One of the first steps any aspiring Forex Trader must do is decide on their choice of a Forex broker. This is a very important decision and should be considered carefully.

One of the first steps any aspiring Forex Trader must do is decide on their choice of a Forex broker. This is a very important decision and should be considered carefully.

There are several different types of Forex Broker models, but broadly speaking, they will typically fall into two main categories – Dealing Desk Operations (DD) and Non-Dealing Desk Operations (NDD). In this lesson, we will be taking a close look at each of these broker models, and by the end of this lesson, you should be able to decide which type would best suit your own personal trading style.

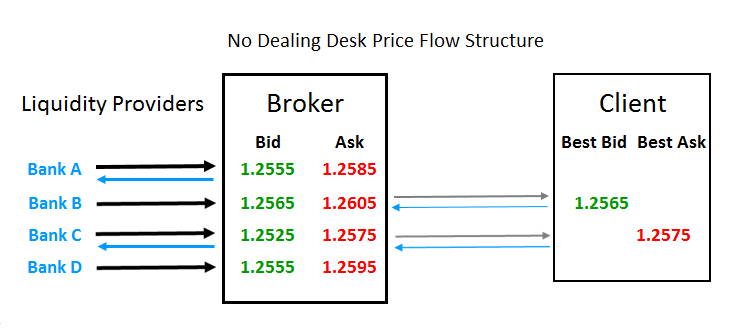

Price Flow Structure in a Non Dealing Desk Broker

The Non Dealing Desk broker uses the prices of other FX participants, usually banks, financial institutions and sometimes other traders to create the bid/ask quote.

These market participants, also known as liquidity providers or market makers, send their prices through an electronic network. This process means that prices are updated in real-time and helps to avoid the need of a requote. There are two types of networks; the ECN or Electronic Community Network and the STP or Straight Through Processing.

Effectively these non-dealing desk (NDD) brokers are price aggregators collecting prices from various sources to then quote the best bid and ask price to their clients. When you trade with these brokers, the other side of the trade (counterparty) is taken by the liquidity provider.

Automation means that the broker can quickly execute his client’s order at the price posted by the counterparty. In this scenario, the broker is acting as an intermediary, taking the price order from his client and executing the order on the liquidity provider’s quote.

An ECN incorporates a multitude of liquidity providers, as it can handle hundreds of orders at the same time for the same currency pair. The STP is also an electronic network but cannot handle as many prices or quotes as an ECN. The STP goes straight to several Tier-1 banks and financial institutions meaning there are fewer players available.

The flow chart above shows the dynamic of prices flowing into the broker’s electronic platform (black arrows), which will then show the client the best bid and ask price available (gray arrows). The electronic network allows the broker to receive the client’s order, usually a couple of mouse clicks, and execute on the counterparty’s price quote (blue arrows).

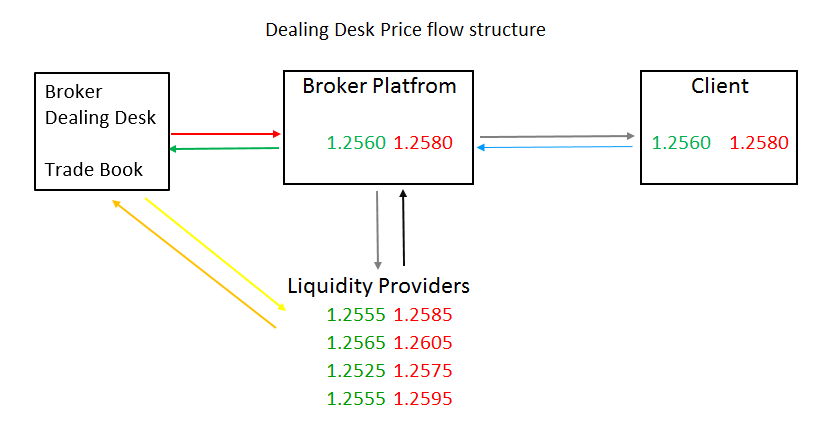

Price Flow Structure of Dealing Desk Broker

The terminology “Dealing Desk Broker” is used to define a broker that does not execute client orders on the prices of liquidity providers, but rather takes the trade for itself and is, therefore, the client’s counterparty. This is not to say that the dealing desk broker has no access to liquidity providers, it surely does. In fact, depending on the trade direction, size, and market condition they will decide whether they keep the trade on their books or not, and at some point, match their position with a market maker. If the market is rallying, and they are hit at the ask price, they may choose to close the trade immediately at the best price available from one of their liquidity providers.

These types of brokers may also use STP as it allows them to efficiently execute when they are not going to keep the other side of the trade. They may also offer their clients STP, that will be able to execute their orders on the broker’s platform electronically and automatically. But you will not necessarily be getting liquidity providers prices through the broker’s interface as the broker has yet to decide whether to keep the position or not on their books. The dealing desk may also choose to build up positions as they often counter for retail traders that are dealing in micro lots.

