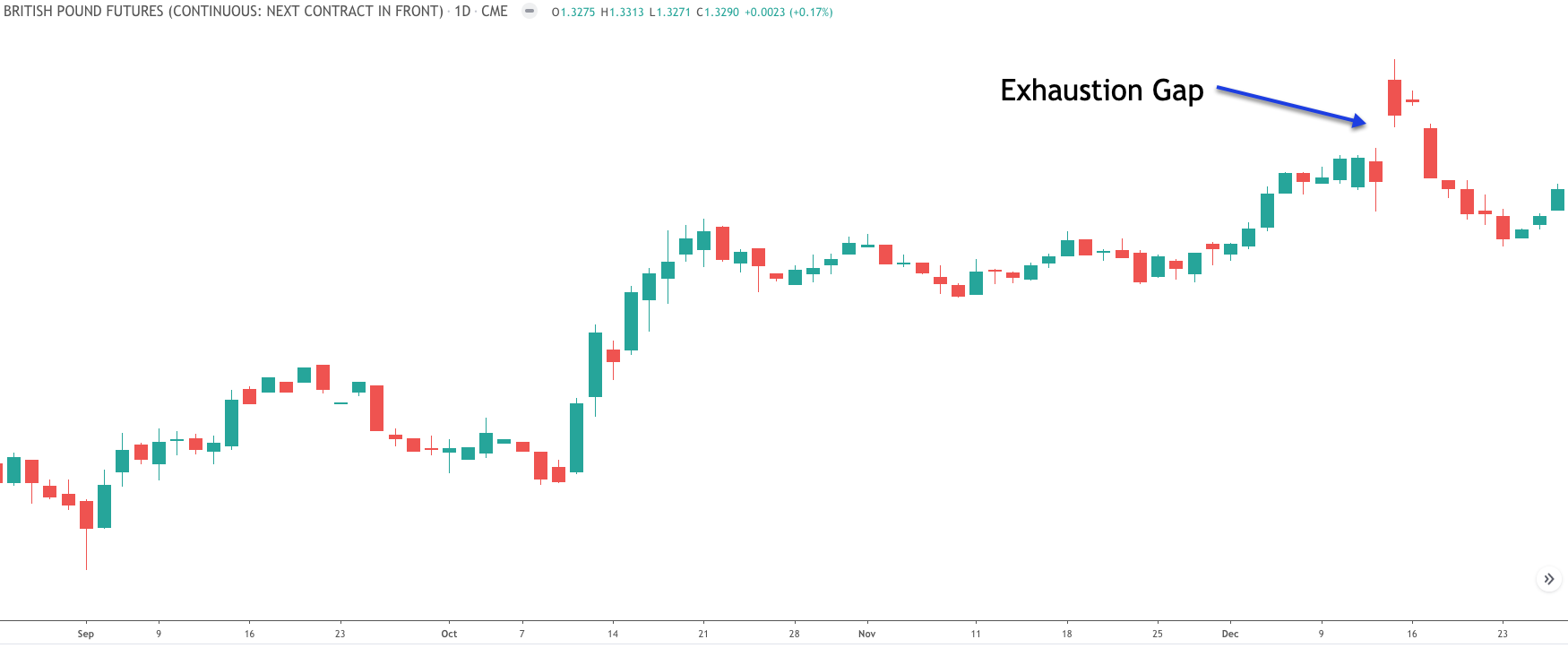

The last major type of gap formation is referred to as the exhaustion gap. Exhaustion gaps occur in the price action after a prolonged move in the market. As the name implies, they are indicative of an exhausted price move. It's as if the market is making one last push to move prices further in the direction of the trend.

But ultimately, exhaustion gaps will lead to a reversal in the market trend. This is because once all the bulls have taken a position in an uptrend, there is no place for price to go but down. And conversely, once all the bears have taken a position in a downtrend, there is no place for price to go but up.

Below is an example of an exhaustion gap:

Weekend Gaps In Forex

Now that we've discussed what market gaps are and how they appear on the price chart, let's now discuss in more detail the occurrence of gaps within the foreign exchange market. More specifically, we will focus on weekend gaps, which can be seen as occurring within a currency pair at the beginning of the new trading week which starts with Sunday's open at 7 PM Eastern Standard Time, following Friday's close at 5 PM EST. This is the forex market open time and close time respectively.