When they have a standard position, usually at least 1 full lot, they may decide to close the position against a liquidity provider’s price. Most liquidity providers are quoting FX prices for the interbank market and are not willing to trade in less than 100k or multiples thereof. Therefore, the dealing desk broker who is providing liquidity to retail traders will have to take the other side of his clients’ trades if they are small, until he has a position that is large enough to execute with one of his liquidity providers.

The chart above shows price flow in a broker with a dealing desk. The prices from liquidity providers are used to create a bid/ask quote (black arrow), the broker then passes a retouched price to his client (gray arrow). The client can trade on these prices (blue arrow) usually electronically, using STP. The broker platform then passes the trade to the dealing desk (green arrow). The dealing desk will then decide upon how to manage the trade. It may sit on the trade, building up the position, or it may have enough volume to exit the position directly with its liquidity providers (orange arrows). The dealing desk may also show prices of its own as it holds positions itself, these prices would go in the quote to its clients (red arrow) or to its liquidity providers (yellow arrow).

Characteristics of a Non Dealing Desk Broker

The most important feature of non dealing desk forex brokers is the fact that they offer the best bid/ask prices in the market. As they have access to various liquidity providers, they offer their clients market prices in exchange for a fee.

The most important feature of non dealing desk forex brokers is the fact that they offer the best bid/ask prices in the market. As they have access to various liquidity providers, they offer their clients market prices in exchange for a fee.

Commissions are the main source of income for these brokers as they never hold positions of their own. The bid/ask spread will also be variable as there will be many quotes from different players and at times the spread will widen, and at times it will be very tight.

In the no dealing desk world, there is some need to distinguish between ECNs and STPs. Both offer the best bid/ask quotes available to them. However, ECNs have access to many more prices than STPs and may offer tighter bid/ask spreads than STPs. As this type of broker passes the best price on to their clients, they must charge a commission, as they are executing the client’s trade at market price, with no markup. Commissions tend to be very small and are usually a fraction of the bid/ask spread.

With an NDD broker, given the speed of electronic networks, it is very rare in normal market conditions that the broker will show a re-quote when you hit the execute button on the platform. As the broker is not holding the position for itself, neither is it using a markup, trades are usually executed at the given price. This may not be the case when markets are particularly volatile, for example, after a big economic data release or headline news.

For a broker declaring to offer no dealing desk execution, they should be getting most of their prices from Tier-1 banks and other financial institutions.

The concept of ECN and STP is broad, and many brokers may correctly say they offer one or the other without exactly offering these services. It is enough to be connected to a multitude of clients that are accessing the platform and creating an ECN, although they may not necessarily be Tier-1 banks or financial institutions.

Textbook definition of ECN means the broker is matching your order in a network of prices from other clients or liquidity providers. And this may be true for a certain broker advertising as such, but then it would be necessary to know how many market makers, and what type i.e. if they are Tier-1 banks, that the broker is actually connected to.

Tier-1 banks do not offer liquidity with tight bid/ask spreads for small sizes. Most institutions will only quote tight prices for minimum sizes that equal multiples of standard 100k lots. This means that brokers with real access to market makers and their liquidity cannot offer brokerage accounts that allow very small opening balances. If the broker is offering mini or micro size accounts usually with extremely high leverage, often in the hundreds, then they are most likely a dealing desk. The desk is necessary as the broker will be accumulating positions to reach the minimum size to trade with its market makers.

Usually, brokers with no dealing desk offer accounts with starting balances of at least around 10k, some ask for even higher amounts, such as 25k. The amount of leverage is also limited rarely exceeding 10 to 1. These account sizes are necessary as the broker will only offer larger minimum size trading; mini and micro lots are not catered to.

The liquidity providers of these brokers are open 24 hours a day, 5 days a week since they usually have trading desks in London, New York, and Tokyo. These Tier-1 banks are also the reason that FX markets are open all week round. Brokers that have access to their liquidity can, therefore, offer their services to their clients during the same time frame.

Characteristics of a Dealing Desk Broker Account

Brokers with a dealer desk typically offer their services to retail clients trading mini or micro lots, which is not available from no dealing desk brokers. As seen above these brokers also have access to market makers and liquidity providers. However, they do not pass on the price directly to the client. As they do not charge a commission, they rely on marking up the price to make their profits.

The markup works if the client is trading a large enough size for the broker to execute directly on a market maker’s price. If the broker has a client looking to trade 10 lots it will widen the best price it gets from its network of market makers. That is to say; it will simply decrease the bid price, and increase the ask price. If the best quote it gets is say 1.2565/1.2575 then it might simply quote 1.2560/1.2580. Matching the client’s trades allows it to make a small profit in pips on a larger volume trade.

Another form of income for these brokers is the bid/ask spread. When trading in small sizes, they cannot trade on market maker’s prices, since they are usually quoted for a minimum of multiples of 100k lots. In this case, the DD broker will keep the position for their own book. However, they can also match one client’s position against another, and take profit from the spread between bid and ask. The spread between bid and ask is one of the main sources of income for the DD broker.

For example, using the price quote above let’s say a client buys 1 micro lot at 1.2680, then the broker’s price changes to 1.2565/1.2585 and another client sells a micro lot at 1.2565; we now have the broker with a flat position having profited from the spread between the bid and ask.

Some dealing desk brokers allow for larger clients to place calls directly to the desk; this allows for more market interaction. Basically, the client doesn’t feel like he is simply alone and there is somebody else on the other side of the screen. Some brokers with a dealing desk offer a more personalized service, that can solve problems or answer questions for customers.

Pros and Cons of DD vs NDD

In terms of tight spreads between bid and ask, it would probably be very difficult to beat brokers with a no dealing desk model.

These brokers can count on an extensive ECN of Tier-1 banks and other market makers and non market markers to provide the best available price for their clients.

The spread is likely to change as market makers change their prices according to the flows they receive and the speed with which the market is trading. Dealing desk brokers will have wider spreads but in do not charge a commission. This allows you to clear your profit and loss at your traded prices rather than discounting your trading P/L by the cost of the commissions to be paid.

There is a lot of controversy as to the possible conflict of interest for a broker with a dealing desk, where the broker is the counterparty to the client’s trade. The thinking goes that if you make money on the trade then the broker is losing money, which would appear a conflict of interest. That is true to a certain point, but is not necessarily always the case. Sometimes the broker may have quickly matched the trade with another client that has placed a trade with the opposite direction.

The existence of a dealing desk in comparison to no dealing desk allows retail traders to access bid/ask spreads that are much tighter than had been previously the norm. This type of set up allows for bid/ask spreads as low as 0.02% or around 2.5 pips in EURUSD, the most traded currency pair worldwide. If you were to go to a bank to exchange your local currency into another, depending on where you live, and the currency you want to buy, the spread, or markup is much more likely to be around 0.5% or higher. There can be some benefits from the dealing desk model, but the controversy seems to lie mainly on the ethical side.

The FX marketplace is by far the largest unregulated financial market in the world, and that doesn’t seem likely to change anytime soon. Most regulated financial markets are controlled by exchanges and allow for thorough oversight and auditing. There is need for investors in stock and bonds to be protected as these instruments are considered the foundation for retirees, pension funds and other investors.

We have therefore seen a set of behaviors evolving that have mainly applied to those markets. For example, a widespread practice used to be front running a client’s order. Typically, what happened was the broker received a big order to buy a block of stock, but bought then for his own account or another more favored client, and then filled the order of the original client. This could happen with a dealing desk environment, although it may not necessarily happen. The possibility, however, is there all the same.

What’s the Best Forex Broker Choice?

The best choice for one trader may not be the best choice for another. This question should be looked at as part of your overall trading style. But there are three primary factors that should be considered – trading size, frequency, and service.

Let’s first look at trading size; if you are a small retail trader, you have no choice but to go to a dealing desk broker. Usually, this aspect is not well advertised, but if the broker offers micro and mini lot orders, then it inevitably has a dealing desk. A concern often raised by retail traders are re-quotes. You click the deal button but find that that the price has changed, usually against you, and you are asked if you still want to execute the trade. If this happens too often then perhaps you want to find and try another broker. From experience, I know some brokers subject their clients to a re-quote way too often, while with others it happens much less frequently.

If you are trading in multiples of whole lots of 100k then your choice is open to other considerations. These depend on how often you trade and what type of service you want. Your trading frequency will dictate how much you pay in commissions and a high level of trading activity may dictate that the commissions charged plus the bid/ask spread may weigh heavily on your P/L. So, typically higher frequency, shorter term traders will require the tightest bid/ask spreads. Usually, the bid/ask spread varies according to markets conditions. While most dealing desk brokers offer set spreads, they are wider than NDD brokers.

Ultimately, traders should be choosing brokers that are regulated in countries with an elevated level of oversight. The US, UK and European jurisdictions all offer very high levels of control. There are also other centers – Japan, Singapore and Australia which have good regulating bodies.

While there is no doubt that NDD ECN brokers offers the best pricing structure and transparency, I would say that the risks of front running or other bad practices by most dealing desk brokers are somewhat overstated myths. In the long run, a well-established regulated broker wants its clients to be successful and continue trading as long as possible. Whether the Broker charges a commission or make their profit from a mark-up or the bid/ask spread they are always making money on the client’s trade, regardless of whether it’s a losing or winning trade for the client.