As we’ve touched upon earlier, sizable market gaps in a currency pair can be due to a number of reasons. The most common of which can include an unexpected news announcement or event that triggers a high level of one-sided emotion in the market.

As an example, consider the case where there is a high level meeting between the President of the United States, and the Prime Minister of England, about the state of future trade between the two countries.

And this particular meeting is scheduled to be held on a Saturday, when the major financial market centers are essentially closed for business. Depending on the result of such a meeting, there could be a major implication for the GBPUSD currency pair when the market opens on Sunday evening, which could likely result in a major gap up or gap down price move.

Many times it's extremely difficult to predict if and by what extent the market will react to such types of weekend events. And so from the perspective of trading, predicting forex market gaps does not provide for a viable trading strategy. Sure you can catch an upside or downside gap from time to time, however, there does not appear to be any real discernible edge in trading opening gaps in this particular manner.

Later we will be discussing a weekend gap strategy in Forex that you can take advantage of, and one that relies not on predicting future gaps, but rather, by waiting for a gap to occur first, and then trading around that occurrence.

Weekend Gap Risk In Forex

As you should be well aware by now, the forex market is essentially closed on the weekends. And so, opening gaps in the Forex market can pose a substantial risk to traders who are currently holding an open position. If you take a moment to think about it for a second, it will become abundantly clear to you why this is the case.

Imagine that you're holding a short position in the Euro Dollar currency pair over the weekend with a 50 PIP stop loss. Now let's say, that some major event occurred over the weekend, that was particularly bullish for the Euro currency, and this resulted in the price of the EURUSD currency pair to gap up on the open Sunday evening EST, at 200 pips above Friday's closing price.

Well what has happened in this particular case, is that you will be stopped out for a loss of approximately 200 PIPs, rather than your preset 50 PIP stop loss. Your 50 PIP stop loss level was never triggered because prices traded straight through this level, and opened the session at 200 pips above Friday's close. As a result, you would've experienced a loss of four times your anticipated loss level due to this unexpected gap move.

And so, if you were risking 3% of your capital on that particular trade, the end result would have actually been a loss closer to the 12% range. Can you see how an adverse gap move can put your trading account in a dangerous predicament?

Forex traders need to be cognizant of the risks that weekend gaps can pose and try to deal with them accordingly. The lesson is quite simple. Always have a plan if you are leaving forex trades open over the weekend.

One of the very best ways to contain weekend gap risk is by limiting your exposure in the market over the weekend to a very small percentage of your overall account. For example, you may opt for a 2% risk per trade model, and decide to reduce that to just 1% for trades held over the weekend.

Another weekend risk containment strategy could call for exiting any and all open positions at the close of Friday's session, and then reentering the same positions at the open of Sunday’s session. The latter is a much more conservative way to deal with weekend risk events, but it will come at the cost of incurring additional transaction costs.

These are just a few examples of limiting your risk to account for weekend gaps. There are a countless number of techniques that you can employ to ensure that you are managing weekend open trade risk in a responsible manner.

Forex Weekend Gap Trading Strategy

We’ll now move on to building a forex gap trading strategy based on the weekend gap scenario. Based on long-term historical data it has been found that over the last 20 years or so that the most liquid currency pairs, including EURUSD, GBPUSD, and USDJPY, will form a weekend gap about 20 to 25% of the time.

So this would mean that over the course of a year, we can expect to see approximately 10 to 12 potential gap trading opportunities in each of these major currency pairs.

So far, we have not discussed the relative size of the price gap and its trading application. Based on the historical data, at least 75% of all weekend Forex currency pair gaps tend to be of a relatively small size.

That is to say that these smaller sized gaps account for a range of less than 30 pips. And approximately 25% of the weekend gaps in the currency markets tend to be of a relatively large size. In other words, this 25% of weekend gap occurrences display an opening price in excess of 30 pips from Friday's close.

Another interesting piece of data as it relates to weekend trading gaps in the major currency pairs over the last 20 years is that the relatively smaller gaps of 30 pips and less have a higher tendency to get filled over the next few trading sessions. On the other hand, larger gaps of 30 pips or more are less likely to get filled, and instead, lead to larger price moves in the direction of gap.

Another point of interest is that gaps occurring within the context of a trend, and contrary to its direction have a higher likelihood of getting filled.

More specifically, when an uptrend is present, and a gap down occurs in the market, there is a higher likelihood of that gap being filled over the next few sessions. Along the same lines, upside gaps that occur within a downtrend will have a higher chance of getting filled.

Intuitively, this will appear to make sense to most traders, but it's important that our actual data set also aligns with this assumption. And that is the case in this particular instance.

So now we can build a weekend gap strategy that is based on solid footing. This strategy can be executed in either the spot forex market or the currency futures market on major forex pairs. The preferred timeframe is the 15 minute chart.

Here are the rules for entering and managing a long weekend gap trade.

- The current price is trading above its 200 day simple moving average

- A weekend gap down has occurred on the price chart, and is greater than 20 pips, but less than 40 pips.

- Enter a market order to buy at the Sunday open EST

- Place a stop loss below the entry at a distance equal in pips to the gap down.

- The target will be set at one PIP below Friday's closing price.

Here are the rules for entering and managing a short weekend gap trade.

- The current price trading below its 200 day simple moving average

- A weekend gap up has occurred on the price chart, and is greater than 20 pips, but less than 40 pips.

- Enter a market order to sell at the Sunday open EST

- Place a stop loss above the entry at a distance equal in pips to the gap down.

- The target will be set at one PIP above Friday's closing price.

Forex Weekend Gap Trade In EURUSD

Now let's look at a real example on a price chart that illustrates our Forex weekend gap trade set up. Below you will find the price chart for the Euro to US dollar currency pair shown on the 15 minute timeframe.

Starting from the left end of this chart, you will notice that prices were moving higher. Although, the uptrend is not clearly apparent from this price chart, there was in fact an uptrend in place. Notice how the prices are trading well above the 200 period simple moving average line, further illustrating that the market has been steadily rising.

Soon after some overlapping price action that appears to form a wedge shaped pattern, the market creates a gap down price move. This gap down occurs within the context of an up trending market, which confirms that it would be a tradable opportunity based on our trading rules for the strategy.

The size of the gap down is 24 pips which is within our preferred range of a minimum of 20 pips and a maximum of 40 pips for the gap size. As soon as the market printed this gap down formation at the open of the session Sunday evening EST, we would have entered a market order to buy the EURUSD currency pair.

The stop loss would be placed at a distance that is equivalent to the gap down move. More specifically, in this case, that would mean that the stop loss should be placed 24 pips below the opening price. The size of the gap is illustrated with the upper vertical bracket, while the measurement for the stop loss is illustrated with the lower bracket and that level is represented by the black dashed horizontal line.

The target for this trade would be set at 1 pip below Friday's closing price. That level is represented by the green dashed line near the top of the chart. Notice how almost immediately after the weekend gap down open, the price began to consolidate and demand began to build which ultimately pushed prices higher towards Friday's closing price.

Soon afterwards, our target was reached and the entire gap was filled, leading to a profitable trade. Also as a point of interest note that as soon as the weekend gap was filled, supply began to enter the market which pushed prices lower. We will often see this type of occurrence following a weekend gap fill. That is to say that following a weekend gap down, Friday's closing price often acts as a level of resistance, and following a weekend gap up, Friday's closing price often acts as a level of support.

Final Thoughts

Weekend gaps are an interesting phenomenon that occur in the currency markets and many other financial markets as well. Forex weekend gaps can provide us valuable insights into market sentiment. Forex traders should be aware of potential risk events that occur during the weekend which can adversely affect any position that they are currently holding. You should have a well thought out plan to deal with the risk that weekend gap opens can pose.

In addition to understanding the implications of weekend gaps from the risk perspective, they can also be utilized as a trade setup from time to time. Now although, tradable weekend market gaps are not particularly frequent, it does pay to be on the lookout for them, as they can provide for a solid short-term trading opportunity.